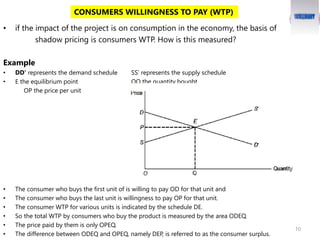

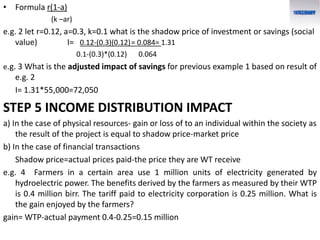

The document discusses social cost-benefit analysis (SCBA), which is used to evaluate the economic impact of projects on a national level. SCBA measures impacts such as foreign exchange earnings, taxation revenue, employment, and income distribution. It considers effects from the perspective of the financial analysis, economic analysis, and distributional analysis. The rationale for SCBA includes market imperfections, externalities, taxes/subsidies, concern for savings and redistribution, and merit wants. The document outlines approaches to SCBA, including shadow pricing of inputs/outputs, and discusses factors such as tradability, consumers' willingness to pay, and production costs.