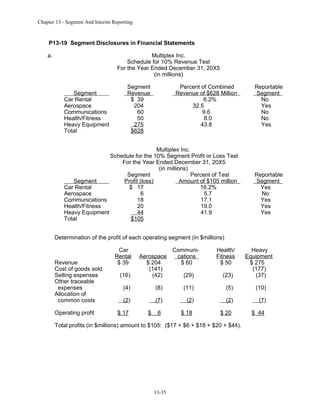

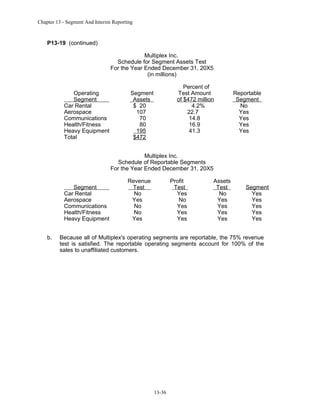

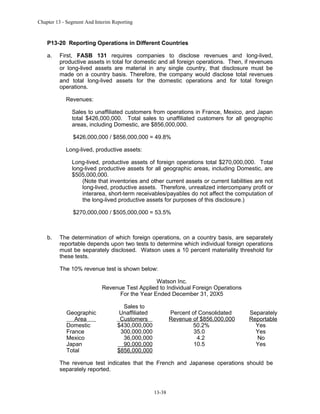

The document provides questions and answers regarding segment and interim reporting requirements. It discusses how companies must determine reportable segments based on certain revenue, profit, and asset tests. It also outlines accounting treatments for revenue, expenses, taxes, and other items for interim financial statements. Companies must follow specific rules for disclosing segment information, foreign operations, significant customers, and accounting changes in interim reports.

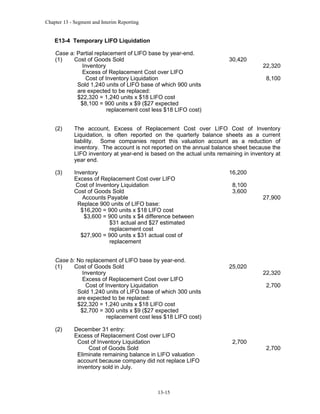

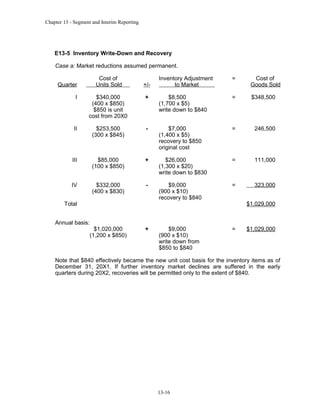

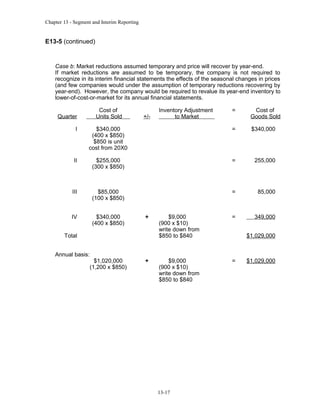

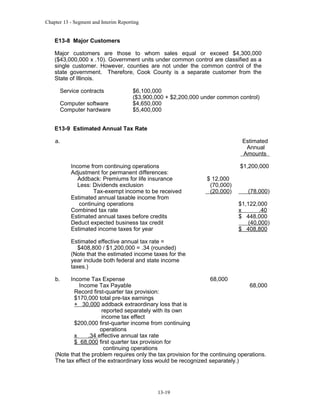

![Chapter 13 - Segment and Interim Reporting

SOLUTIONS TO CASES

C13-1 Segment Disclosures [CMA Adapted]

a. The purpose for requiring segment information to be disclosed in financial

statements is to assist financial statement users in analyzing and understanding the

enterprise's financial statements by permitting better assessment of the enterprise's

past performances and future prospects.

b. The determination of the segments appropriate for an enterprise is the

responsibility of management; that is, management should use its judgment in

deciding how to report its segment information. Specific characteristics or sets of

characteristics management can use in determining how to group its products into

segments include the following:

1. Use of existing profit centers.

2. A segment shall be regarded as significant and identified as a reportable

segment if one or more of the following are satisfied:

i. 10% or more of the total revenue is derived from one segment.

ii. 10% or more of the greater in absolute amount of the aggregate profits or

aggregate losses is contributed by the segment.

iii. 10% of the combined assets can be associated with the segment.

3. Management has the ability to define the breakdown of the segments, but the

segment definitions used for external purposes must be the same as used for

internal decision making purposes.

c.

The options available to Chemax Industries are as follows:

1.

Segment by product line — antihistamines. This single product meets the

10 percent test and can be anticipated as a significant product line in the

future.

2.

Segment by product group — pharmaceutical, medical instruments, and

medical supplies. Antihistamines can be carried as a part of the

pharmaceutical group.

3.

Disaggregate pharmaceutical into ethical and proprietary drugs and carry

antihistamines under whichever industry segment is appropriate (probably

proprietary drugs, in this case).

13-4](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-4-320.jpg)

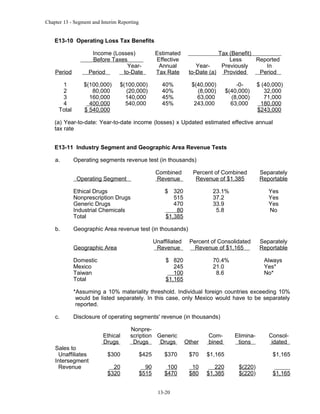

![Chapter 13 - Segment and Interim Reporting

C13-3 Segment Disclosures in the Financial Statements [CMA Adapted]

a. A subdivision of an entity is a reportable segment if one of the following tests is

met:

1. Revenue, both unaffiliated and intersegment revenue, is ten percent or more of

total revenue, which includes intersegment revenue. For each of Bennett's

segments, divide the sum of the unaffiliated sales and intersegment sales by

total company sales of $63,000. If the result is ten percent or more, the

revenue test is met for that specific segment.

2. The absolute value of profit or loss is ten percent or more of the greater of

either the total profit of segments that did not incur a loss or the total, in

absolute amounts, of the segments that did incur a loss. For each segment,

divide the absolute value of the profit or loss by the sum of the segment profits

of $6,200. If the result is ten percent or more, the segment profit or loss test is

met for that specific segment.

3. Assets are ten percent or more of total assets. For each segment, divide the

value of the assets by total assets of $100,000. If the result is ten percent or

more, the assets test is met for that specific segment.

The calculations for the segments of Bennett Inc. yield results that show that all

segments are reportable with the exception of Security Systems, which does not

meet any of the tests. See the results of all the tests in the table below.

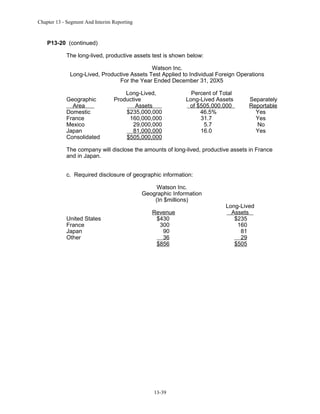

Bennett Inc.

Results of Required Tests for Determining Segment Reporting

For the Year Ended December 31, 20X5

Revenue

Profit

Assets

Reportabl

e

Power

Tools

.67

.73

.50

Yes

Fastening

Systems

.16

.16

.23

Yes

Household

Products

.08

.10

.17

Yes

Plumbing

Products

.06

.11

.06

Yes

Security

Systems

.03

.02

.04

No

b. For the reportable segments of Bennett Inc. to represent a substantial portion of

total operations, the combined revenue from sales to unaffiliated customers of all

reportable segments must be at least 75 percent of the total sales for the company as

a whole. Since the sales to unaffiliated customers of Bennett's reportable segments

are $44,300 and represent approximately 96 percent of the company's total sales

($44,300 / $46,300), this criterion would be met.

13-6](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-6-320.jpg)

![Chapter 13 - Segment and Interim Reporting

C13-7 Defining Segments for Disclosure

MEMO

To:

Randy Rivera, CFO, Stanford Corporation

From:

Re:

Segment Disclosures

For the current annual reporting period, Stanford Corporation has identified four operating

segments that meet the quantitative thresholds to be considered reportable segments

under FASB Statement No. 131 (FASB 131). Neither the cereals segment nor the sports

beverage segment meets any of the three quantitative thresholds in the current period.

[FASB 131, Par. 18]

However, the FASB 131 quantitative thresholds are intended to insure that information

about significant business segments is included in the disclosures, not to limit the

information that can be provided.

The cereals segment, which was disclosed as a reportable segment last year, can

continue to be reported this year if its disclosure provides significant information for the

users of the financial statements, even though the segment does not meet the specific

criteria for separate disclosure specified in paragraph 22 of FASB 131.

In addition, the segment disclosure standard allows companies to designate additional

operating segments as reportable segments. Management may decide to provide

separate disclosure of segment information for other segments that management feels

that the disclosure would be of information value to the users of the financial statements.

Finally, paragraph 24 of FASB 131 addresses the possibility that identification of too

many reportable segments might result in overly detailed segment information. As a

general guideline, the standard suggests that a reasonable limit of 10 segments should

be used and smaller, somewhat comparable segments can then be combined for

purposes of the footnote disclosure.

As a result of my research, I conclude that it would be acceptable for Stanford to report

information about six segments, including the cereals and sports beverage segments.

Disclosure of information for six segments does not approach the practical limit on the

number of segments suggested in FASB 131. The continuing significance of the cereals

segment and the developing significance of the sports beverage segment make their

inclusion appropriate even though these segments do not meet the FASB 131

quantitative thresholds in the current year.

Primary references

FASB 131, Par. 22

FASB 135, Par. 4 (x) [replaces a section of FAS 131, Par. 18]

Other references

FASB 131, Par. 24

Query Used

reportable segment*

13-9](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-9-320.jpg)

![Chapter 13 - Segment and Interim Reporting

C13-8 Income Tax Provision in Interim Periods

MEMO

To:

Andrea Meyers, Controller's Department, Vanderbilt Company

From:

Re:

Income Tax Provision in Interim Periods

In computing the income tax provision for interim periods, APB 28 states that the

company should make its best estimate of the effective tax rate expected to be applicable

for the year. [APB 28, Para. 19] This estimate should reflect all expected tax credits, and

other tax rates, such as foreign taxes. Therefore, anticipated tax credits available to

Vanderbilt should be included in the computation of the expected effective annual tax

rate.

However, the first quarter calculation of this tax rate cannot include the anticipated

energy tax credit benefits because the tax law providing the energy tax credit has not yet

been enacted into law.

Vanderbilt's first quarter estimate of the effective annual tax rate should not include the

expected tax benefits of the energy tax credit. Changes in the tax rate are to be

recognized as changes in estimate, according to APB 28. If the legislation is enacted as

expected, the effect of the tax credit should be factored into the estimate of the effective

annual tax rate made at the end of the third quarter, which would reduce the income tax

provision for the third quarter of 20X5.

Primary references

APB 28, Par. 19

FAS 109, Par. 288(h) [replaces a sentence of APB 28, Par. 20]

Other references

APB 28, Par. 26

Query Used

tax rate* interim

13-10](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-10-320.jpg)

![Chapter 13 - Segment and Interim Reporting

E13-2 Multiple-Choice Questions on Segment Reporting [AICPA Adapted]

1.

b

2.

a

$ 750,000

(325,000)

(90,000)

$ 335,000

d

3.

Sales

Traceable operating expenses

Indirect operating expenses

(3/4 x $120,000)

Operating profit

Sales ($1,800,000 x .60)

Traceable costs

Income before common costs

Cost allocated

[($480,000 / $600,000) x $350,000]

Operating profit

4.

c

Sales

Traceable costs

Income before allocable costs

Cost allocated

[($60,000 / $300,000) x $150,000]

Operating profit

5.

20X6

Total

$1,800,000

(1,200,000)

$ 600,000

(280,000)

$ 200,000

Segment B

$ 300,000

(240,000)

$ 60,000

$

Total

$ 900,000

(600,000)

$ 300,000

(30,000)

30,000

c

6.

Segment 3

$1,080,000

(600,000)

$ 480,000

a

Sales

Traceable costs

Allocated costs

[($400,000 / $1,000,000) x $500,000]

Operating profit

7.

b

$260,000 = [($2,000,000 + $600,000) x .10]

8.

d

[.10 x ($1,200,000 + $180,000 + $60,000)]

9.

c

10.

c

11.

d

12.

a

13-13

$ 150,000

200,000

$ 400,000

$

(350,000)

50,000](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-13-320.jpg)

![Chapter 13 - Segment and Interim Reporting

E13-3 Multiple-Choice Questions on Interim Reporting [AICPA Adapted]

1.

d

2.

c

3.

a

4.

b

5.

c

6.

a

7.

a

8.

b $145,000 = [($180,000/4) + ($300,000/3)]

9.

b

10.

b

11.

b According to APB 28, gains and losses arising from events such as

discontinued operations, unusual or infrequent events, and extraordinary items

should be reported in the interim period in which the event occurs. On the other

hand, expenses incurred in one interim period that benefit other interim periods

should be allocated to the interim periods benefited. In the case of Park Corp.,

the $40,000 of property taxes should be allocated to all interim periods. For the

six months ended June 30, 20X5, Park should recognize 50% of the $40,000,

or $20,000, as an expense. However, the entire $100,000 net loss from the

disposal of the business segment should be recognized as a loss for the six

months ended June 30, 20X5. Therefore, a total of $120,000 should be

included in the determination of Park's net income for the six months ended

June 30, 20X5.

13-14](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-14-320.jpg)

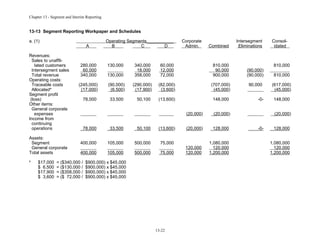

![Chapter 13 - Segment and Interim Reporting

E13-6

Multiple-Choice Questions on Income Taxes at Interim Dates [AICPA

Adapted]

1.

a

2.

b

$170,000 x .45 = $ 76,500

$130,000 x .40 = (52,000)

Third quarter

$ 24,500

3.

c

Net operating loss credit ($100,000 x .40)

Other tax credit

Total credits

Estimated annual operating loss

Tax benefit rate ($50,000 / $100,000)

Operating loss in first quarter

Tax benefit in first quarter

4.

c

5.

c

.25 X $200,000 = $50,000.

6.

b

Deferred taxes are computed only for temporary

differences. The other items are permanent differences.

$ 40,000

10,000

$ 50,000

÷100,000

.50

x$20,000

$ 10,000

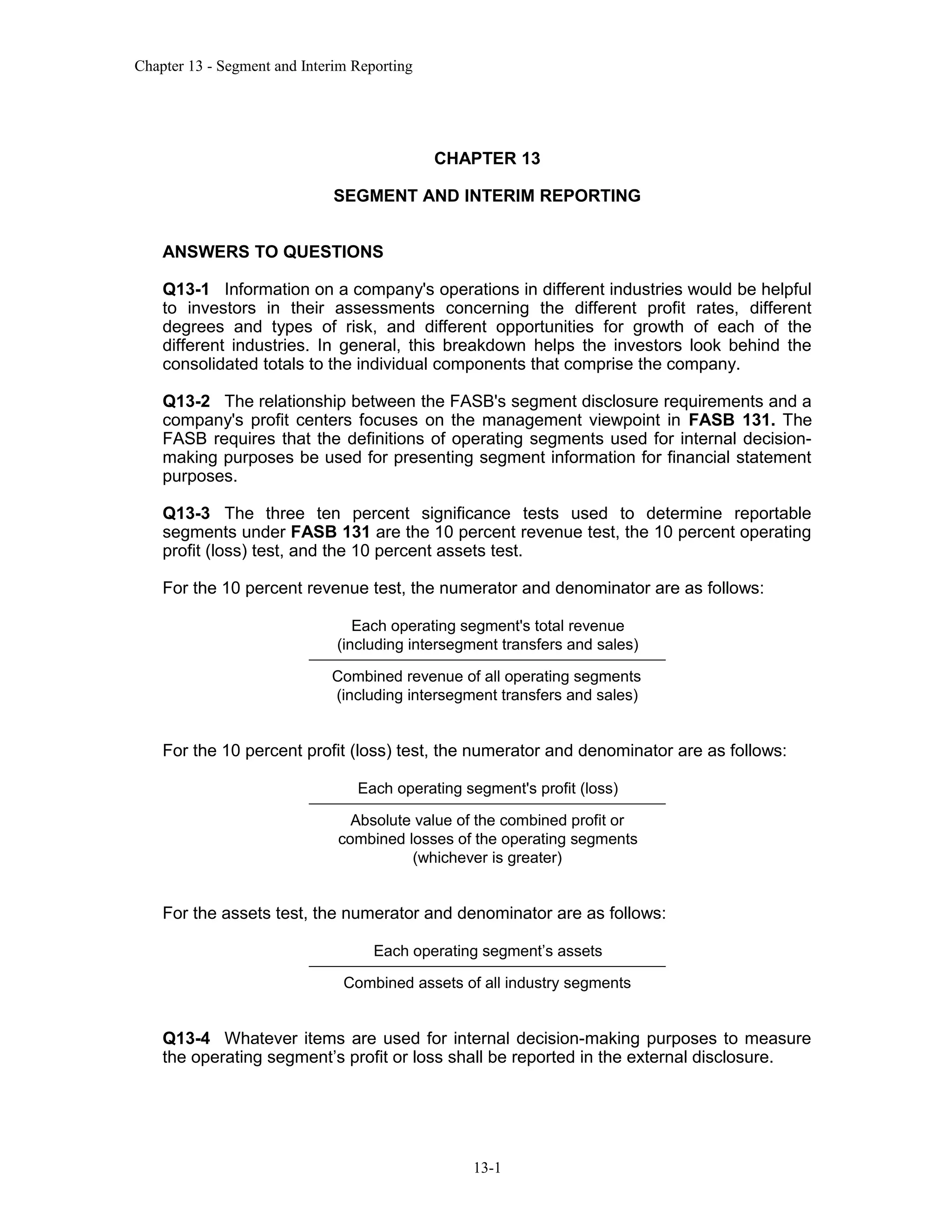

E13-7 Significant Foreign Operations

Geographic Area

U.S.

Britain

Brazil

Israel

Australia

Consolidated Revenue

Sales to

Unaffiliated

Customers

$364,000

252,000

72,000

58,000

47,000

$793,000

Percent of

Consolidated

Revenue of

$793,000

45.9%

31.8

9.1

7.3

5.9

Note that the country-based revenue test is based on sales to

customers. All countries having material sales to unaffiliated customers

($793,000 x .10) or more must be separately reported.

Percent of

Total LongLong-Lived

Lived Assets

Geographic Area

Assets

of $1,182,000

U.S.

$ 509,000

43.1%

Britain

439,000

37.1

Brazil

93,000

7.9

Israel

66,000

5.6

Australia

75,000

6.3

Total Assets

$1,182,000

Separately

Reportable

Yes

Yes

No

No

No

unaffiliated

of $79,300

Separately

Reportable

Yes

Yes

No

No

No

All geographic areas reporting long-lived assets of $118,200 ($1,182,000 x .10) or

more must be separately reported.

13-18](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-18-320.jpg)

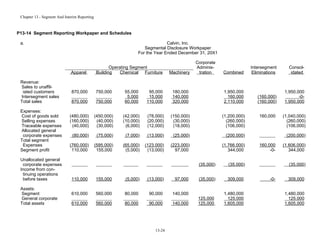

![Chapter 13 - Segment and Interim Reporting

P13-11 (continued)

d.

Disclosure of geographic areas' revenue (in thousands)

Geographic Area

United States

Total Foreign

Total

Significant country:

Mexico

Unaffiliated Revenue

$ 820

345 *

$1,165

$ 245

*Individual foreign countries exceeding 10% of total unaffiliated revenue ($1,165)

would be listed separately. In this case, only Mexico would be reported separately.

E13-12 Different Reporting Methods for Interim Reports [CMA Adapted]

1.

Not acceptable. Revenue should be recognized when realized.

2.

Acceptable. The gross profit method may be used for interim reports.

3.

Acceptable. Costs may be allocated on a reasonable basis.

4.

Acceptable. A recovery to original cost may be recorded in a subsequent interim

period.

5.

Not acceptable. Gains are recognized in the period of the sale.

6.

Acceptable. Costs may be allocated on a reasonable basis.

7. Not acceptable. FASB 154 requires that a change in depreciation in long-lived

assets be accounted for as a change in estimate effected by a change in

accounting principle. The current and prospective application is used, and no

cumulative effect, nor any retrospective restatement, is used for this change.

13-21](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-21-320.jpg)

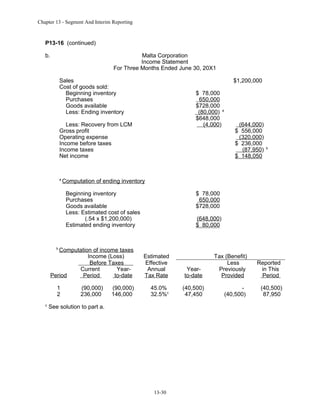

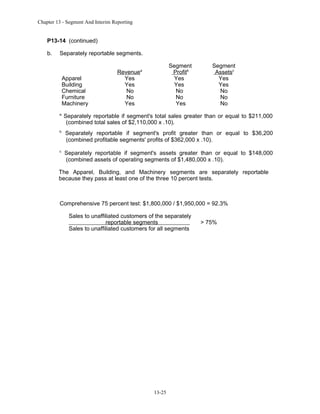

![Chapter 13 - Segment And Interim Reporting

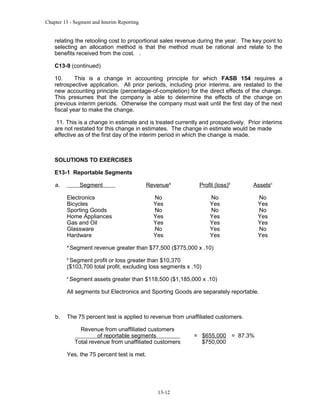

P13-15 Interim Income Statement

a.

Estimate of effective annual tax rate at end of second quarter:

Estimated

Annual

Amounts

Income from continuing operations

Less: Dividend exclusion

Estimated annual taxable income

Combined tax rate

Estimated annual taxes before credits

Less: Business tax credit

Estimated income taxes for year

$600,000

(30,000)

$570,000

x

50%

$285,000

(15,000)

$270,000

Estimated effective annual tax rate ($270,000/$600,000)

=

b.

45%

Chris, Inc.

Income Statement

For Three Months Ended June 30, 20X2

Sales

Cost of goods sold

Gross profit

Operating expense ($230,000 - $45,000

factory rearrangement deferred)

Income before taxes

Income taxes

Net income

a

$850,000

(525,000) a

$325,000

(185,000)

$140,000

(68,000)

$ 72,000

Computation of Cost of Goods Sold

Cost of goods sold as given

Add: LIFO inventory liquidation

[7,500 x ($26 - $12)]

Adjusted cost of goods sold

b

$420,000

105,000

$525,000

Computation of Income Taxes

Interim

Period

Income (Loss)

Before Taxes

Current

YearPeriod

to-date

Estimated

Effective

Annual

Tax Rate

Yearto-date

1

100,000

100,000

40%

40,000

2

140,000

240,000

45%

108,000

13-28

Tax (Benefit)

Less

Previously

Provided

-040,000

Reported

in this

Period

40,000

68,000](https://image.slidesharecdn.com/chap013-131230191526-phpapp01/85/solusi-manual-advanced-acc-zy-Chap013-28-320.jpg)