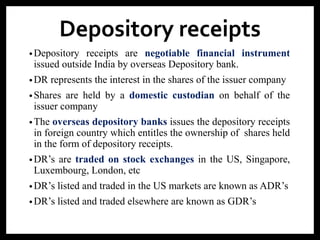

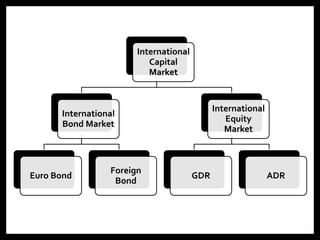

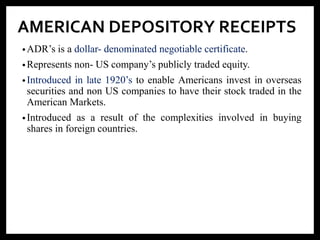

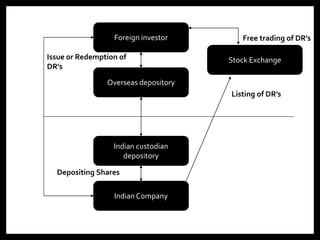

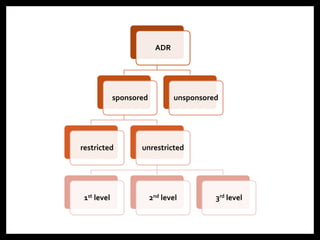

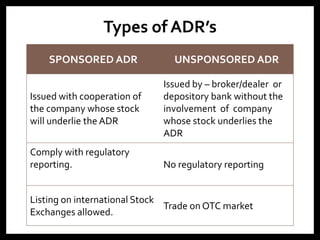

Depository receipts represent shares of a foreign company that are held in domestic custody on the foreign company's behalf. They allow investors to trade foreign securities on a domestic exchange. There are two main types: American Depository Receipts (ADRs), which are traded on U.S. markets, and Global Depository Receipts (GDRs), which are traded elsewhere. ADRs introduce foreign companies to American investors by allowing trading of the foreign company's shares on U.S. exchanges in dollar denominations. They exist in sponsored and unsponsored forms at three levels of increasing regulation and information disclosure.

![Levels of ADR’s

•Level 1- Depository receipts are the lowest level of sponsored

ADRs that can be issued. When a company issues sponsored

ADRs, it has one designated depository who also acts as its

transfer agent.

• Level 1 shares can only be traded on the OTC market and the

company has minimal reporting requirements with the U.S.

[SEC].

• Level 2- Depository receipt programs are more complicated for

a foreign company. When a foreign company wants to set up a

Level 2 program, it must file a registration statement with the

U.S. SEC and is under SEC regulation.

The advantage that the company has by upgrading their

program to Level 2 is that the shares can be listed on a U.S. stock

exchange. These exchanges include the New York Stock

Exchange (NYSE), NASDAQ, and the American Stock Exchange

(AMEX).](https://image.slidesharecdn.com/americandepositoryreceipts-181022075642/85/American-depository-receipts-8-320.jpg)