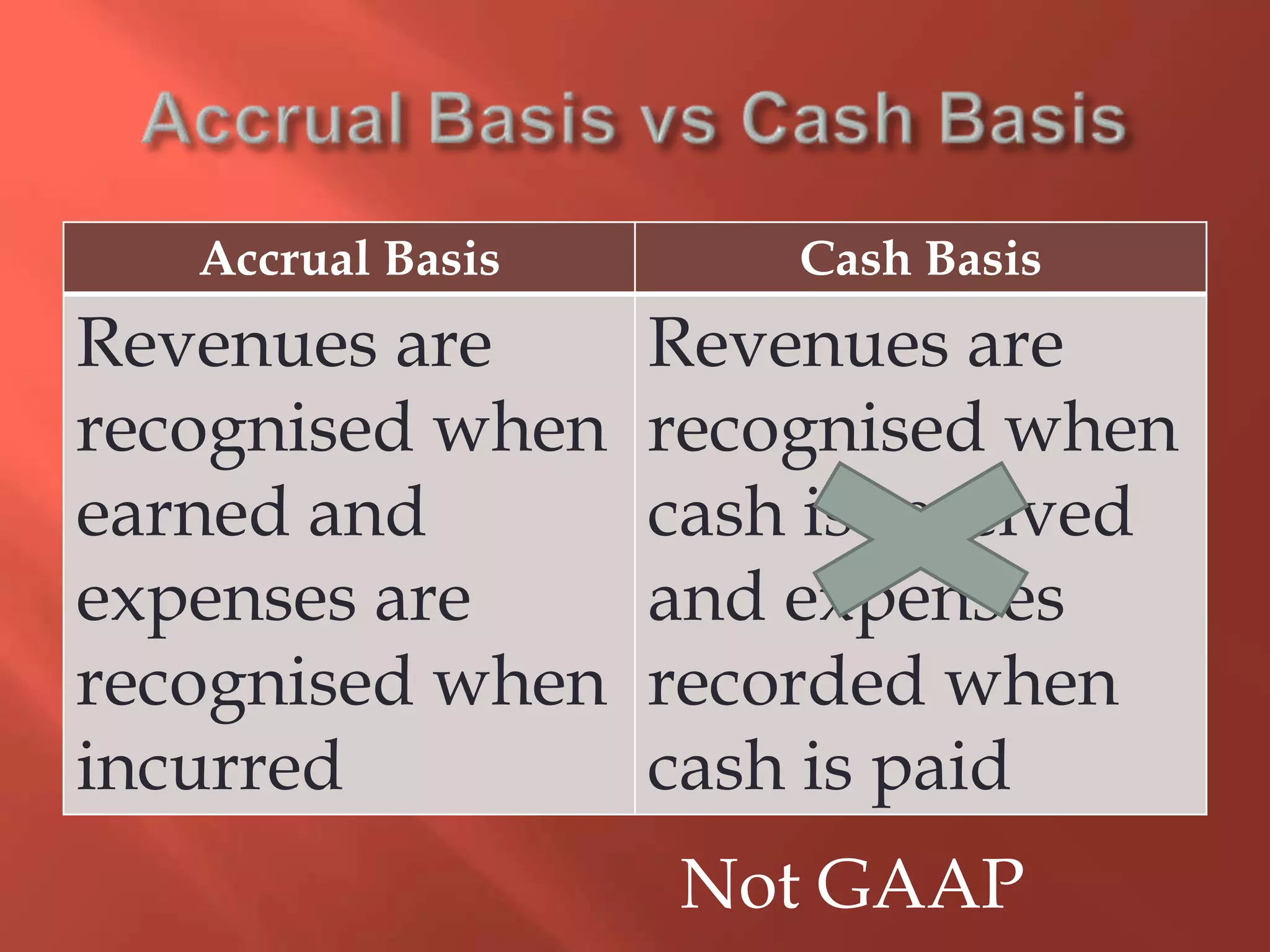

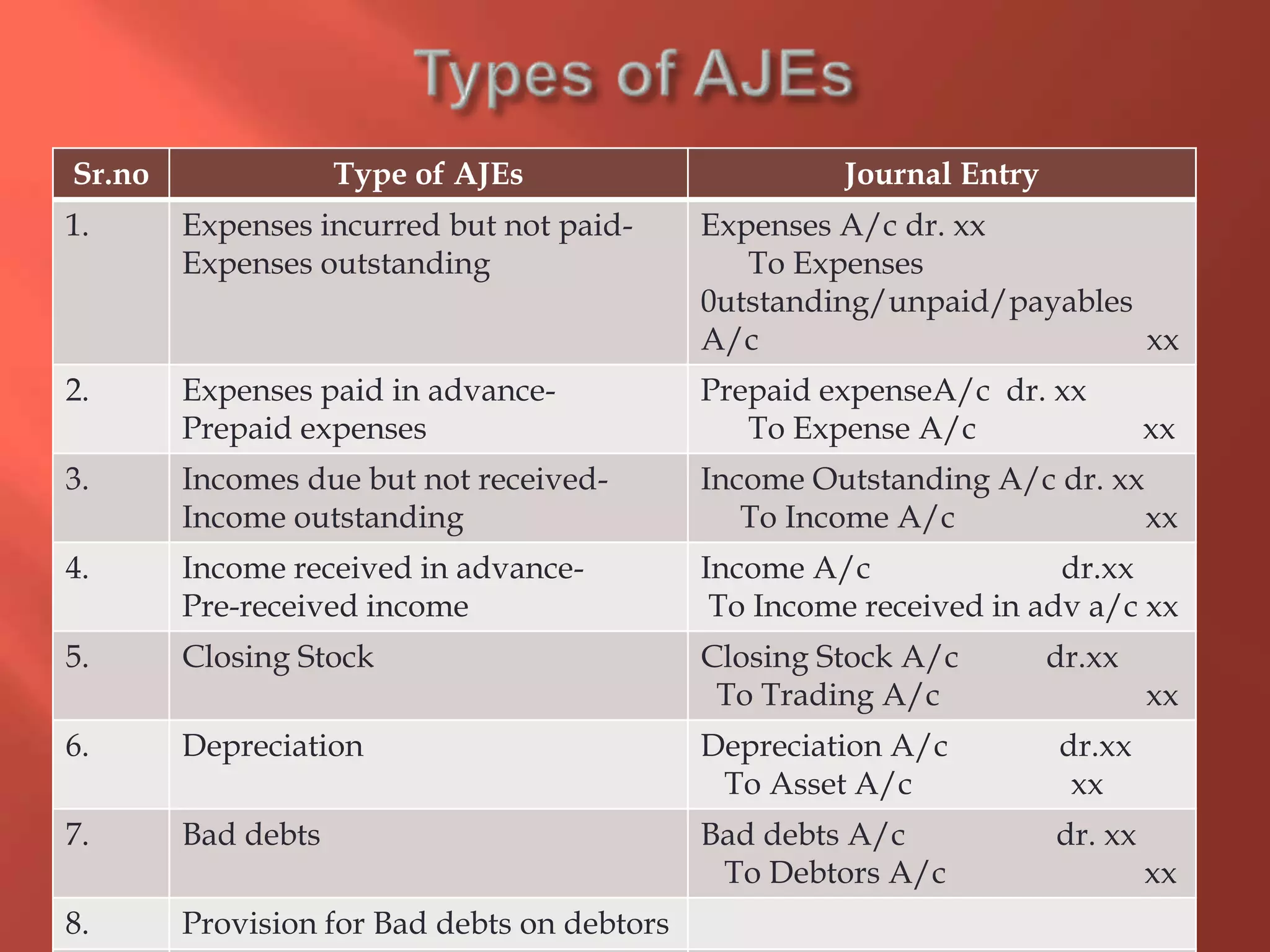

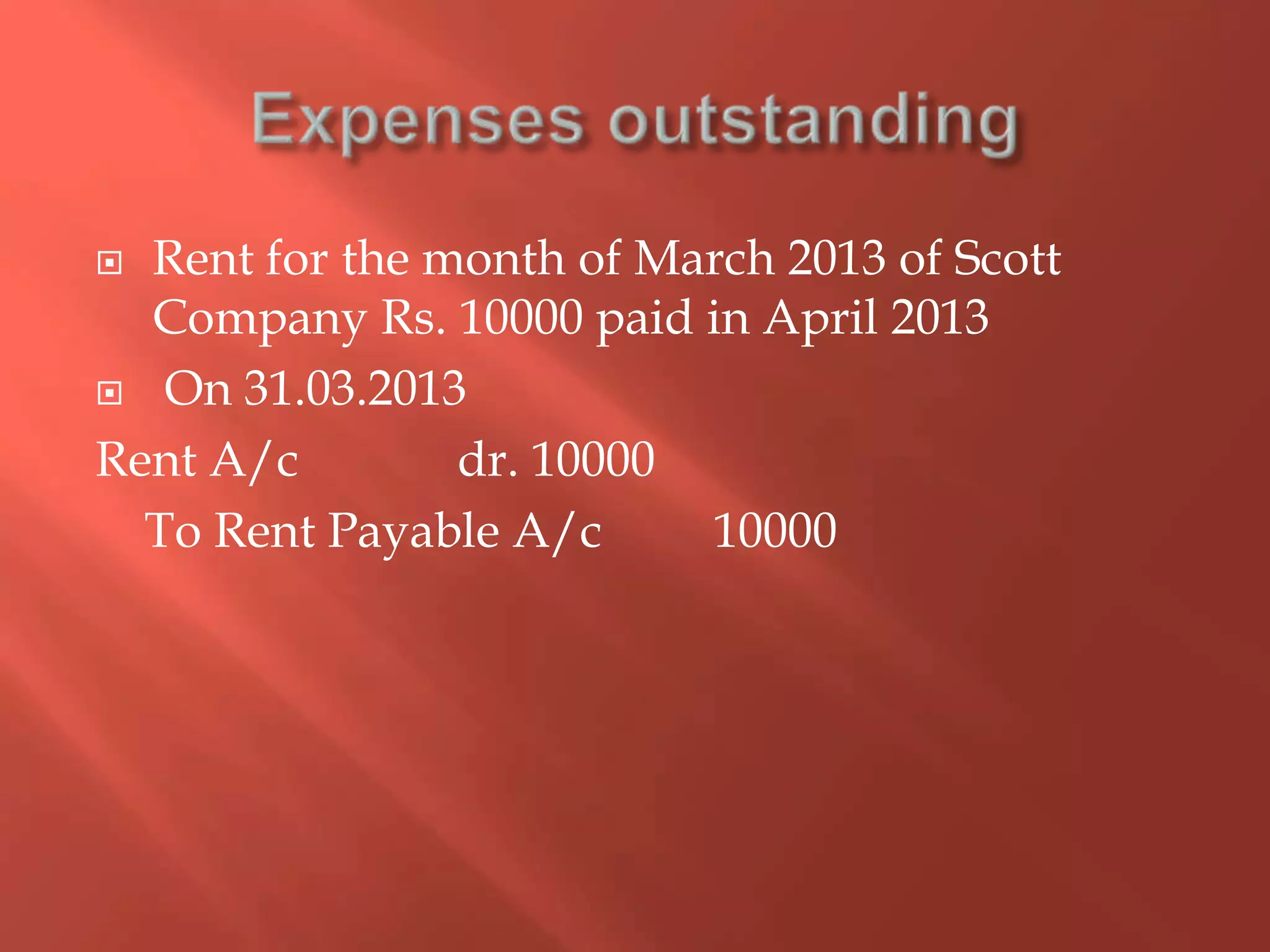

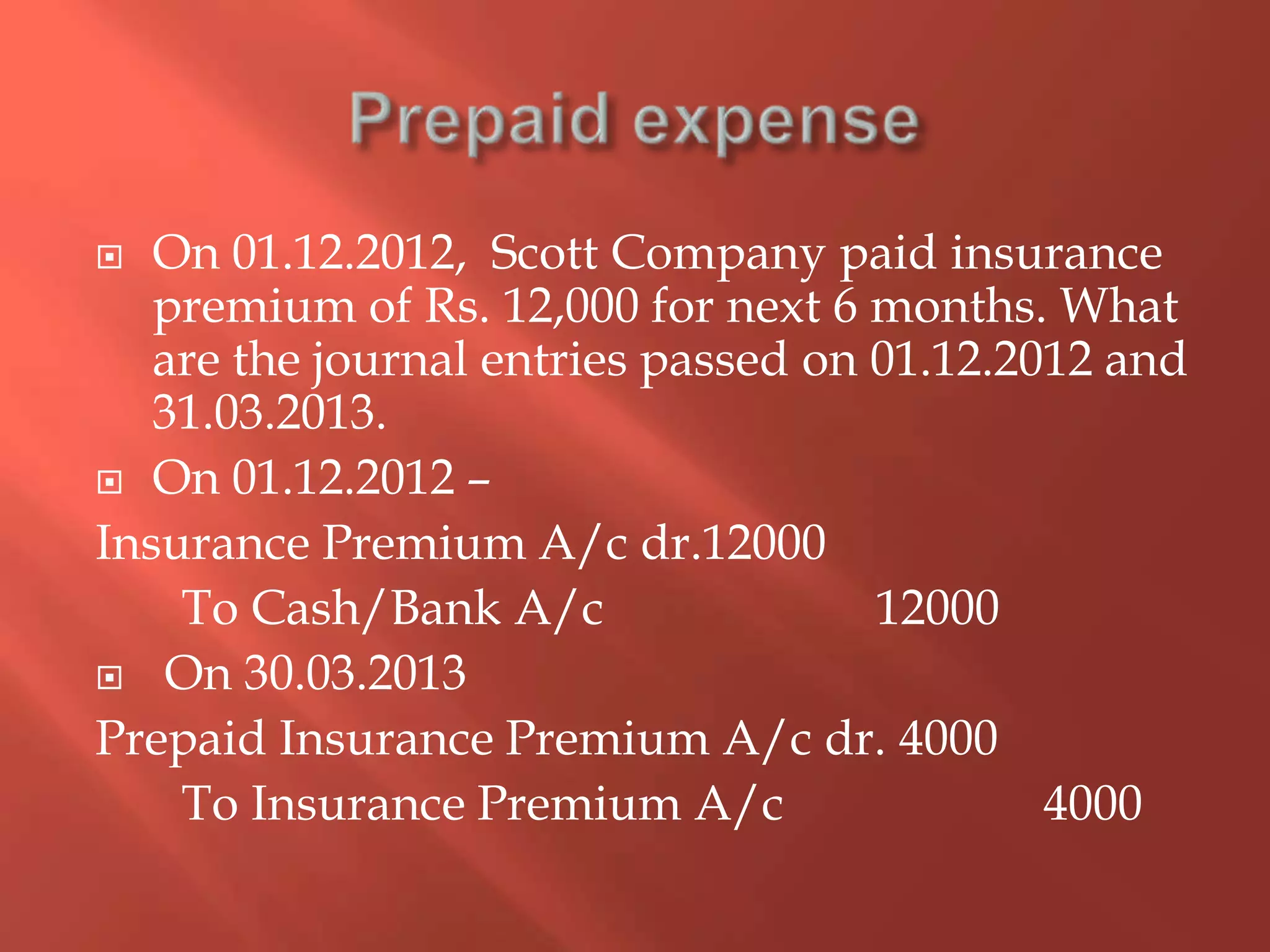

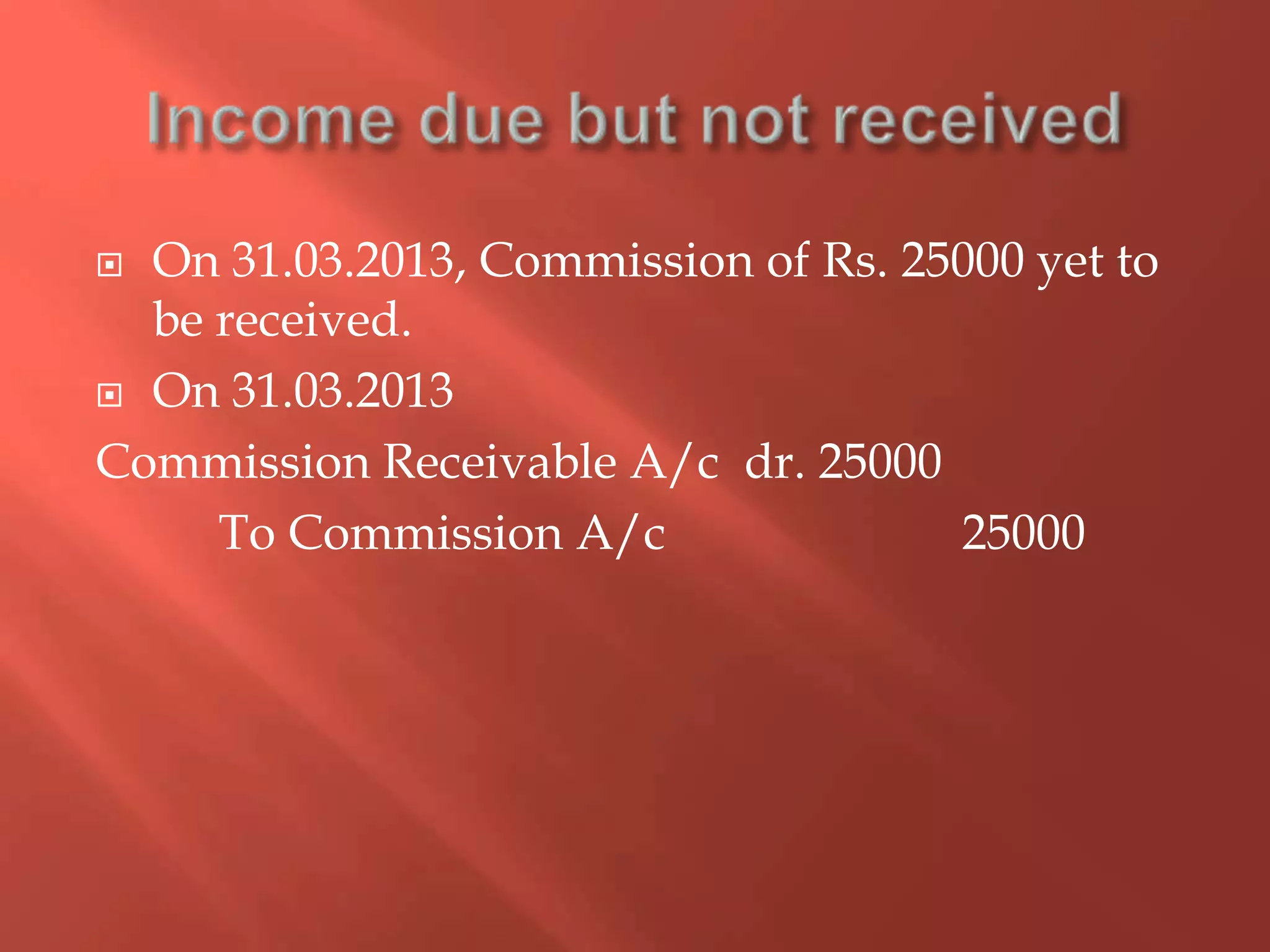

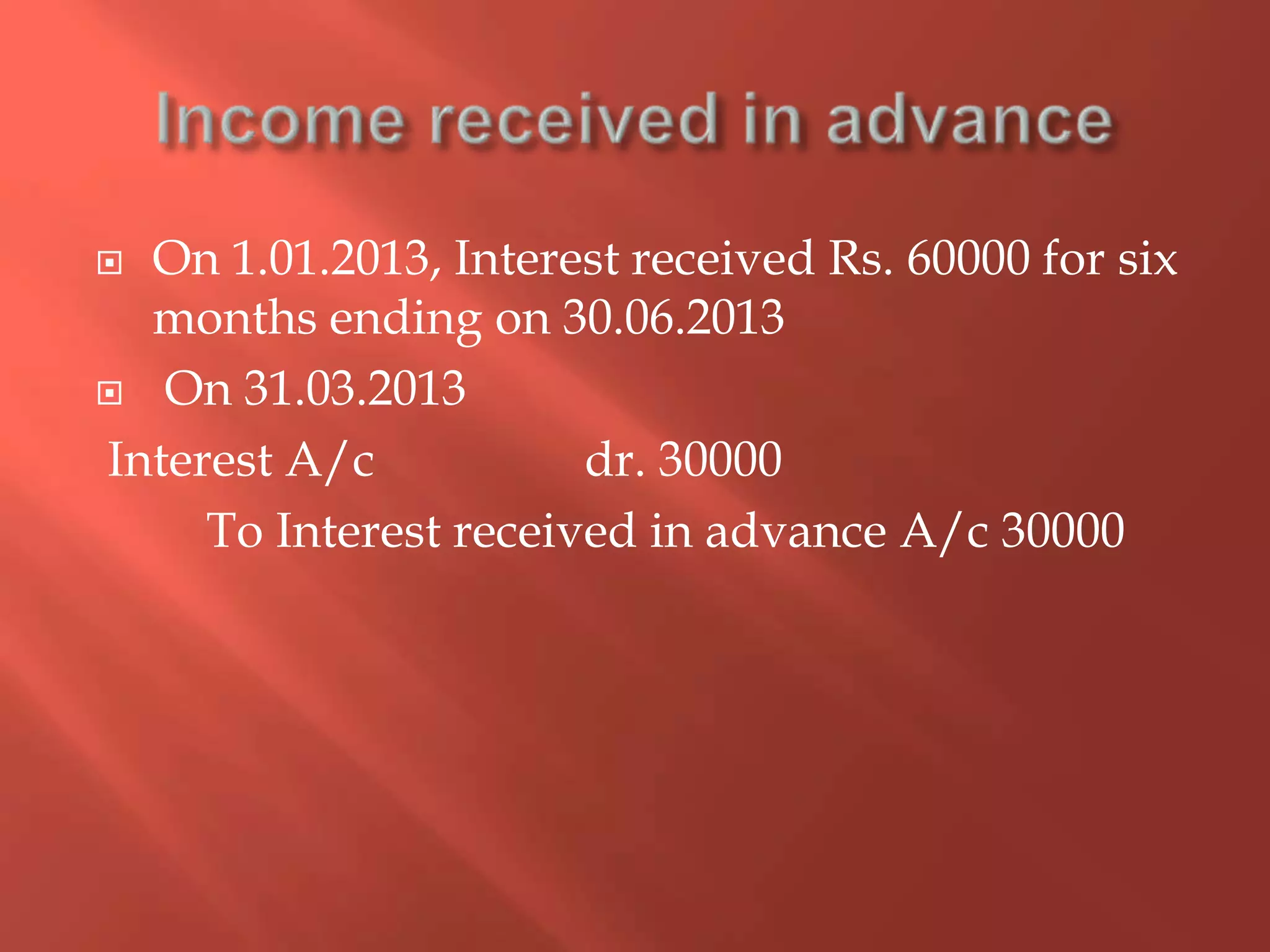

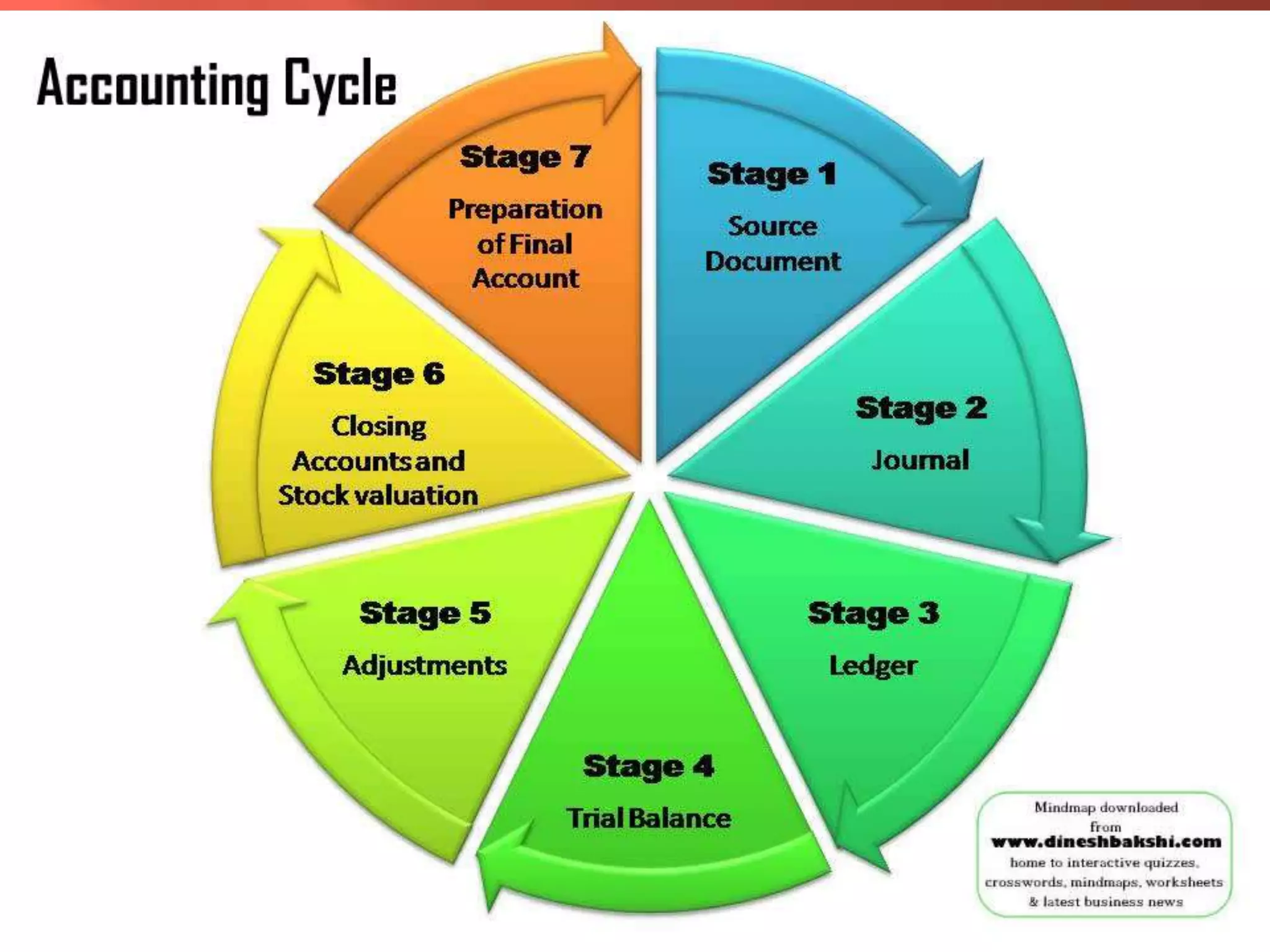

This document discusses key accounting concepts related to accrual basis accounting, adjusting entries, and accounting for various transactions through journal entries. It defines accrual basis and cash basis accounting. It explains that adjusting entries are made at the end of an accounting period to properly state accounts and recognize revenues and expenses according to the matching principle. Various types of adjusting entries are described for expenses/revenues due or received, prepaid/deferred items, closing stock, depreciation, bad debts, and more. Examples of adjusting entries for specific transactions are provided.