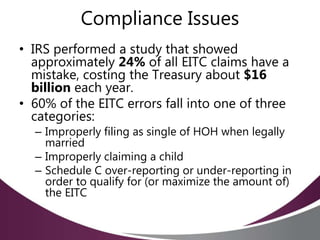

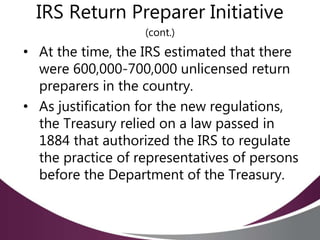

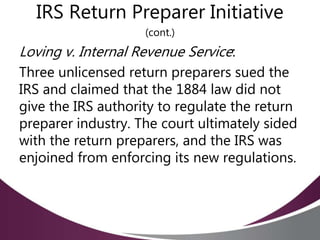

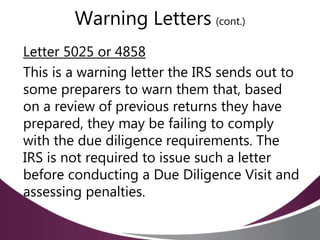

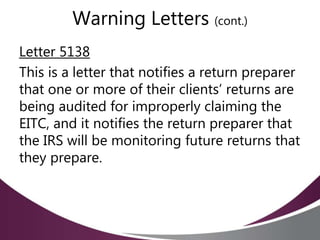

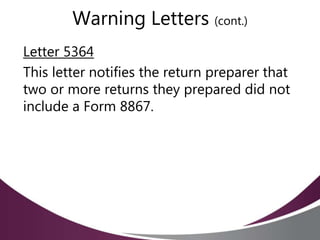

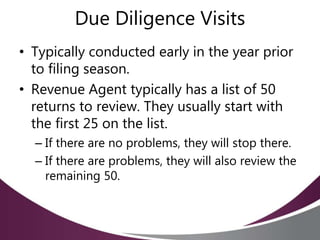

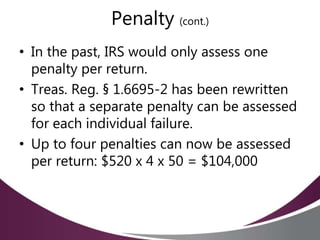

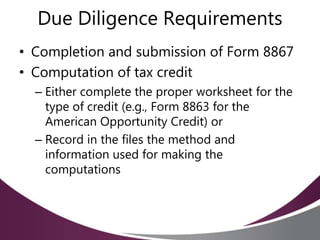

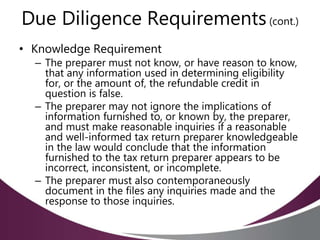

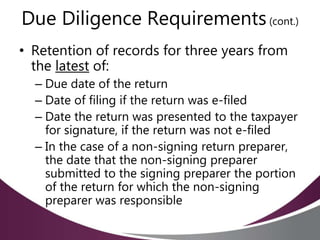

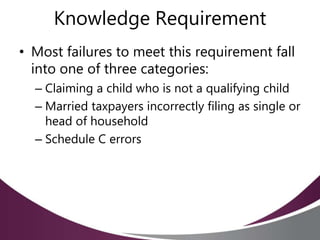

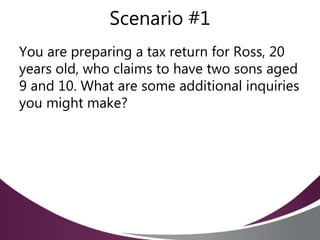

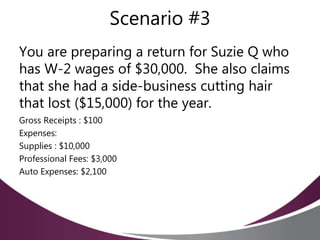

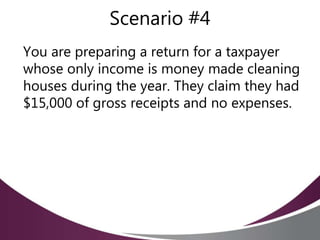

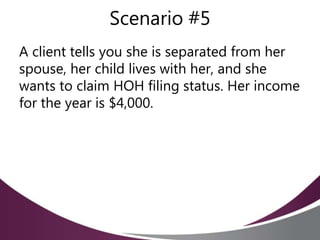

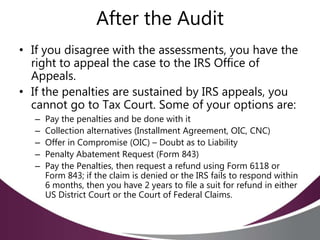

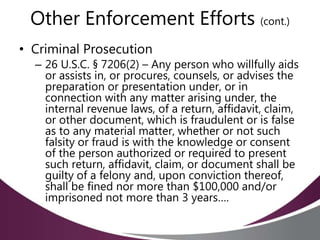

The document discusses the IRS's efforts to ensure compliance with refundable credit due diligence through various programs and penalties, emphasizing the high error rates in Earned Income Tax Credit (EITC) claims. It outlines scenarios for tax preparers to consider regarding due diligence requirements and the implications of non-compliance, including potential penalties. The document also describes the legal developments surrounding IRS regulations for tax preparers and the options available for appealing penalties post-audit.