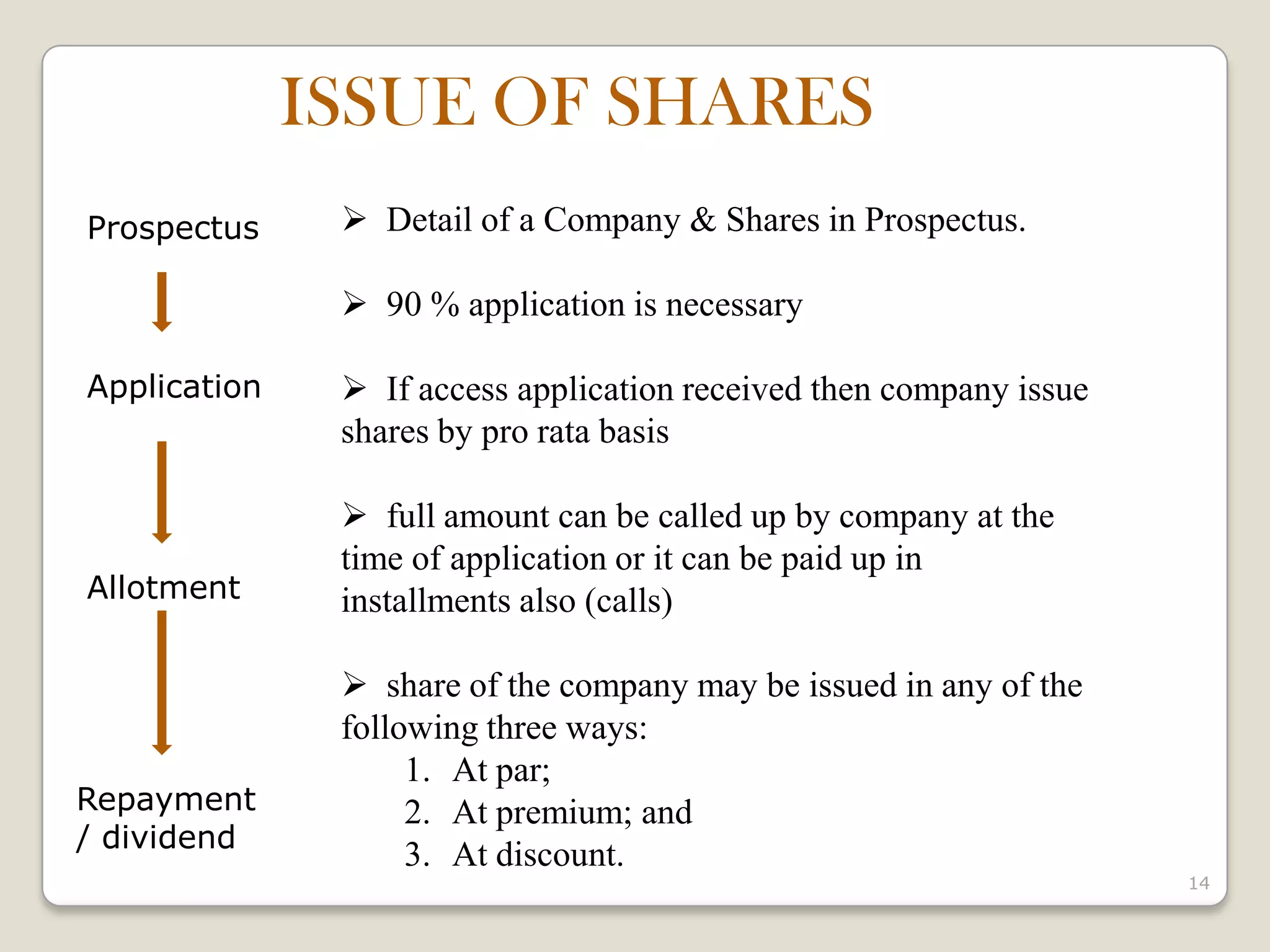

This document provides an overview of shares and debentures. It defines shares and share capital, and describes the different types of shares including equity shares, preference shares, and bonus shares. It also defines debentures and describes different types of debentures. Additionally, it explains various share capital terms like authorized share capital, issued capital, subscribed capital, called up capital, and paid up capital. Real life examples are provided to illustrate the concepts discussed.