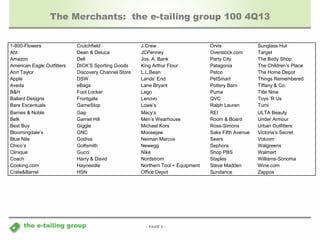

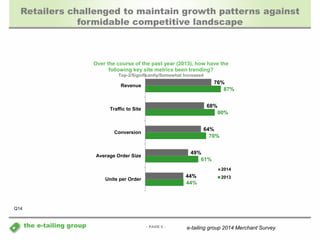

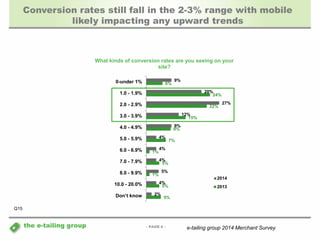

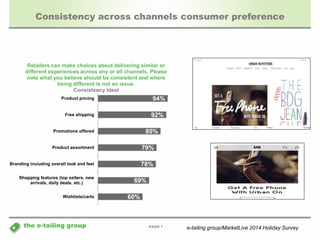

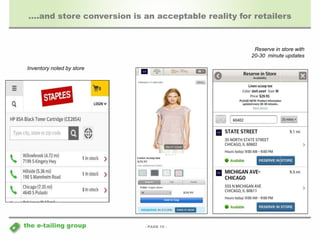

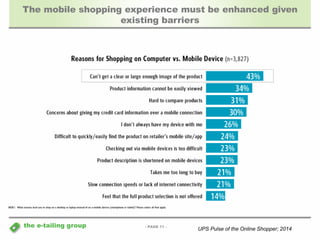

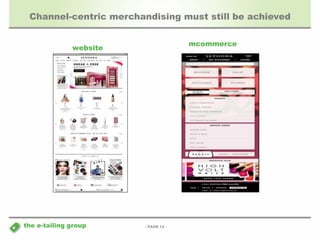

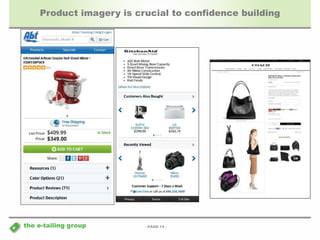

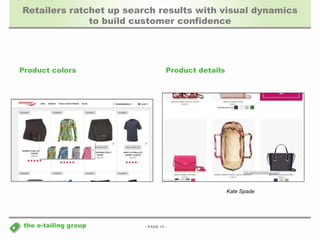

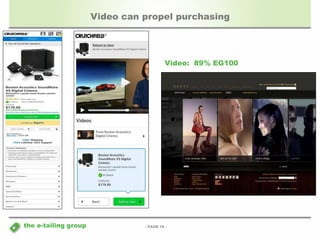

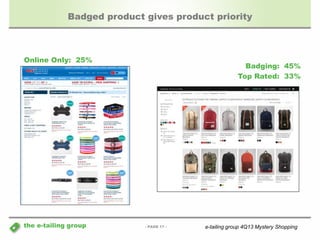

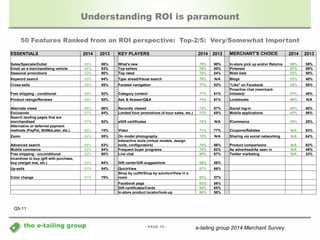

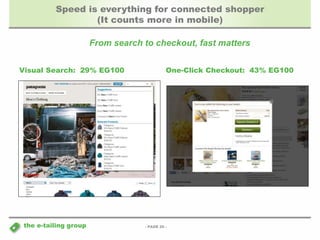

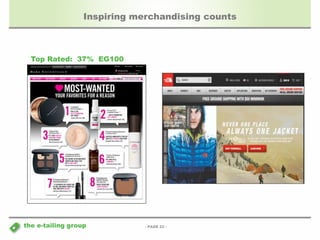

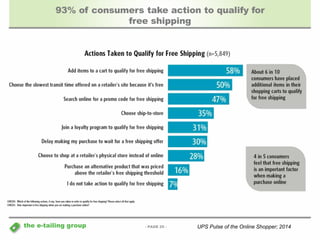

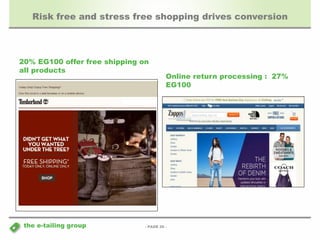

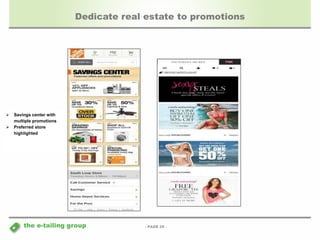

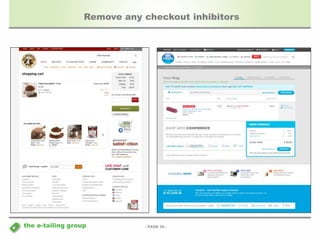

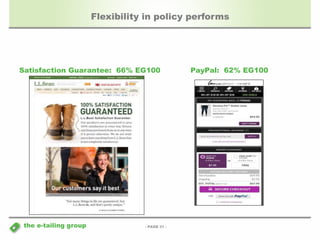

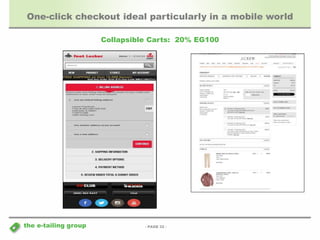

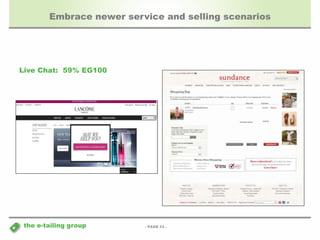

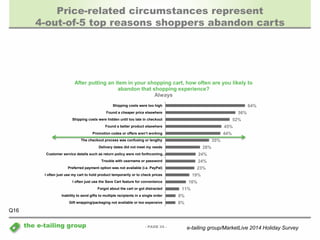

The document discusses the challenges retailers face in improving online conversion rates, which remain in the 2-3% range, influenced by factors such as mobile device usage and customer preferences for consistent experiences across channels. It highlights key metrics affecting retail growth, such as revenue and traffic to sites, and emphasizes the importance of product photography, streamlined checkout processes, and effective merchandising strategies. Additionally, it outlines consumer behaviors and motivations, including the significance of free shipping and competitive pricing in driving loyalty and conversions.