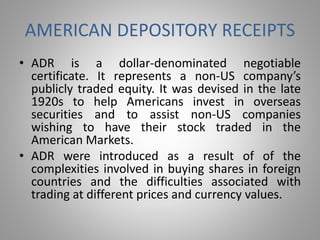

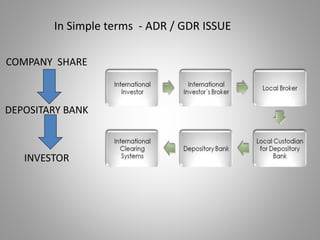

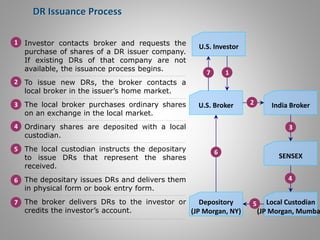

Depositary receipts (DRs) like American depositary receipts (ADRs) and global depositary receipts (GDRs) allow foreign companies to list shares on an exchange outside their home country. ADRs trade on US exchanges and represent ownership of shares in a foreign company, while GDRs trade internationally. DRs offer benefits to both companies raising capital abroad and international investors, including exposure to foreign markets in familiar terms. Companies issuing DRs must comply with regulations of the foreign market and designate depositary banks and custodians to facilitate the issuance and trading of the receipts.

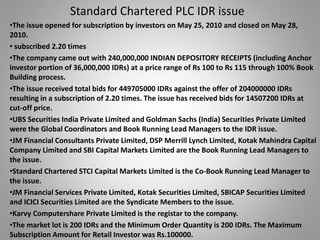

![Levels of ADR

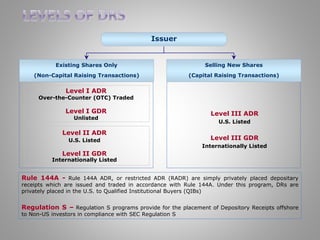

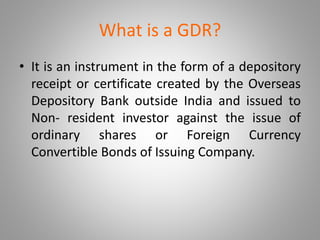

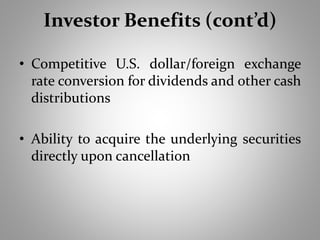

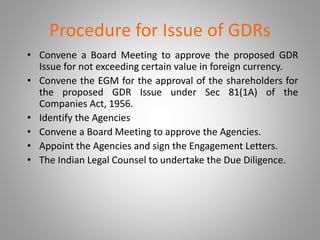

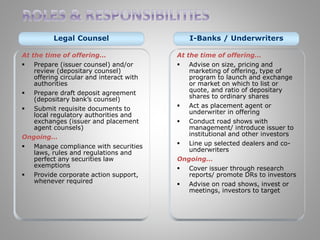

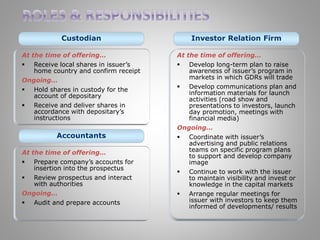

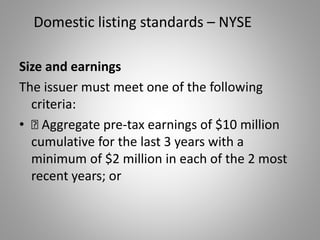

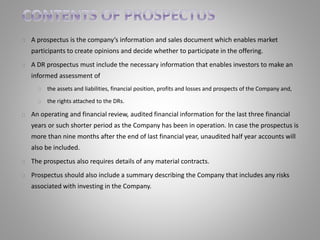

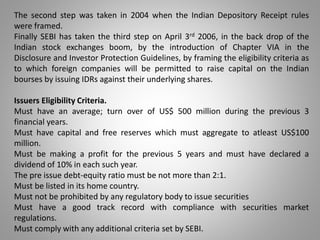

• Level 1- Level 1 depositary receipts are the lowest

level of sponsored ADRs that can be issued. When a

company issues sponsored ADRs, it has one

designated depositary who also acts as its transfer

agent.

• Level 1 shares can only be traded on the OTC market

and the company has minimal reporting requirements

with the U.S. Securities and Exchange Commission

[SEC].

• Level 2- Level 2 depositary receipt programs are more

complicated for a foreign company. When a foreign

company wants to set up a Level 2 program, it must

file a registration statement with the U.S. SEC and is

under SEC regulation.](https://image.slidesharecdn.com/globaldepositoryreceipts-140918141030-phpapp02/85/Global-depository-receipts-9-320.jpg)

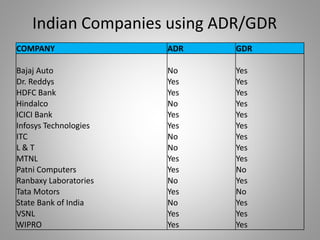

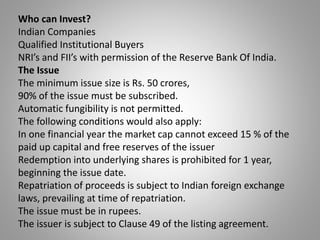

![Global Depositary Receipt (GDR) Stock Prices

This list gives you a Current Market Price (US $), P/E, Change (US $) and % Change.

Company CMP(US$) PE Chg(US$) Chg(%)

Dr. Reddy's (A) 38.70 58.85 0.11 0.3

GAIL (G) 32.35 17.73 1.09 3.5

Grasim Industries (G) 44.22 13.03 2.13 5.0

ICICI Bank (A) 32.11 28.02 0.93 3.0

Infosys Tech (A) 49.15 28.98 0.25 0.5

Instanex Skindia DR Index 2,077.79 23.81 41.38 2.0

ITC (G) 5.48 35.58 [0.01] [0.1]

L & T (G) 13.35 12.46 0.67 5.3

Mahindra & Mah. (G) 13.88 16.71 0.47 3.5

Ranbaxy Labs (G) 5.85 -23.71 0.29 5.2

Reliance (G) 27.55 18.73 1.10 4.2

Satyam Computers (A) 2.64 4.60 0.00 0.0

State Bank of India (G) 54.00 10.52 1.44 2.7

Sterlite Industries (A) 6.22 54.55 0.00 0.0

Tata Communications (A) 4.50 9.29 0.00 0.0

Tata Motors (A) 28.01 52.73 0.71 2.6](https://image.slidesharecdn.com/globaldepositoryreceipts-140918141030-phpapp02/85/Global-depository-receipts-70-320.jpg)