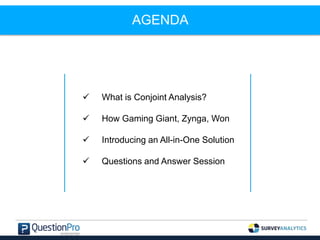

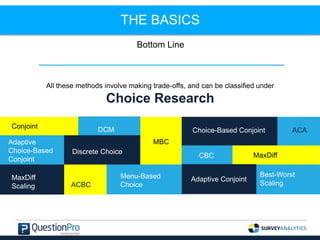

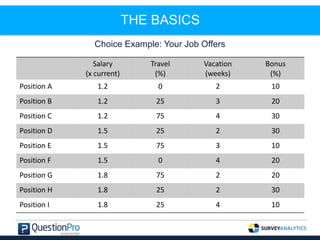

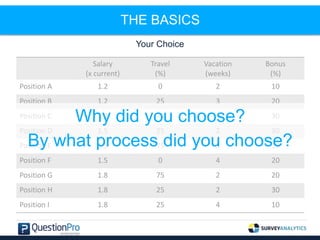

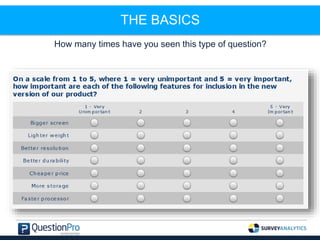

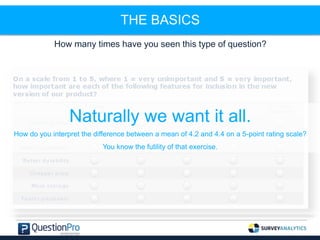

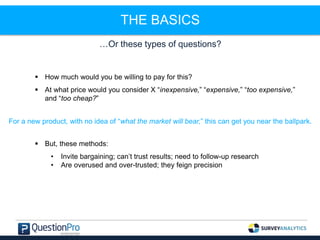

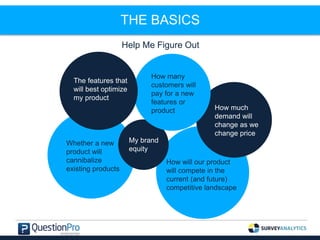

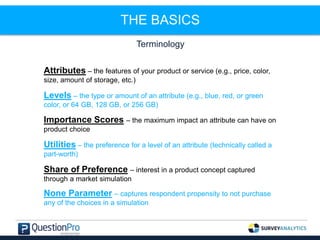

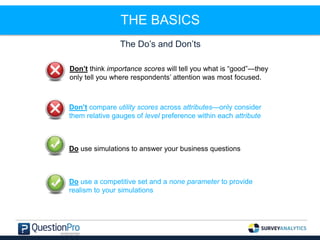

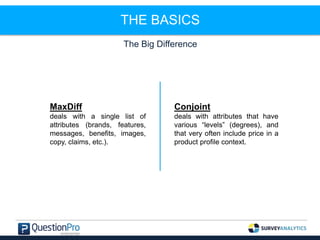

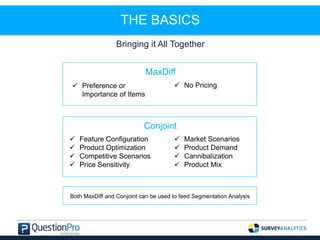

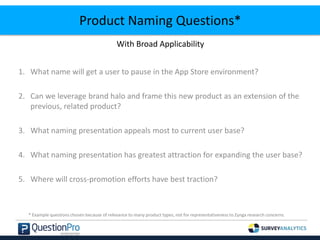

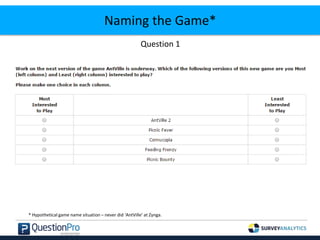

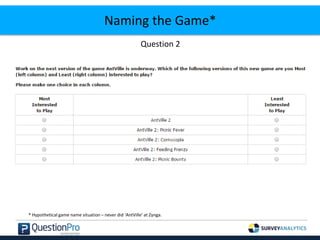

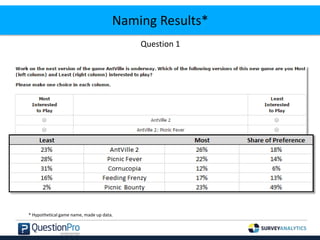

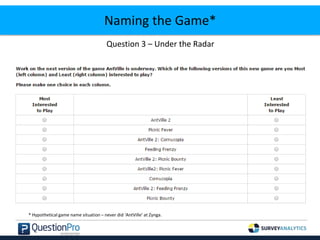

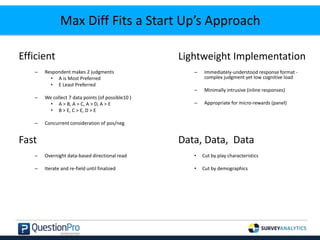

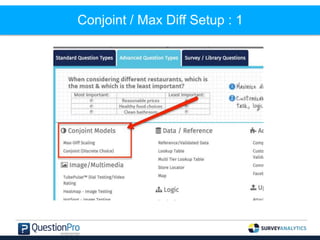

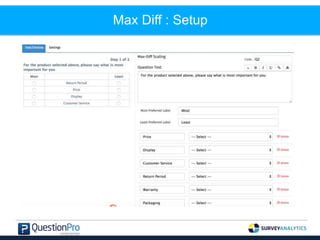

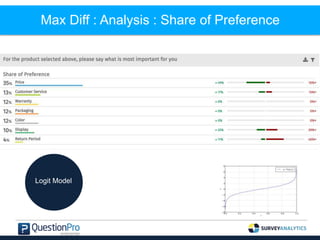

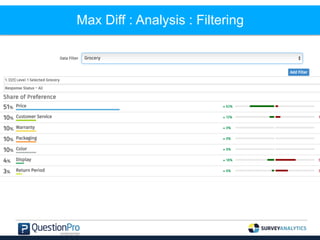

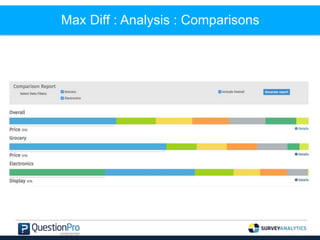

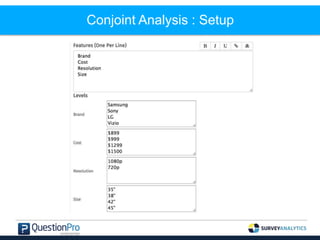

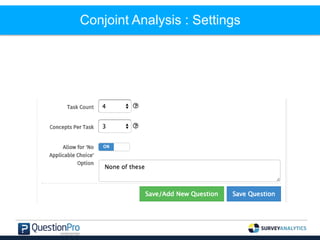

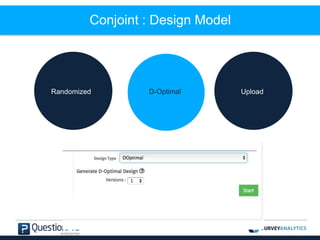

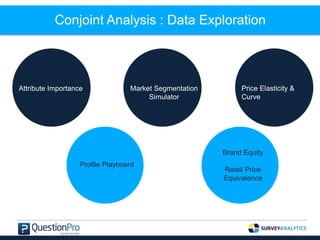

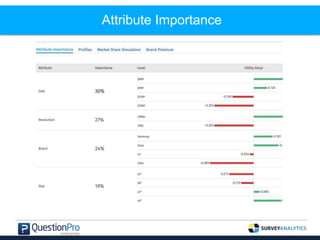

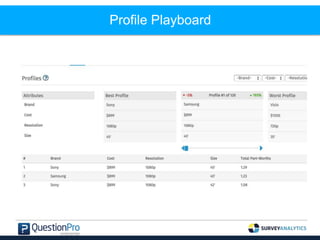

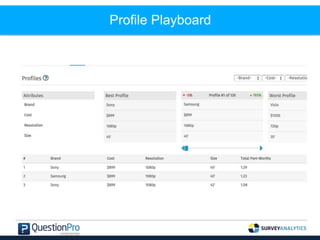

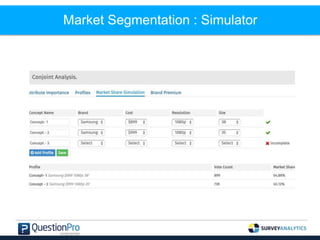

This document outlines a webinar on conjoint analysis aimed at improving business decision-making, featuring speakers from SurveyAnalytics and Zynga. It covers the methodology and application of various choice research techniques, including MaxDiff and Conjoint, while providing insights into optimizing products through market simulations and customer preferences. The session also addresses practical questions related to product naming and market competition dynamics.