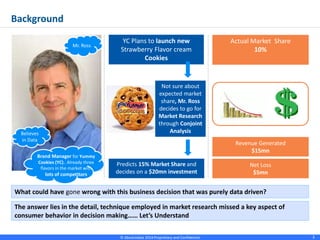

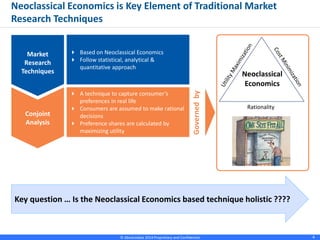

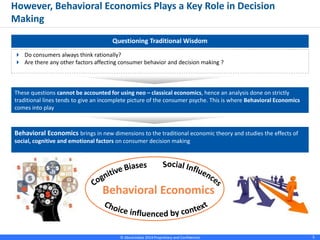

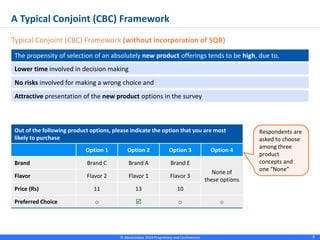

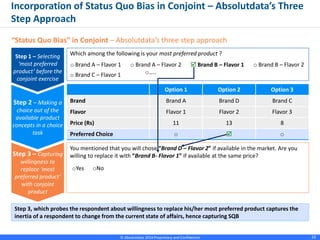

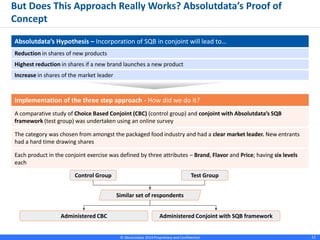

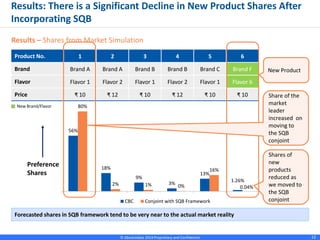

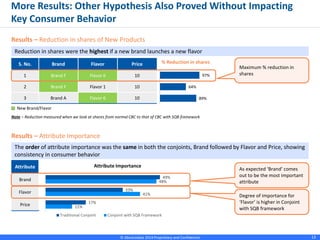

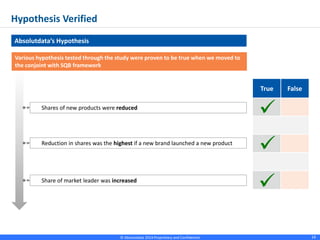

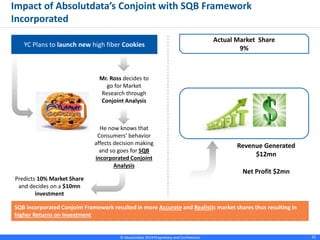

The document discusses the integration of behavioral economics, particularly status quo bias (SQB), into market research methodologies like conjoint analysis to improve the accuracy of predicting consumer behavior and market shares. It illustrates the shortcomings of traditional neoclassical economic methods in capturing the complexities of consumer decision-making and demonstrates how SQB can lead to more realistic market share forecasts through a three-step approach. The findings suggest that incorporating SQB in analysis can significantly reduce predicted shares of new products while increasing the market share of established brands.