This document provides an overview of omnichannel trends from the perspective of Deborah Weinswig, Executive Director and Head of Global Retail & Technology at the Fung Business Intelligence Centre. The summary is as follows:

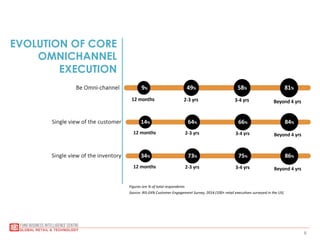

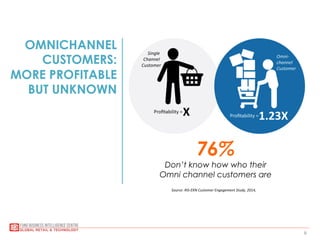

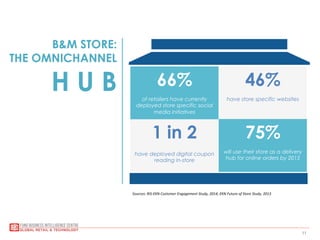

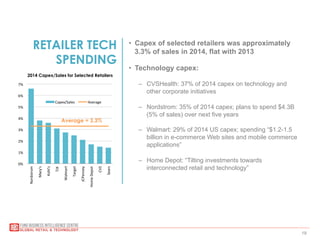

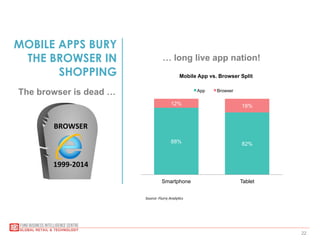

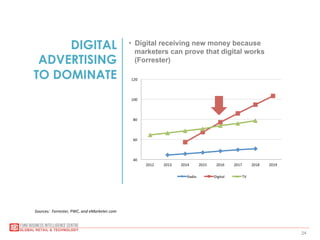

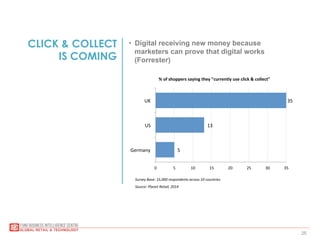

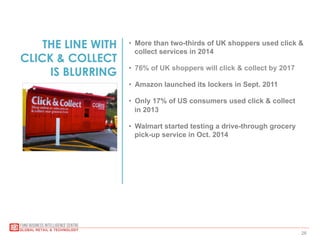

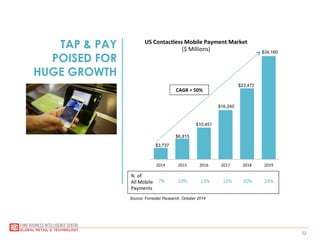

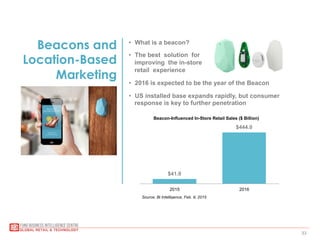

Webrooming, where customers research products online and then purchase in-store, has become more common than showrooming. Brick-and-mortar retailers are investing heavily in technology like beacons, mobile apps, and inventory tracking to improve the customer experience across channels. Emerging trends that will impact retail include the growth of mobile shopping via apps, click-and-collect services, subscriptions, and investments in security as retail becomes more digital.