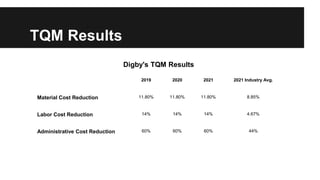

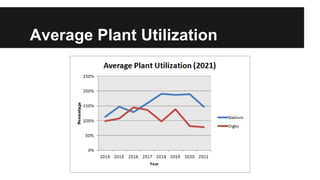

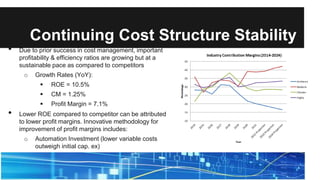

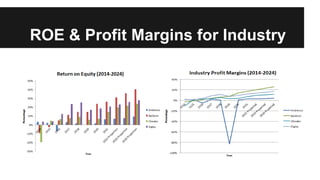

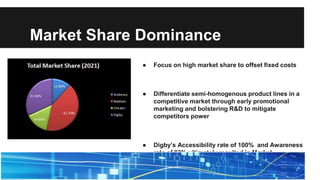

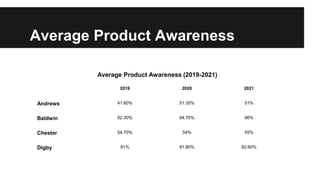

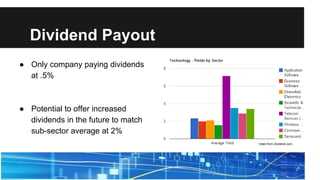

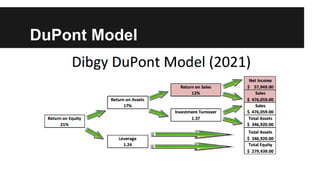

Digby's report to shareholders outlines its promise of a 10% annual stock price increase over 5 years. It summarizes Digby's previous cost structure strategy which lowered costs through total quality management. This resulted in material, labor, and administrative cost reductions above industry averages. Digby also emphasized capacity utilization to take advantage of competitor demand. The report discusses continuing cost structure stability through automation investment and inventory management. It addresses Digby's market share dominance through differentiation and promotional marketing, resulting in high awareness and accessibility rates. Finally, the report notes Digby's dividend payout of 0.5% and potential to increase this to the sub-sector average of 2%.