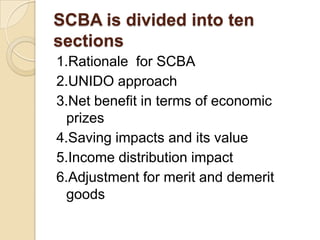

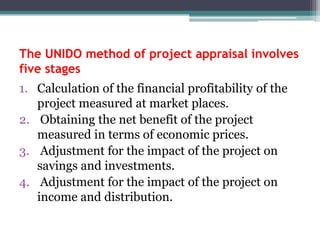

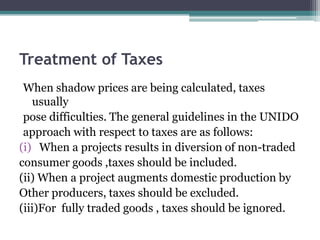

This document discusses social cost benefit analysis (SCBA) and the UNIDO approach to SCBA. It is divided into several sections that cover: the rationale for SCBA including market imperfections, externalities, and taxes/subsidies; the UNIDO approach and its 5 stages; calculating net benefits using shadow pricing and choosing a numeraire; the concept of tradable goods; sources of shadow prices; and treatment of taxes in the analysis. The overall document provides an overview of how to conduct SCBA according to the UNIDO methodology.