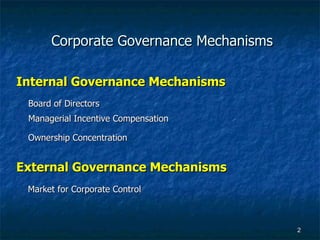

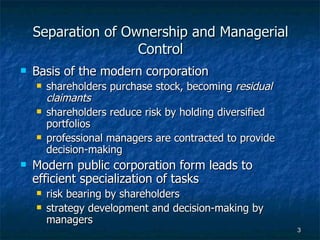

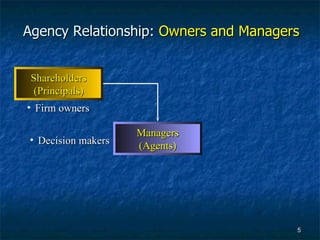

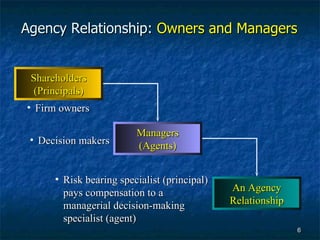

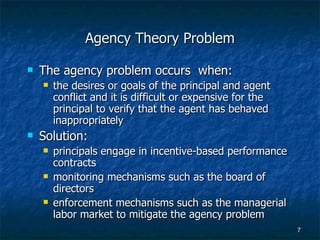

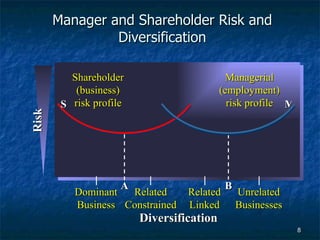

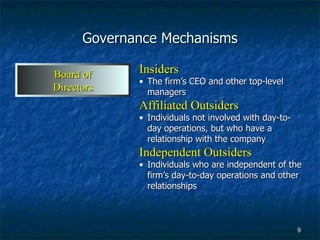

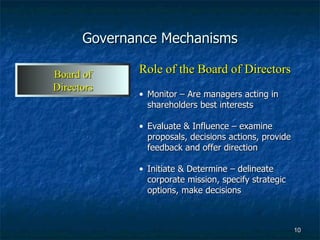

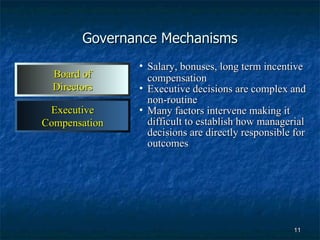

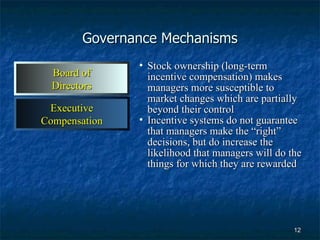

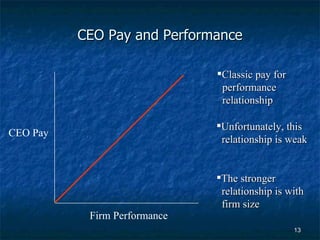

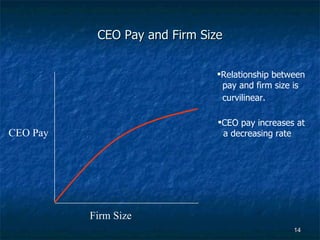

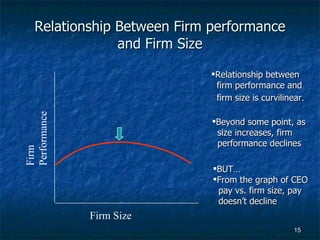

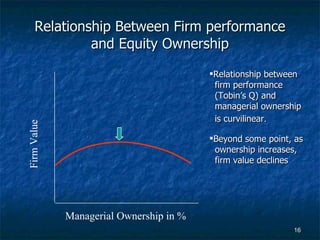

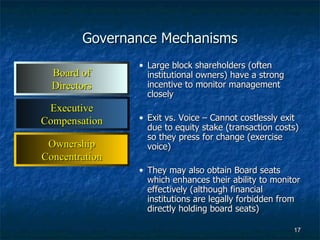

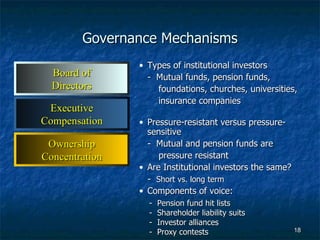

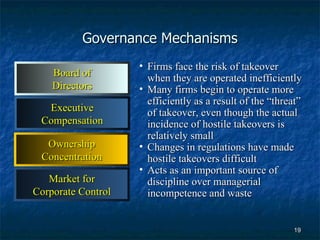

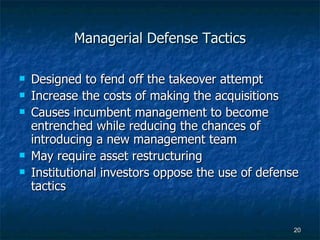

Corporate governance involves establishing order between a firm's owners and managers through mechanisms like boards of directors and executive compensation. The separation of ownership and control in modern corporations creates an agency problem where the interests of shareholders and managers may not be aligned. Various governance mechanisms attempt to monitor managers and incentivize them to act in shareholders' best interests.