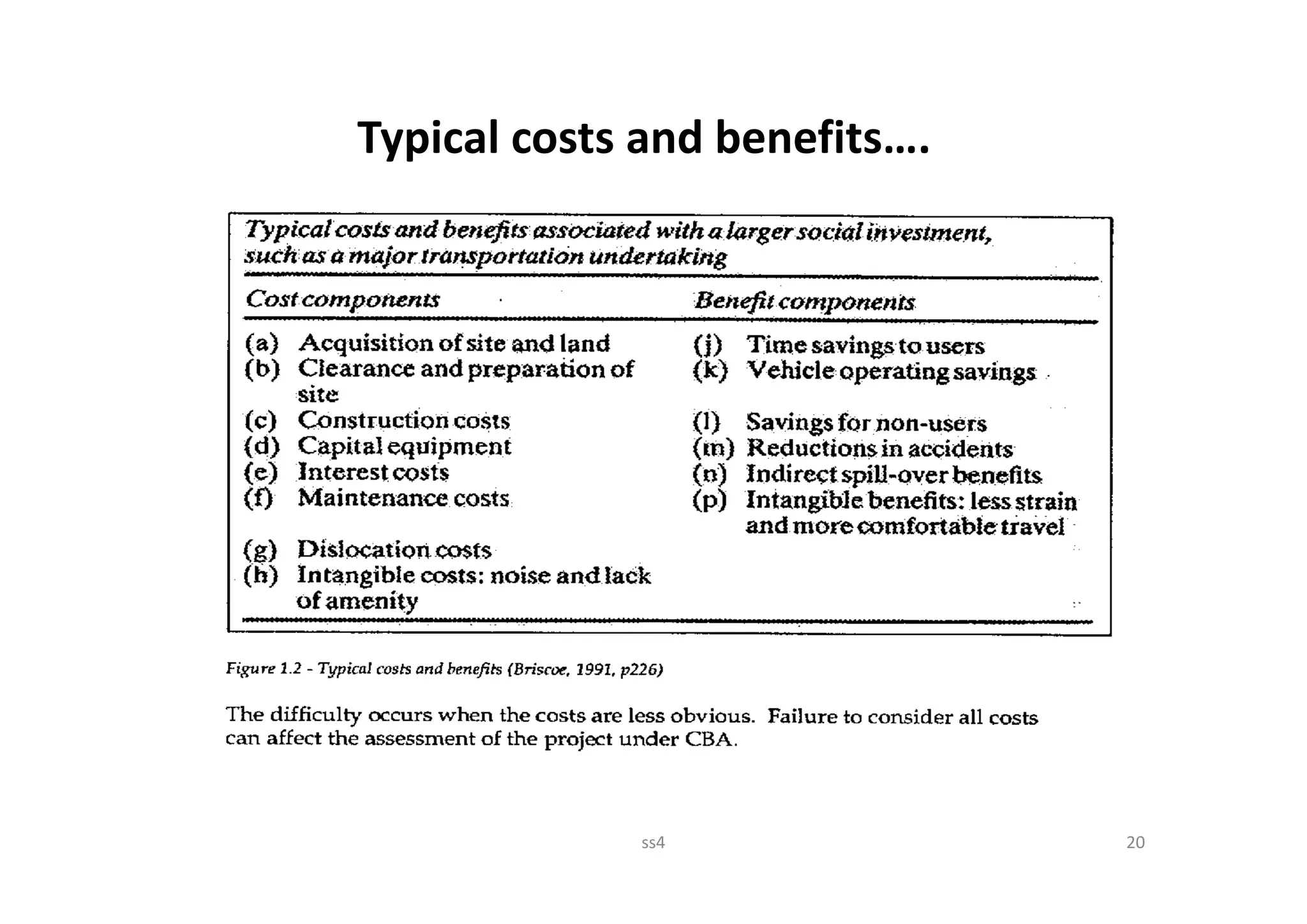

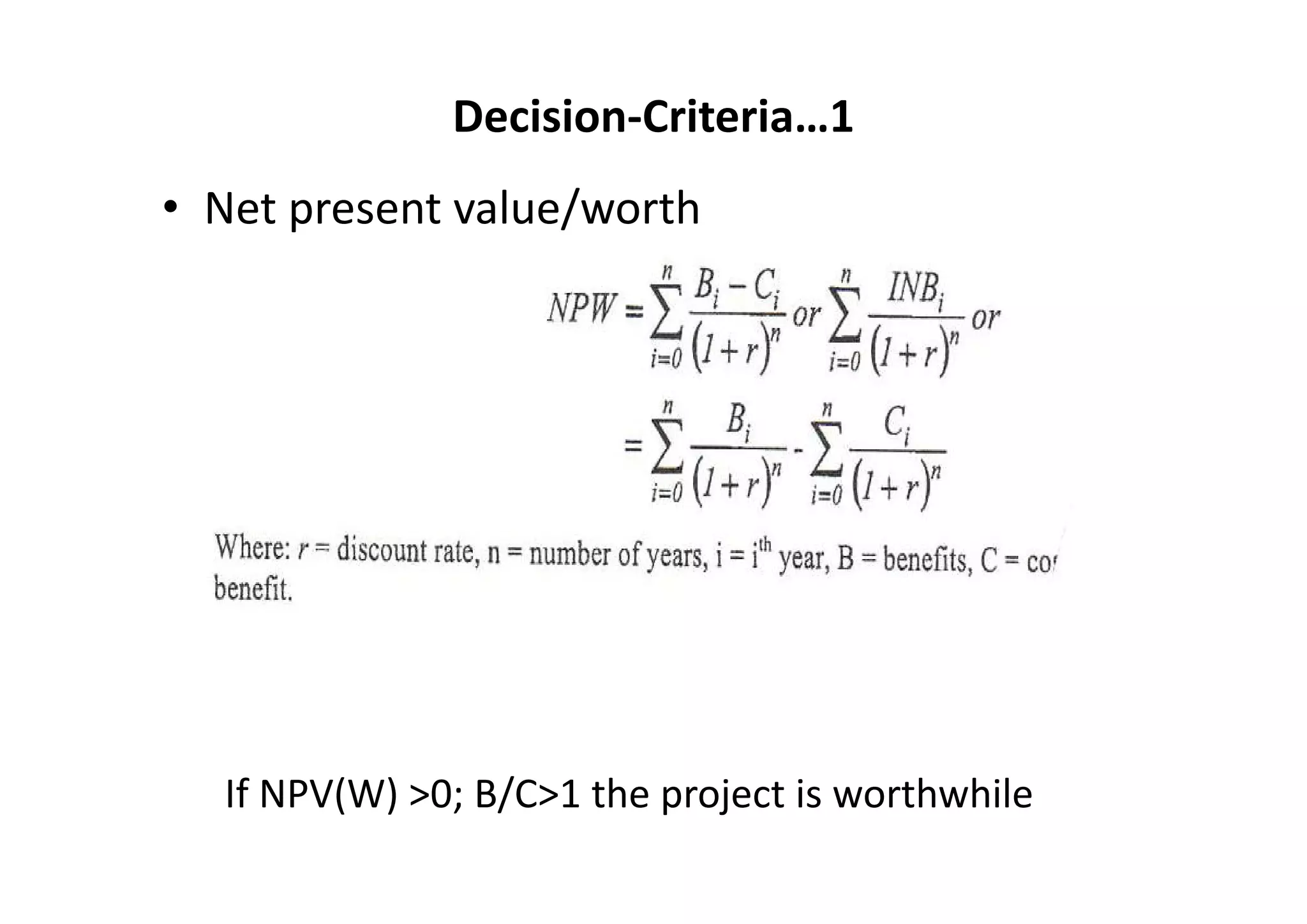

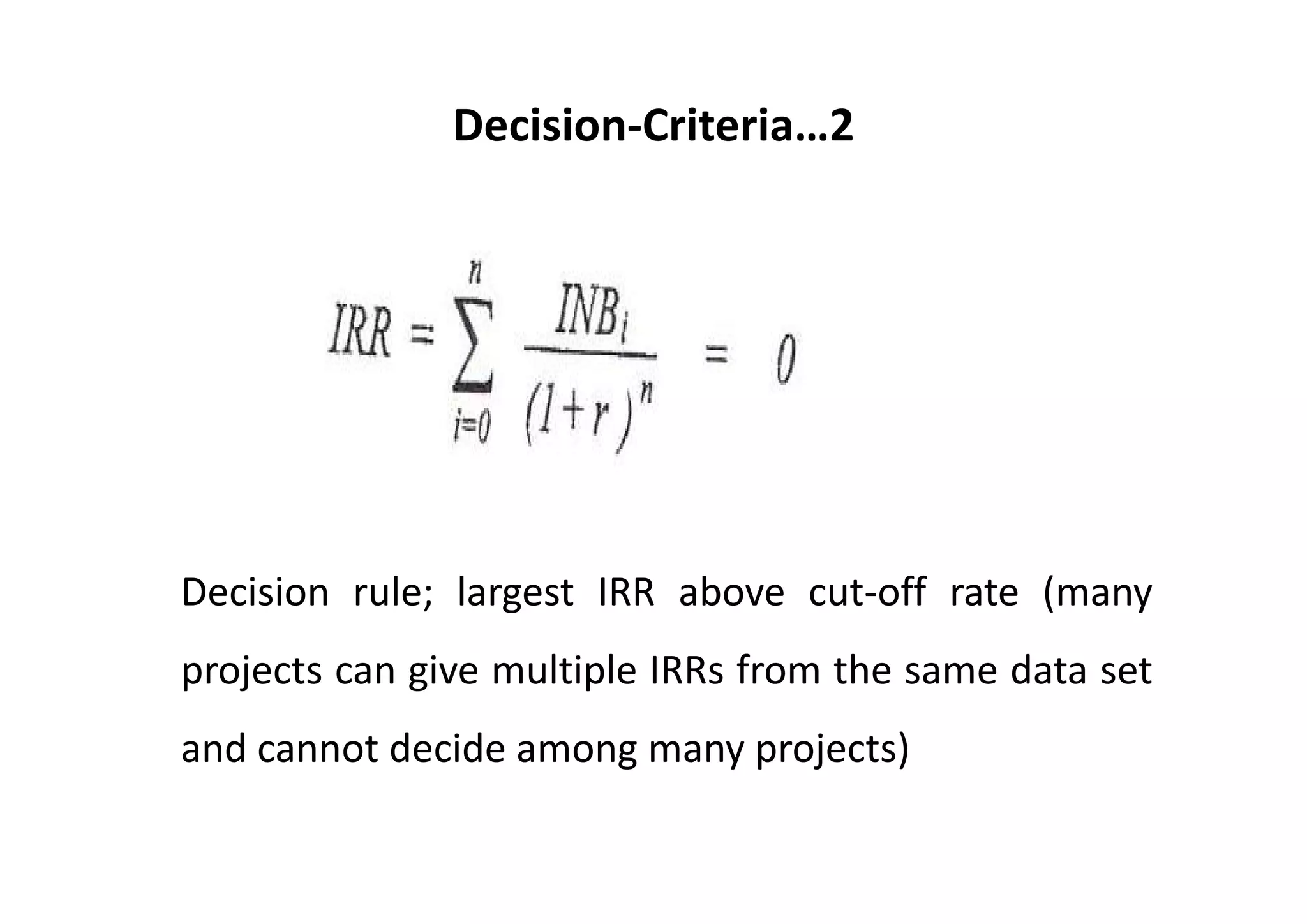

The document provides an overview of cost-benefit analysis (CBA) as a tool for evaluating projects, particularly in the context of government decision-making regarding social and economic policies in Africa. It discusses the distinctions between financial and economic CBA, emphasizing the importance of considering externalities and the broader impacts on society beyond private profitability. Key elements of conducting a CBA include identifying costs and benefits, quantifying impacts, and applying decision criteria such as net present value and internal rate of return.