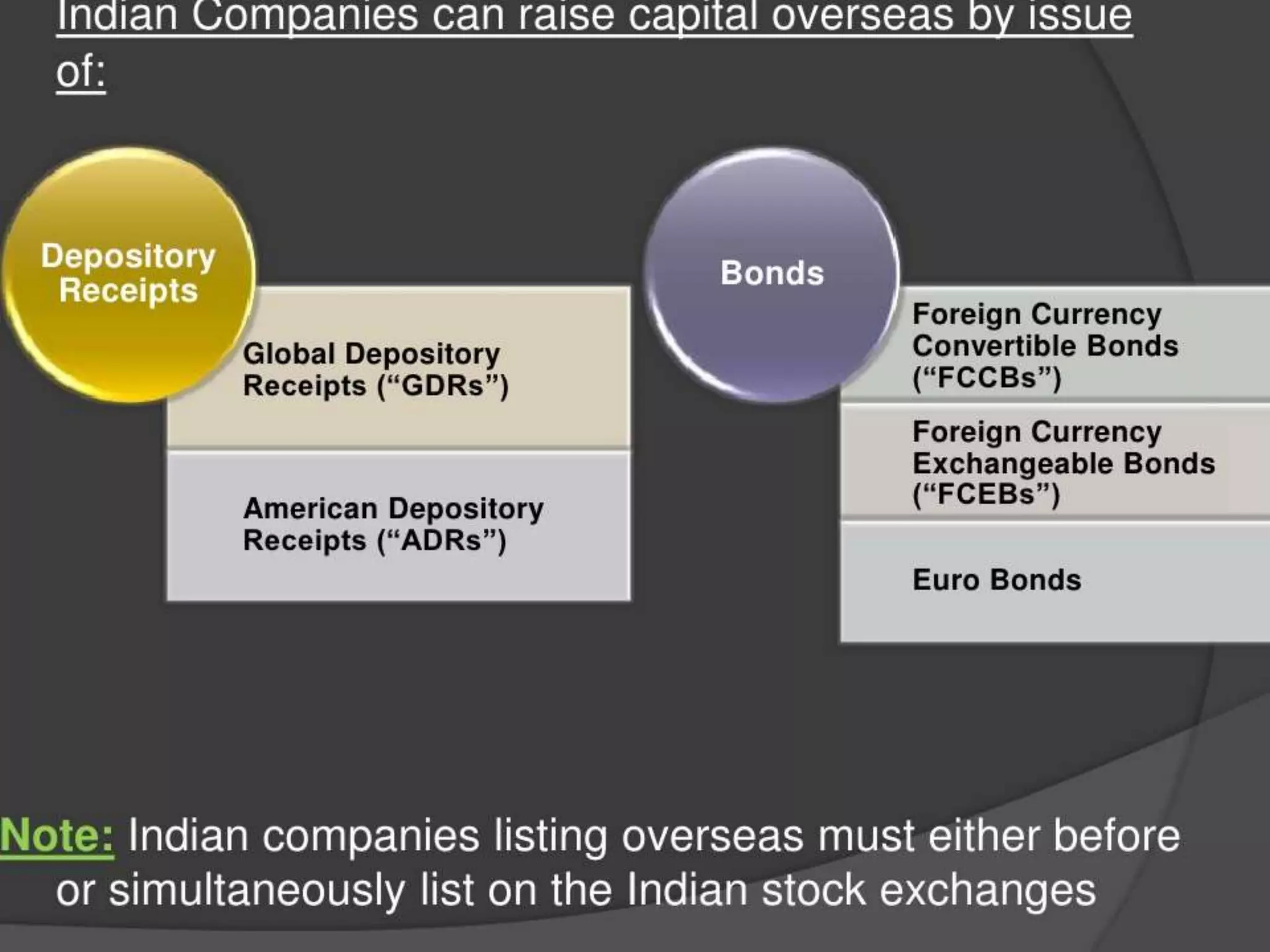

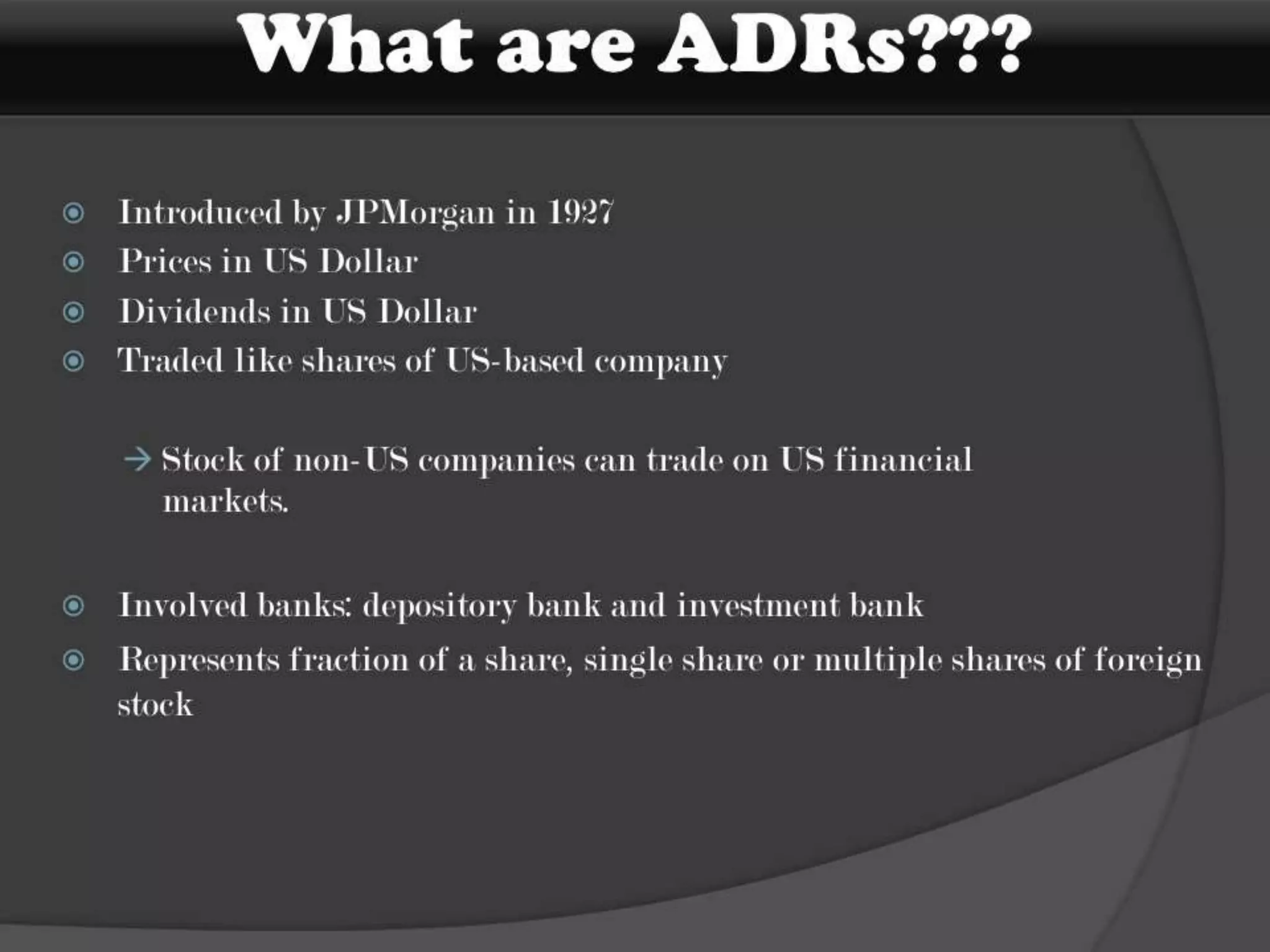

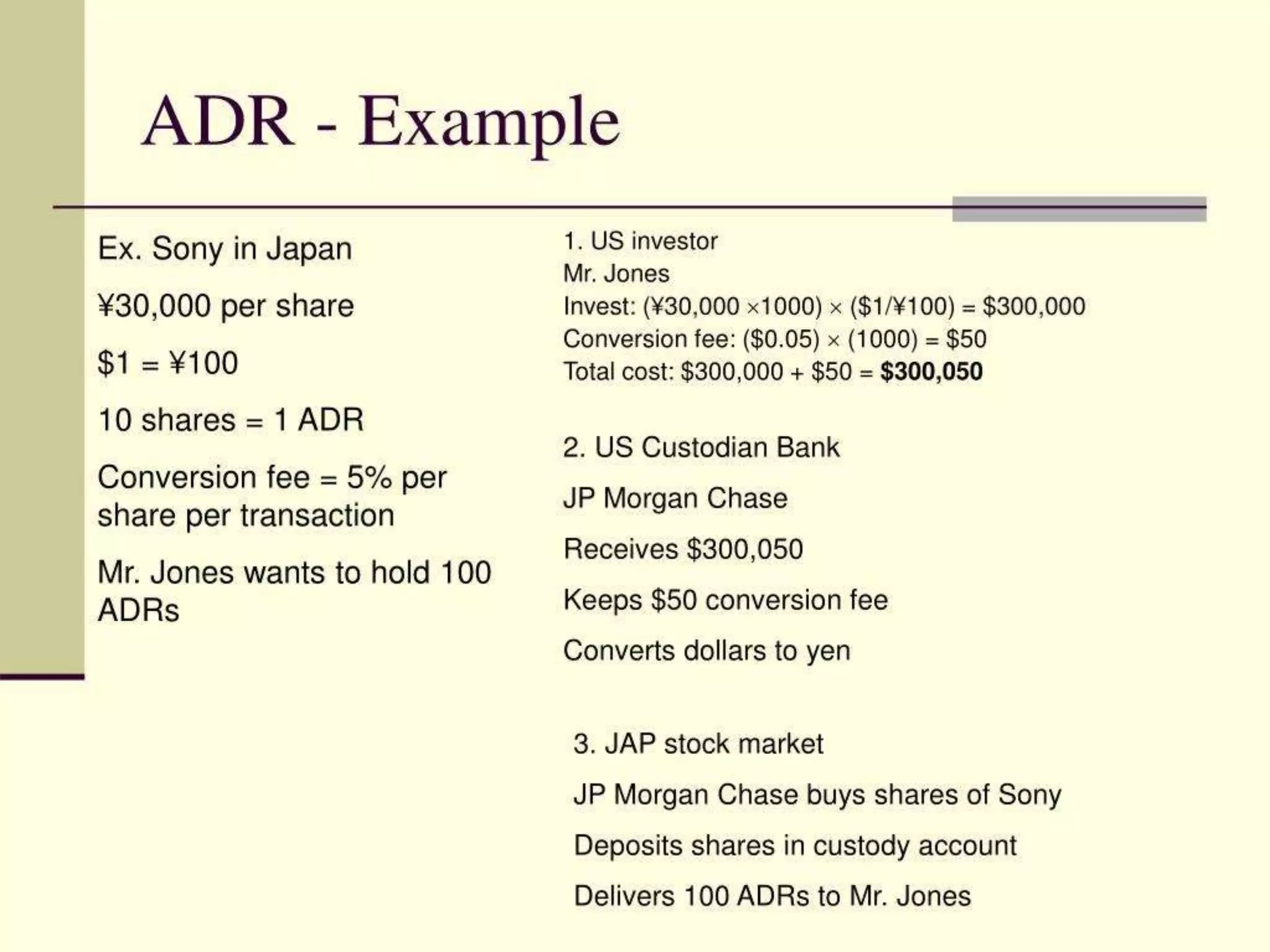

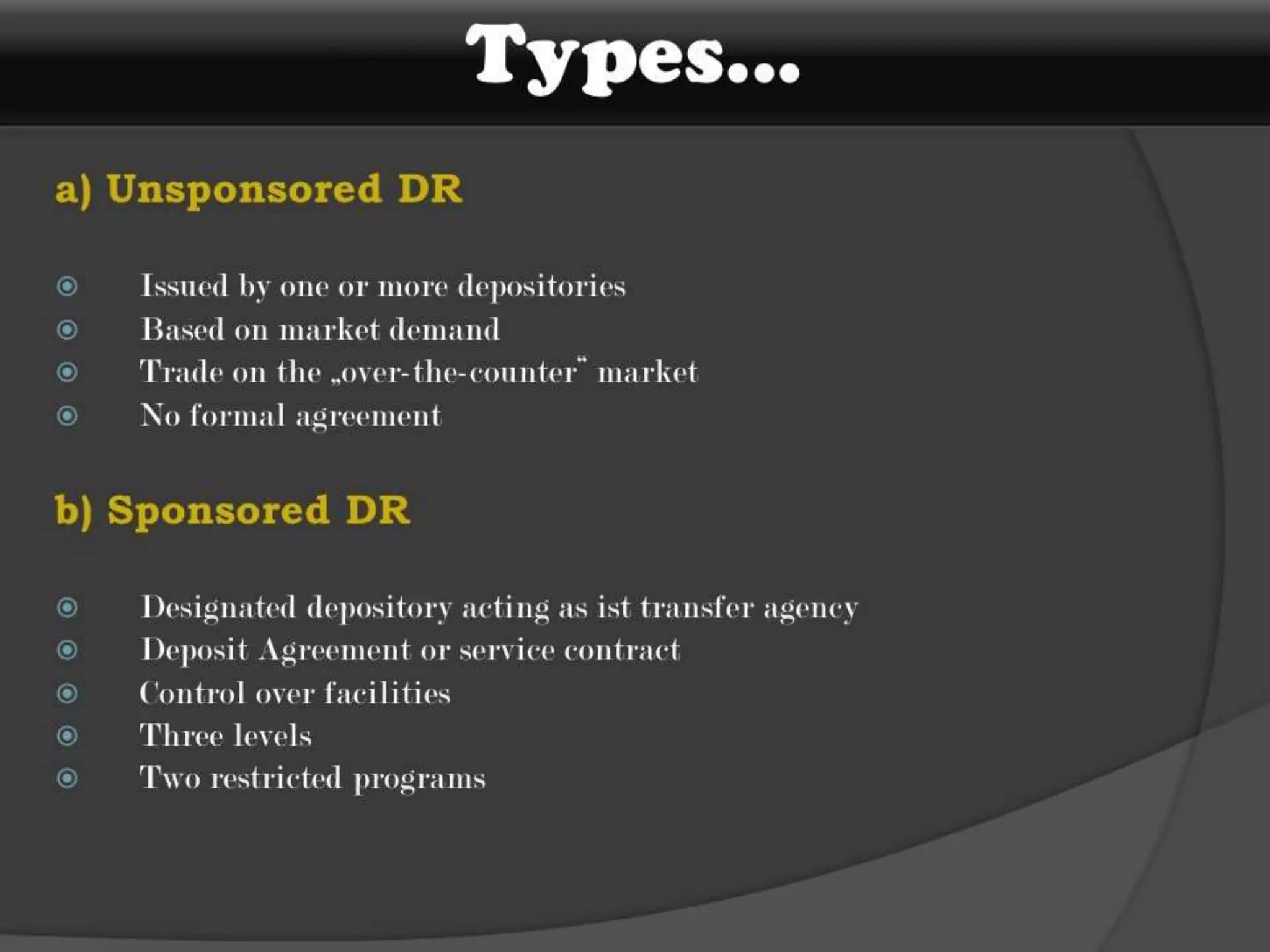

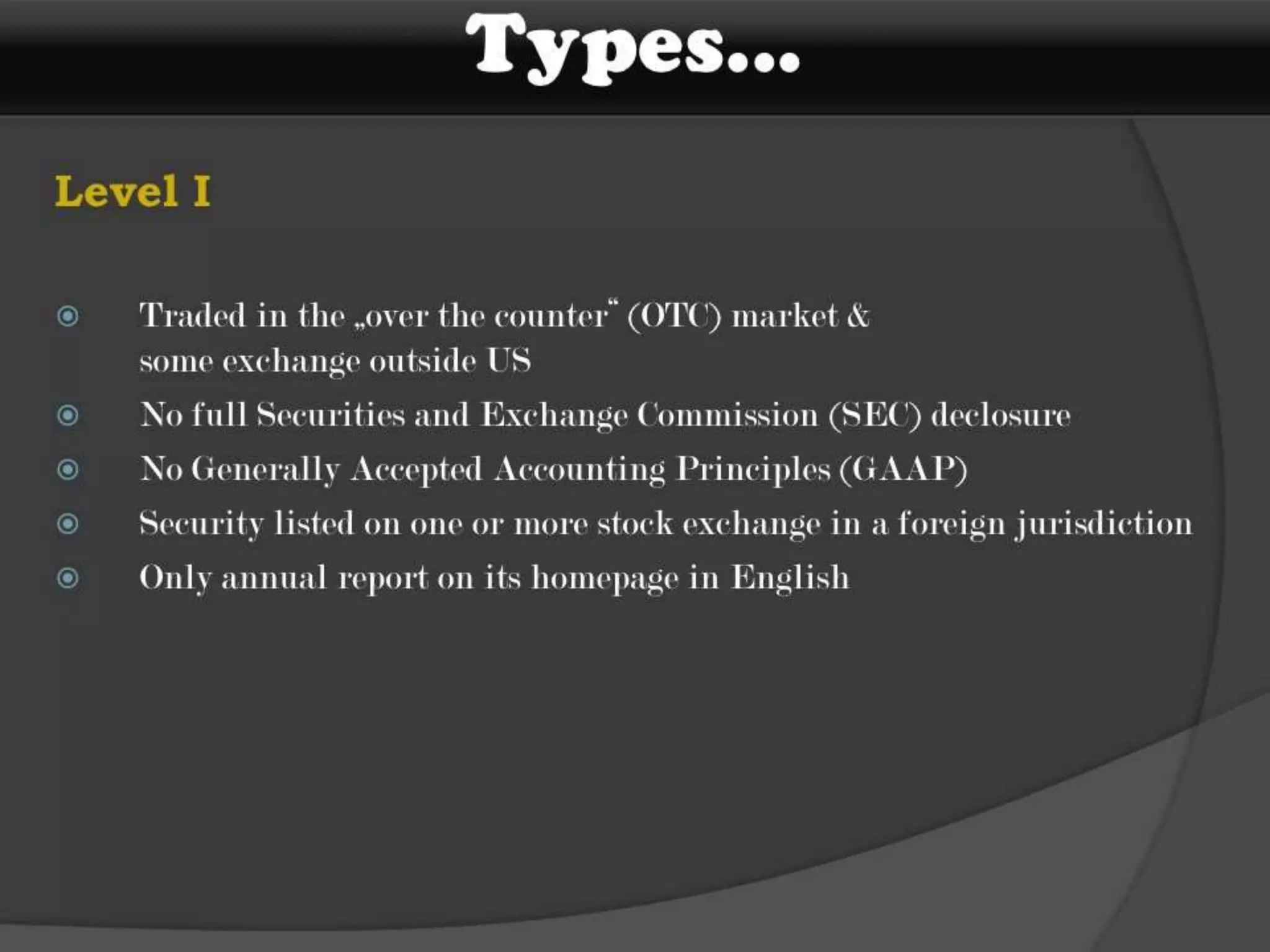

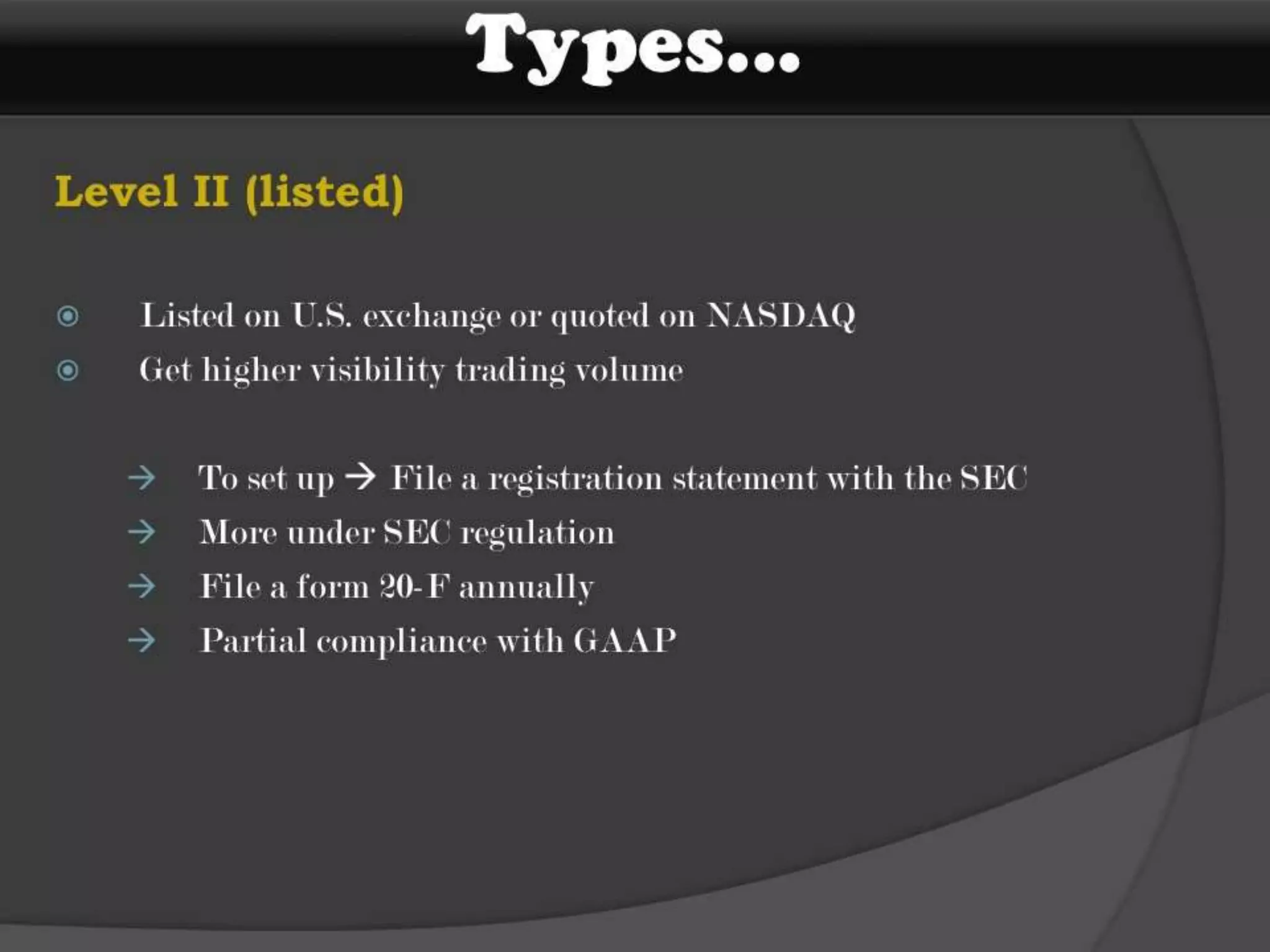

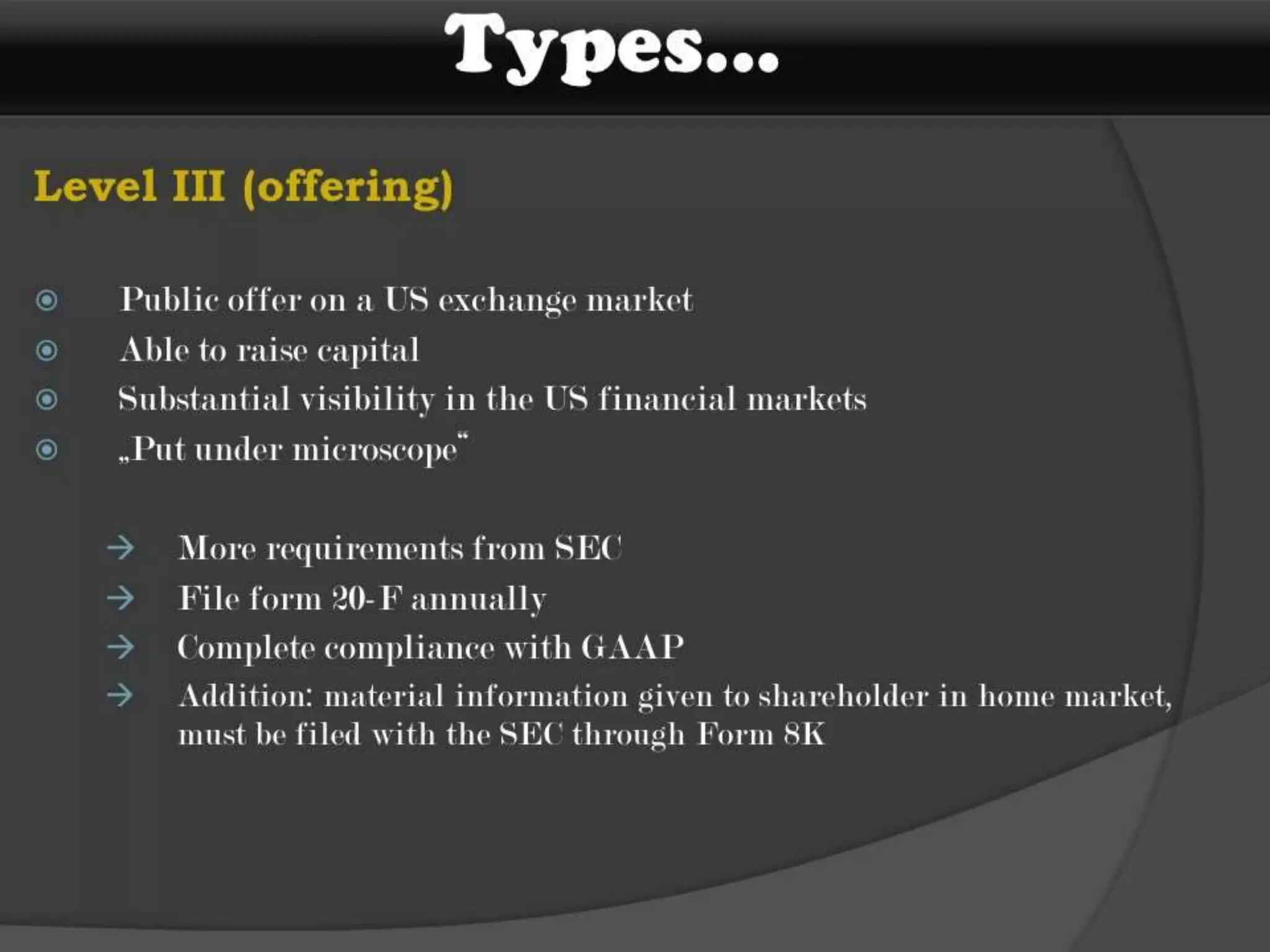

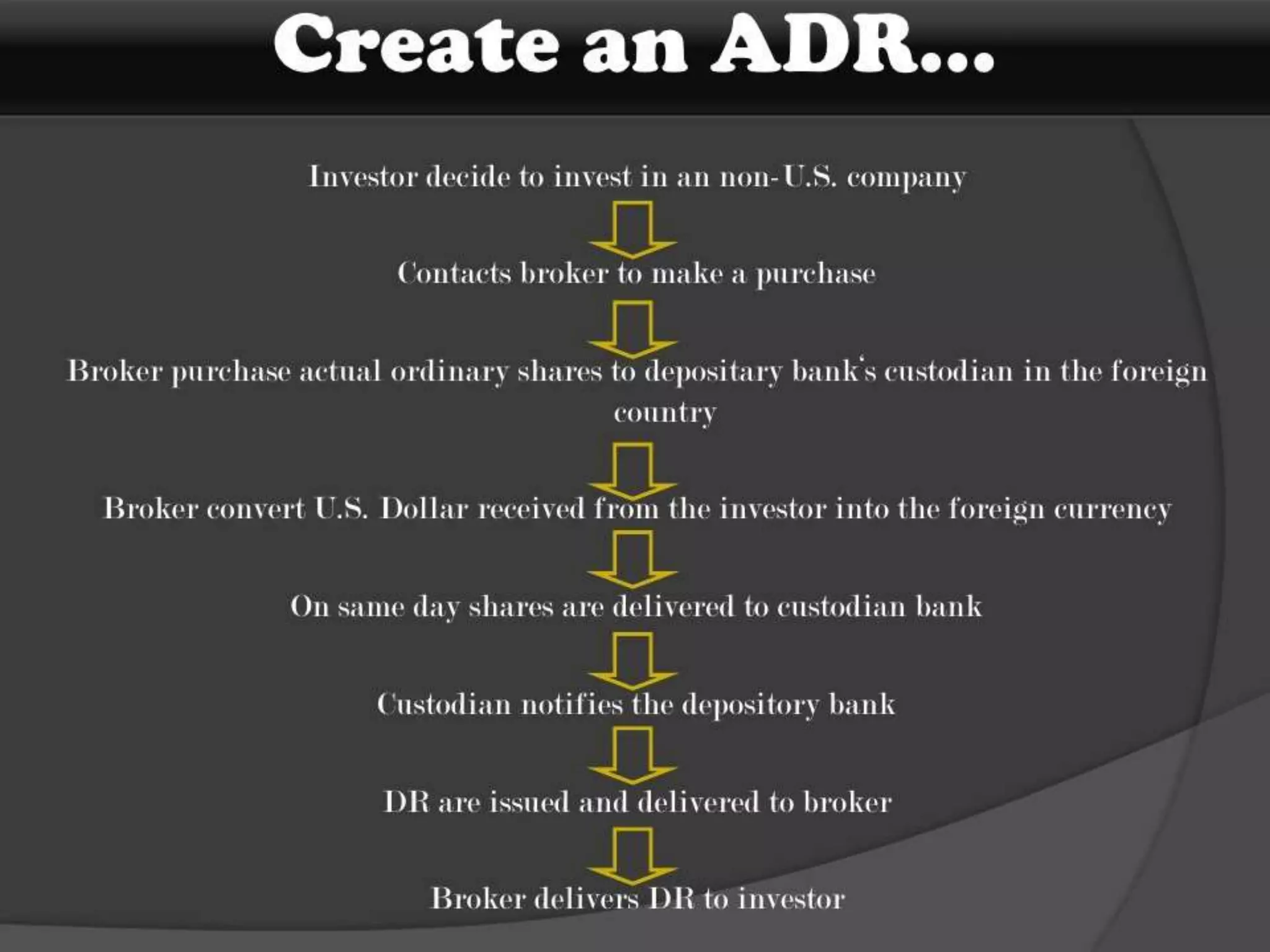

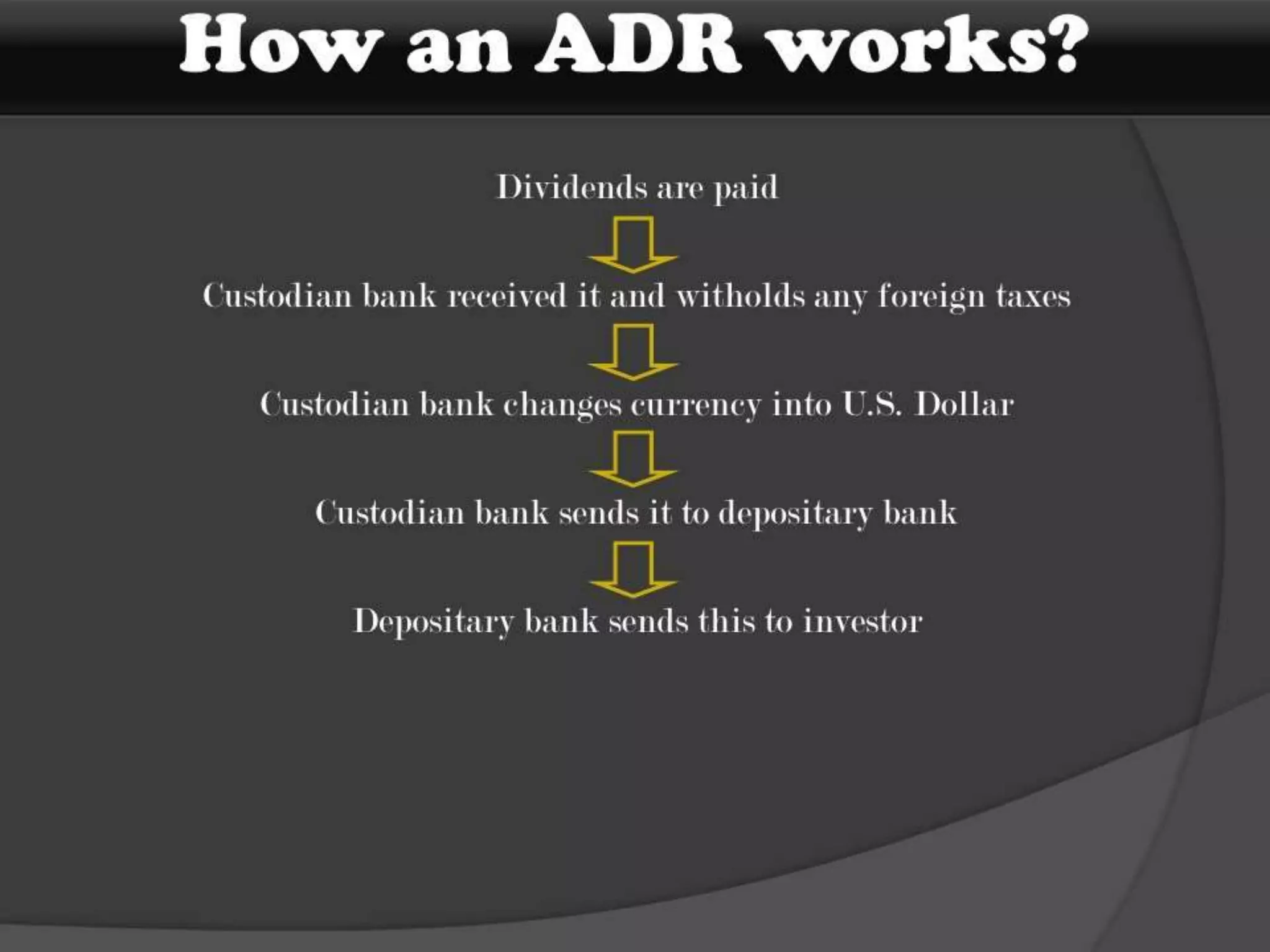

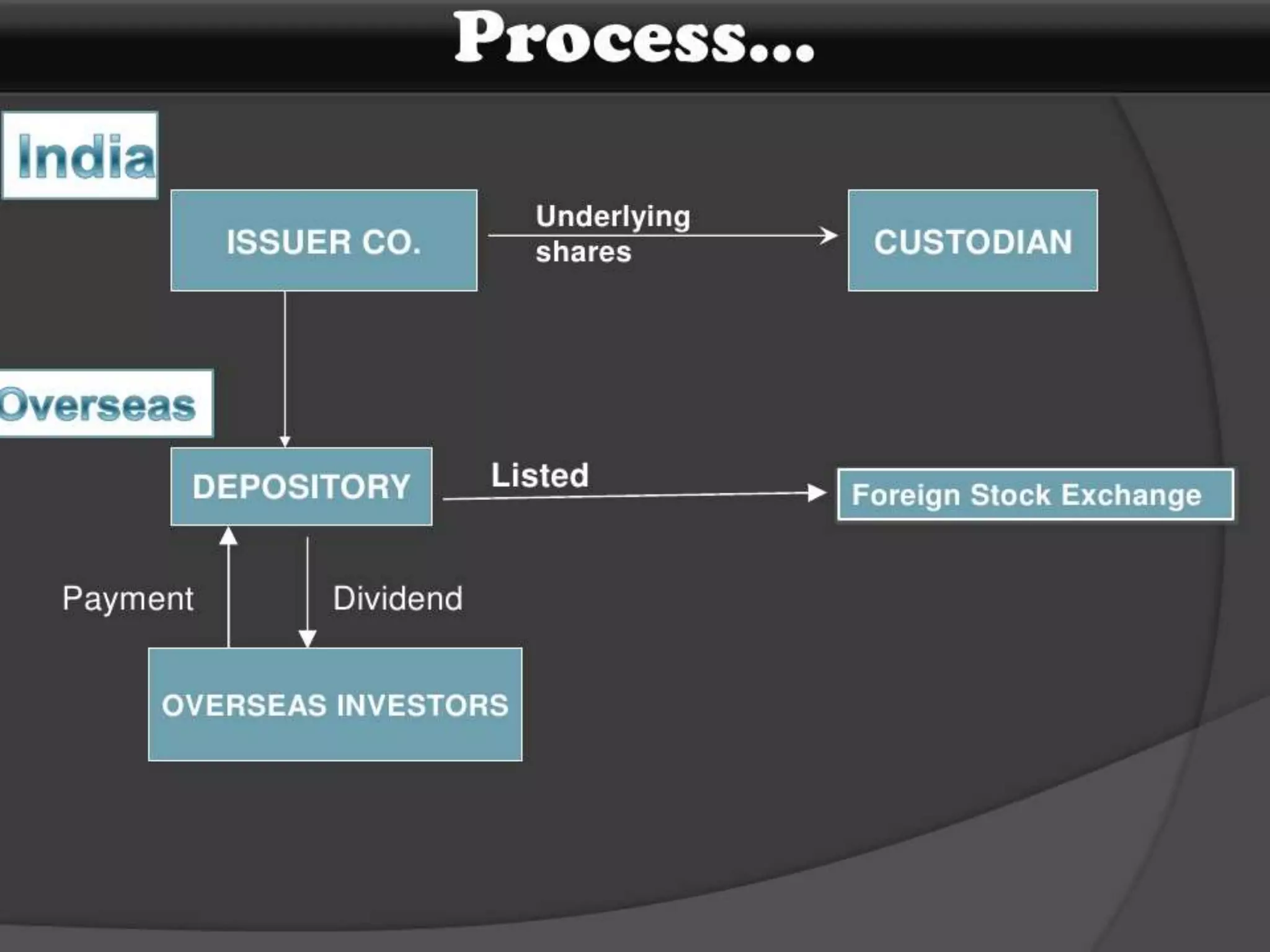

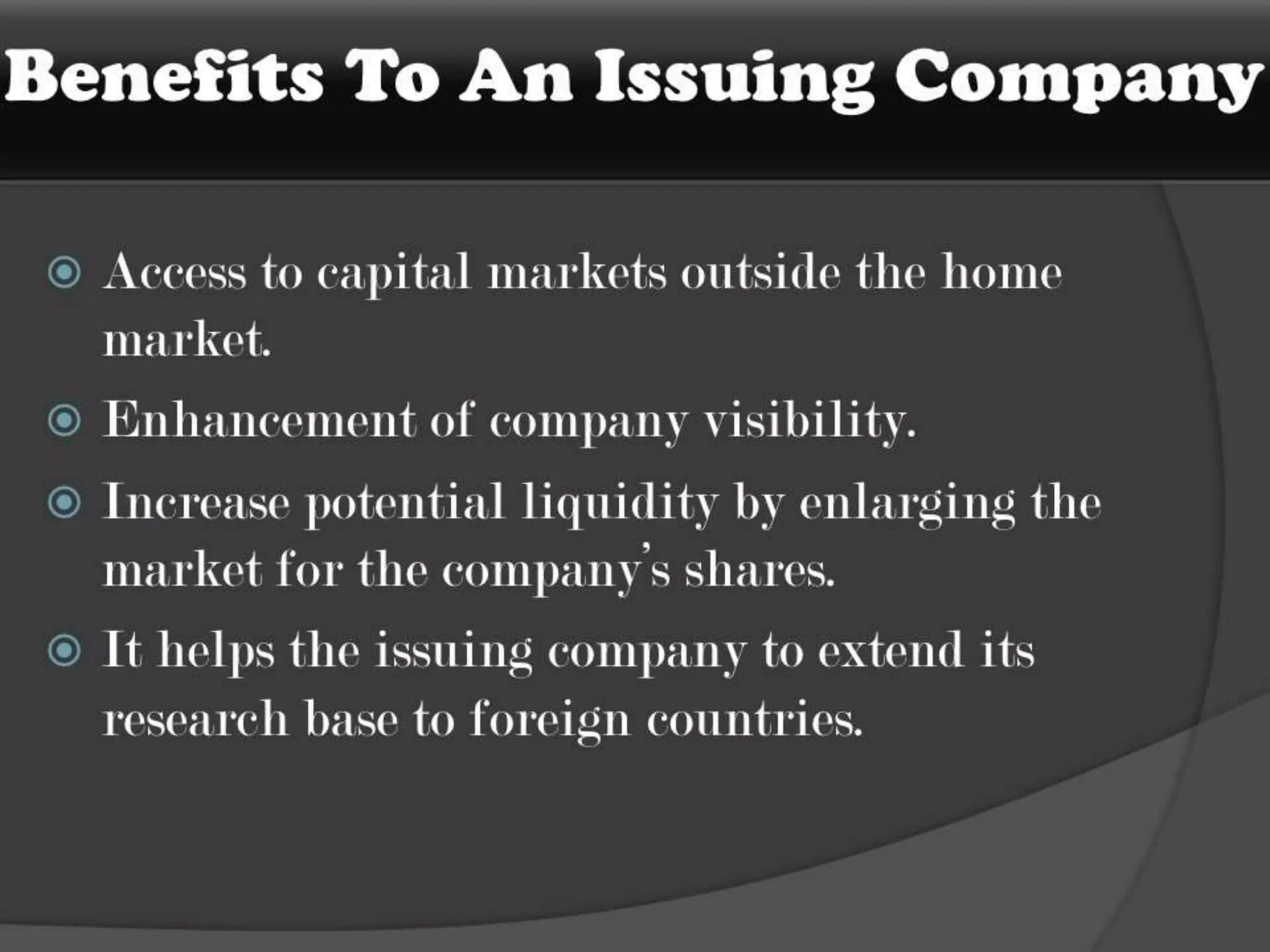

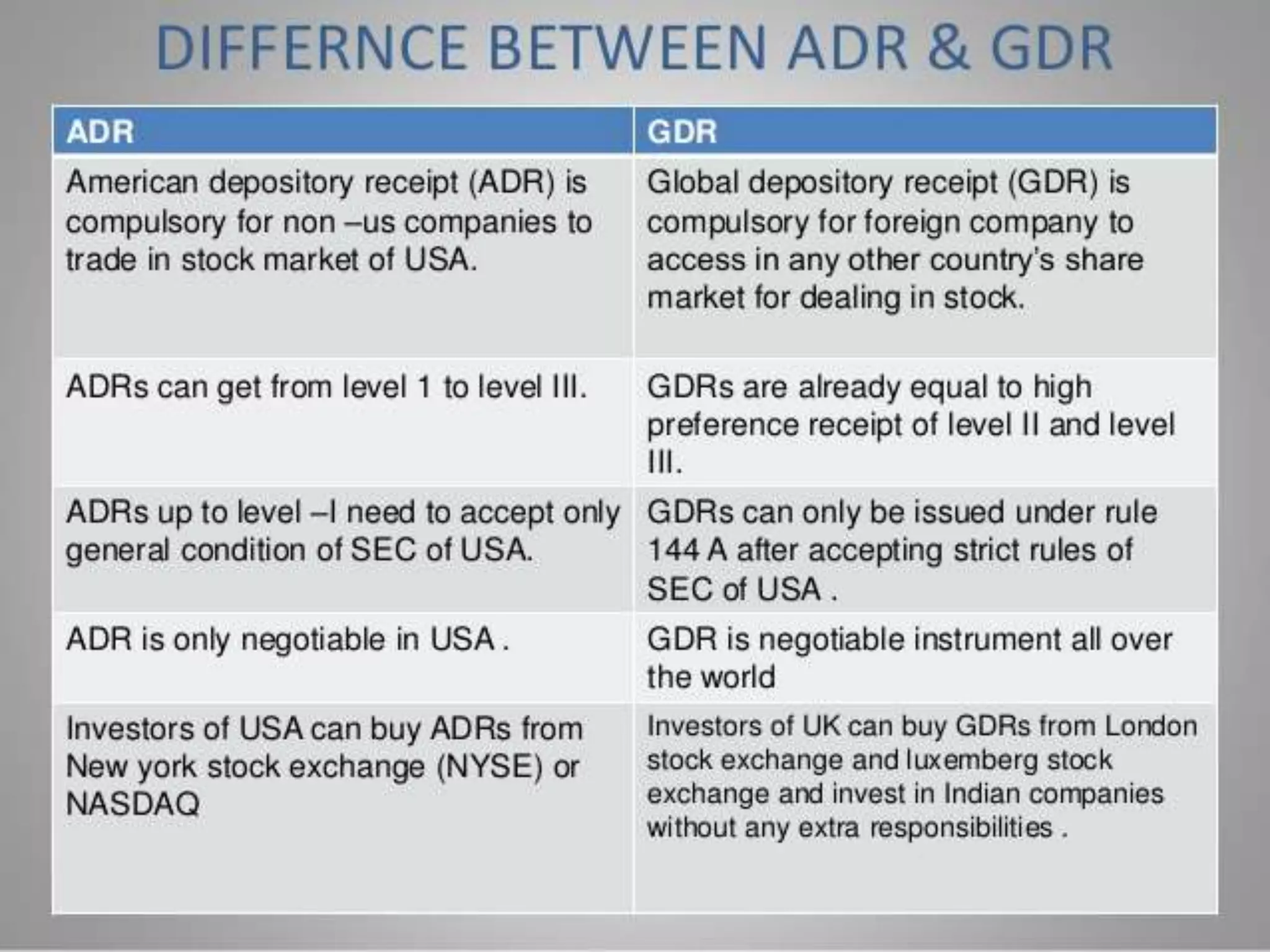

The document discusses depositary receipts, which allow foreign companies to have their shares traded on domestic exchanges. A depositary receipt is issued by a bank and represents shares of a foreign company that are held in custody overseas. There are two main types: American Depository Receipts (ADRs), which trade on US exchanges, and Global Depository Receipts (GDRs), which trade internationally. The document then provides details on the meaning and features of ADRs and GDRs, where they are listed, and which banks commonly issue them.