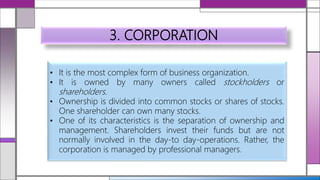

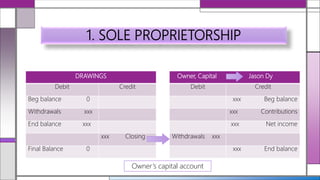

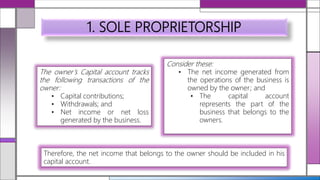

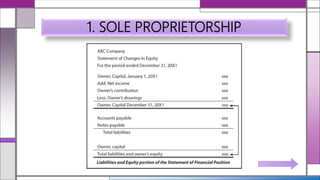

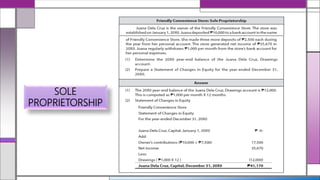

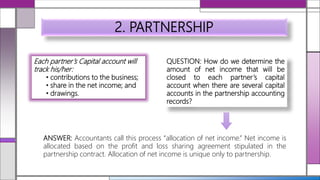

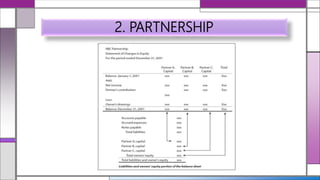

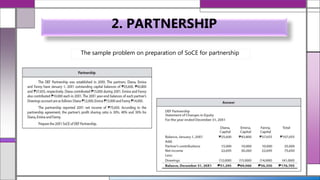

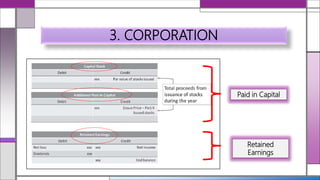

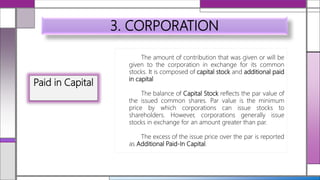

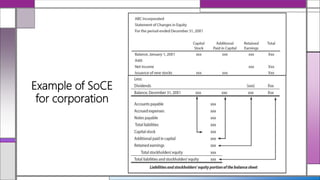

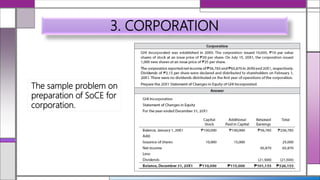

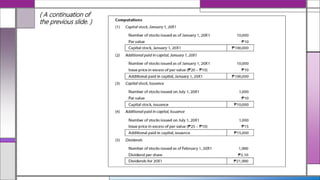

The document discusses the Statement of Changes in Equity (SoCE) and provides examples of how to prepare an SoCE for different business organizations. Specifically, it defines an SoCE as a statement that shows the reconciliation of beginning and ending equity account balances and summarizes equity transactions with owners during the year. It then provides examples of preparing an SoCE for a sole proprietorship, partnership, and corporation. For each, it discusses what equity accounts are included and how net income or owner contributions/withdrawals are treated.