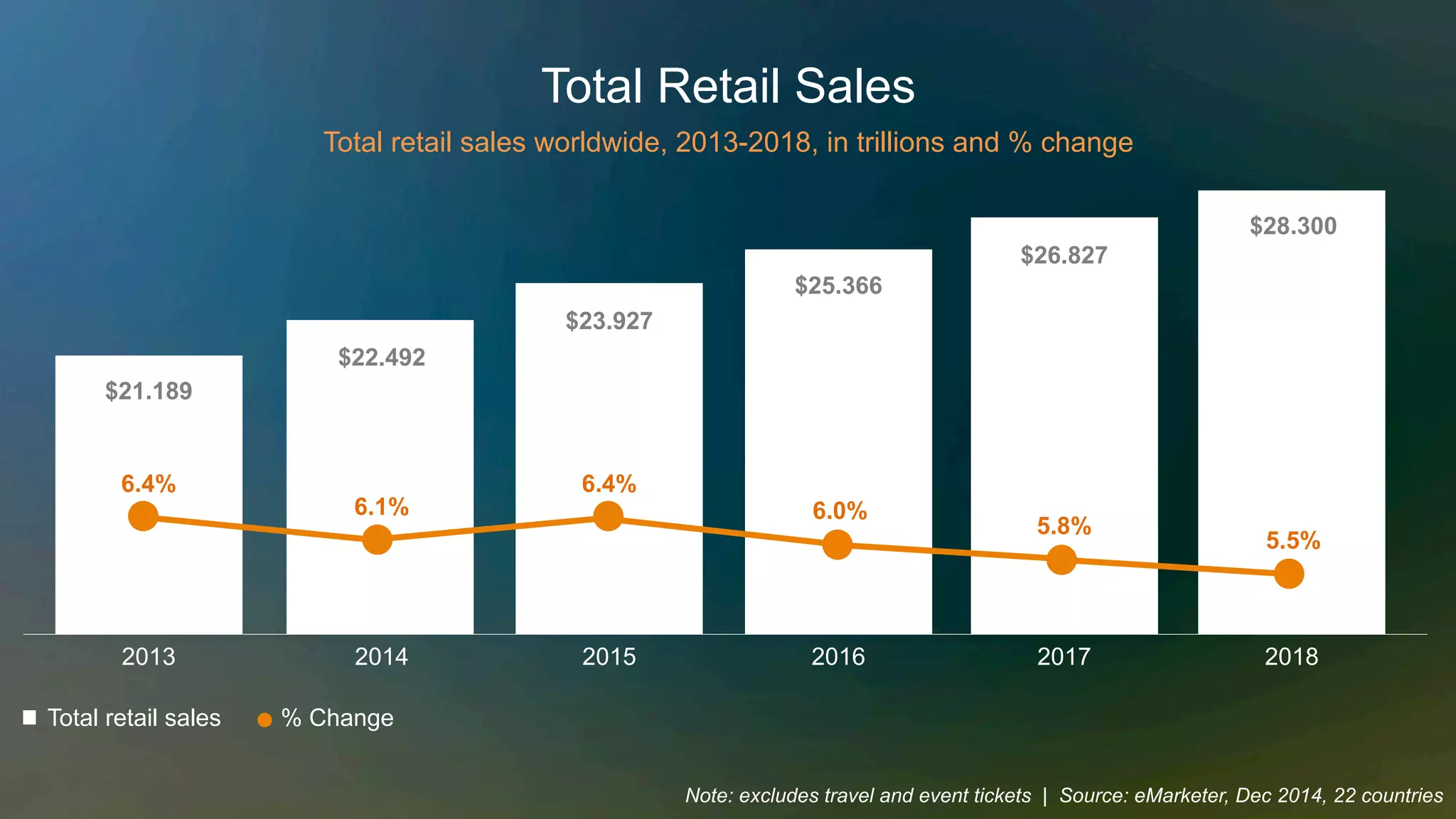

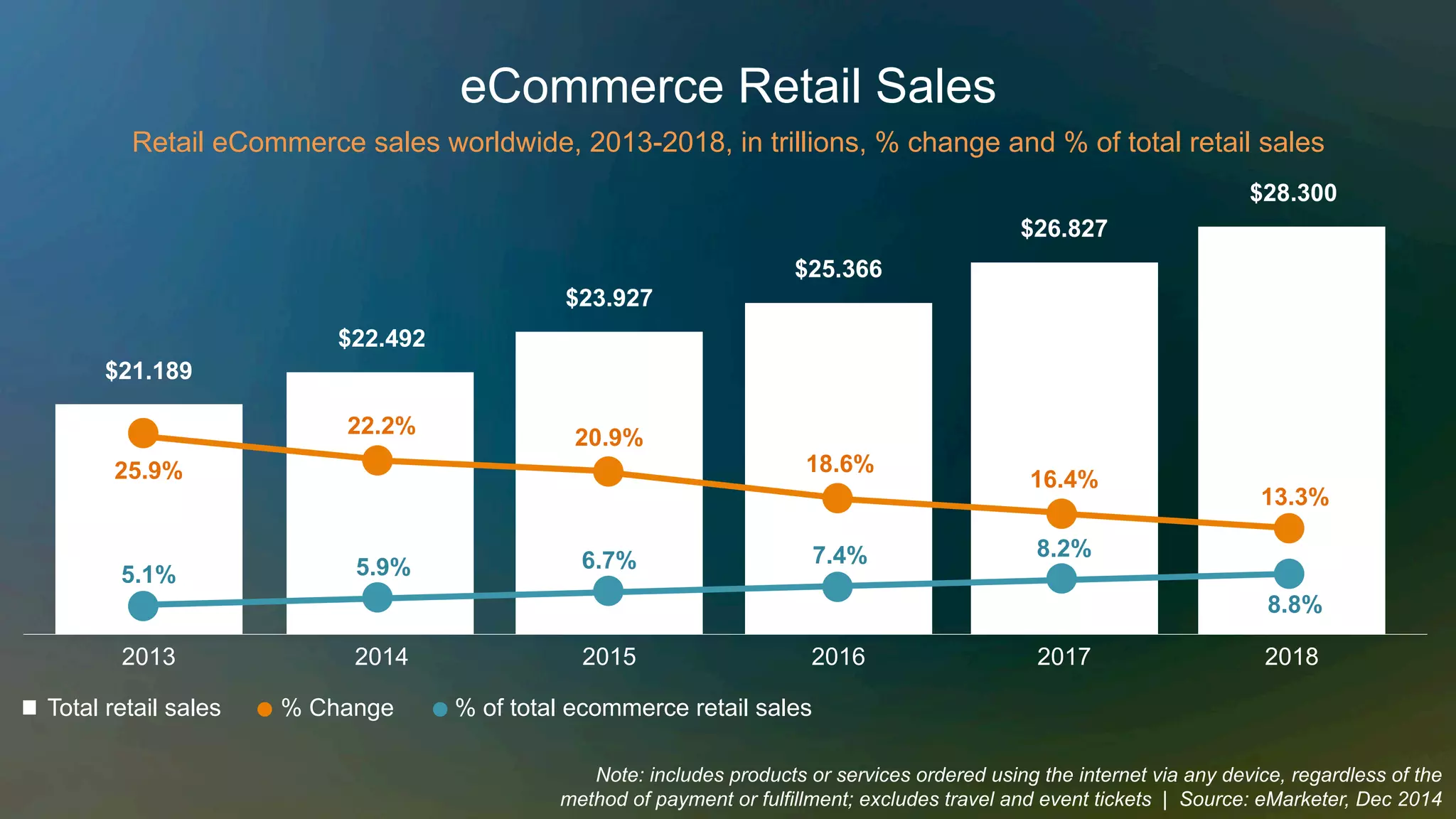

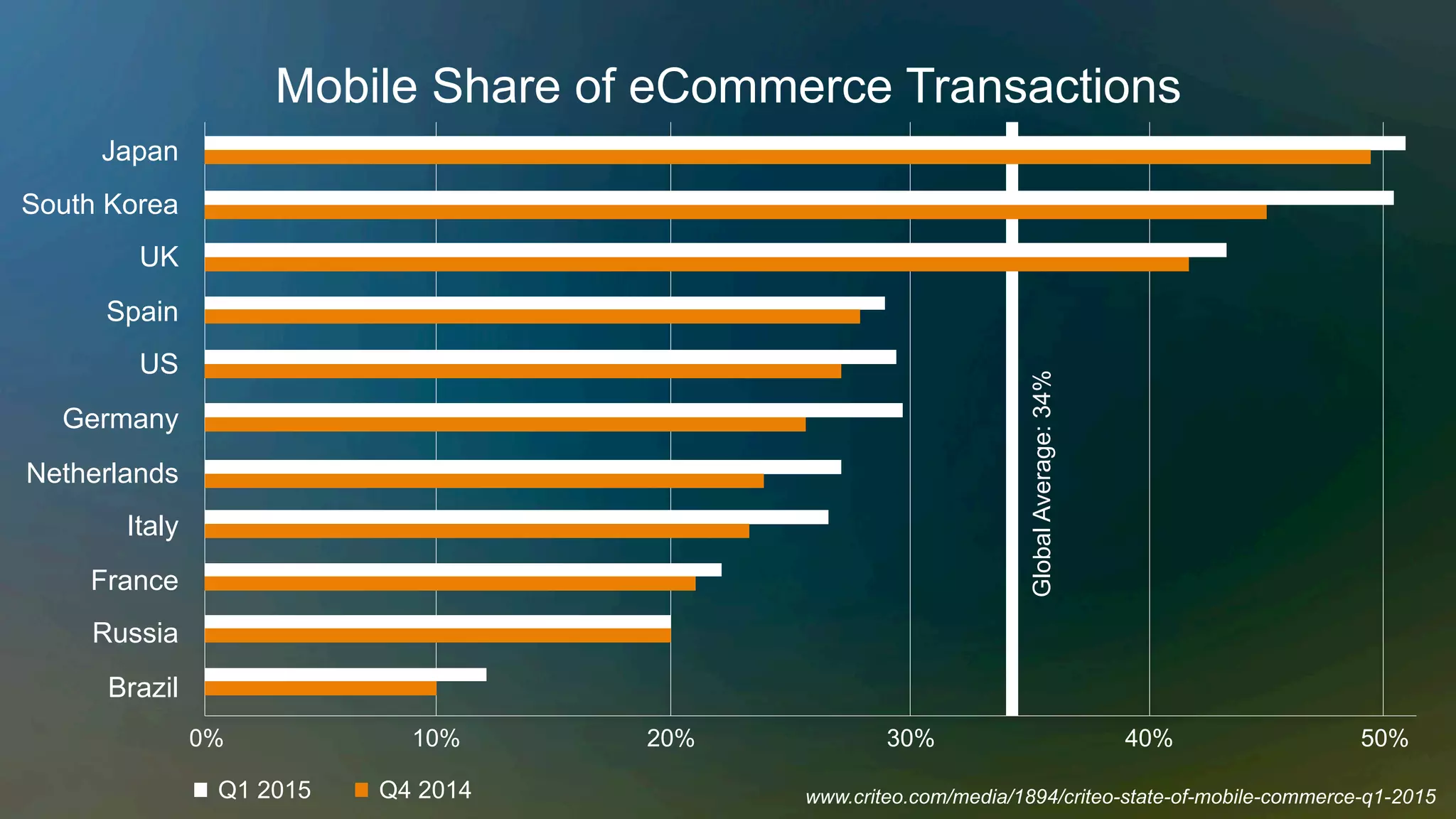

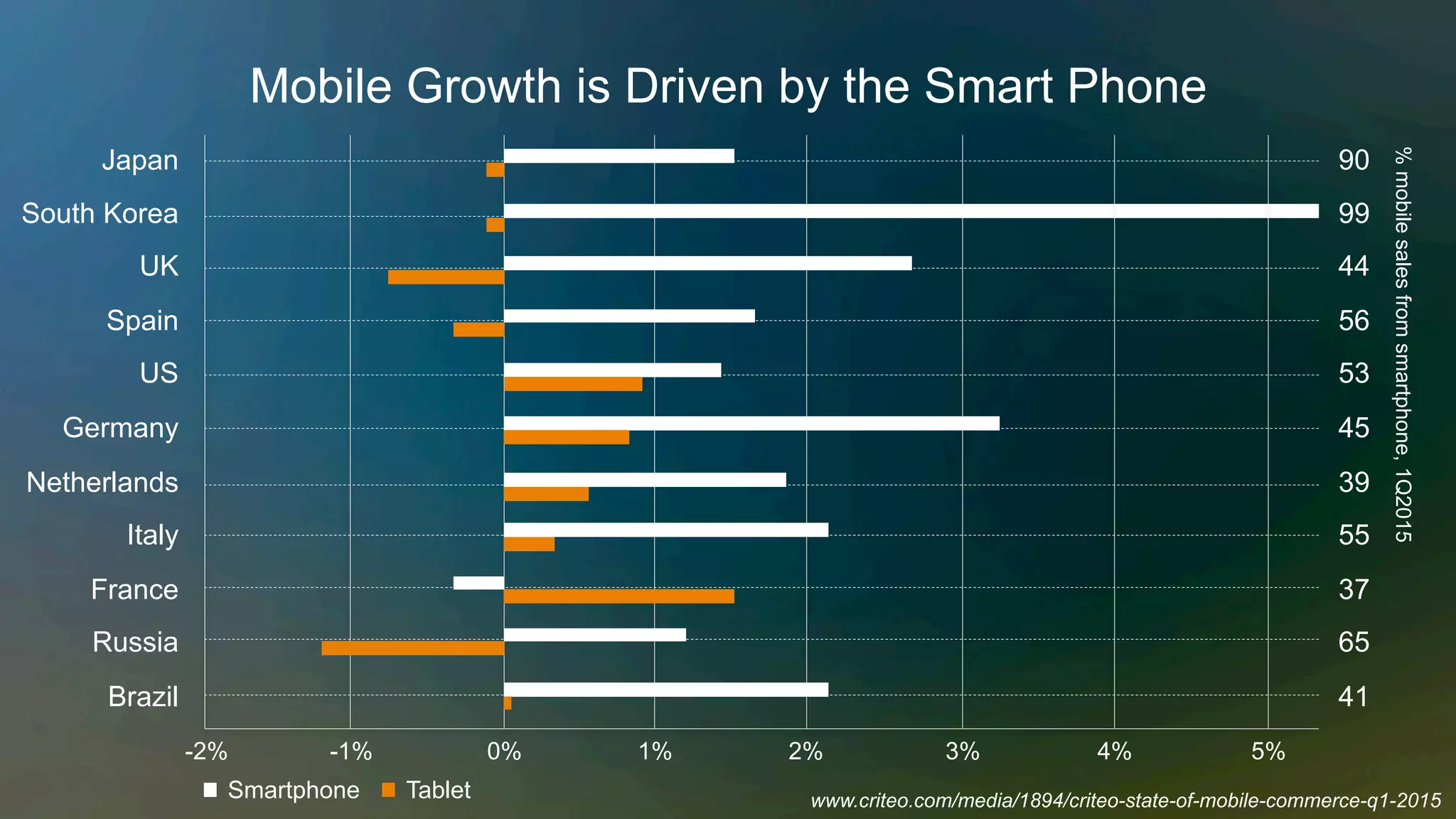

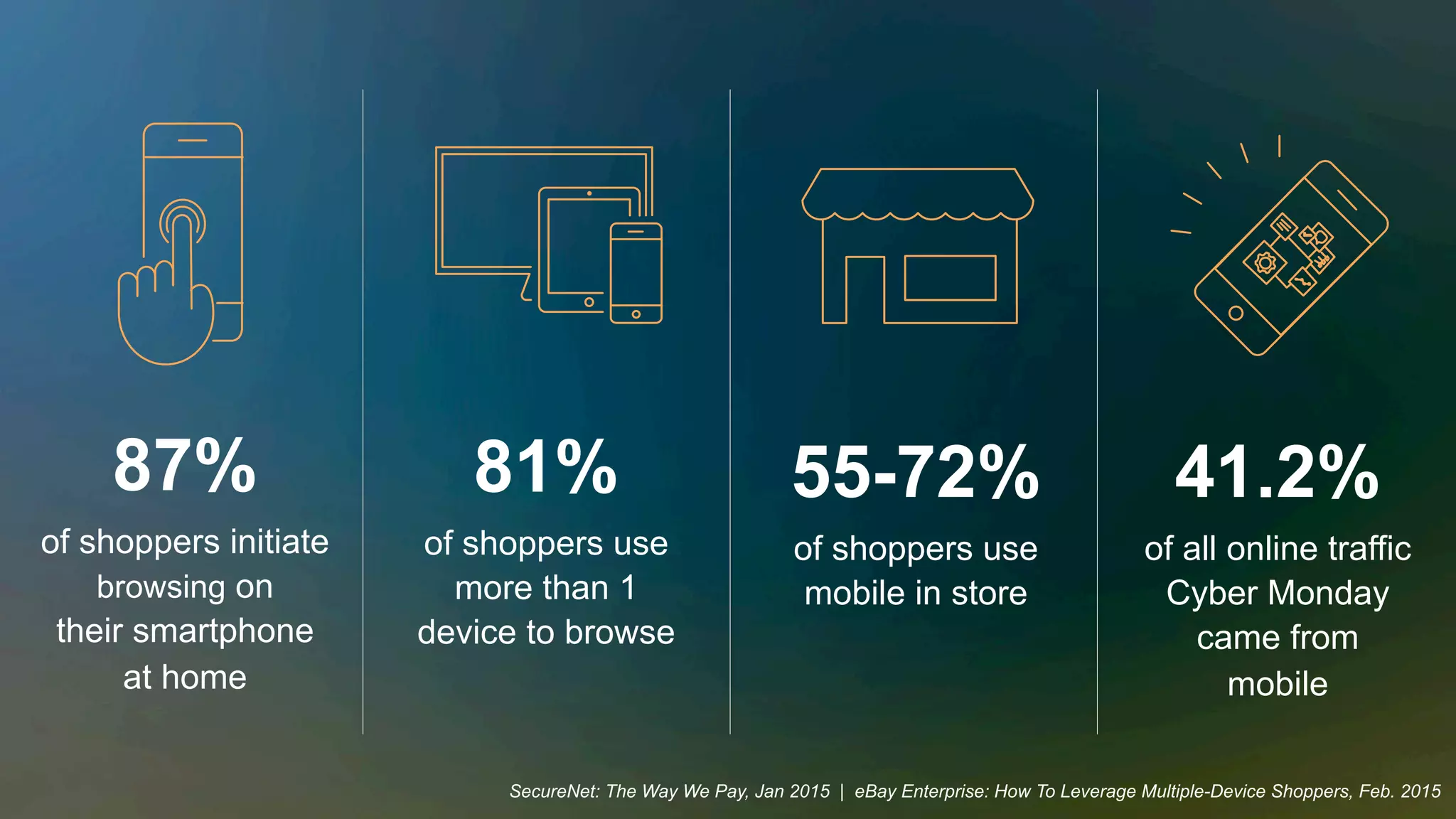

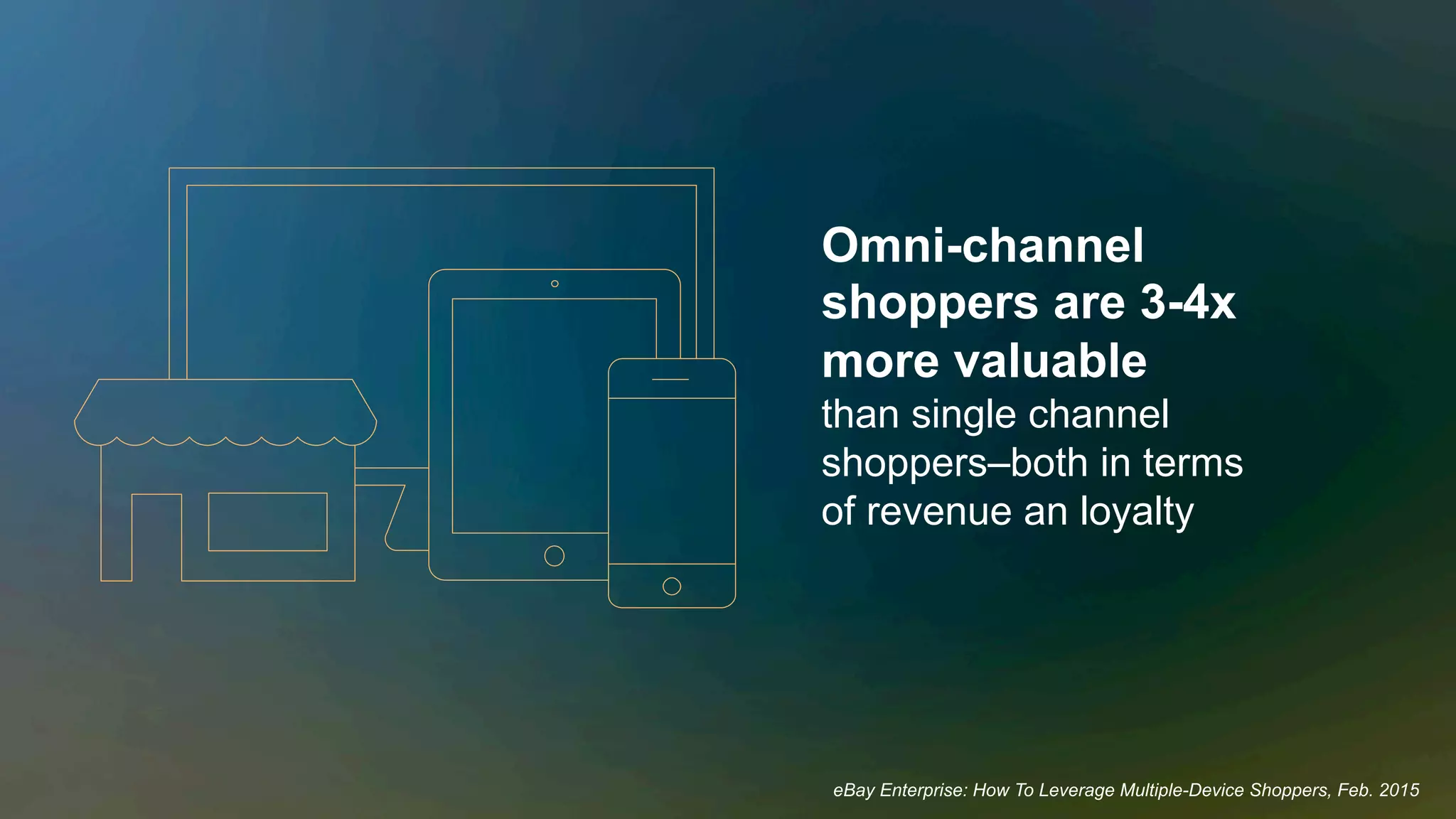

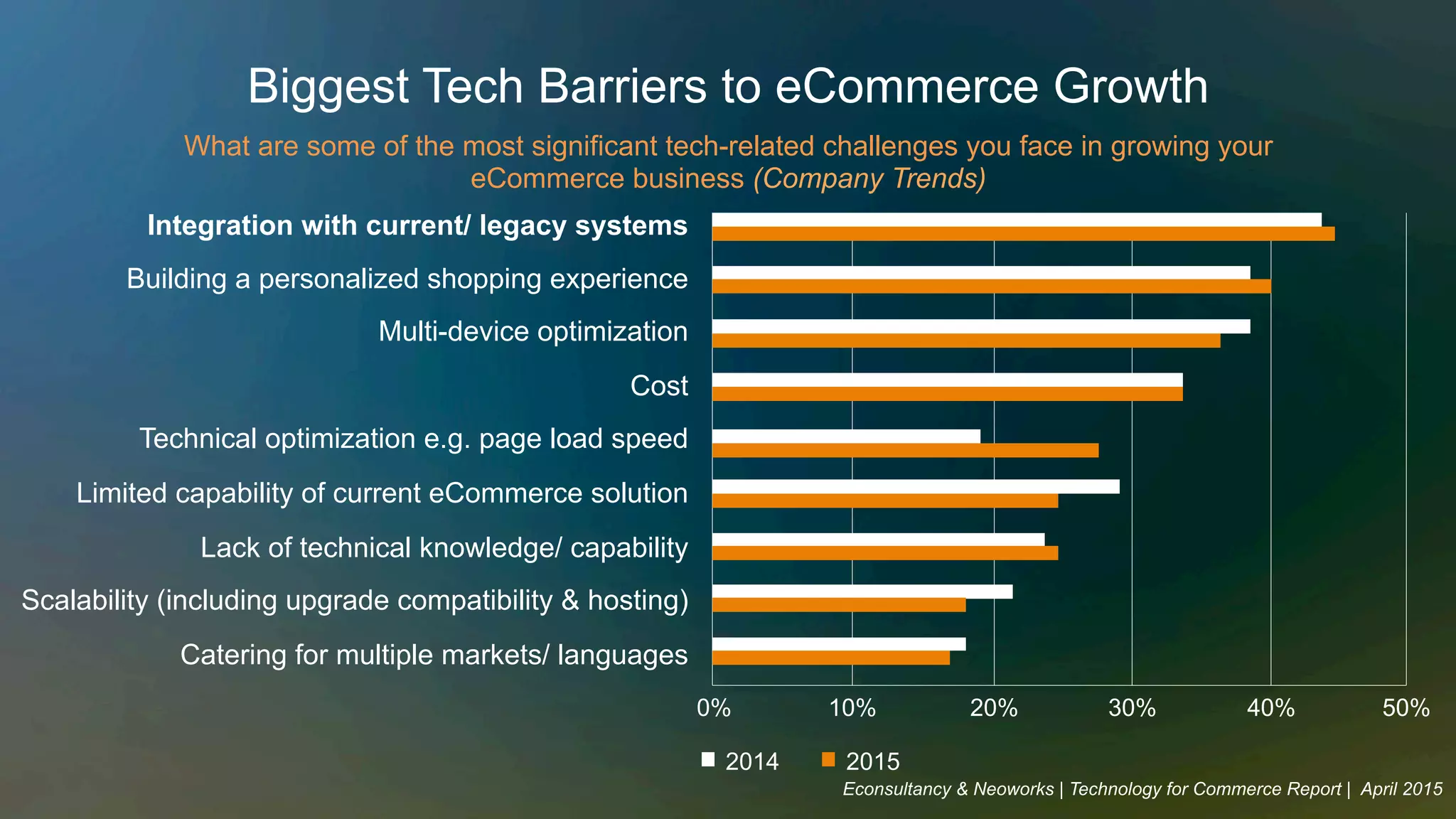

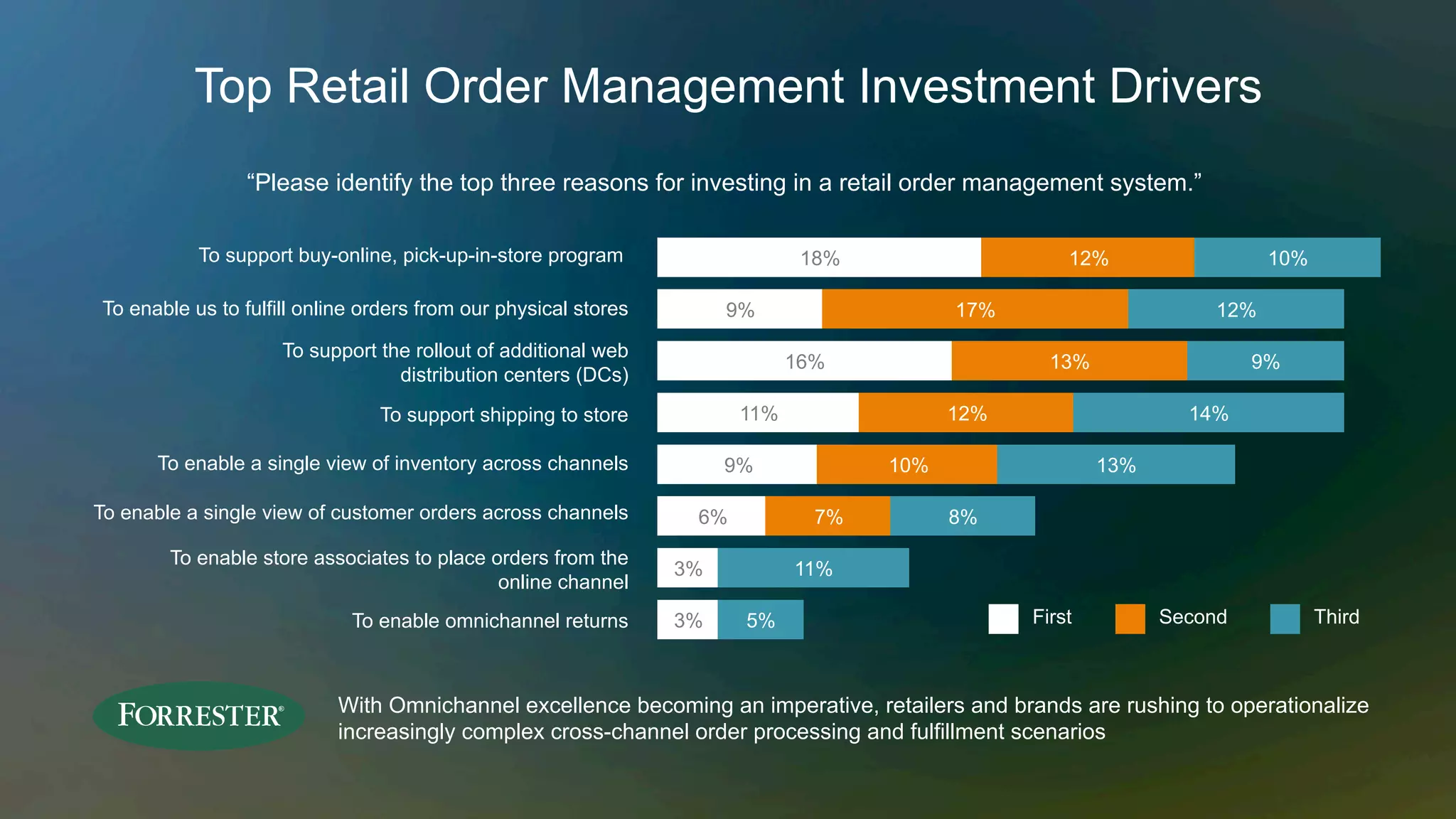

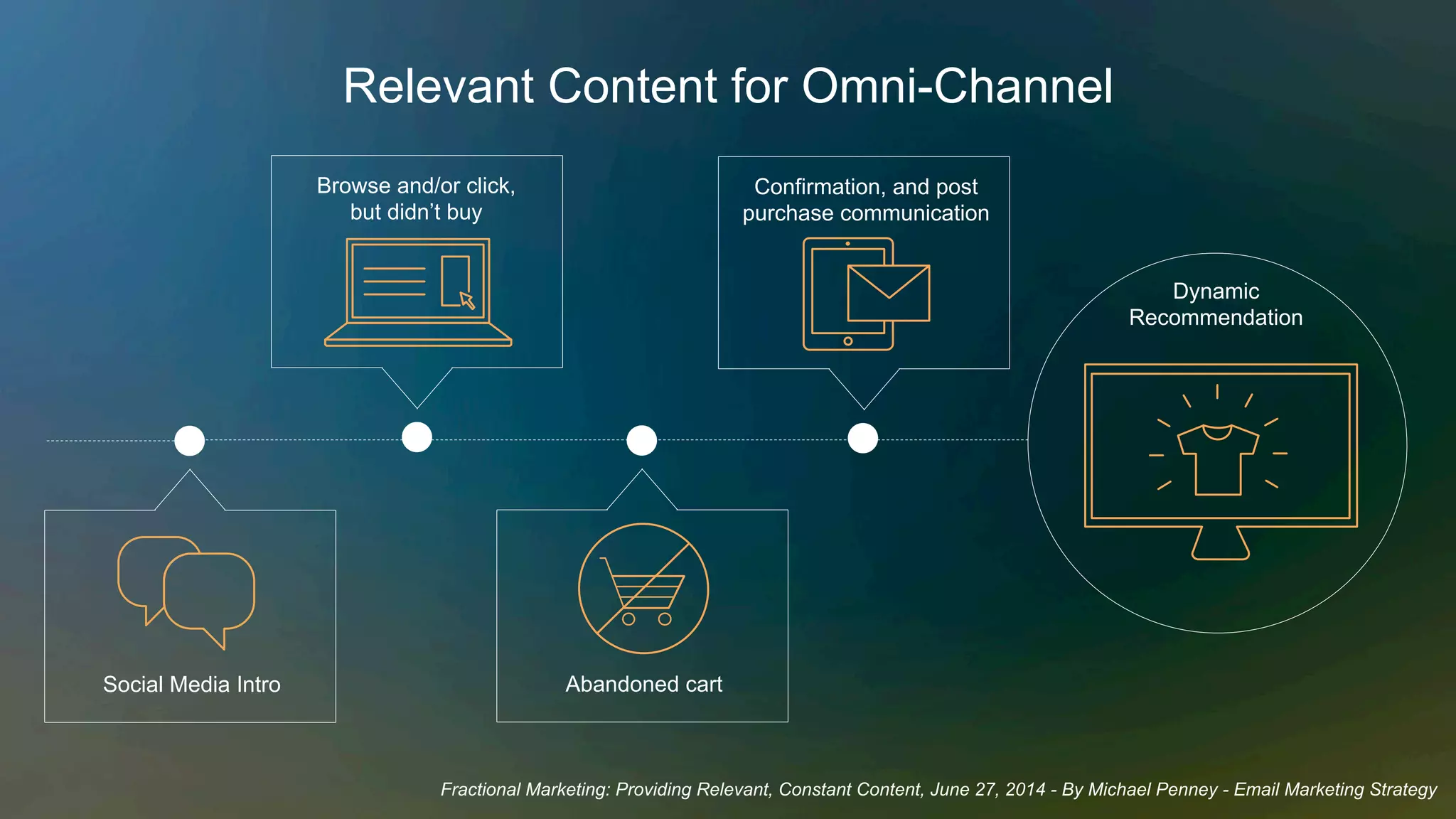

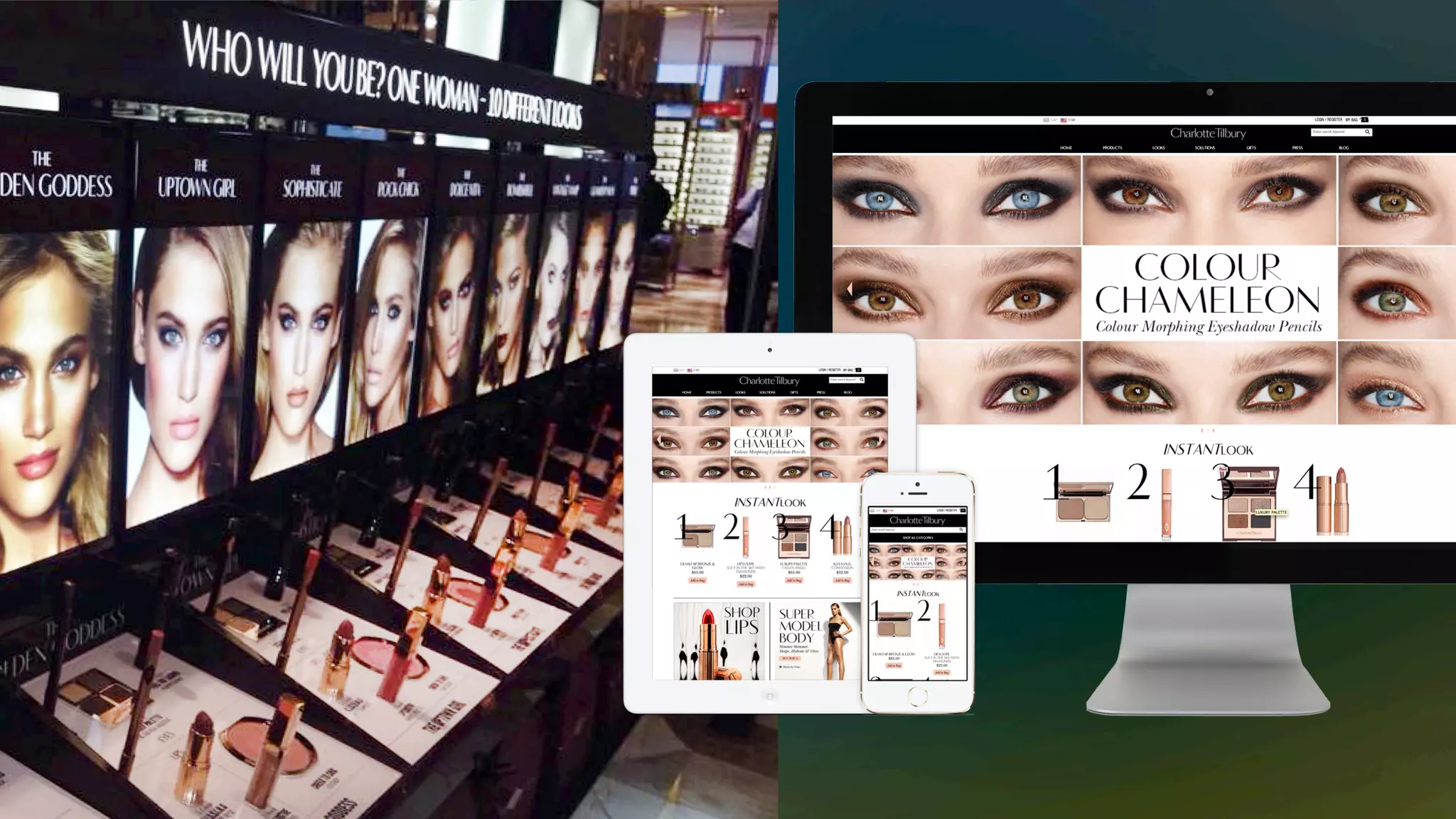

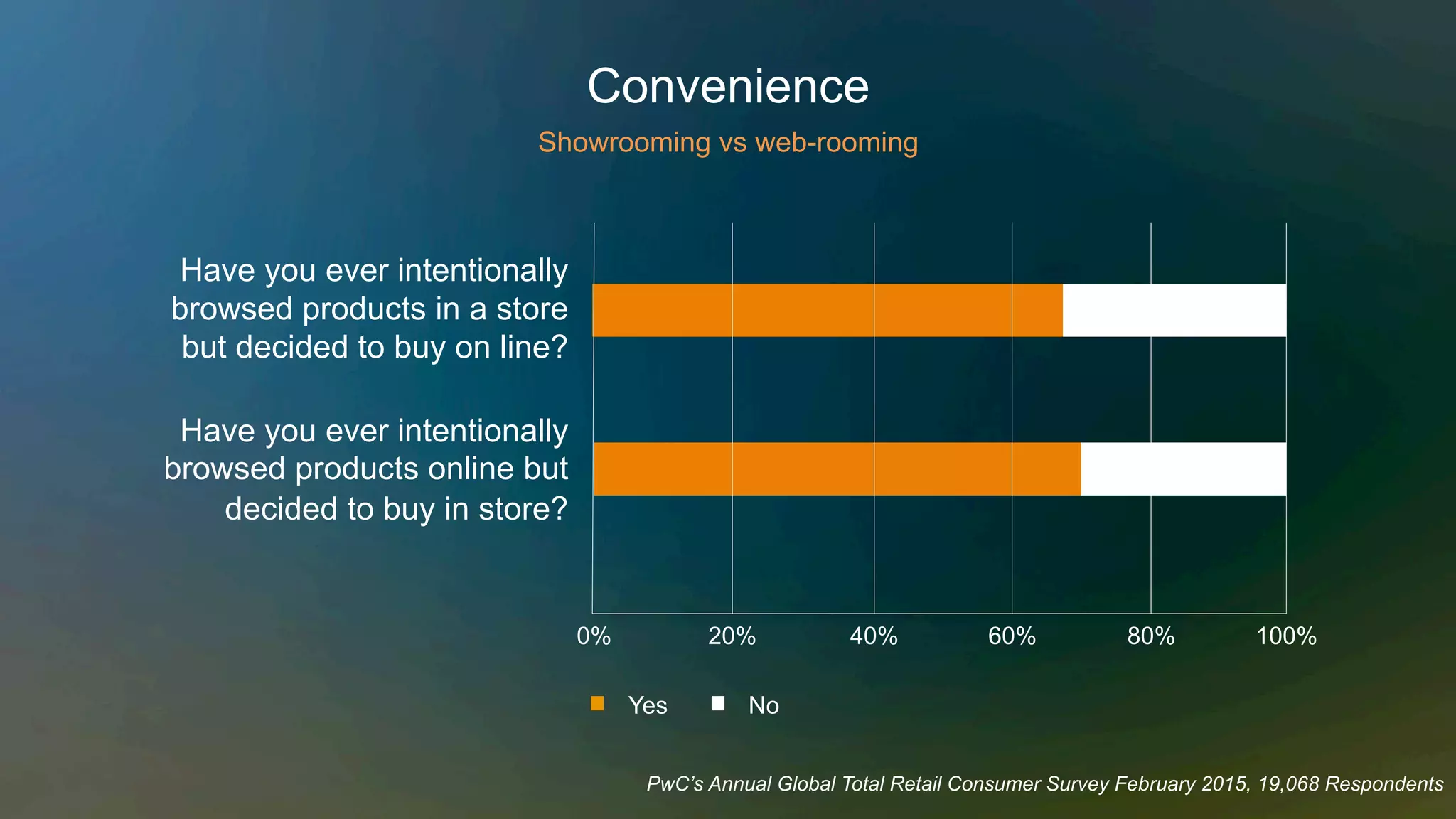

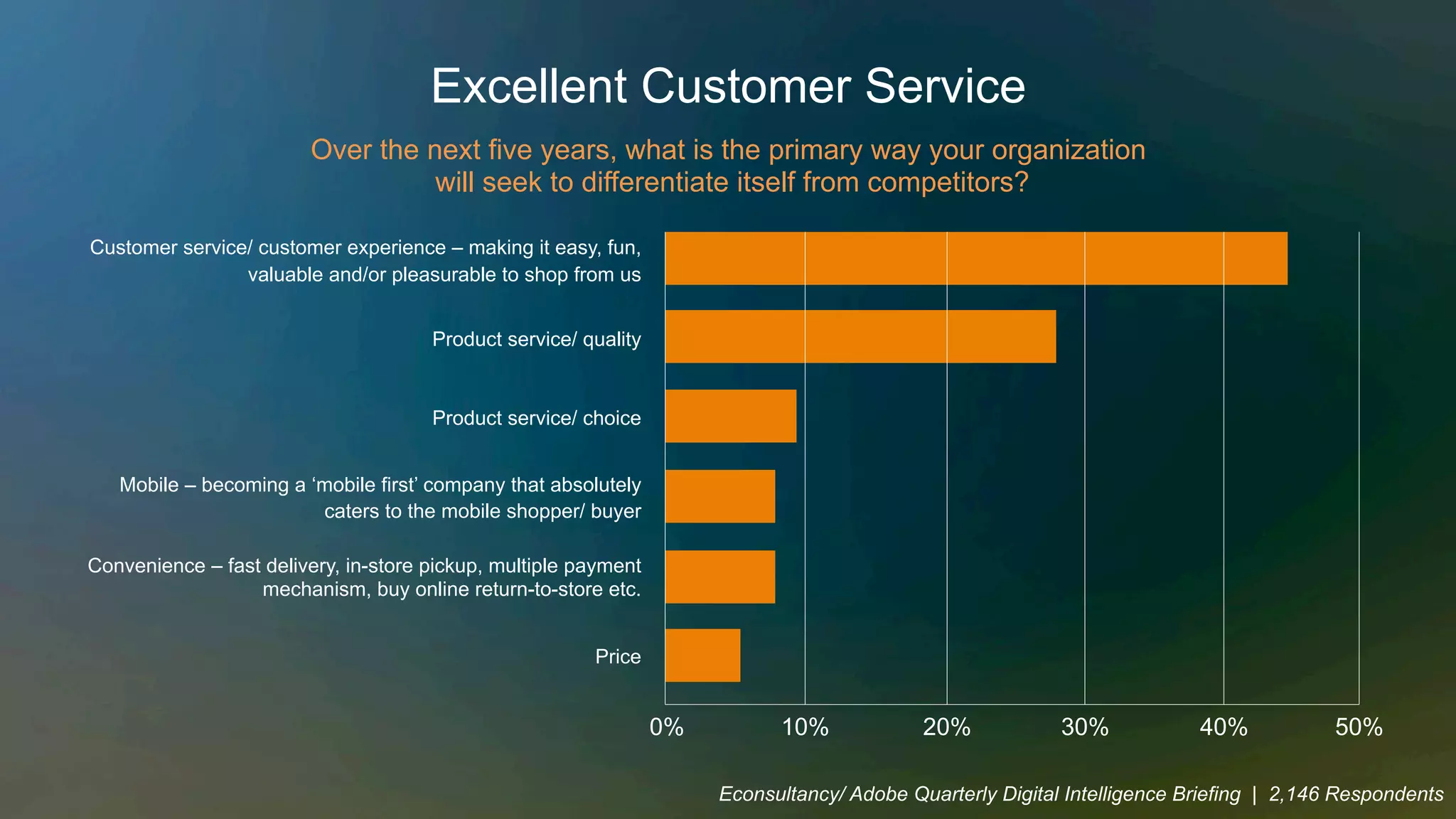

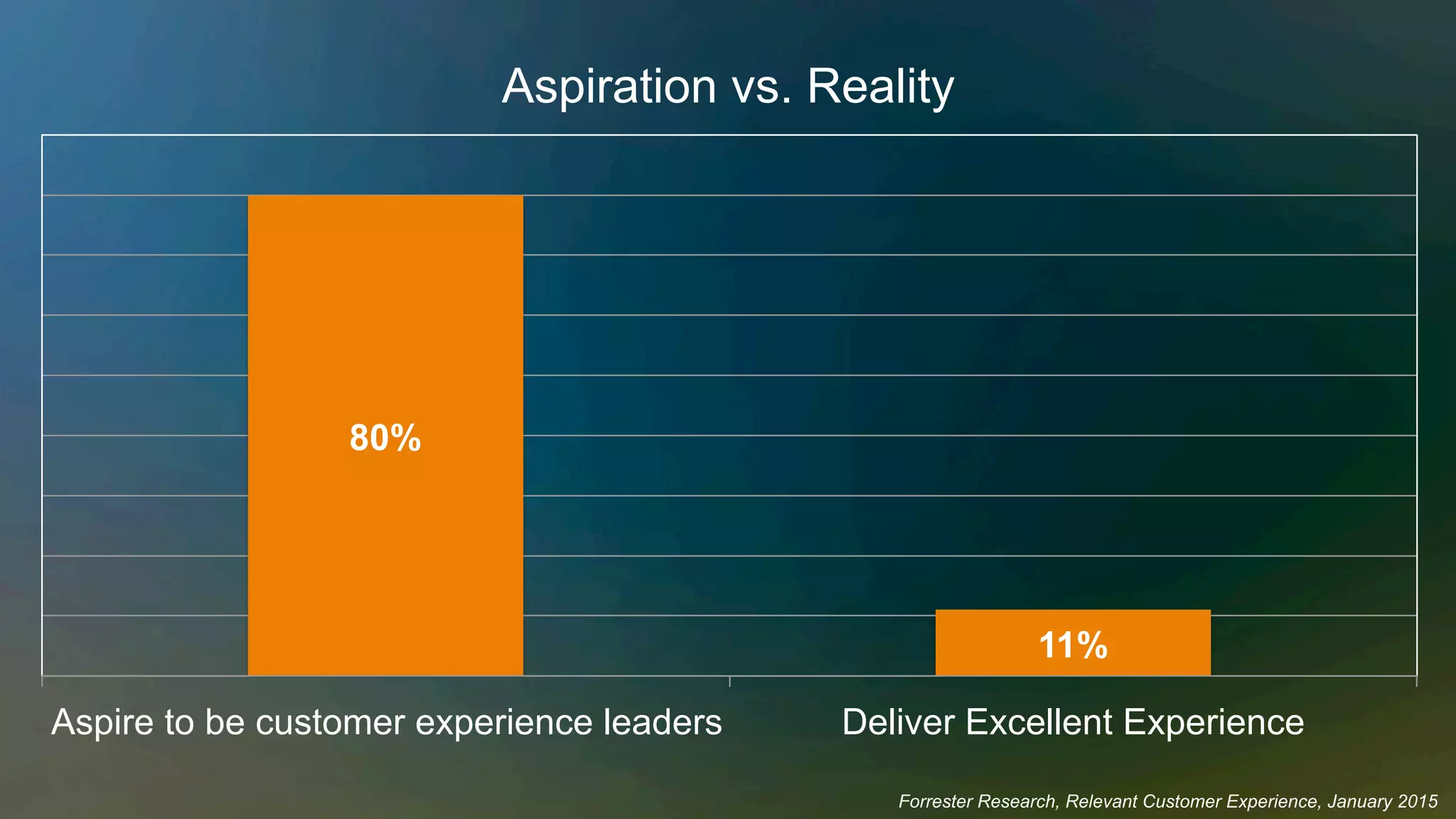

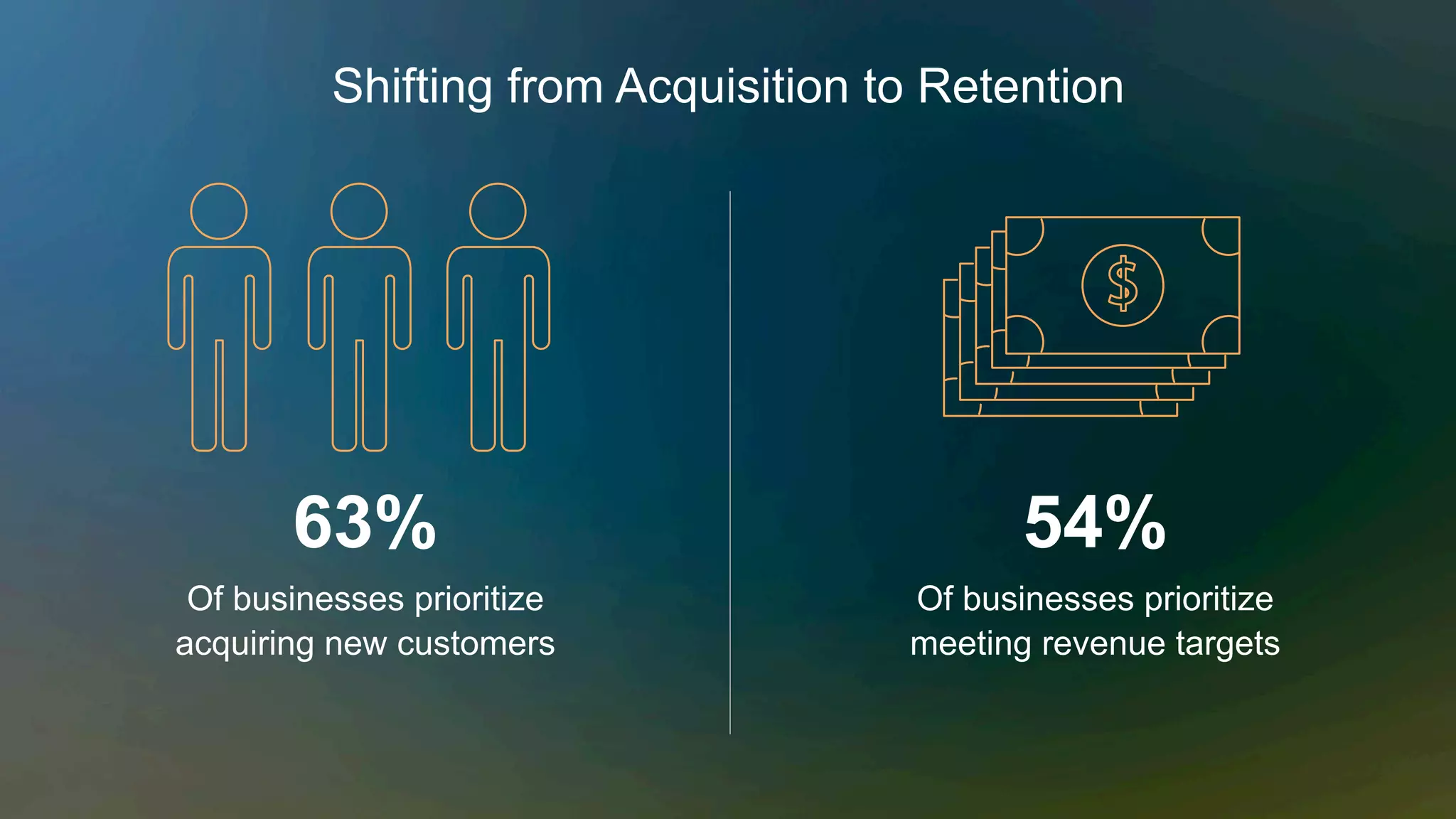

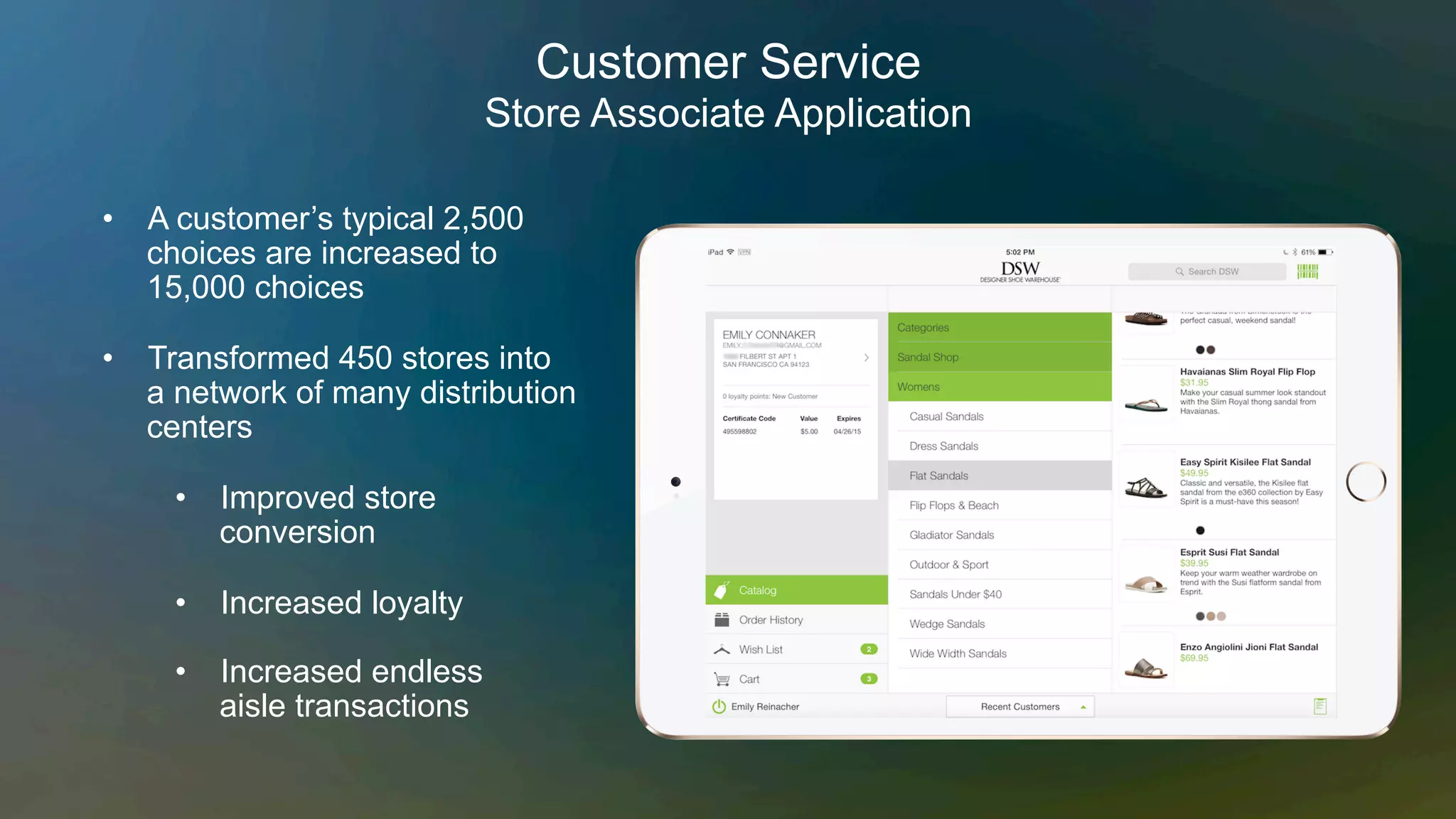

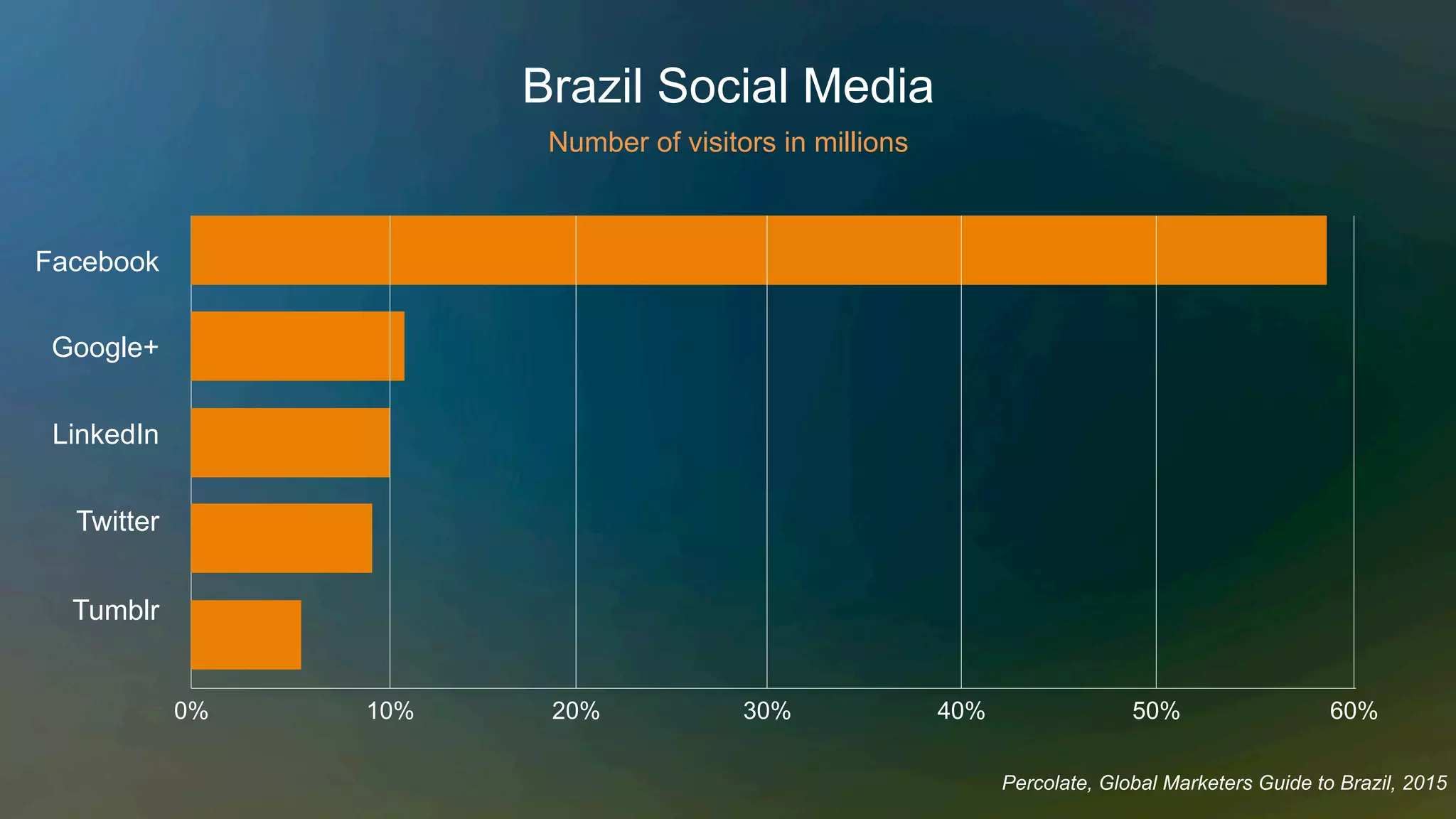

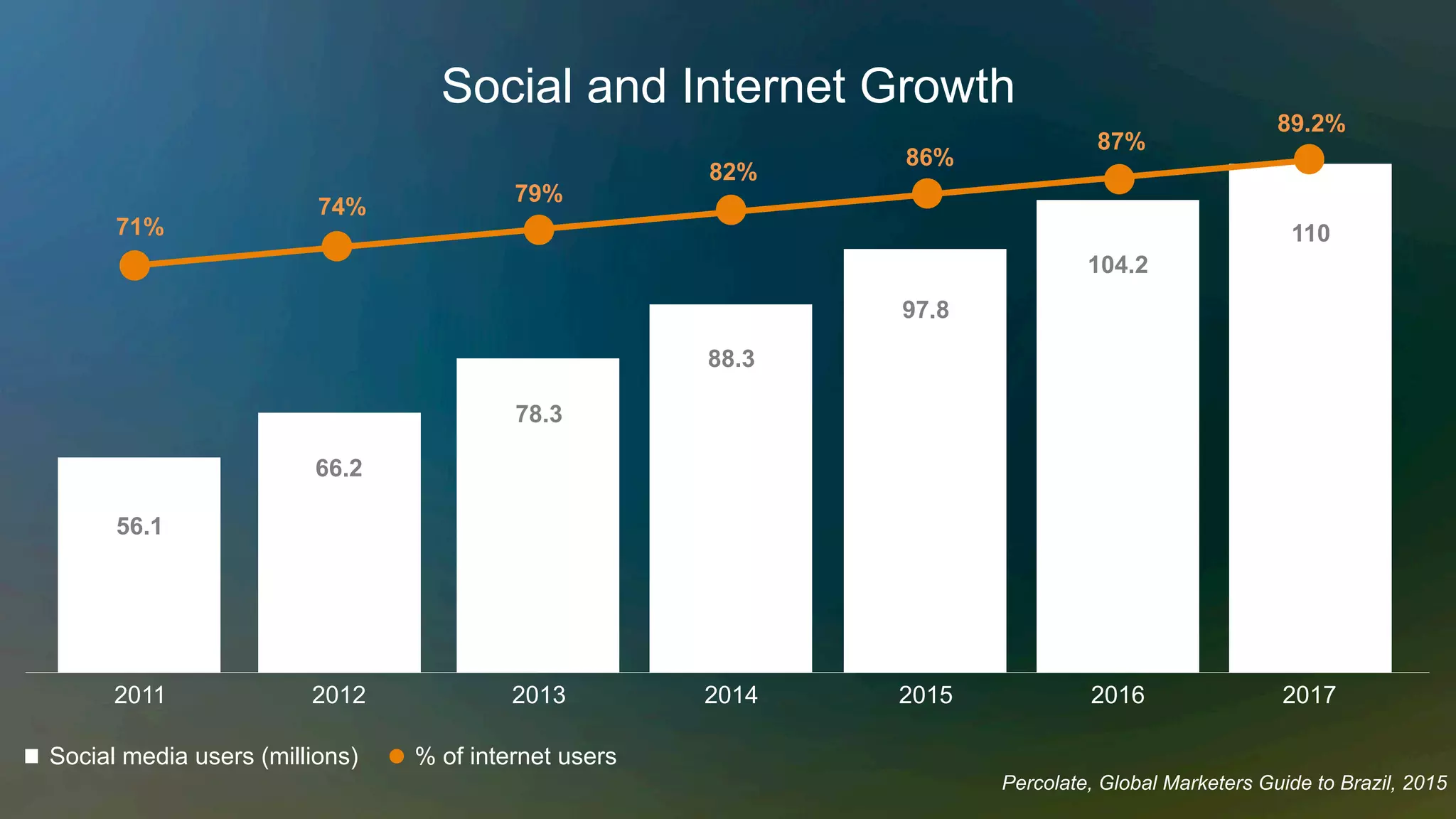

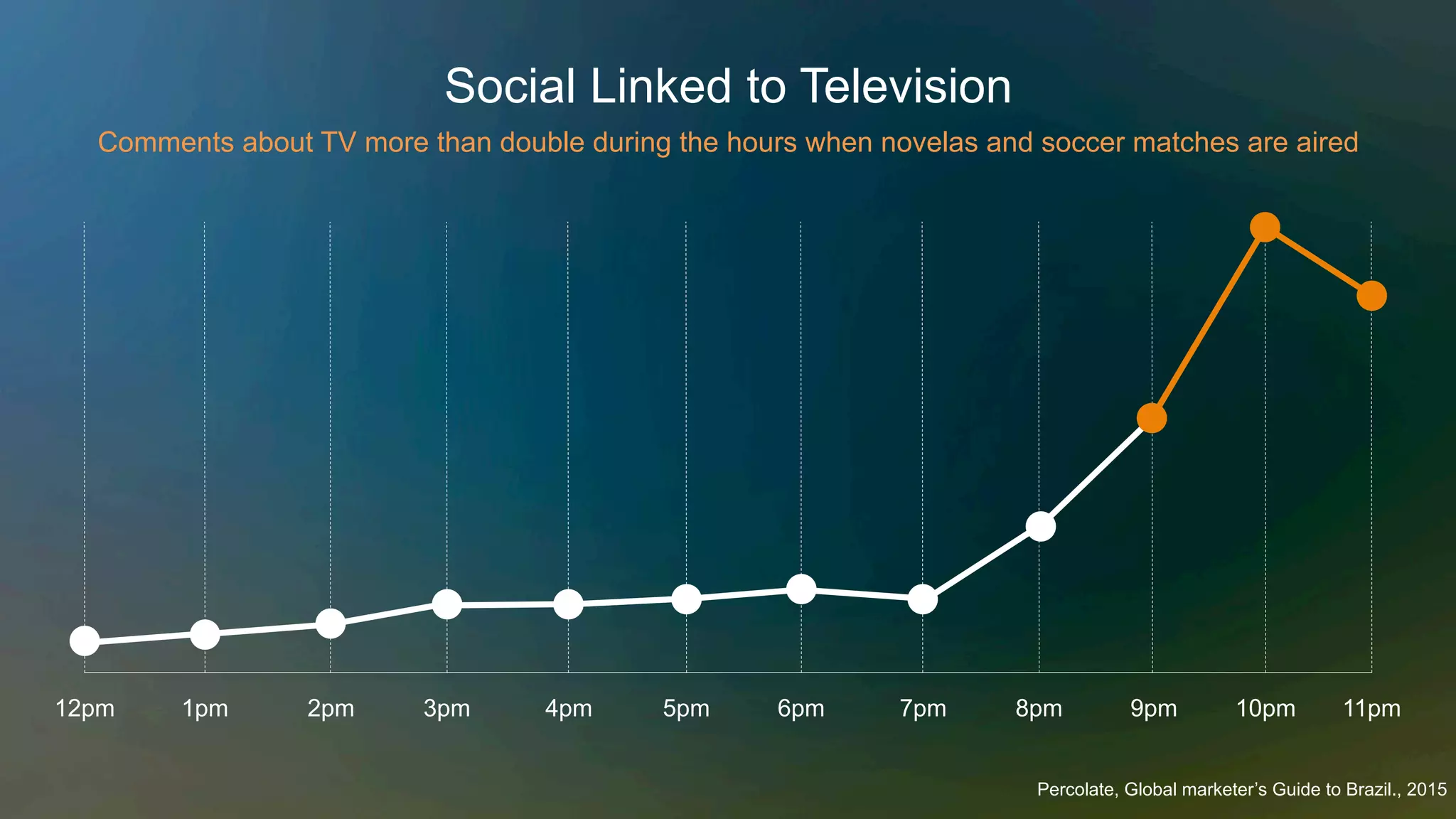

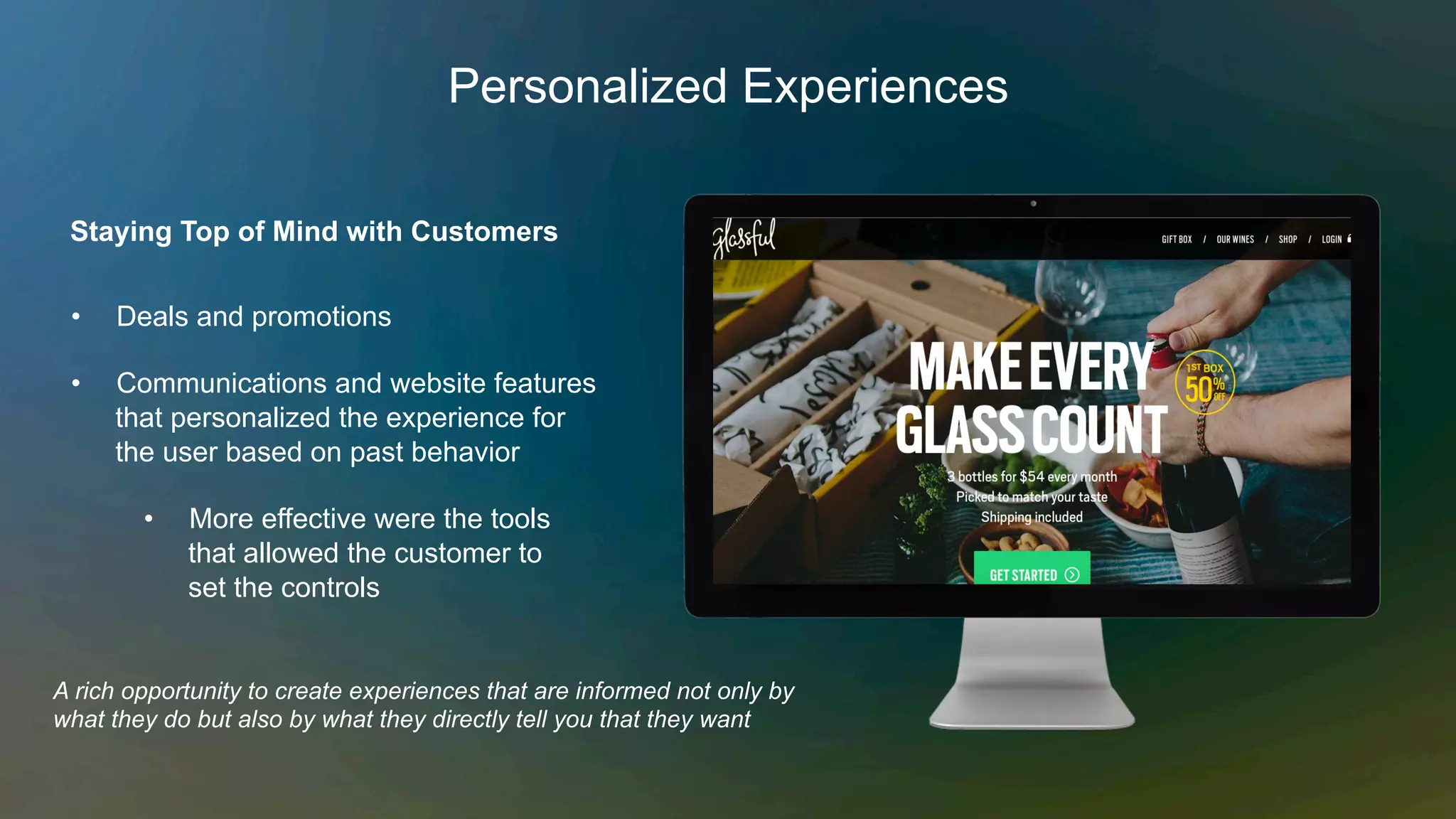

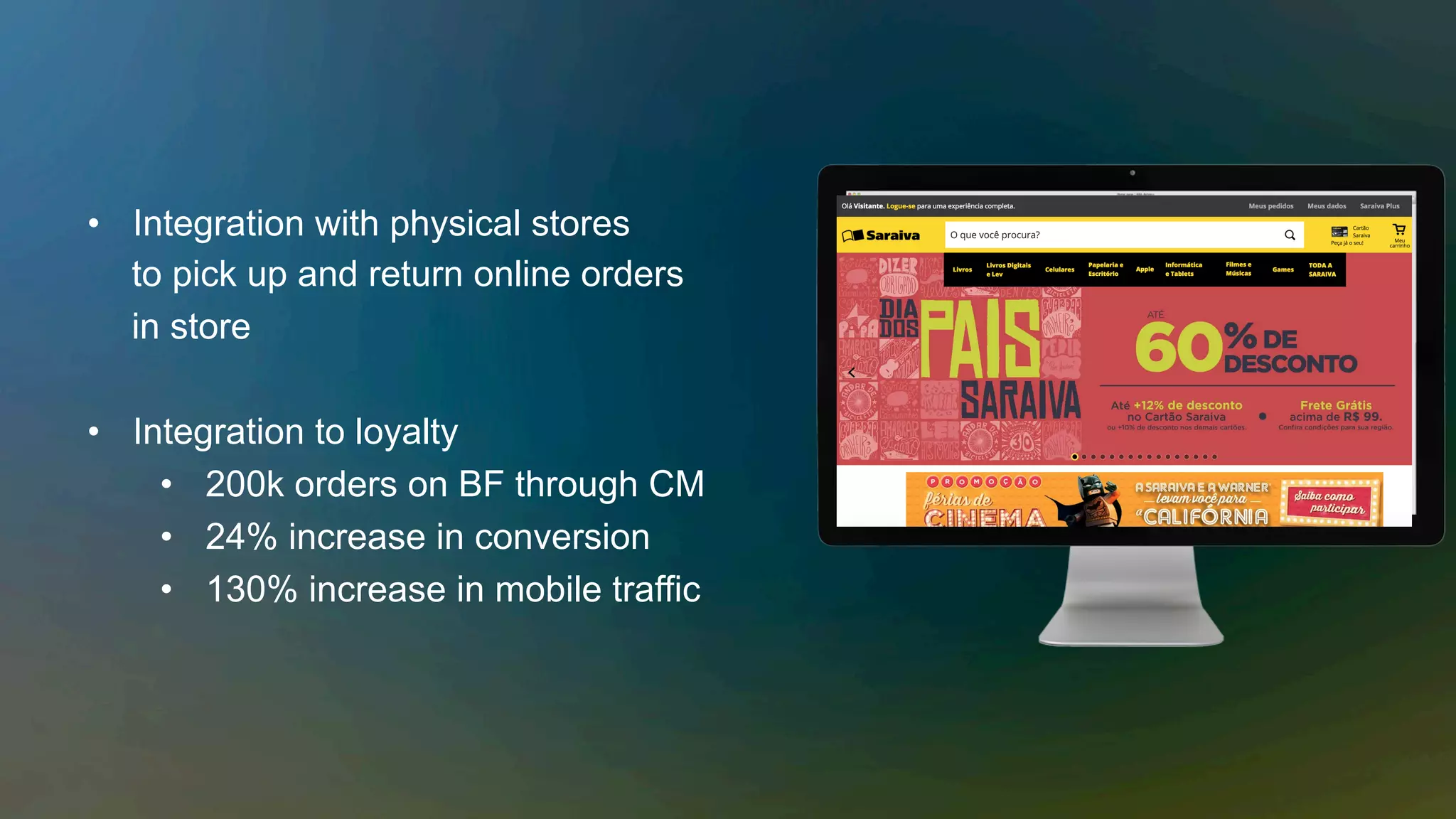

The document discusses the growth and trends in e-commerce and omni-channel retail strategies, focusing on global retail sales, the impact of mobile commerce, and consumer behavior in Brazil. It highlights the importance of customer-centricity and the integration of various sales channels to enhance customer experience. Additionally, it addresses the challenges retailers face in technology adoption and operational efficiency to meet evolving consumer expectations.