Embed presentation

Download to read offline

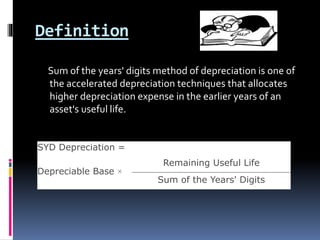

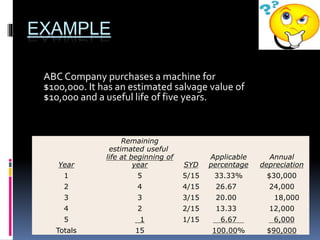

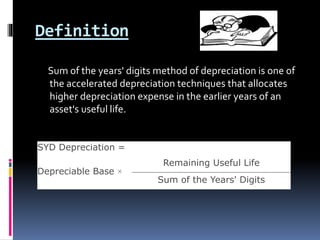

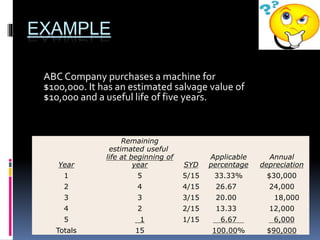

This document discusses the sum of the years' digits method of depreciation. It is an accelerated depreciation technique that allocates higher depreciation expenses in the early years of an asset's life. The method calculates depreciation as the depreciable base multiplied by the remaining useful life divided by the sum of the years' digits. An example is provided to illustrate the calculation. Some negative aspects are that it artificially reduces near-term profits and can indirectly impact cash flows by providing uneven depreciation amounts over the asset's life.