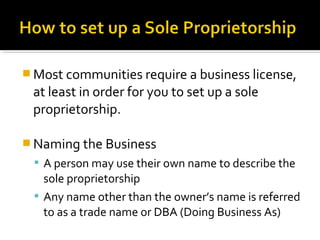

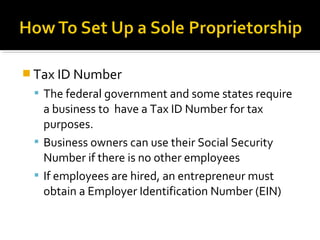

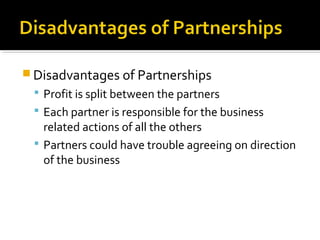

This document discusses different types of business ownership structures and their associated liabilities. It notes that a sole proprietorship is a single individual who owns and operates the business and has unlimited liability for its debts. Most small businesses are sole proprietorships. While they are simple and inexpensive to start, sole proprietors have unlimited liability and it is difficult to attract investors or expand. Partnerships involve at least two individuals who share management, profits, and liability of the business. General partnerships make all partners liable, while limited partnerships limit liability for some partners. Partnerships allow founders to pool resources but profits and responsibilities must be agreed upon.