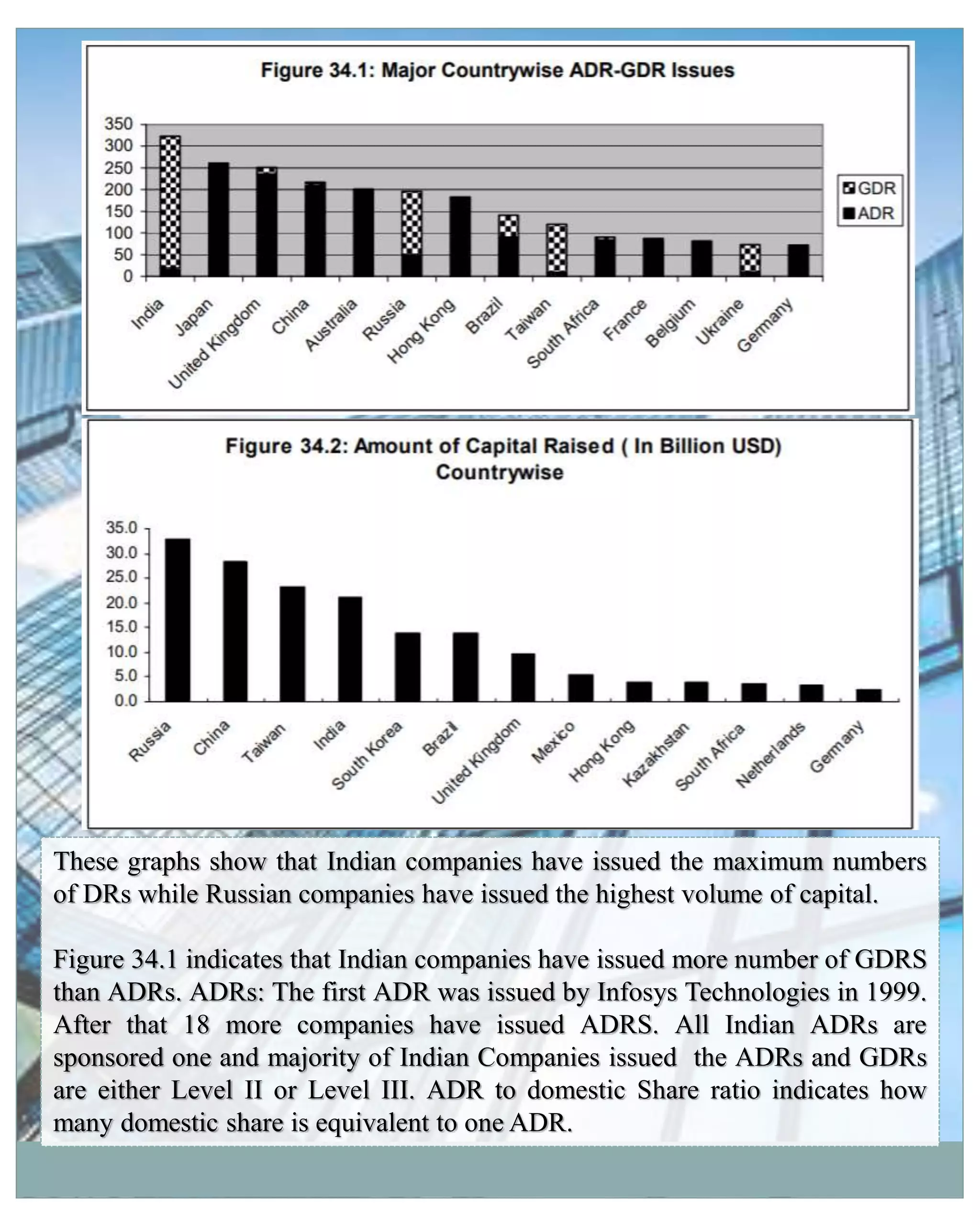

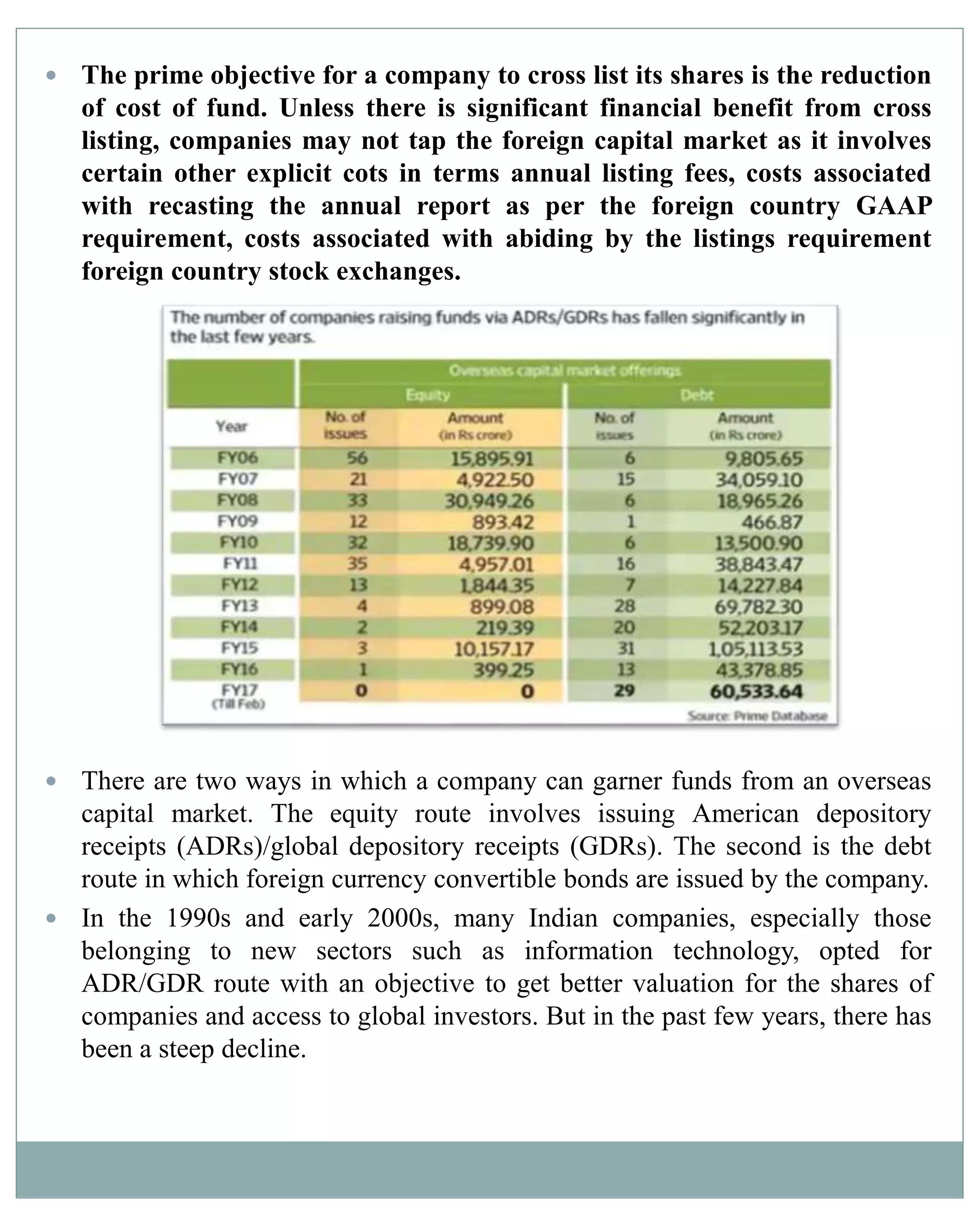

The document discusses the evolution and mechanisms of American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) in fundraising for multinational corporations and Indian companies. It highlights the advantages and disadvantages of these financial instruments, the regulatory environment, and factors driving their popularity, as well as recent declines in their issuance due to the rise of domestic funding options and changes in market conditions. Additionally, it covers the concept of Samurai bonds, which allows foreign companies to raise capital in Japan's stable market, detailing their benefits and limitations.

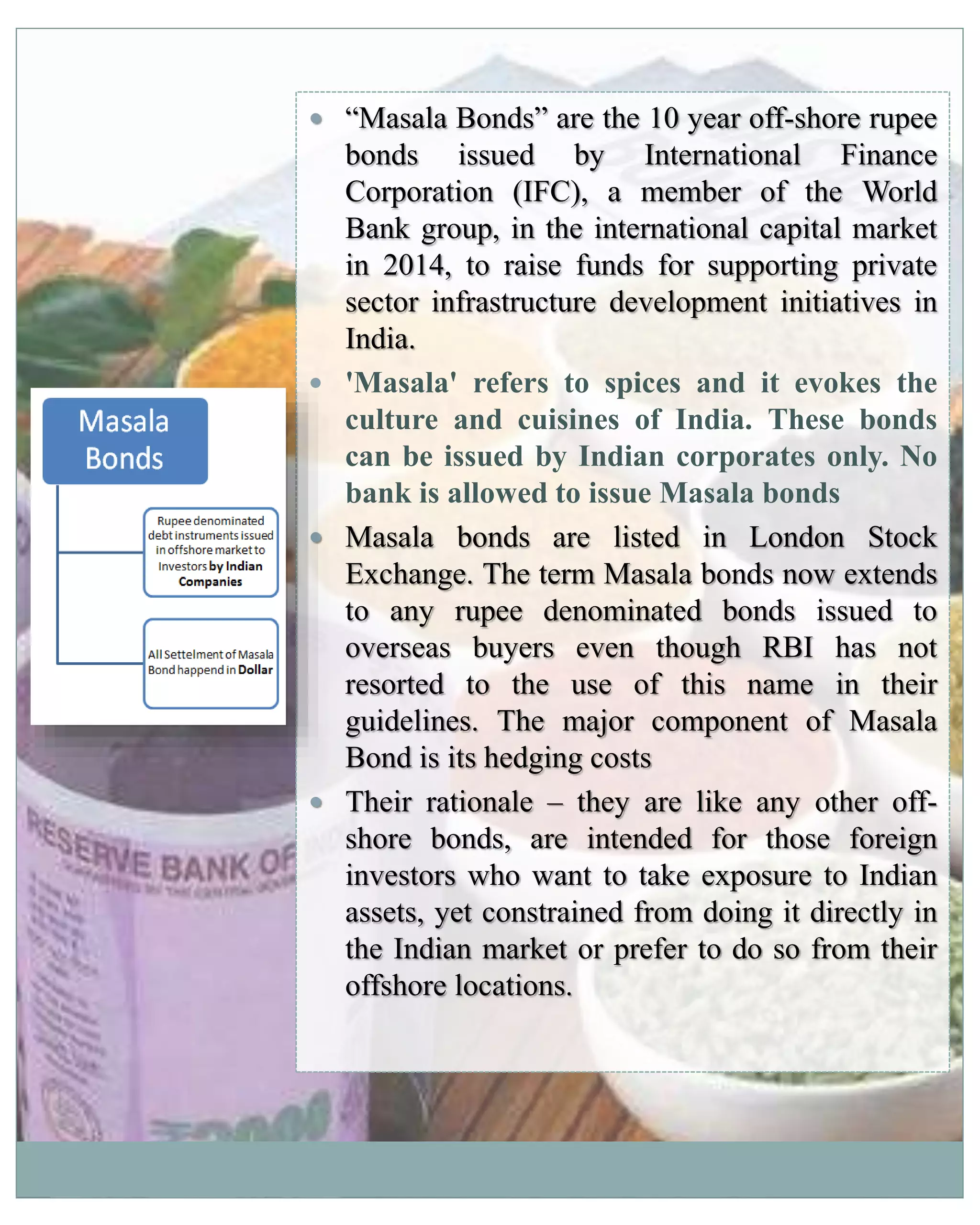

![Advantages to the

Investor

Advantages for

Borrowers

Less documentation- No

need to register as foreign

portfolio investment in India.

Lower Tax- The Finance

Ministry has cut the

withholding tax [a tax

deducted at source on

residents outside the

country] on interest income

of such bonds to 5% to 20%

making it attractive for

investors.

Operational convenience-

The masala bonds can be

settled in foreign currency

through the international

custodians.

Cheaper cost of funds- If

the company issues any

bond of 7.5% to 9%

whereas, Masala bonds

outside India is issued

below 7% interest rate.

No currency risk-

Companies issuing Masala

Bonds do not have to

worry about rupee

depreciation, which is

usually a big worry while

raising money in overseas

markets.

Advantages of Masala Bonds](https://image.slidesharecdn.com/ifm2-201029183104/75/External-Overseas-sources-of-funds-for-MNCs-by-Anshika-Singh-24-2048.jpg)