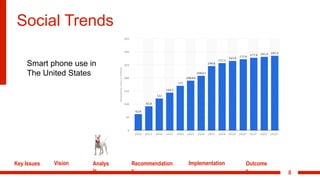

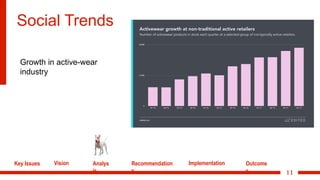

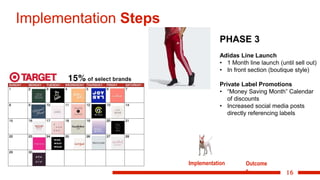

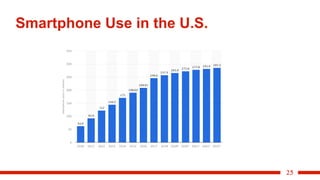

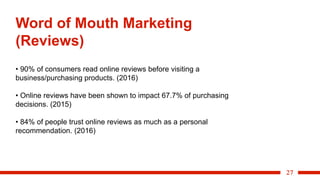

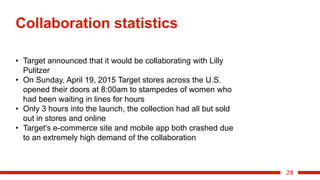

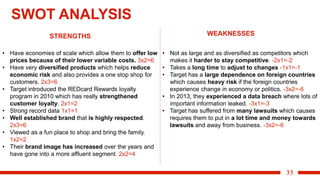

Target aims to improve Susan's in-store experience and spending. They analyze social trends like increased smartphone use and word-of-mouth influence. Their recommendations include implementing digital platforms like QR codes and iPads in stores, and exciting guests with exclusive partnerships and private label promotions. This is expected to increase trip frequency, sales, and basket size, generating an estimated $2.9 billion in additional apparel and accessories sales.