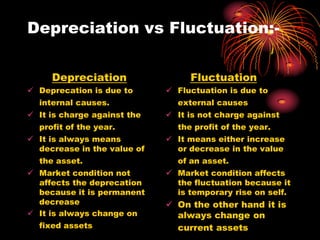

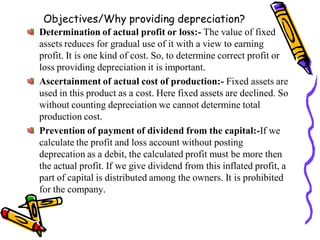

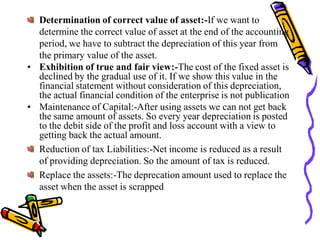

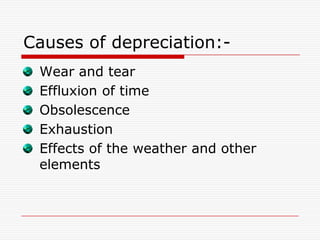

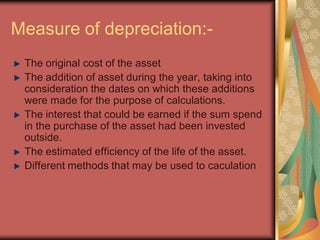

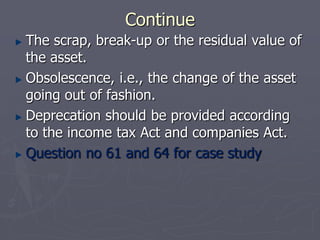

The document discusses depreciation, which refers to the decrease in value of fixed assets over time. Depreciation is a method of allocating the cost of fixed assets over their useful lifetime in a systematic manner. It is an expense that is charged against profits each year to reflect the use and aging of fixed assets. Calculating depreciation helps determine actual profit/loss, cost of production, asset value over time, and ensures capital is maintained. Various methods can be used to calculate depreciation based on original cost, additions, estimated useful life, and residual value of the asset.