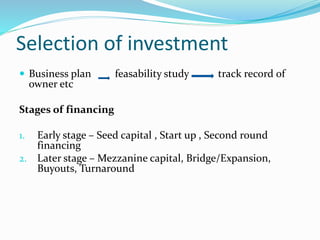

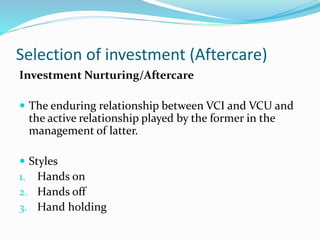

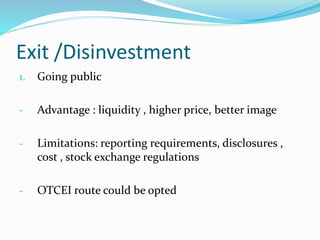

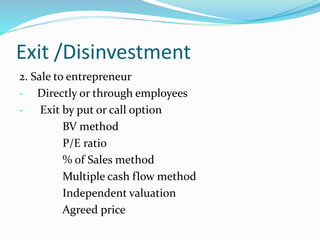

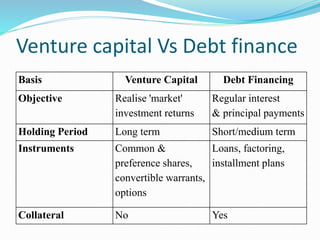

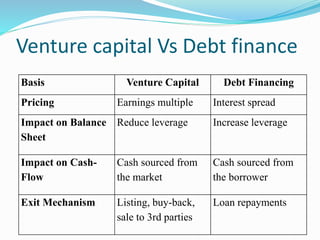

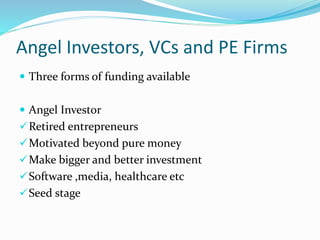

Venture capital involves equity investment in growth-oriented small/medium businesses in return for shares or rights to acquire the business. It provides long-term financing through various stages from seed funding to later expansions. Venture capitalists select investments based on business plans and feasibility studies, and provide active involvement and guidance to portfolio companies. Successful exits include IPOs, trade sales, and sales to new investors. While risky, venture capital is an important source of financing for entrepreneurs.