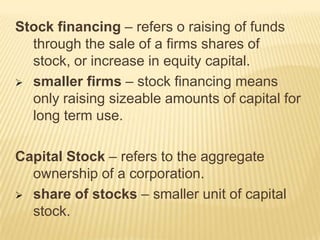

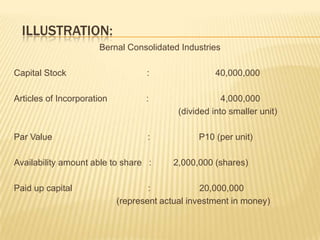

This document discusses different types of corporate stocks used by companies to raise long-term funds. It describes common stocks and preferred stocks, and the key differences between them. Preferred stocks have priority over common stocks in terms of dividends and assets. The document also discusses various features of stocks, including convertible, callable, sinking fund provisions, and classes of common stocks that restrict voting or have preferential dividend rights.