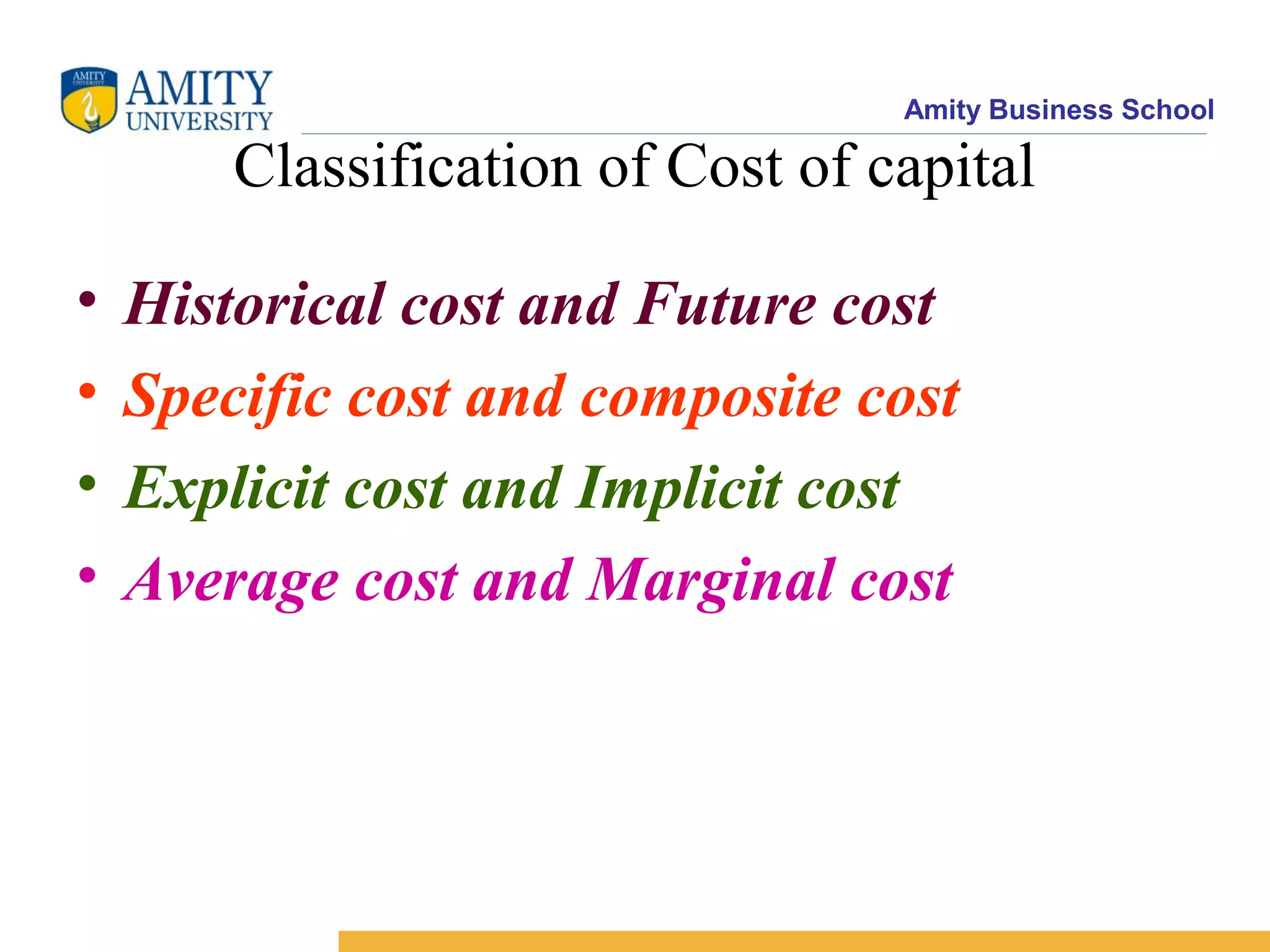

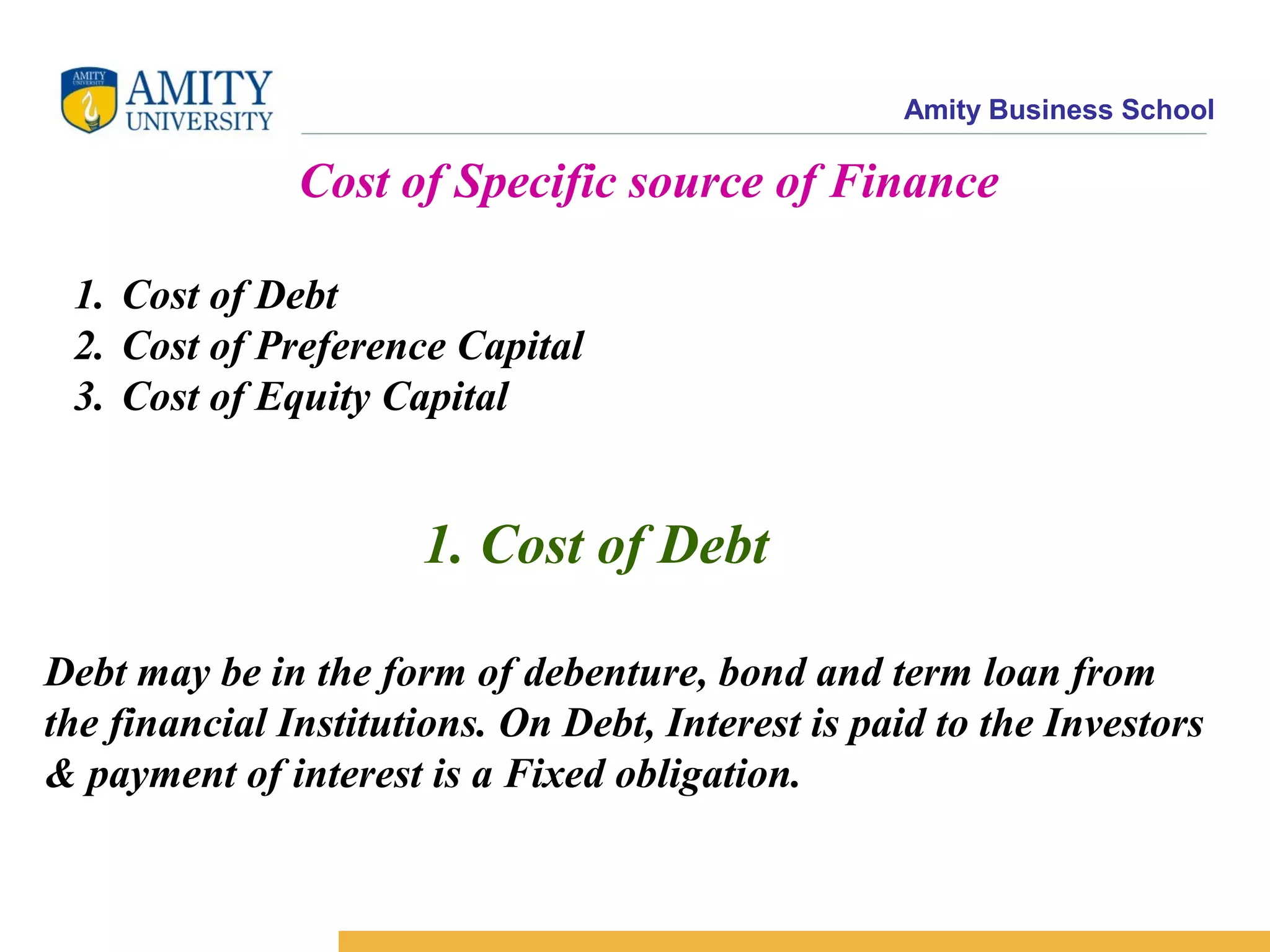

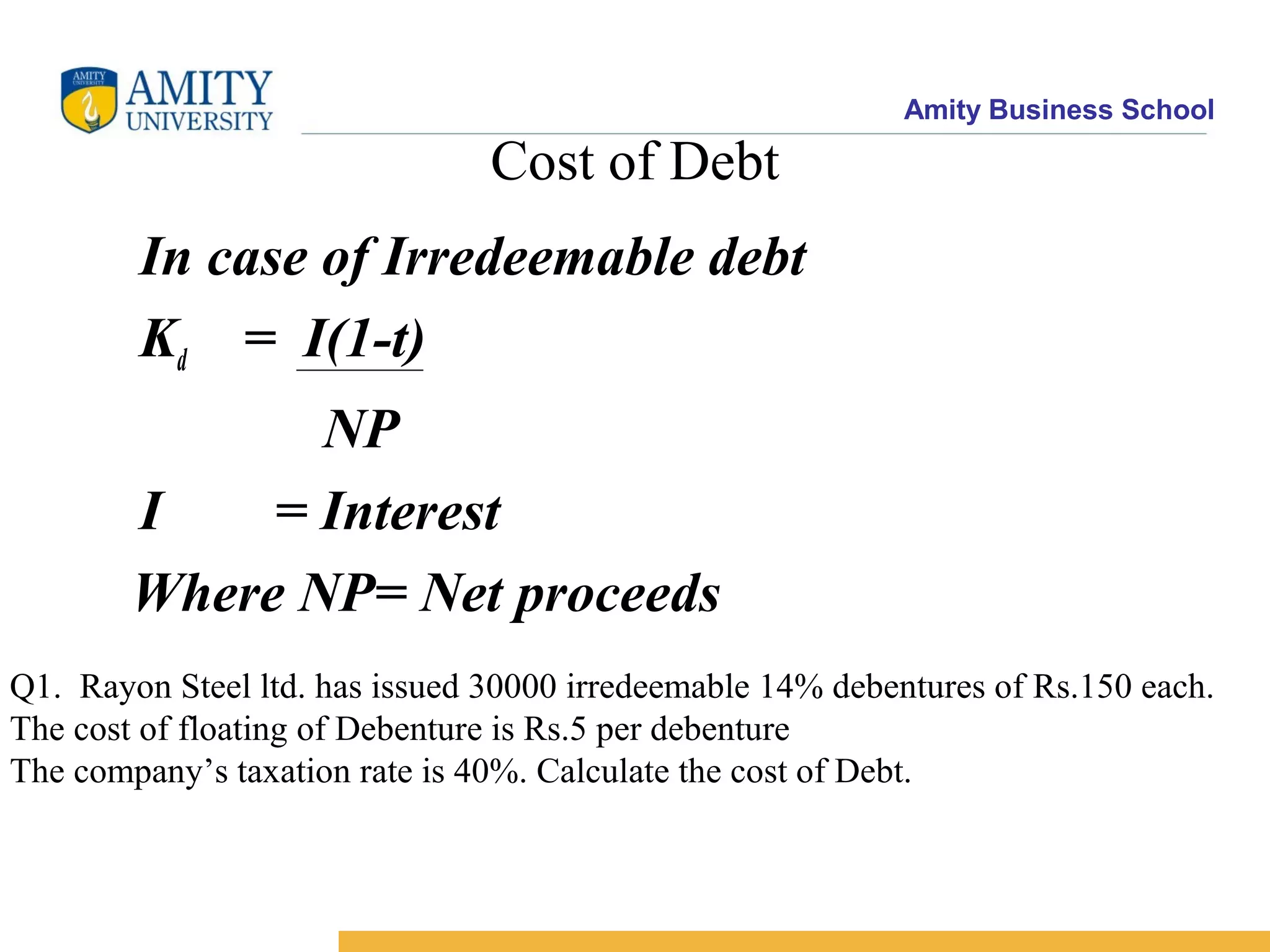

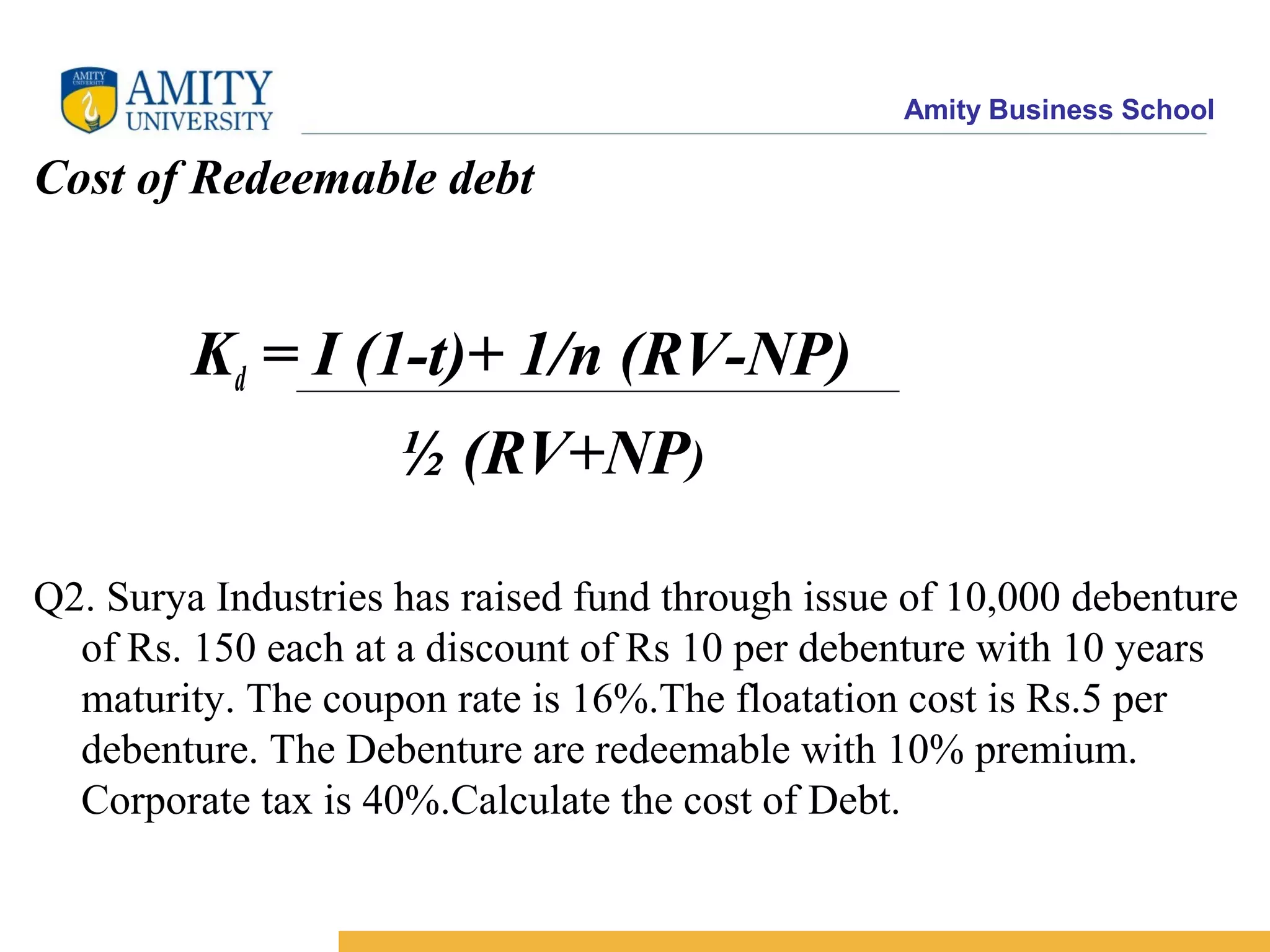

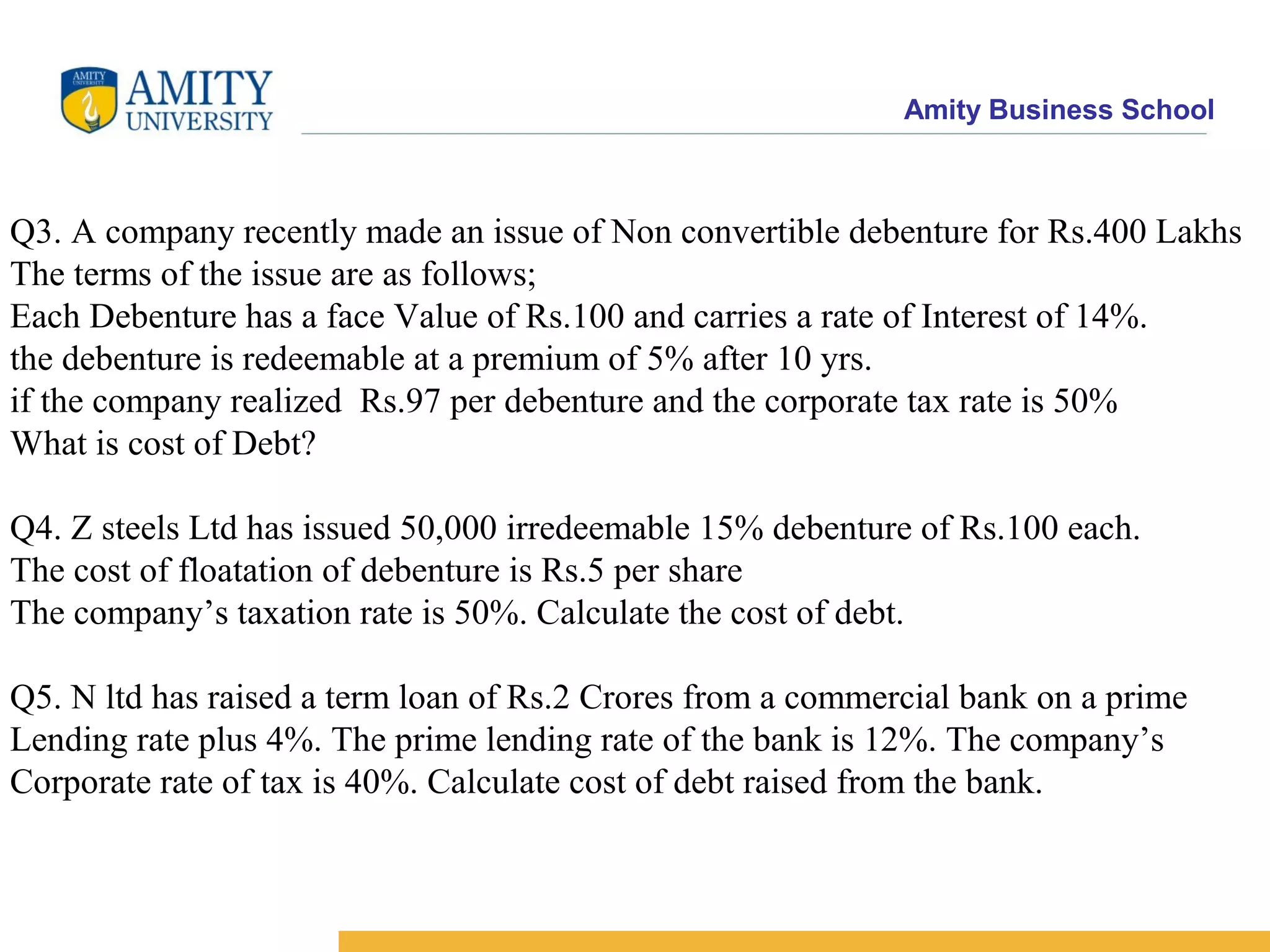

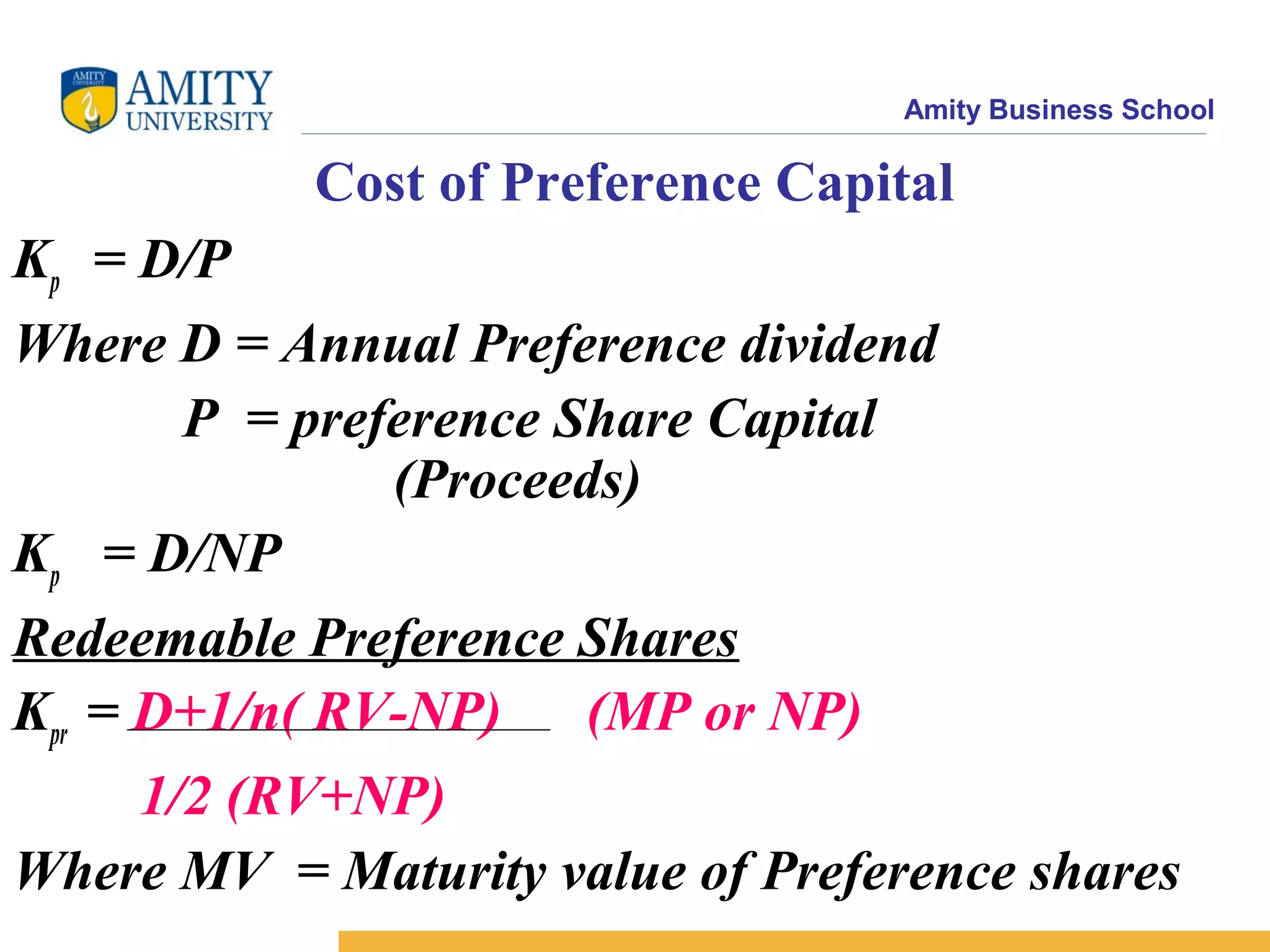

This document discusses cost of capital and provides examples of how to calculate cost of different sources of capital. It defines cost of capital as the minimum rate of return a firm must earn on its investments to maintain its market value. Cost of capital is important for capital budgeting, capital structure decisions, and other financial decisions. It then discusses different classifications of cost of capital and provides formulas and examples for calculating the specific costs of different sources of capital, including debt, preference shares, and equity.