This document discusses the fundamental concepts and processes of revenue recognition, focusing on the five-step revenue recognition standard adopted by the IASB and FASB. It details how to identify contracts, performance obligations, and how to determine and recognize revenue based on these factors. Examples illustrate the application of these principles in various business scenarios.

![18-55

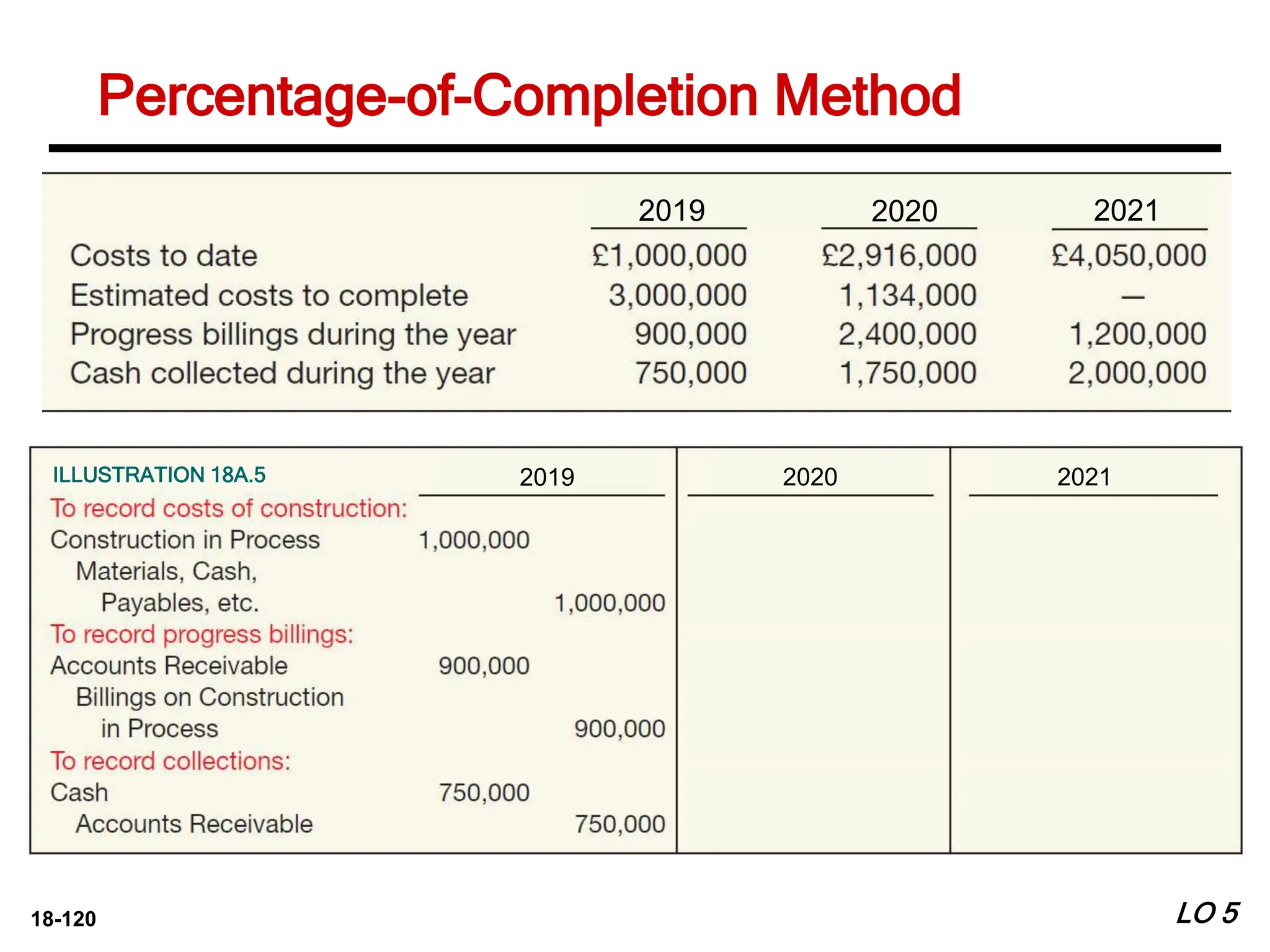

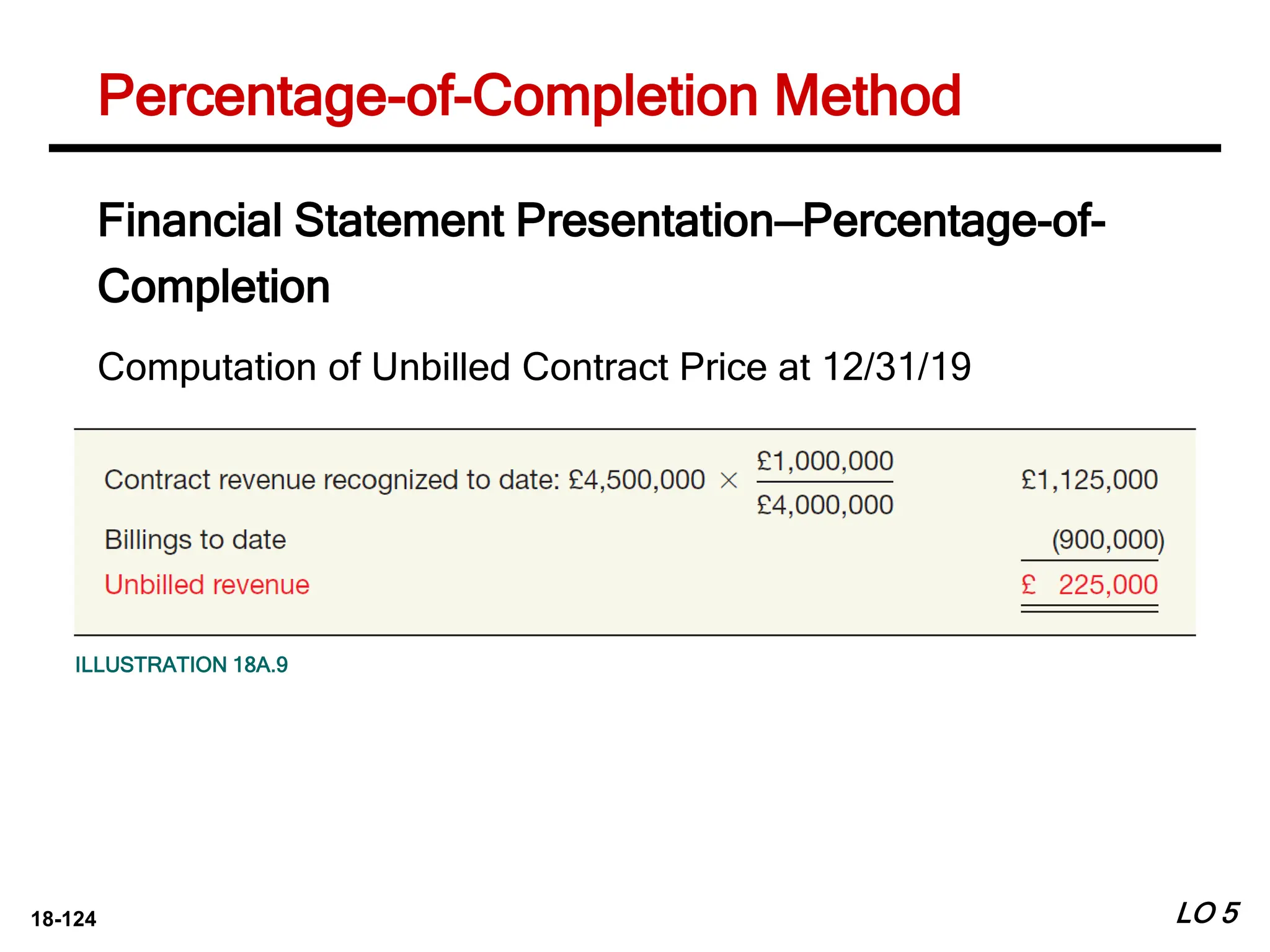

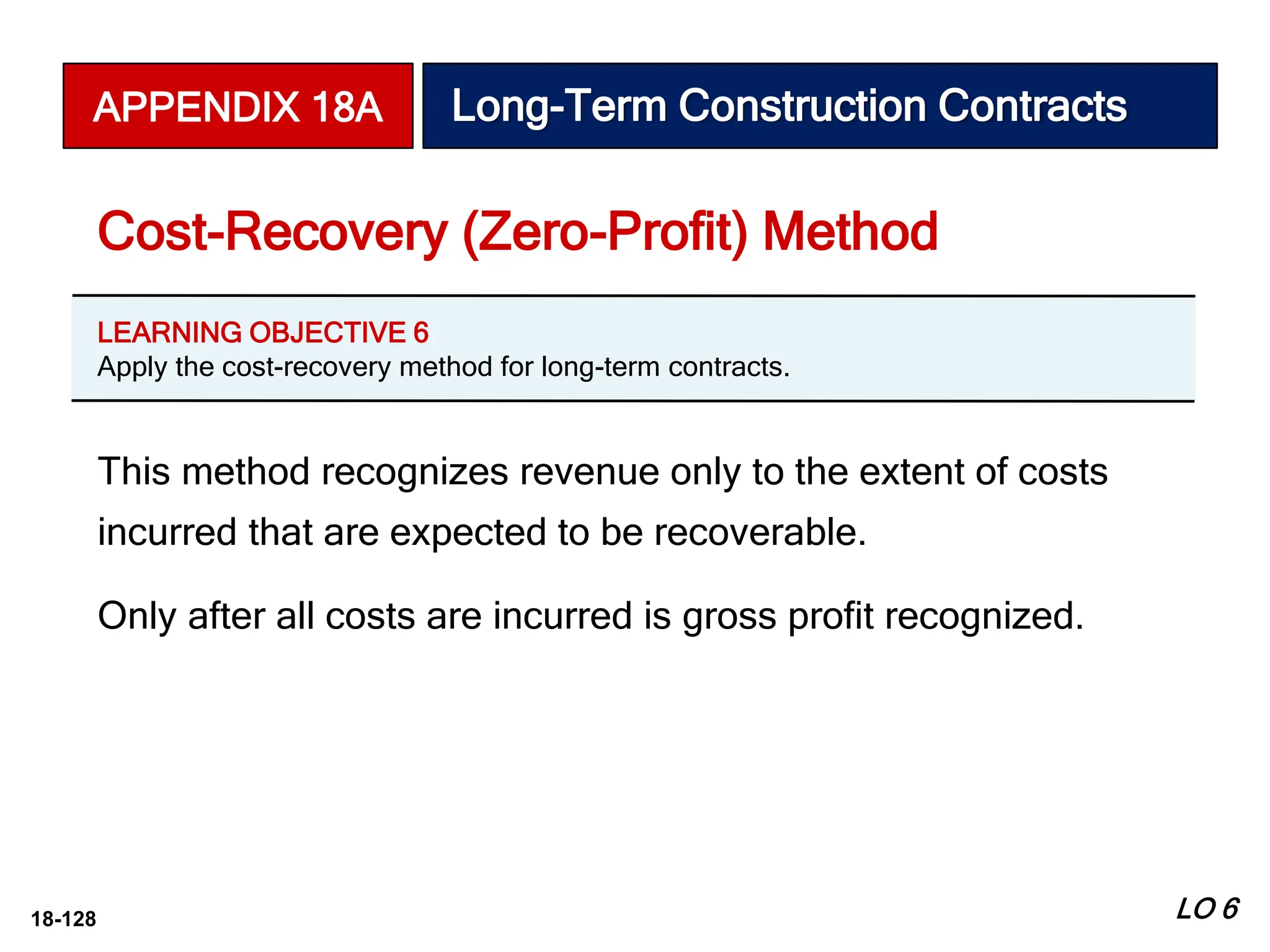

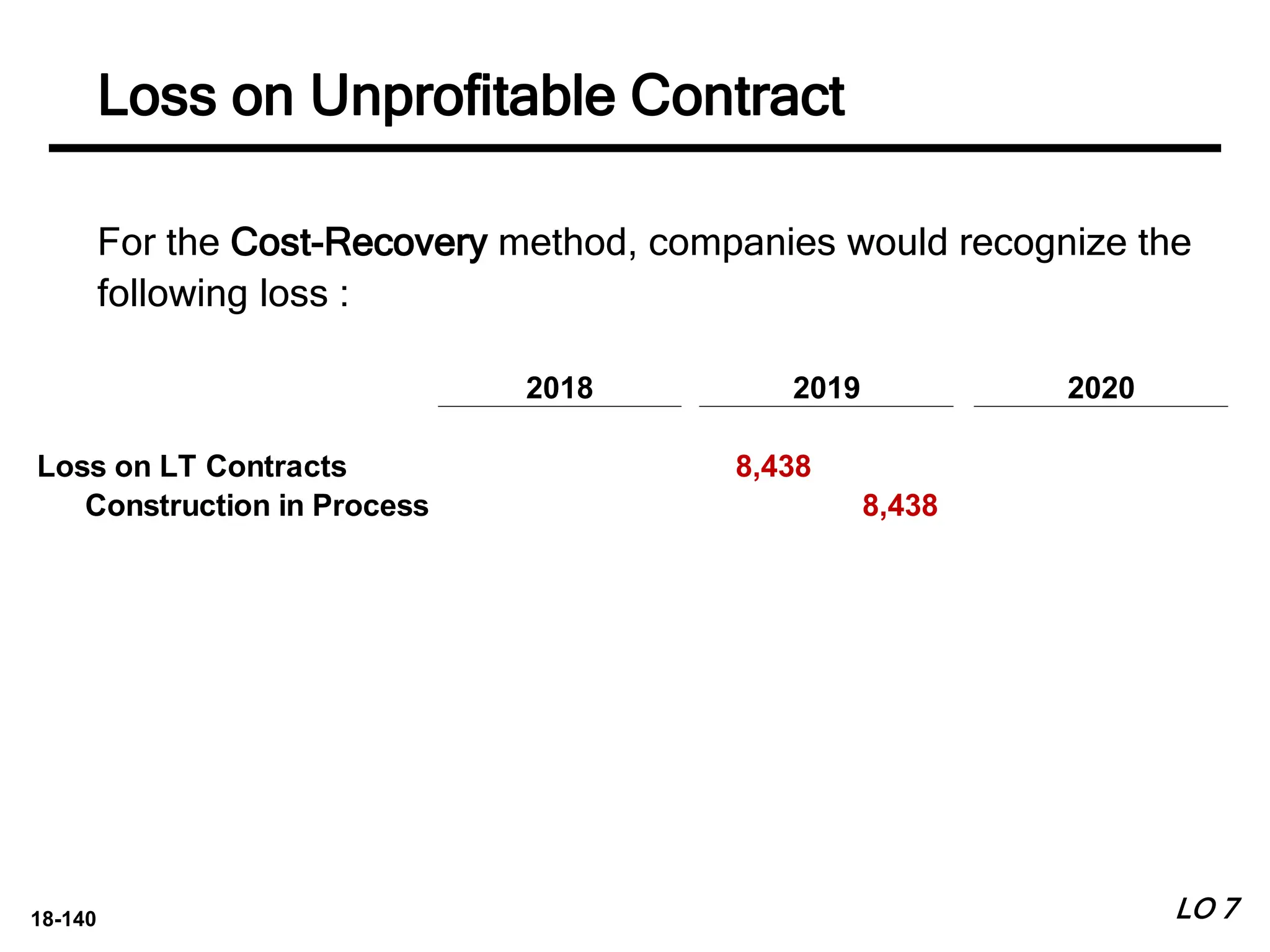

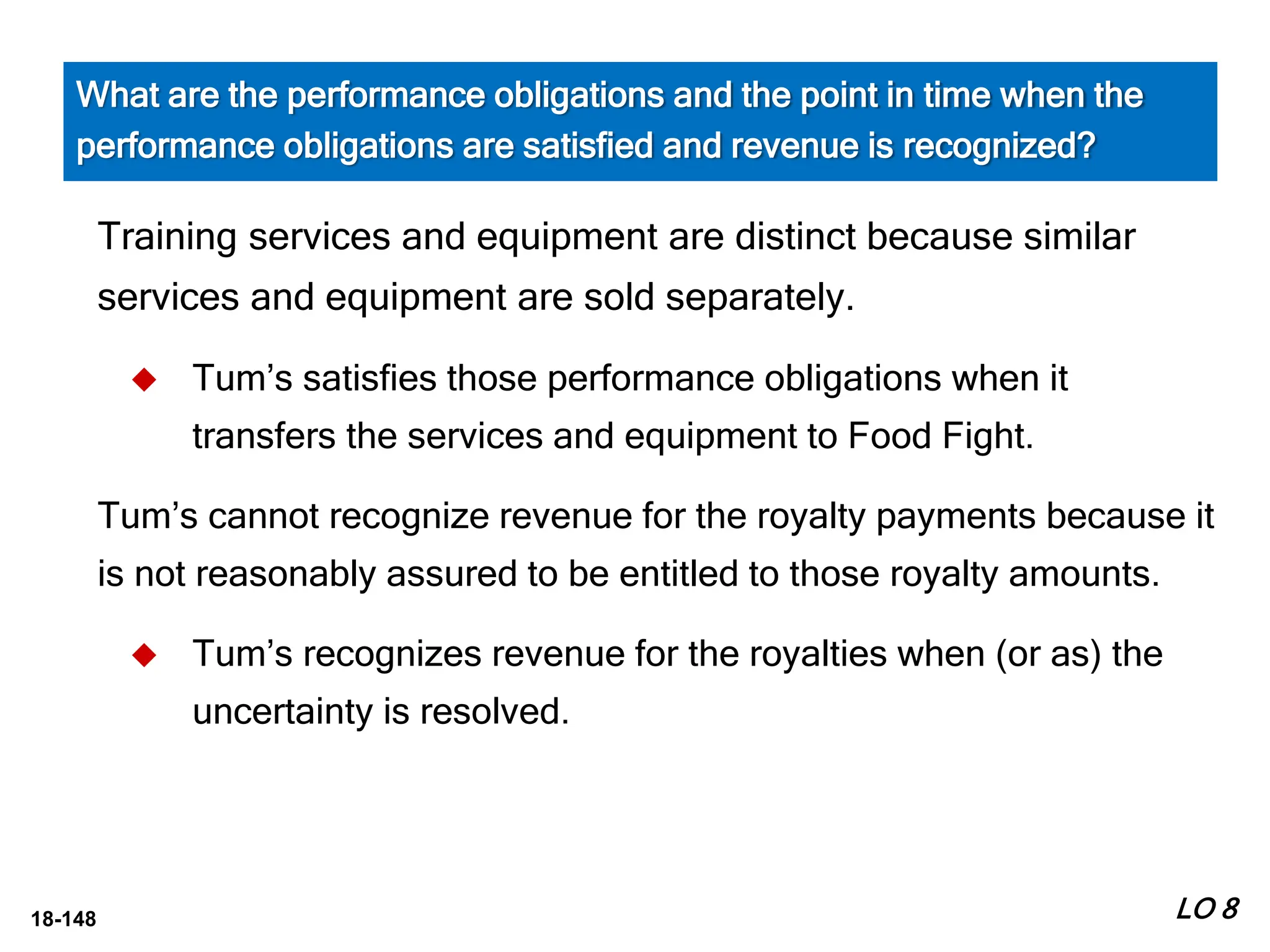

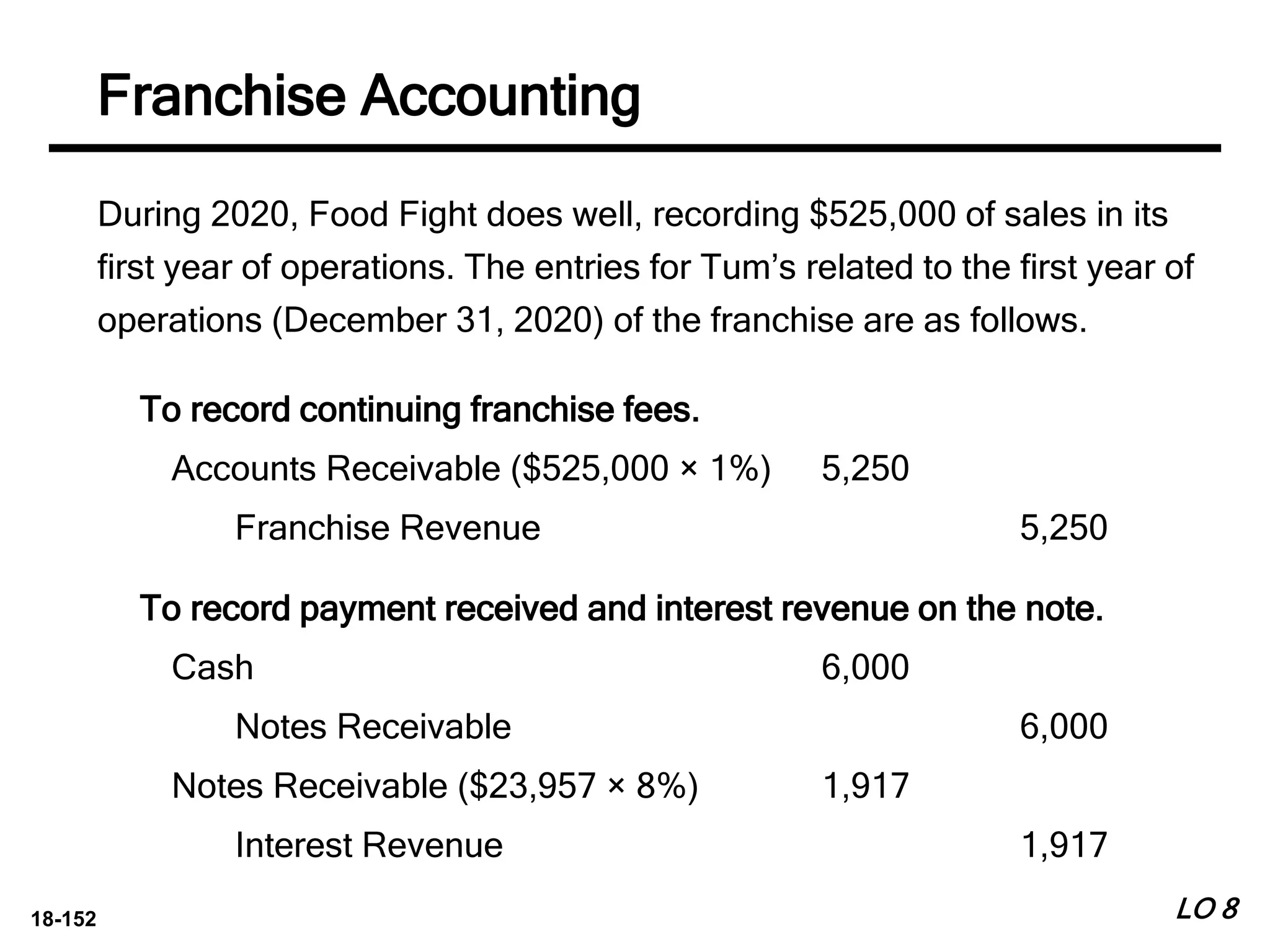

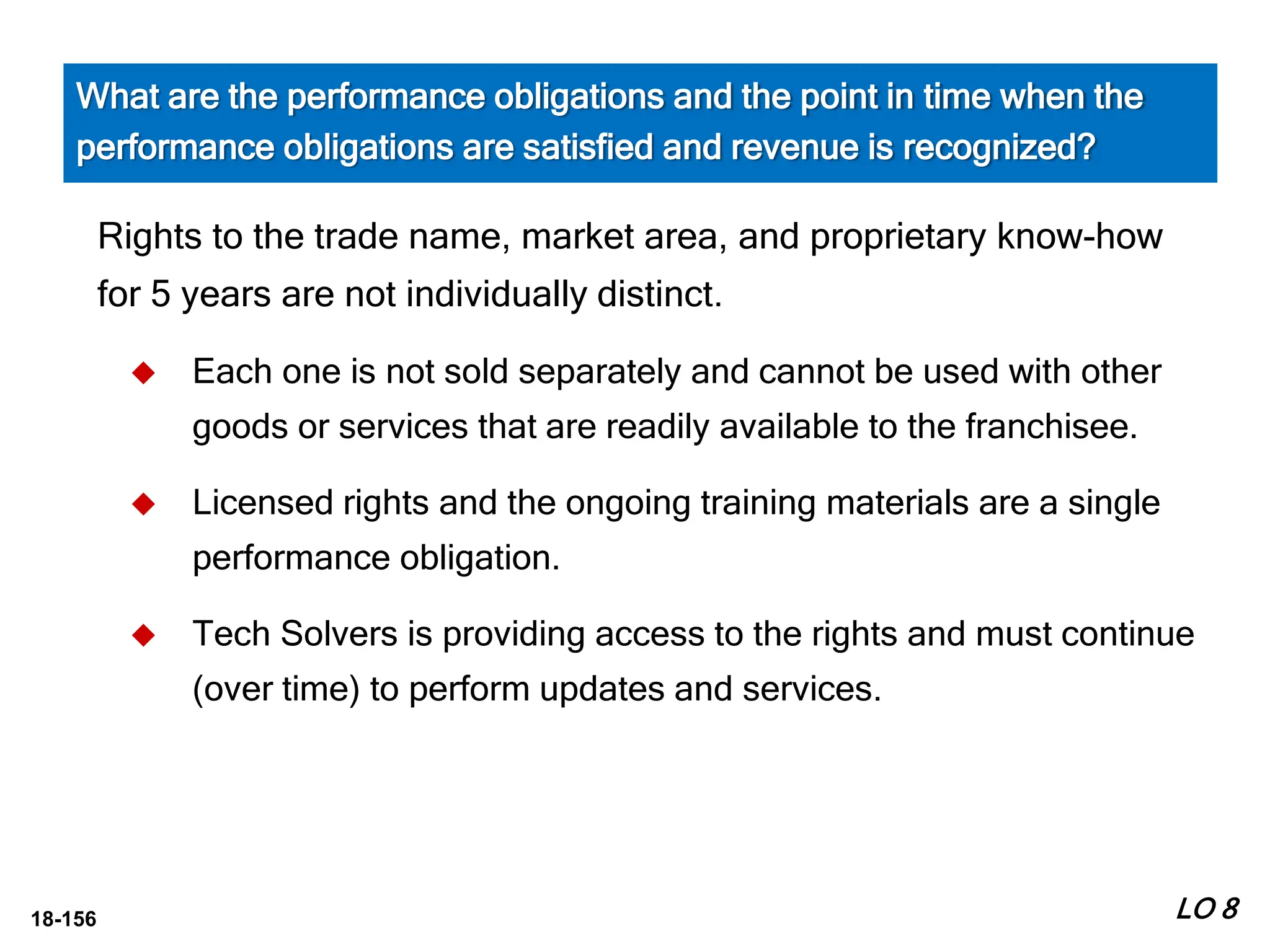

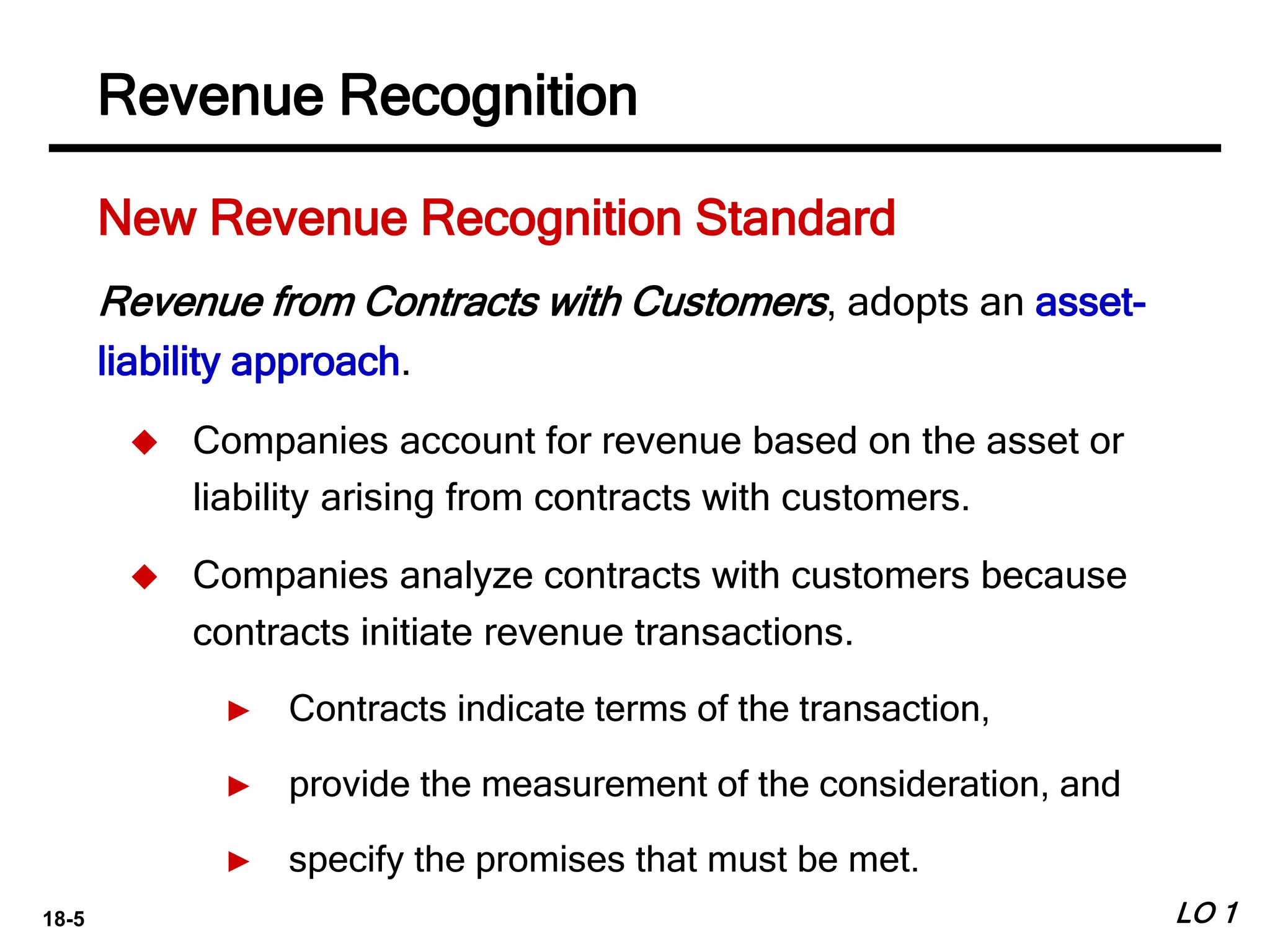

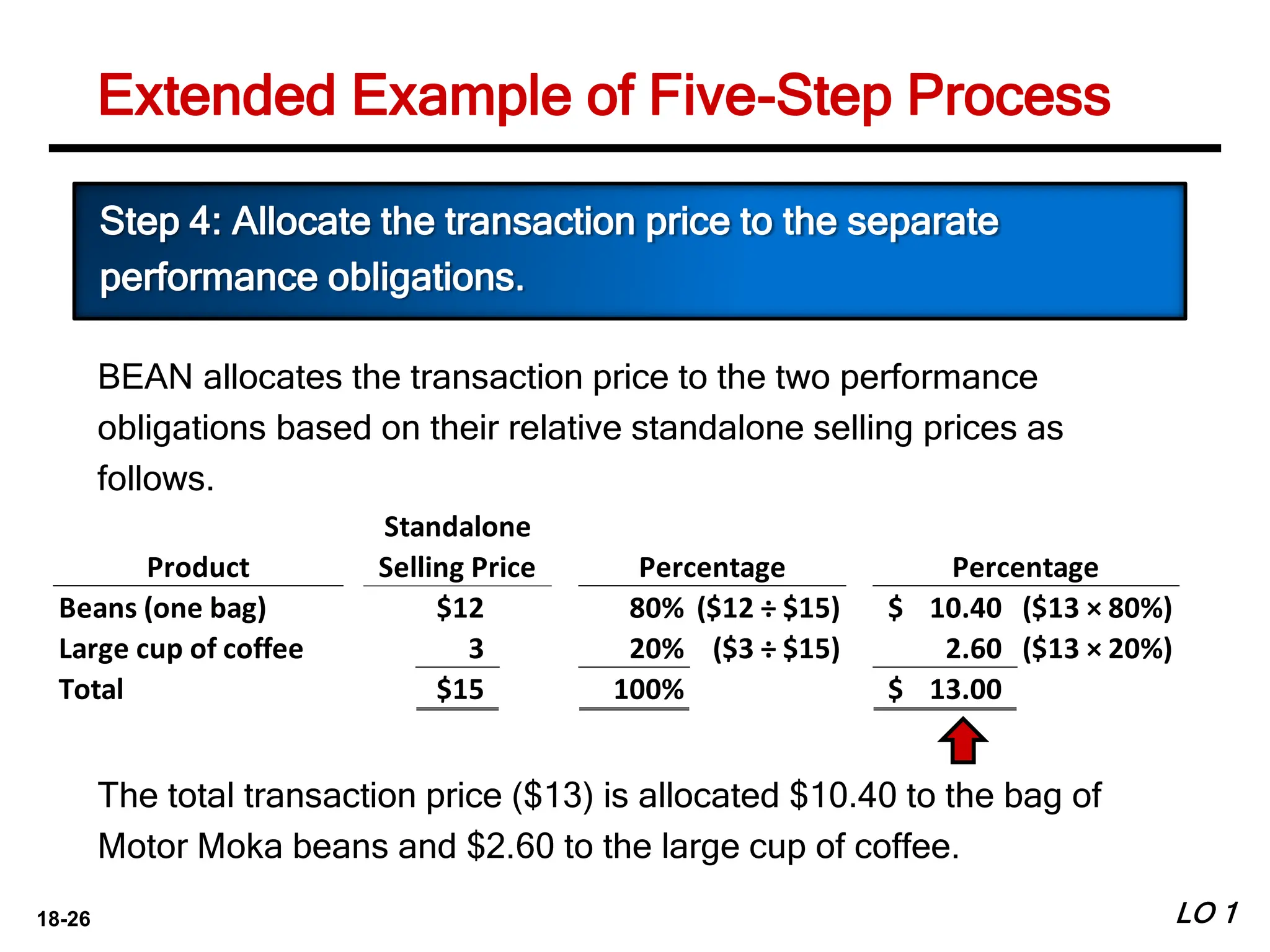

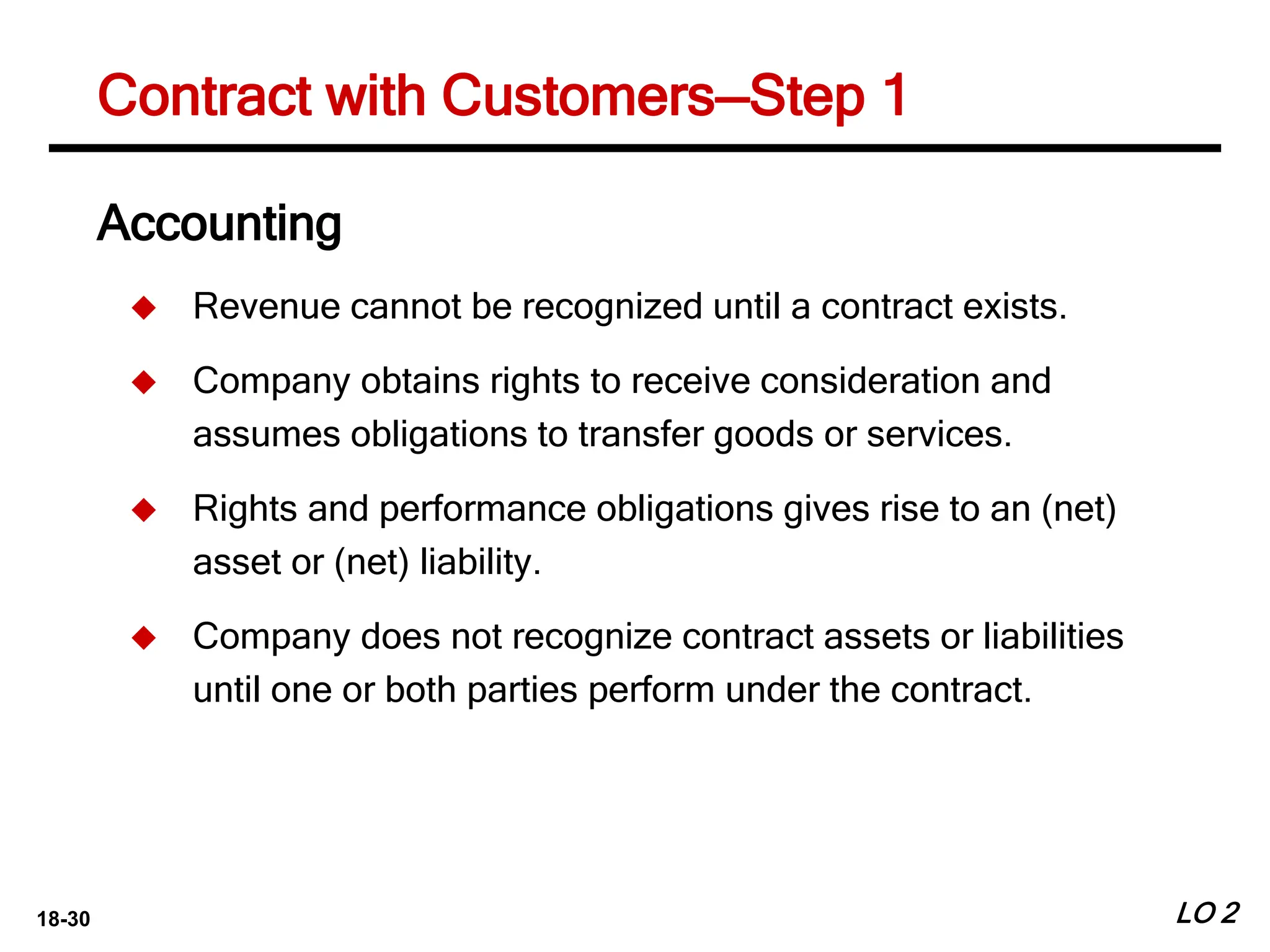

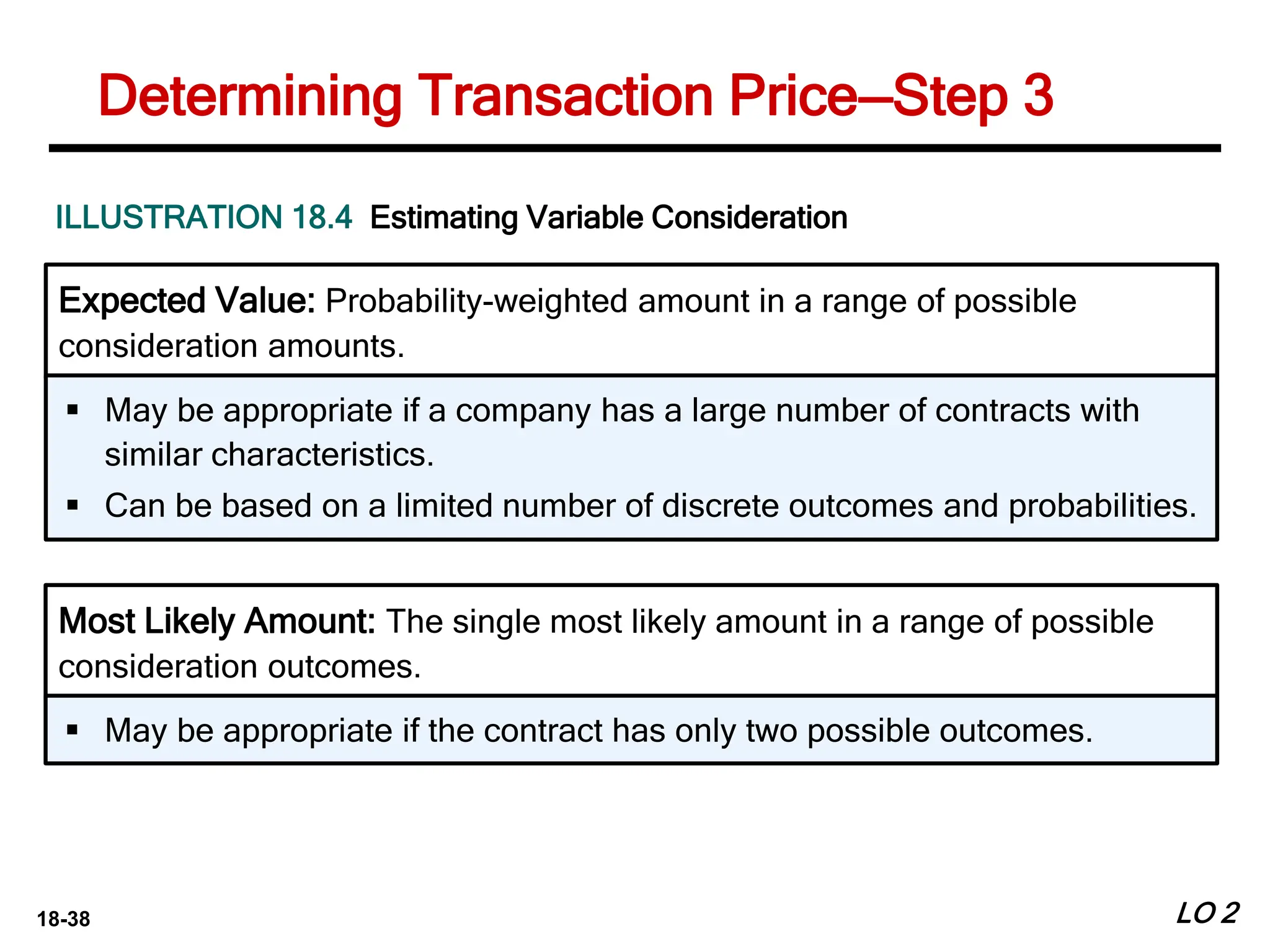

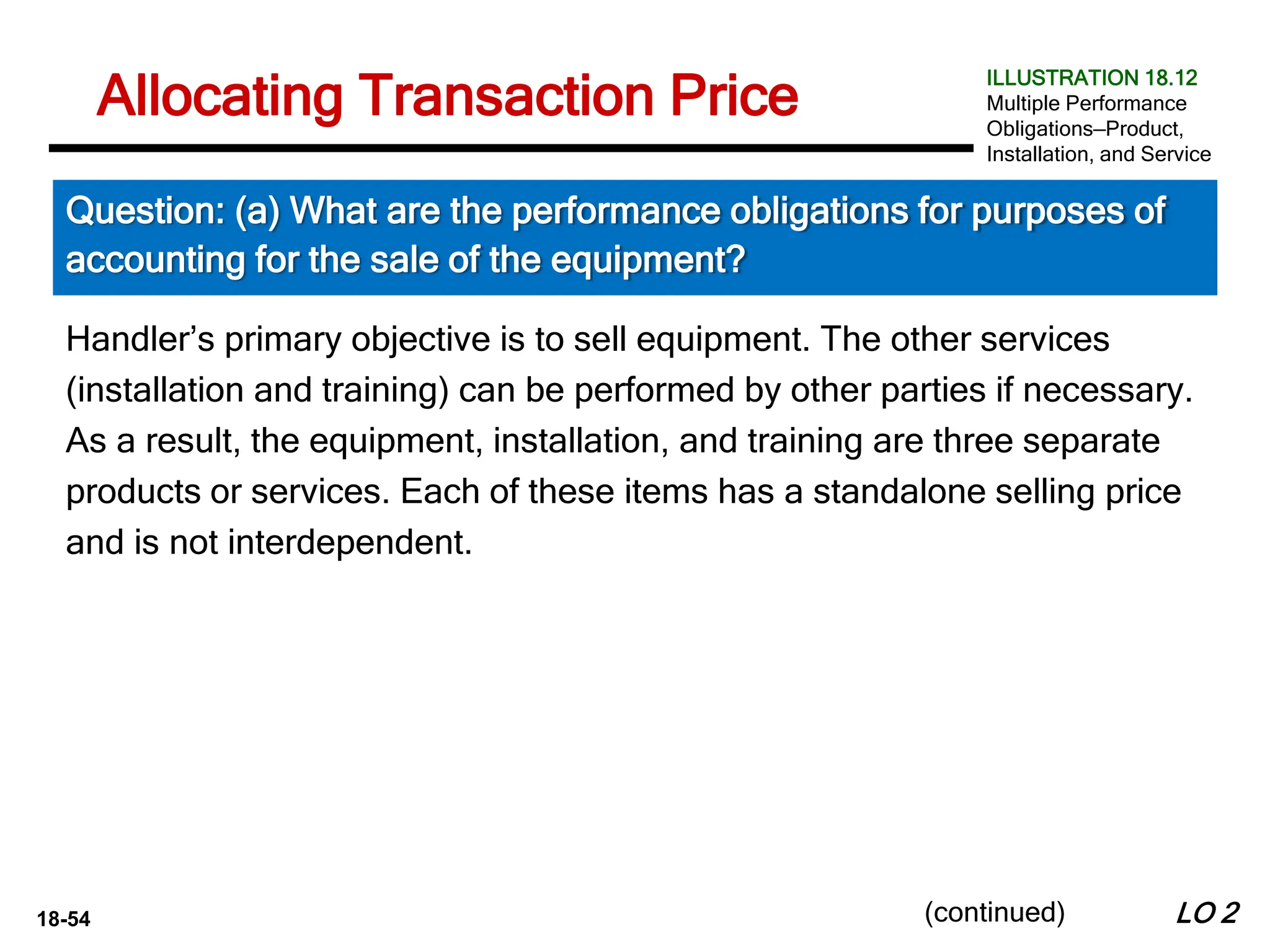

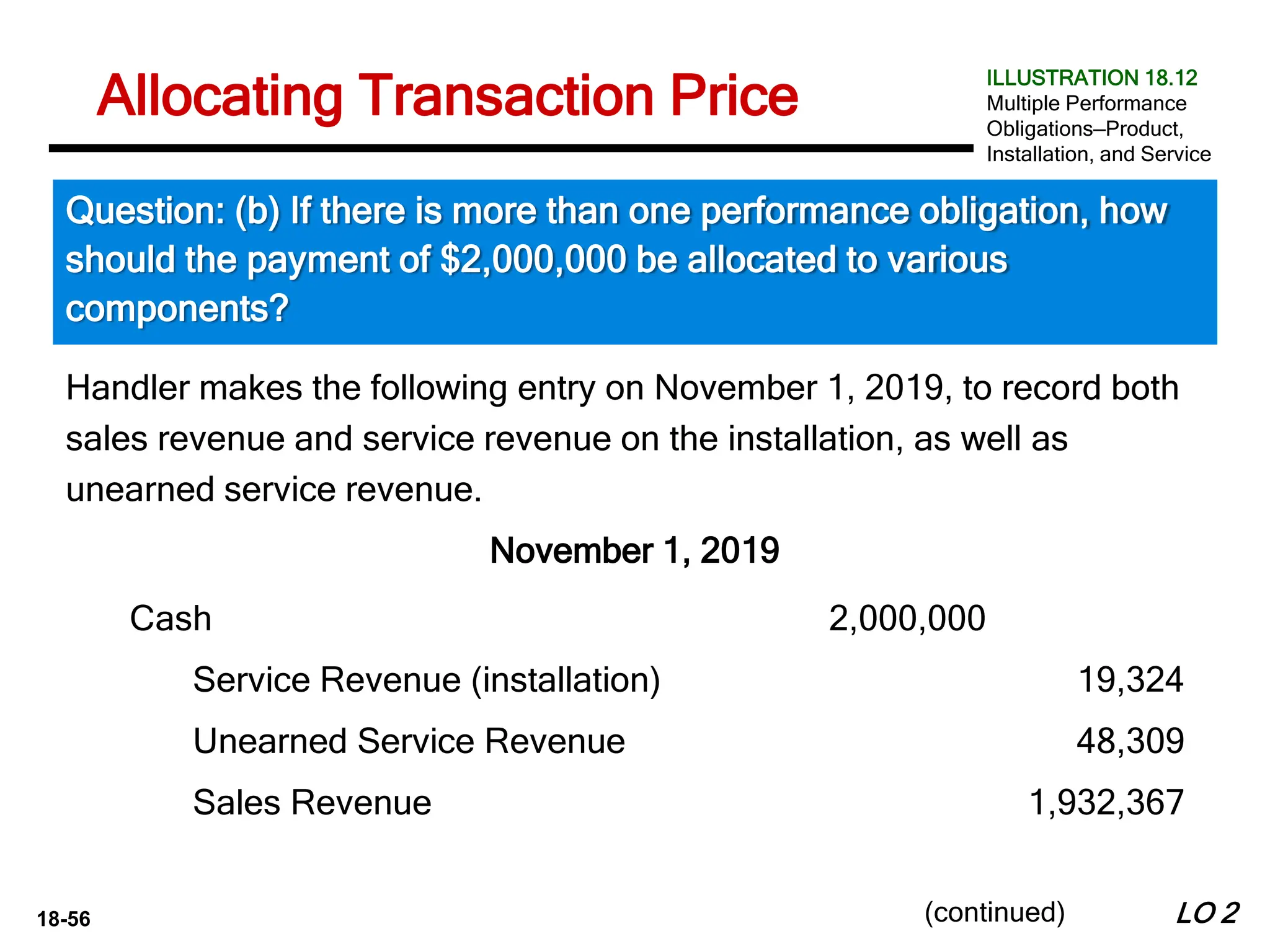

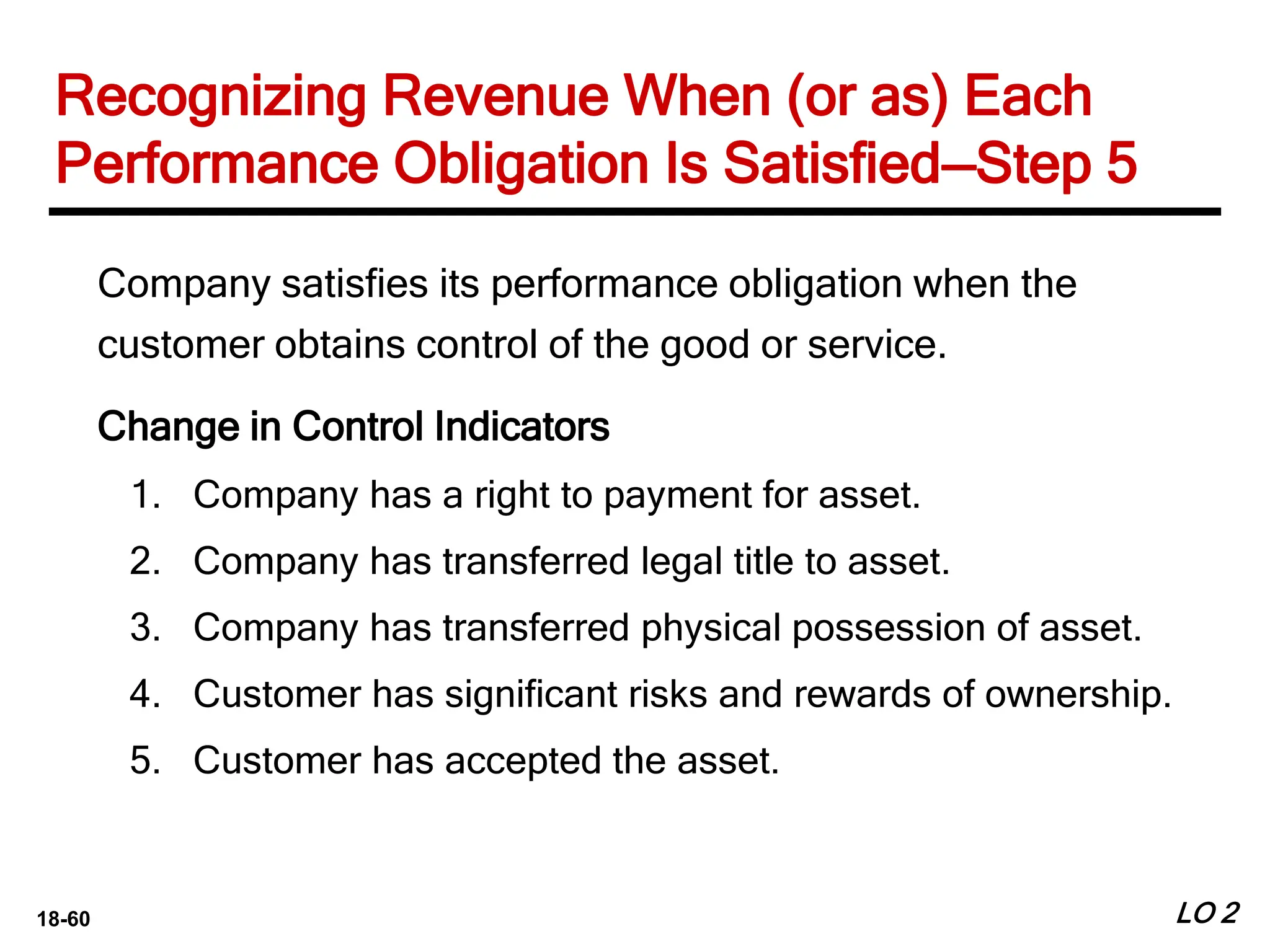

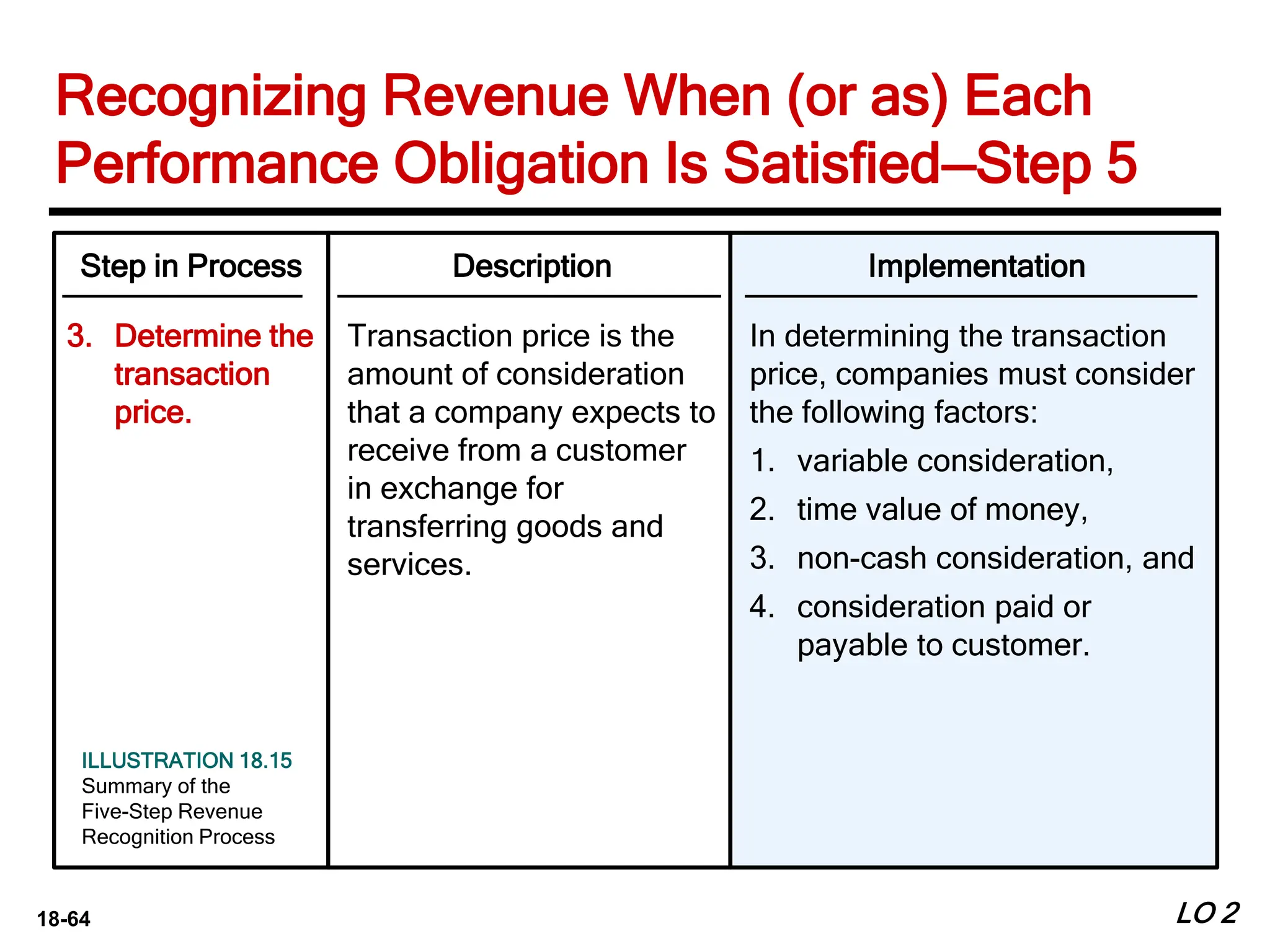

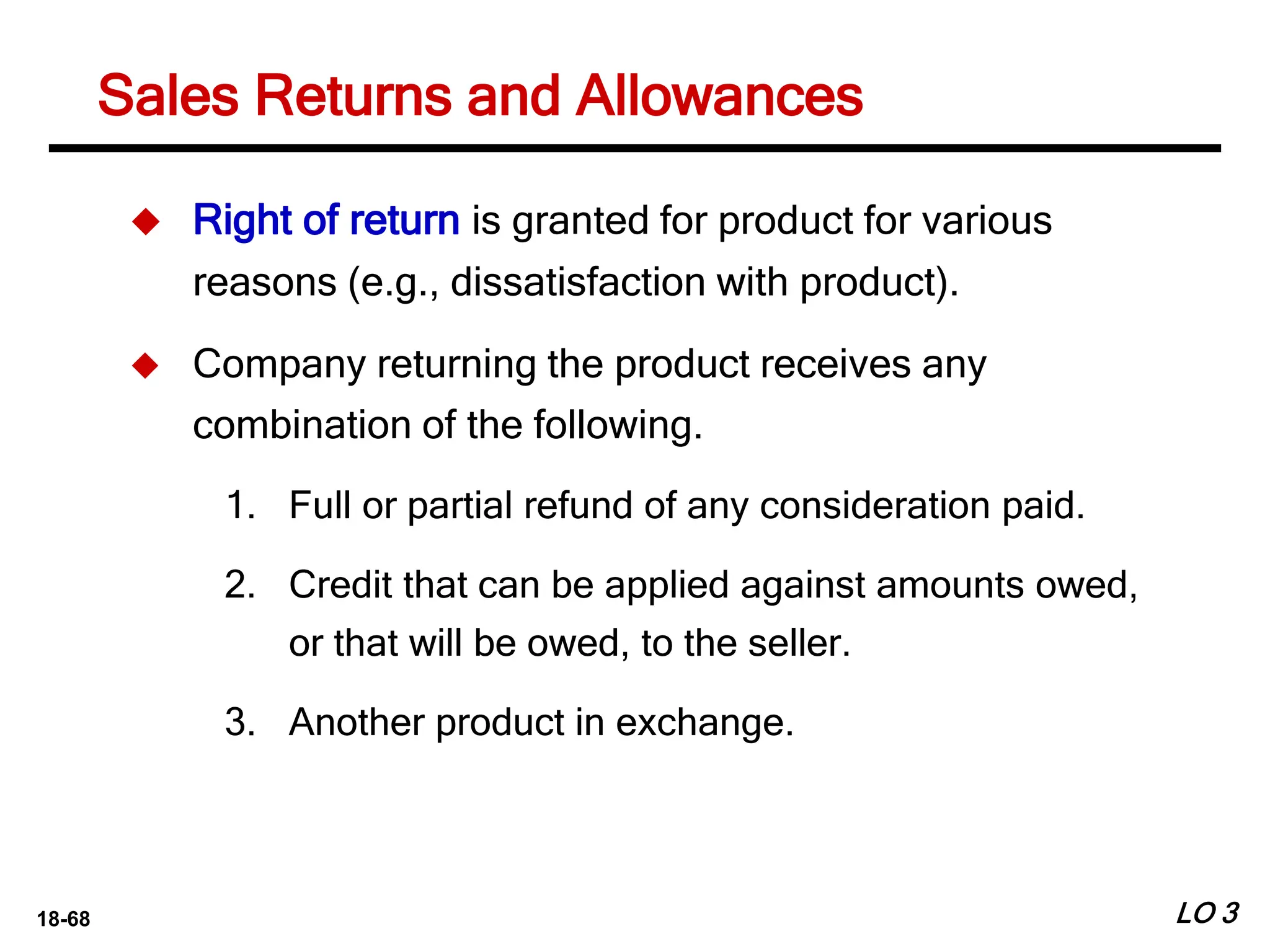

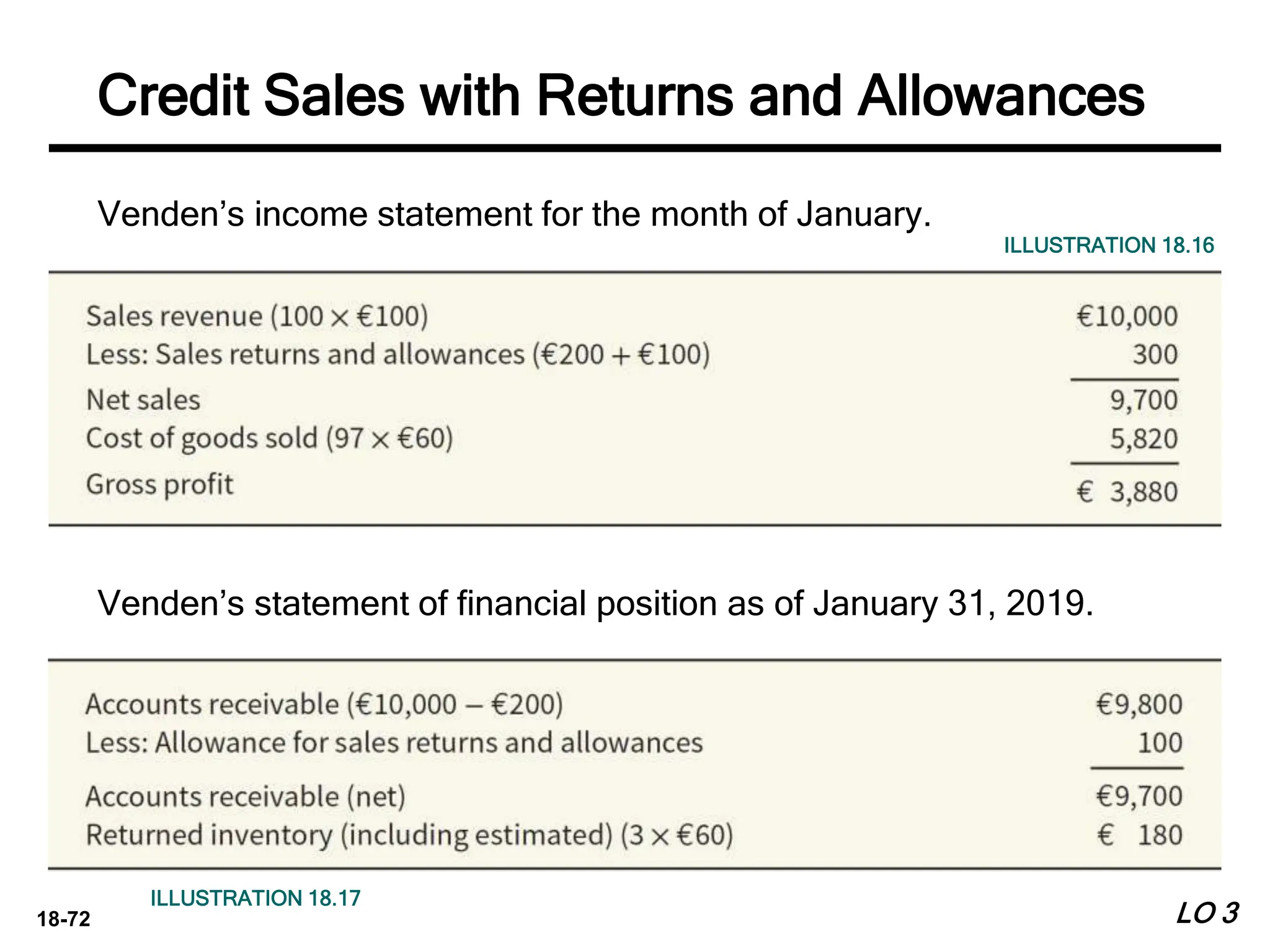

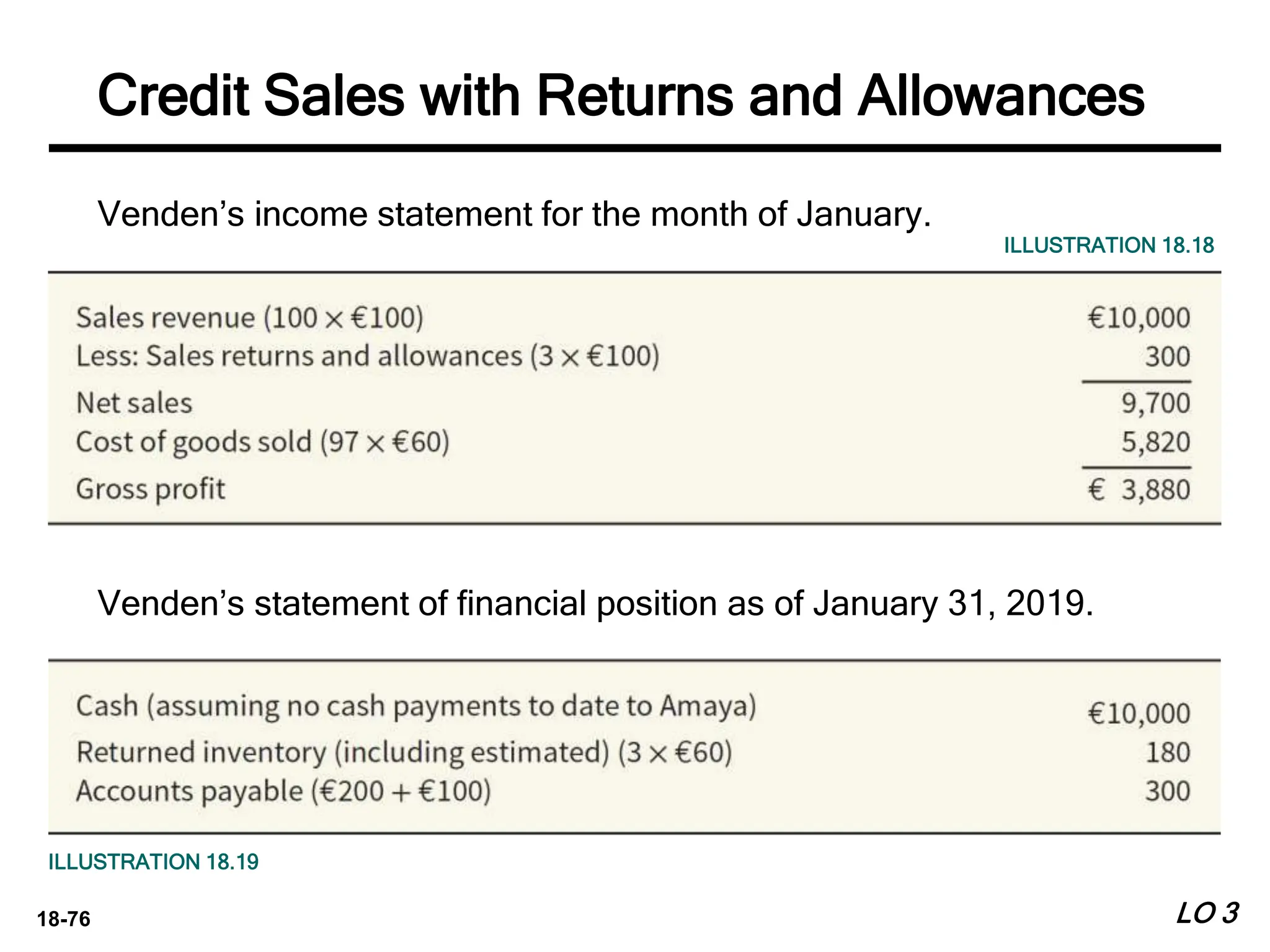

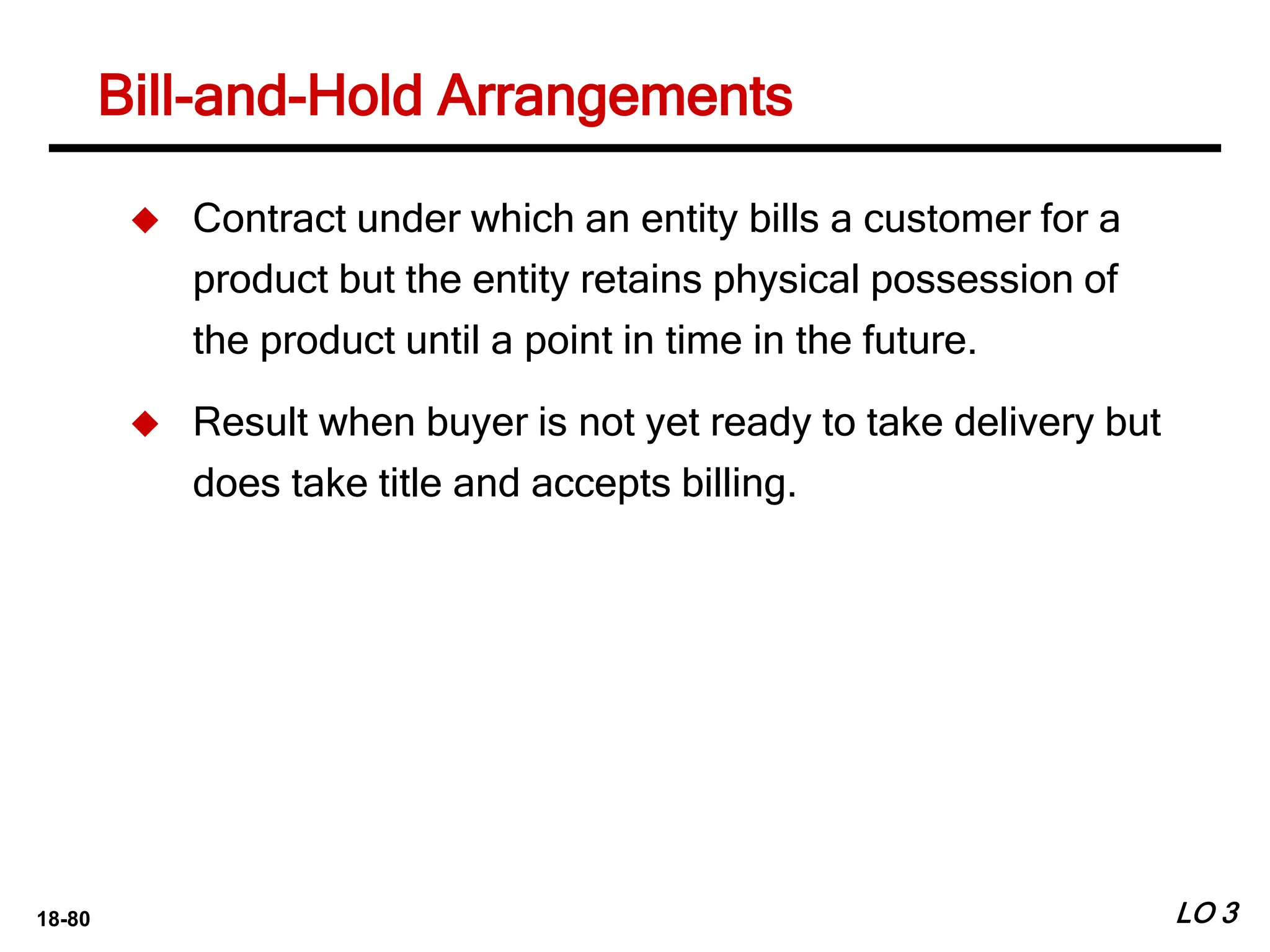

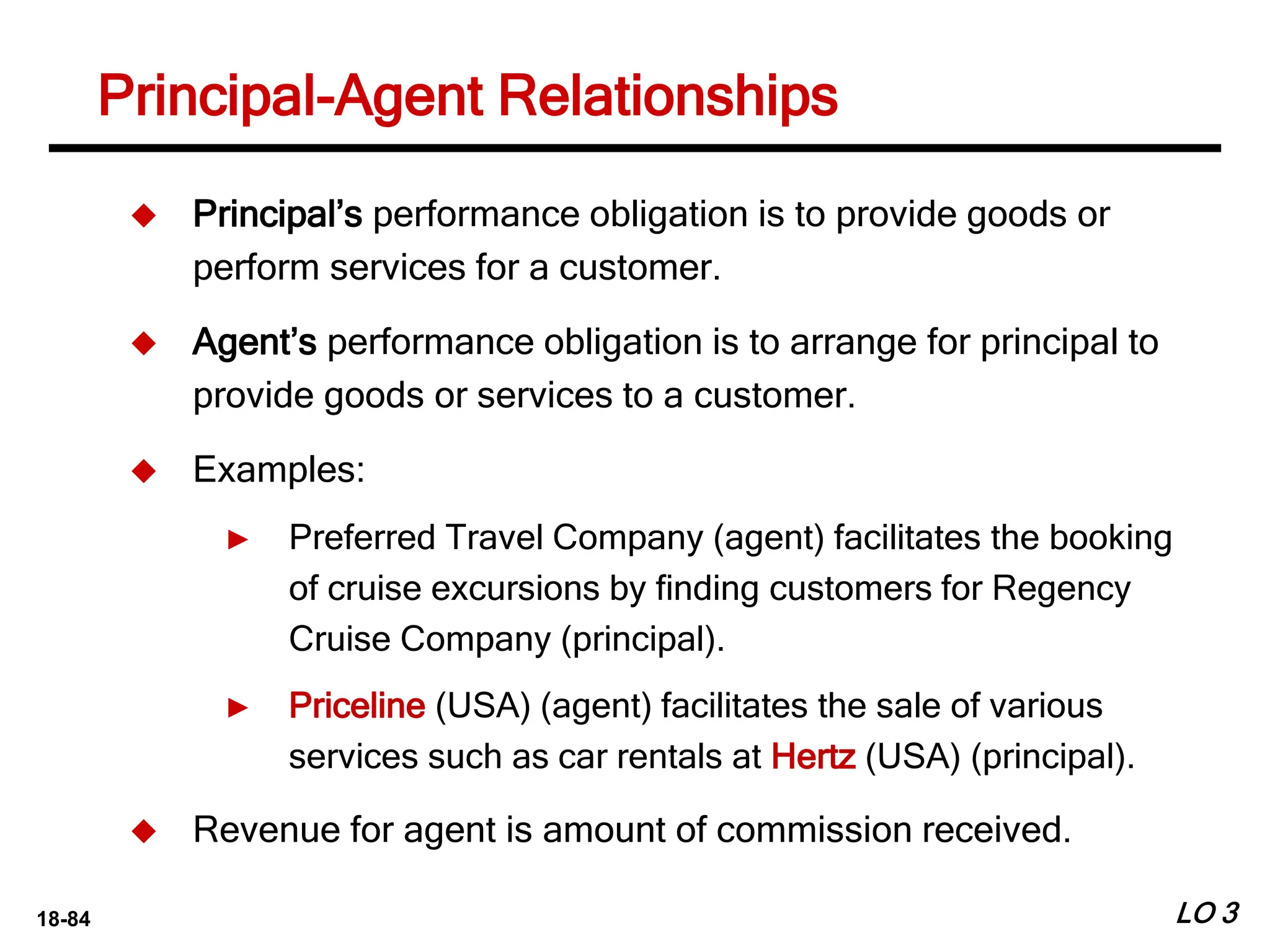

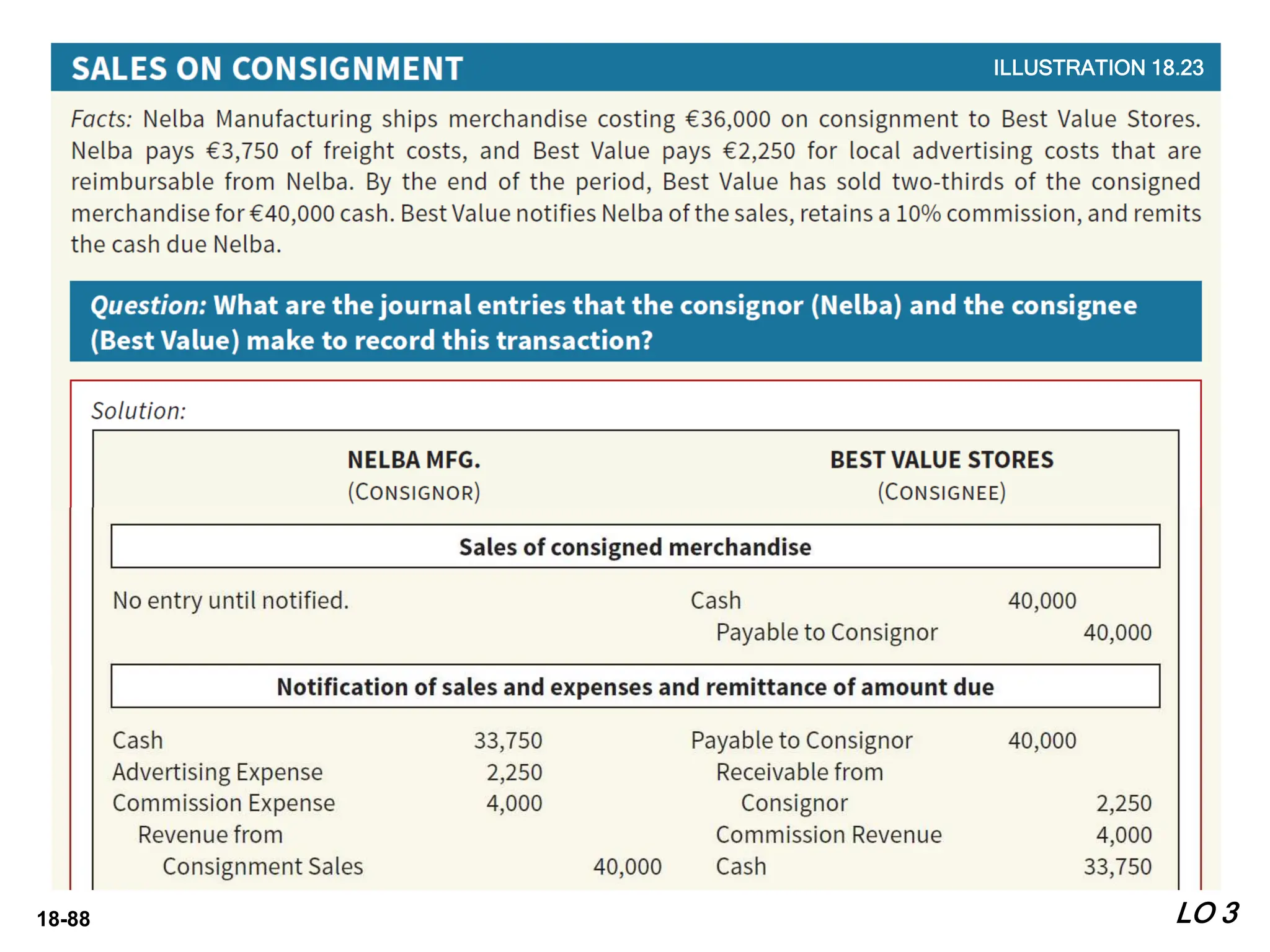

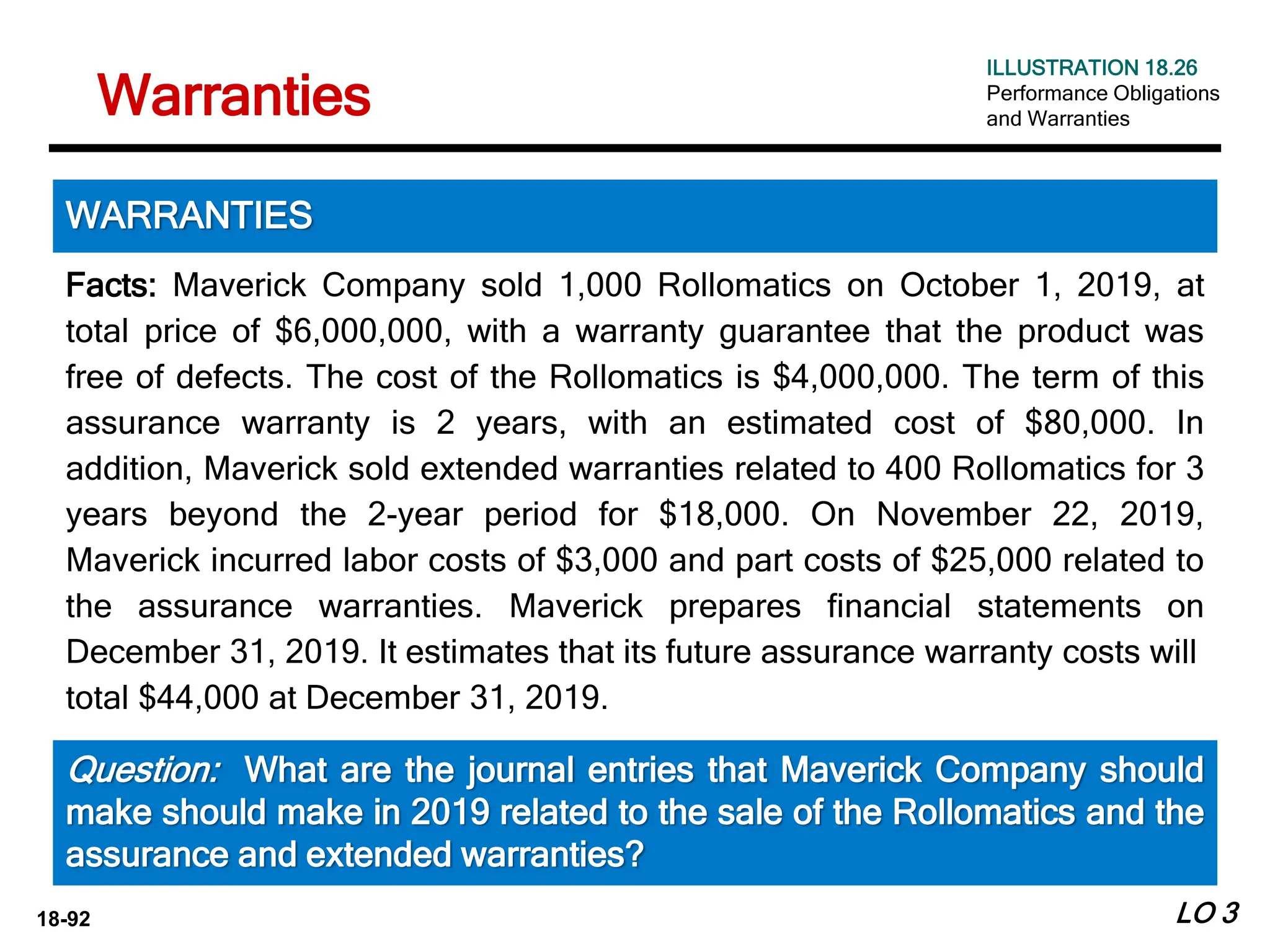

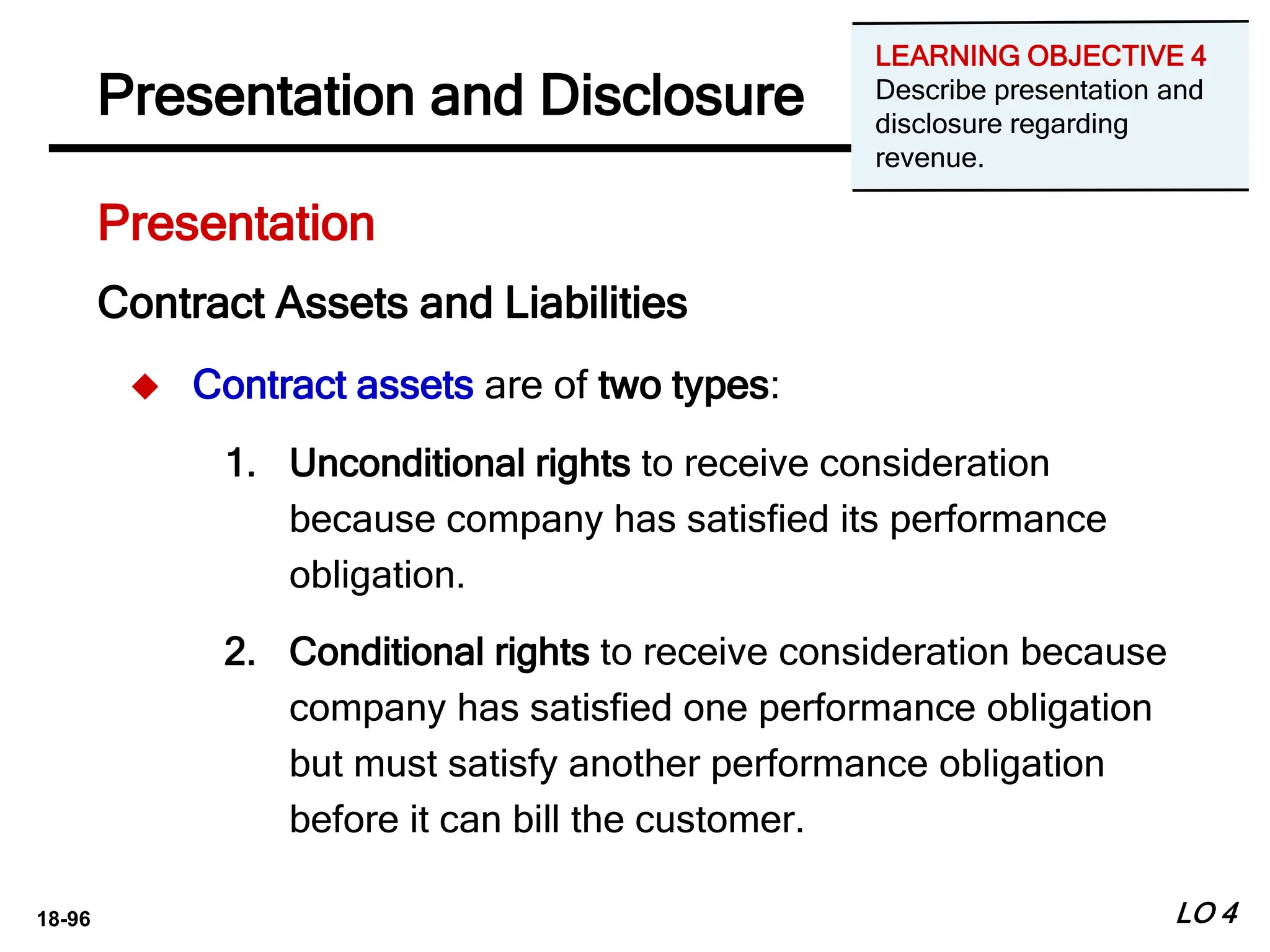

The total revenue of $2,000,000 should be allocated to the three

components based on their relative standalone selling prices. In this

case, the standalone selling price of the equipment is $2,000,000, the

installation fee is $20,000, and the training is $50,000. The total

standalone selling price therefore is $2,070,000 ($2,000,000 + $20,000 +

$50,000). The allocation is as follows.

Equipment $1,932,367 [($2,000,000 ÷ $2,070,000) × $2,000,000]

Installation $19,324 [($20,000 ÷ $2,070,000) × $2,000,000]

Training $48,309 [($50,000 ÷ $2,070,000) × $2,000,000]

LO 2

Allocating Transaction Price

Question: (b) If there is more than one performance obligation, how

should the payment of $2,000,000 be allocated to various

components?

ILLUSTRATION 18.12

Multiple Performance

Obligations—Product,

Installation, and Service

(continued)](https://image.slidesharecdn.com/ch18-240218193452-3f7db7c3/75/Revenue-Recognition-Intermediate-Accounting-55-2048.jpg)

![18-103

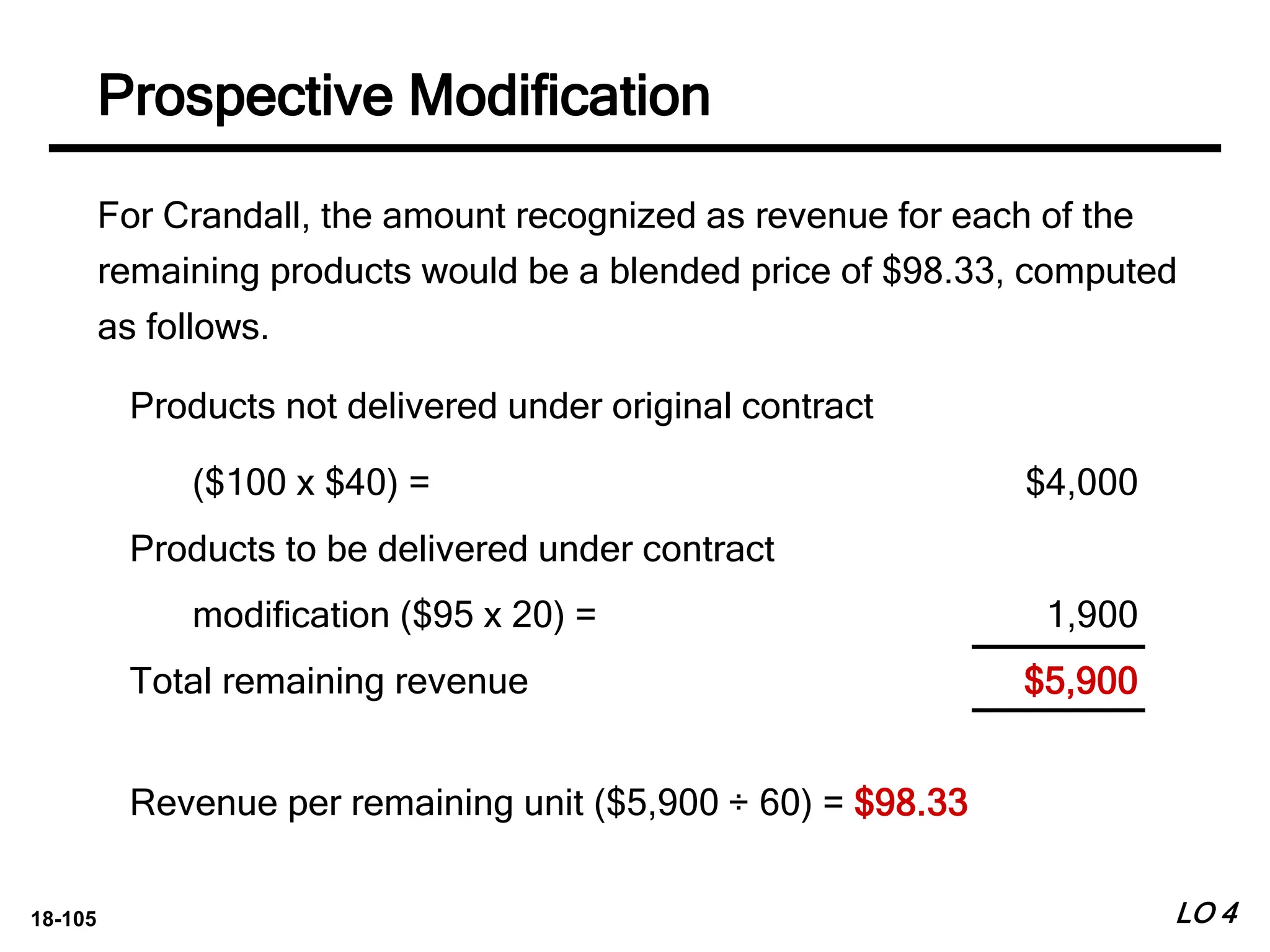

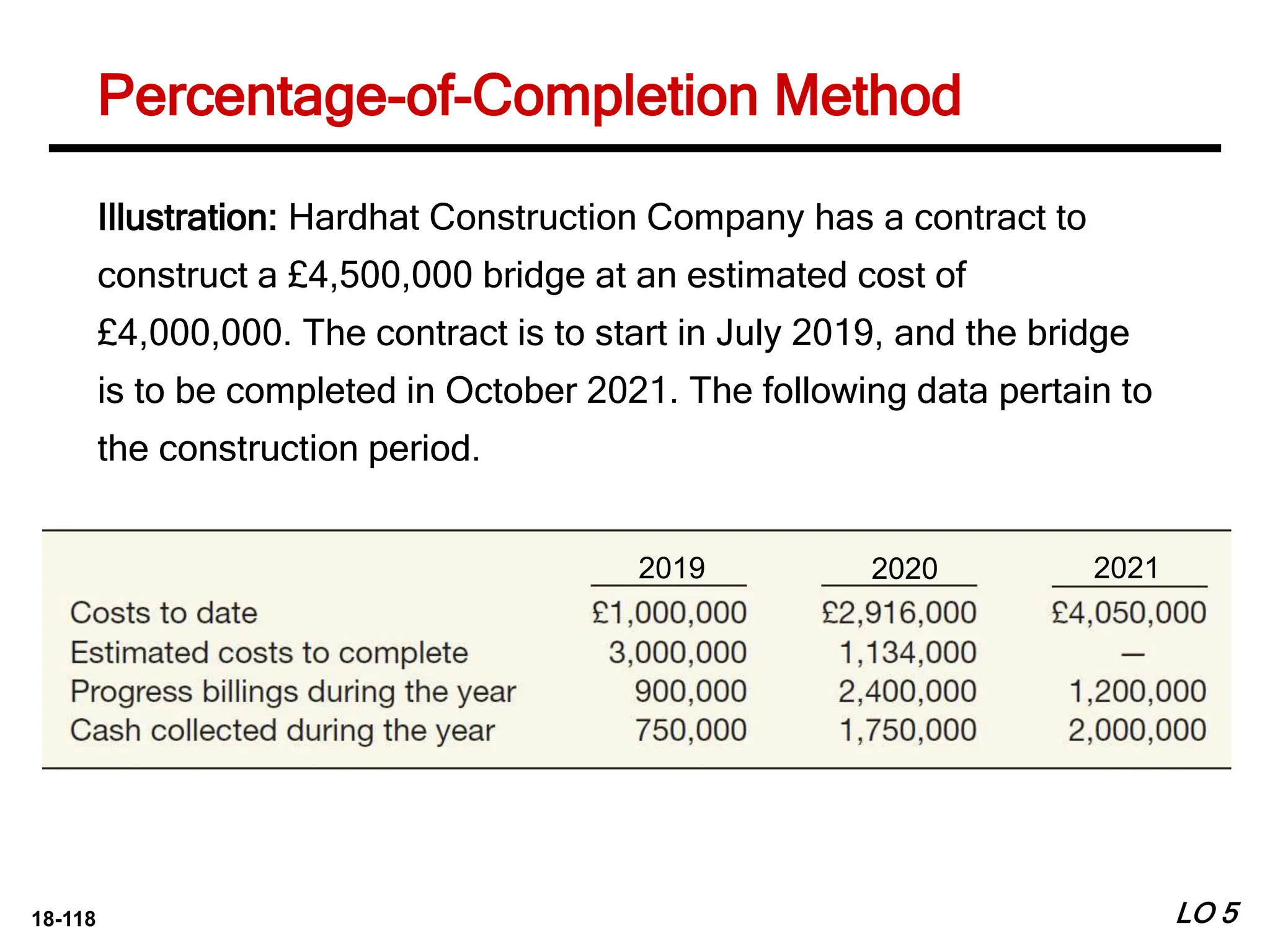

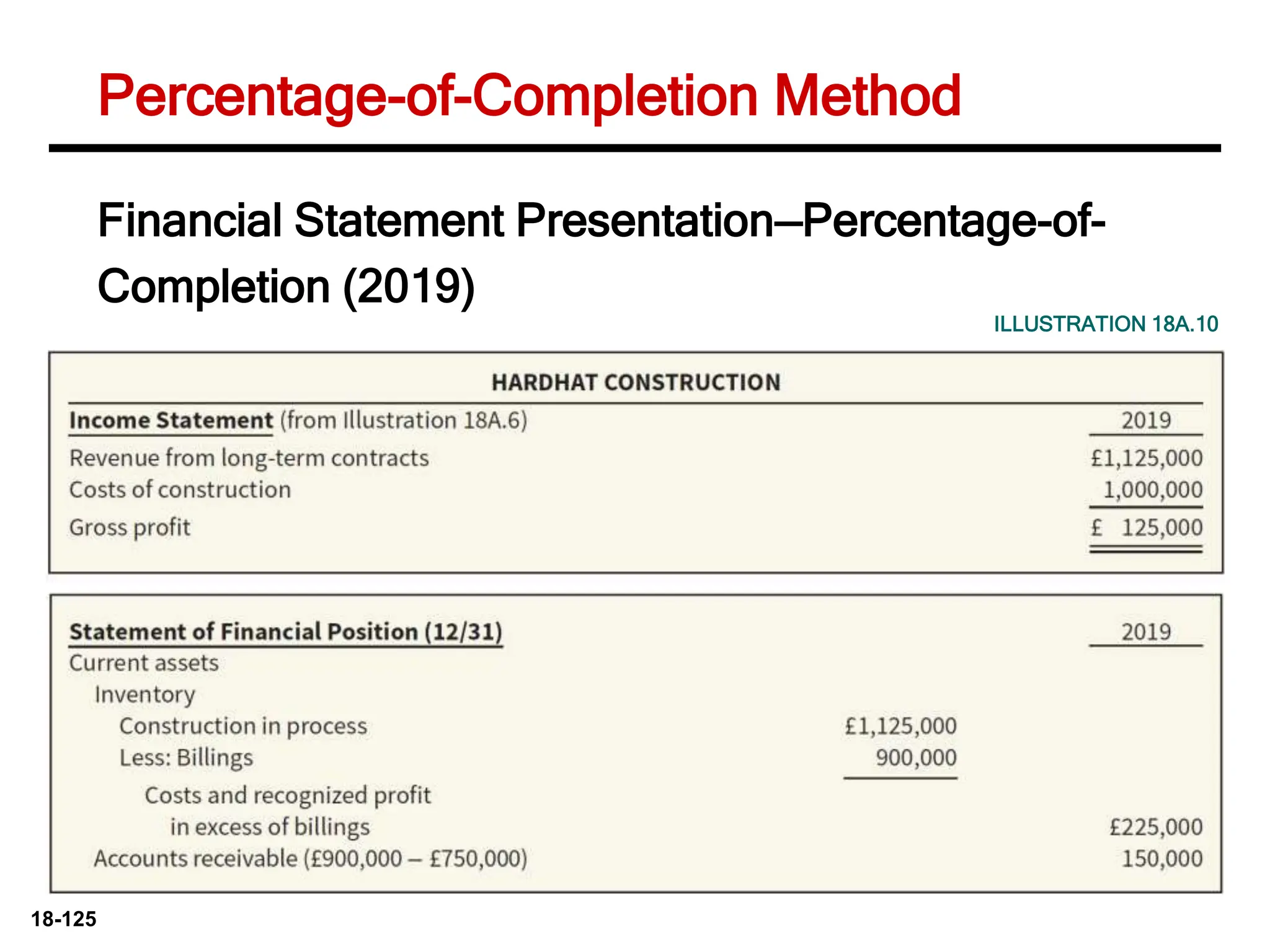

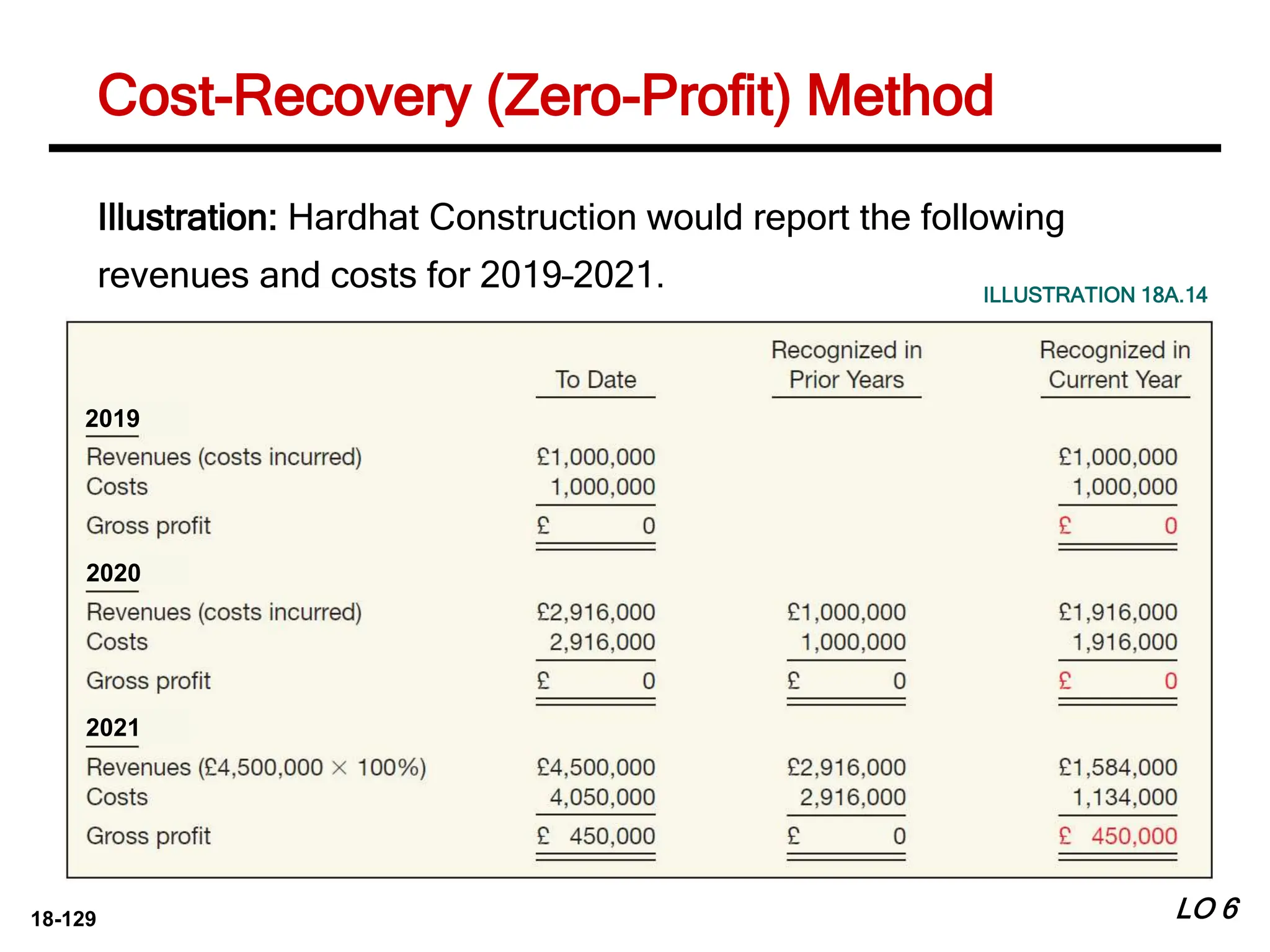

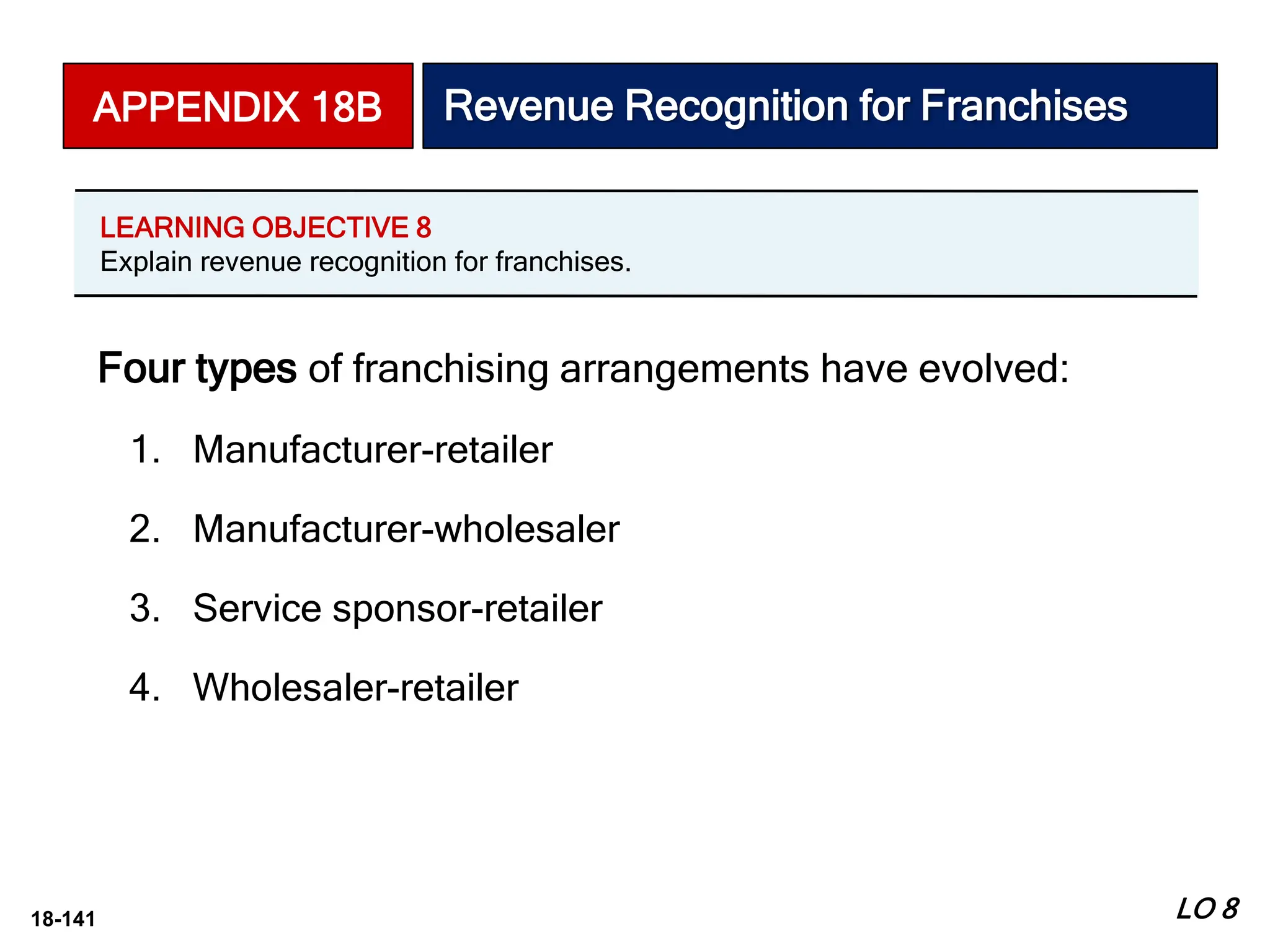

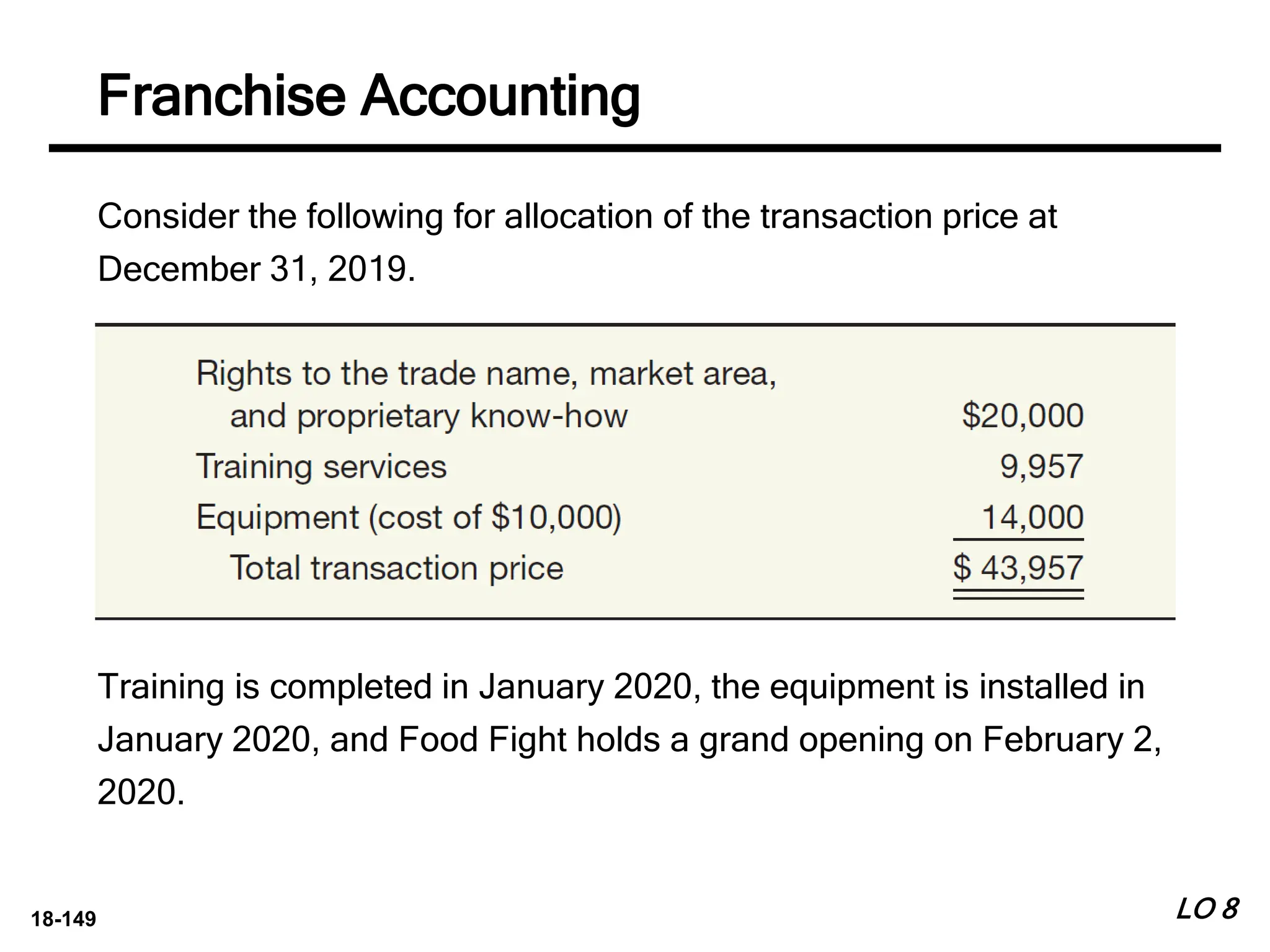

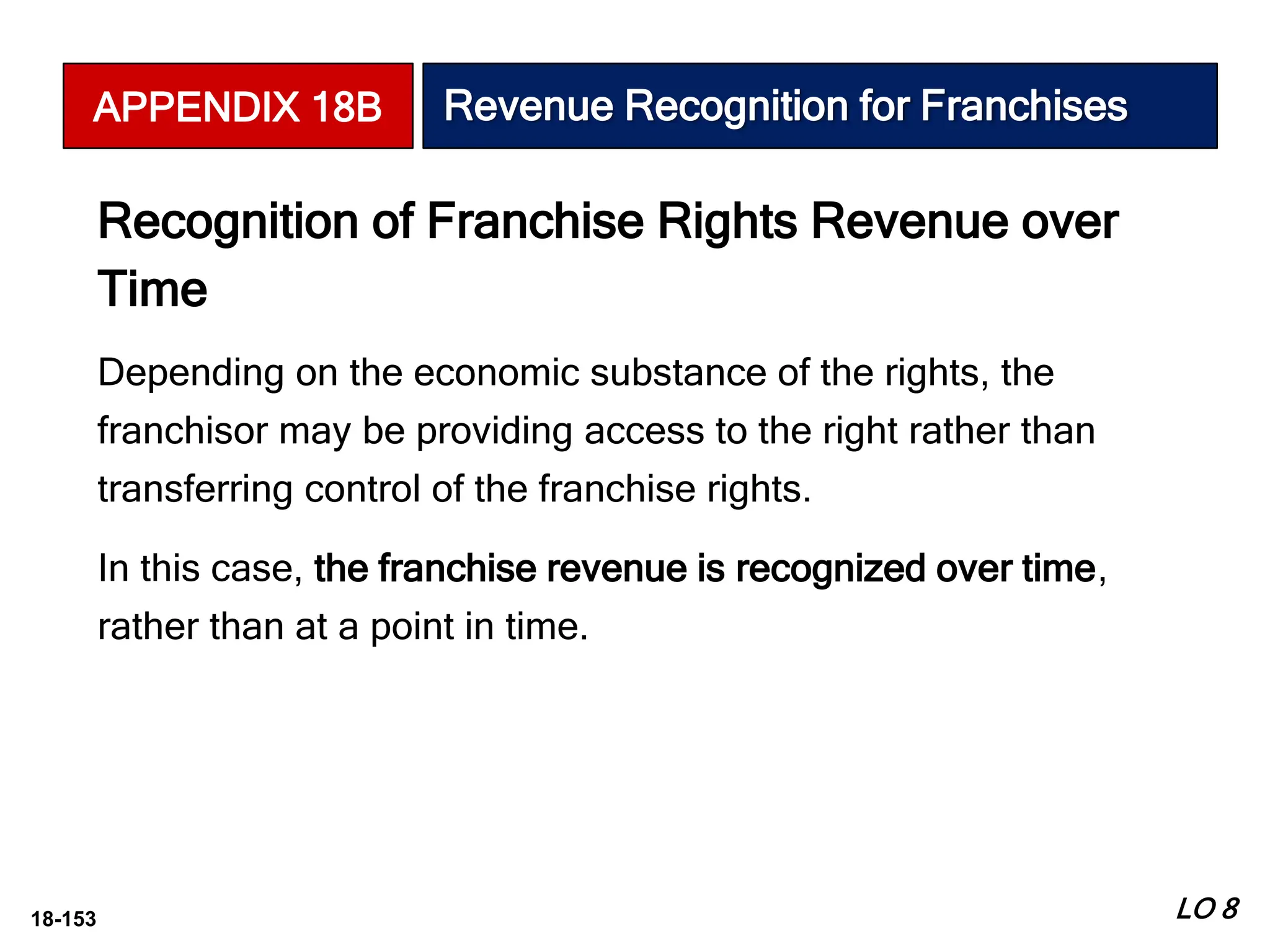

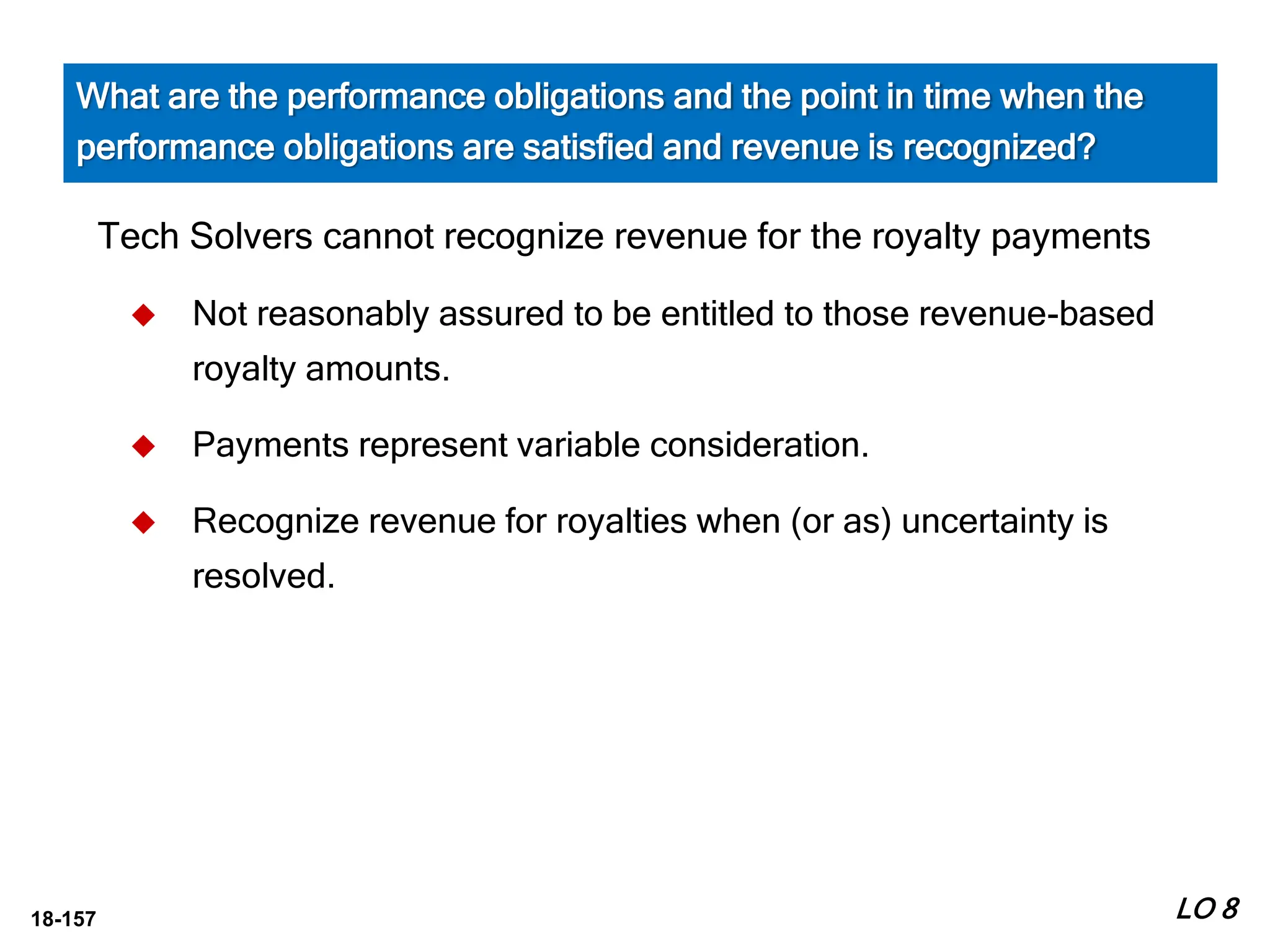

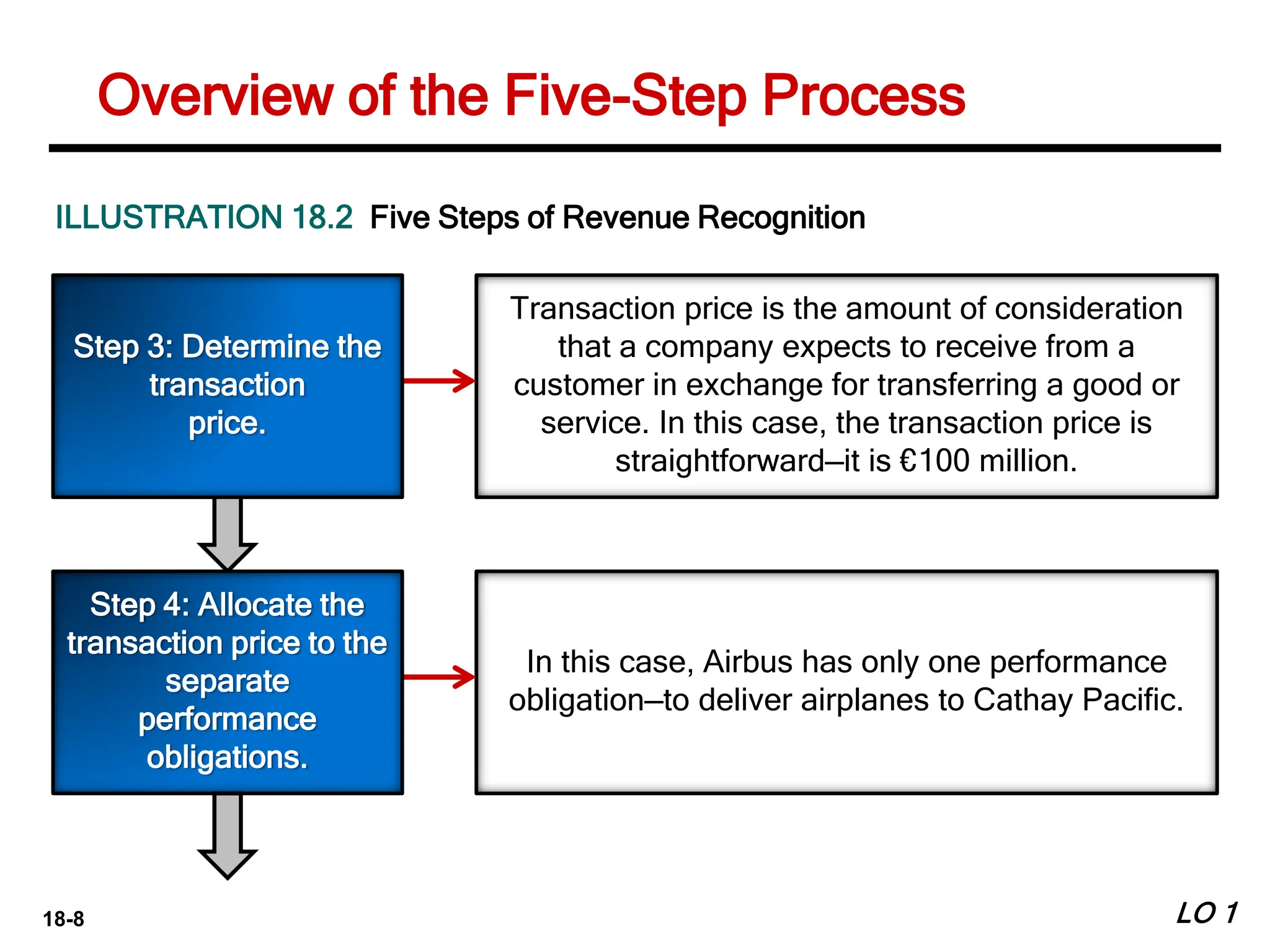

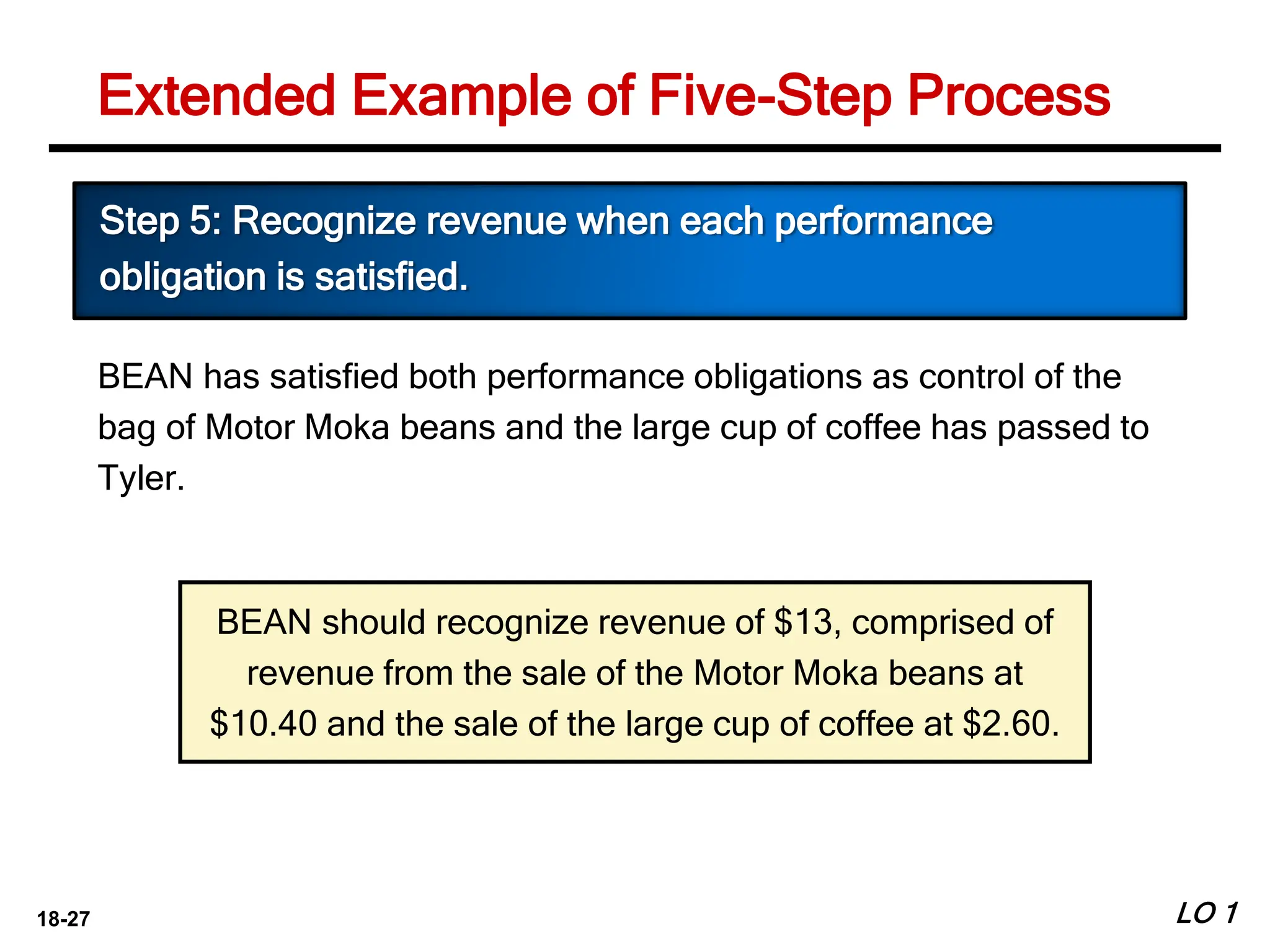

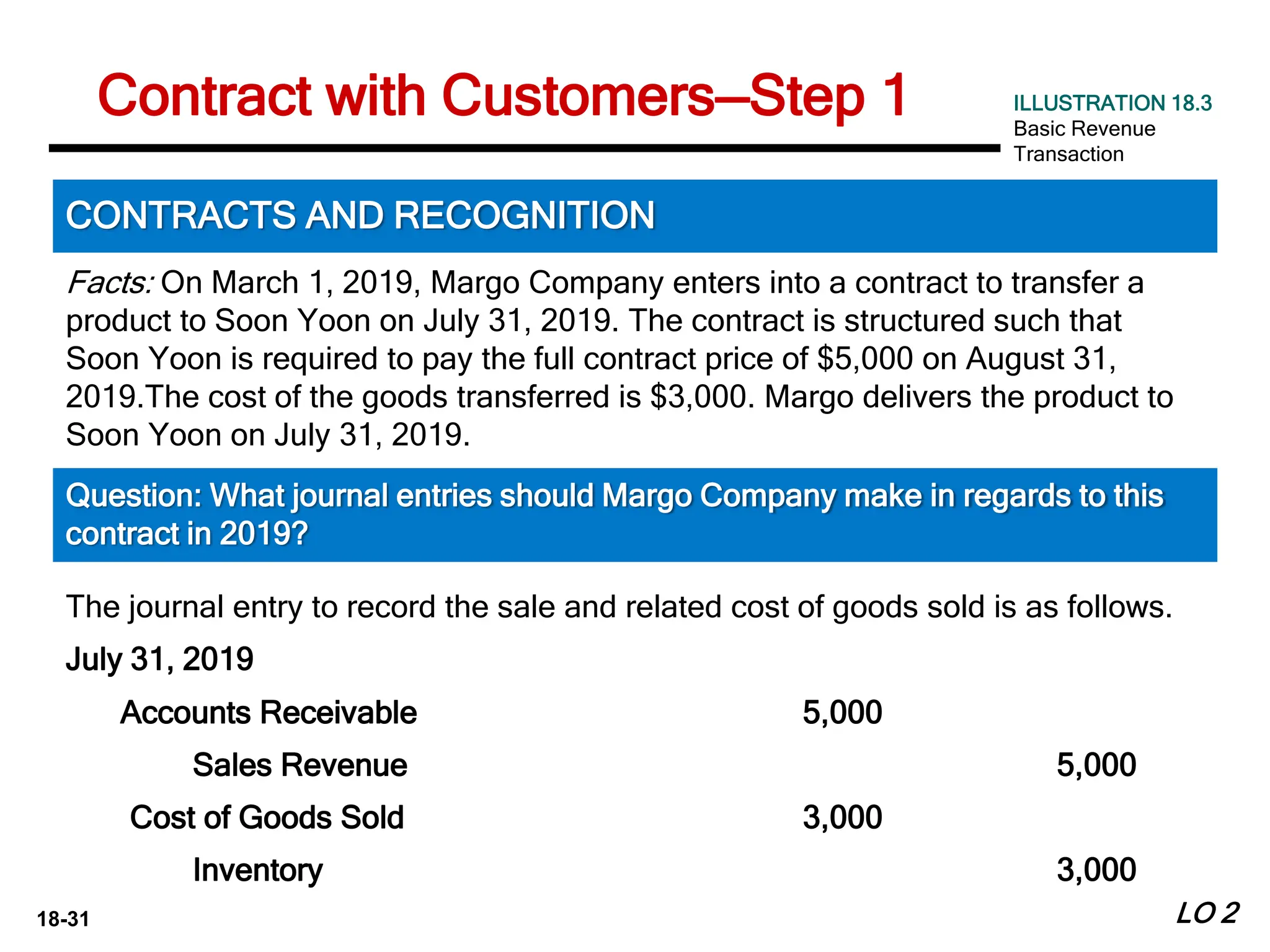

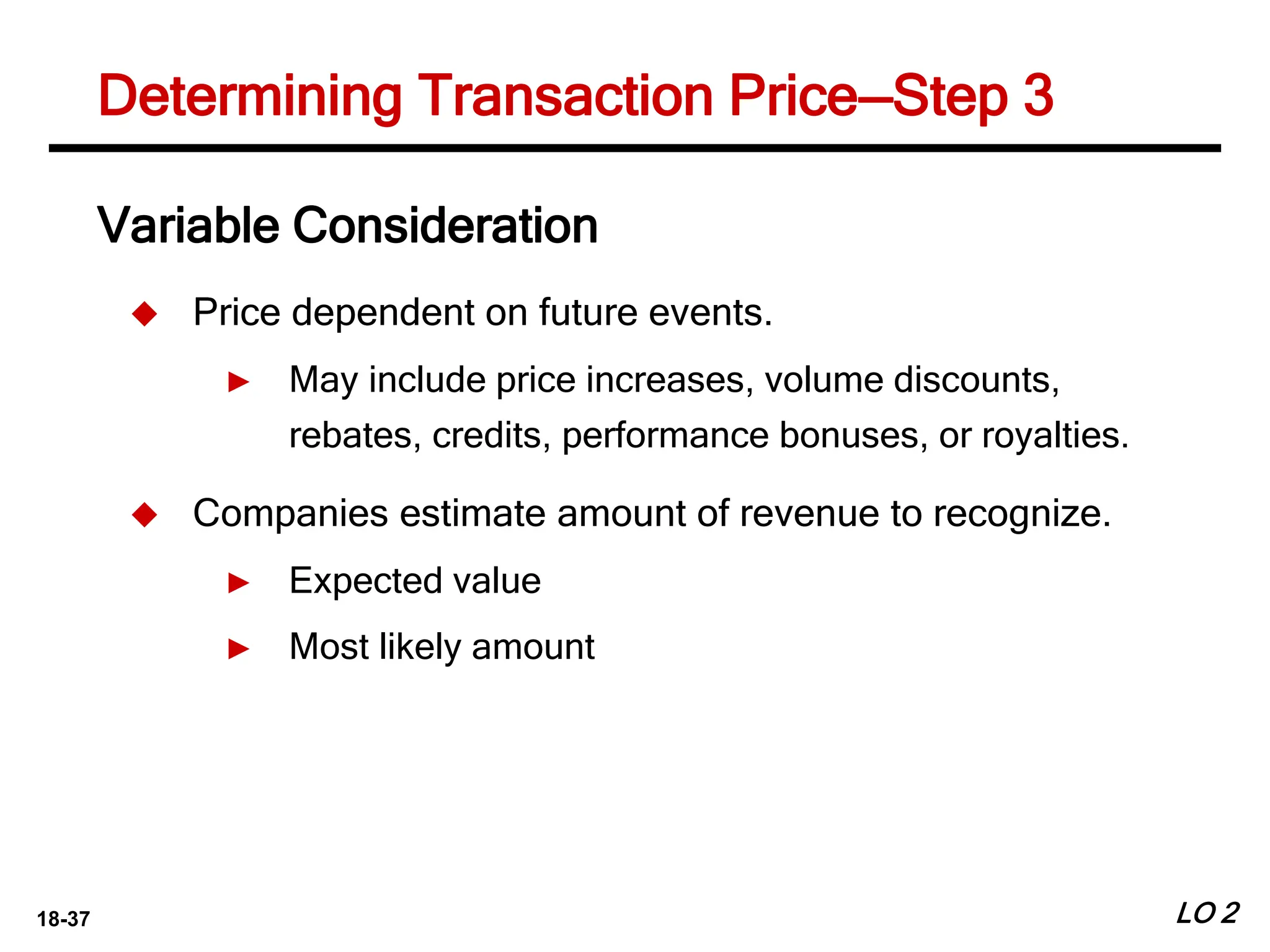

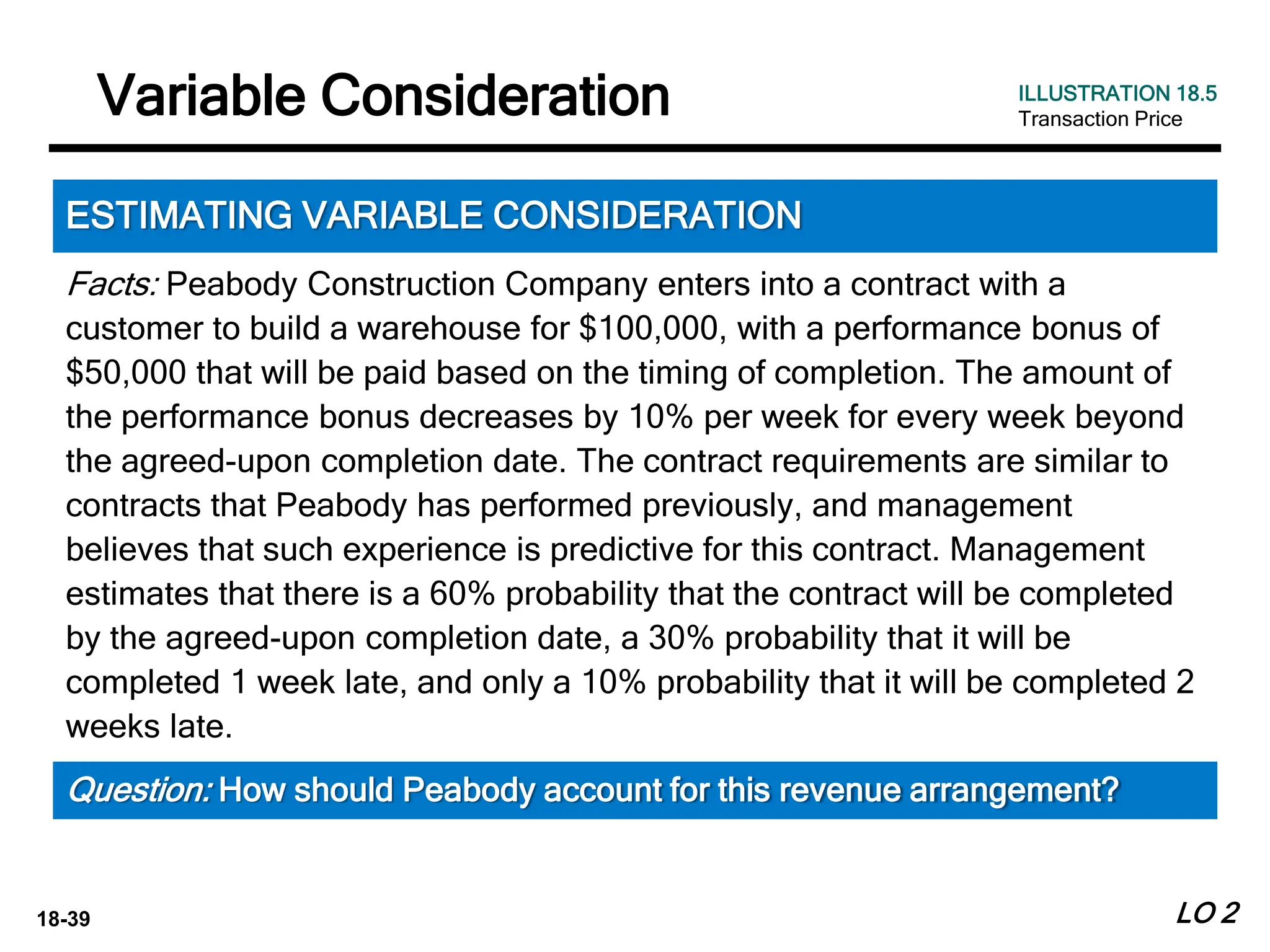

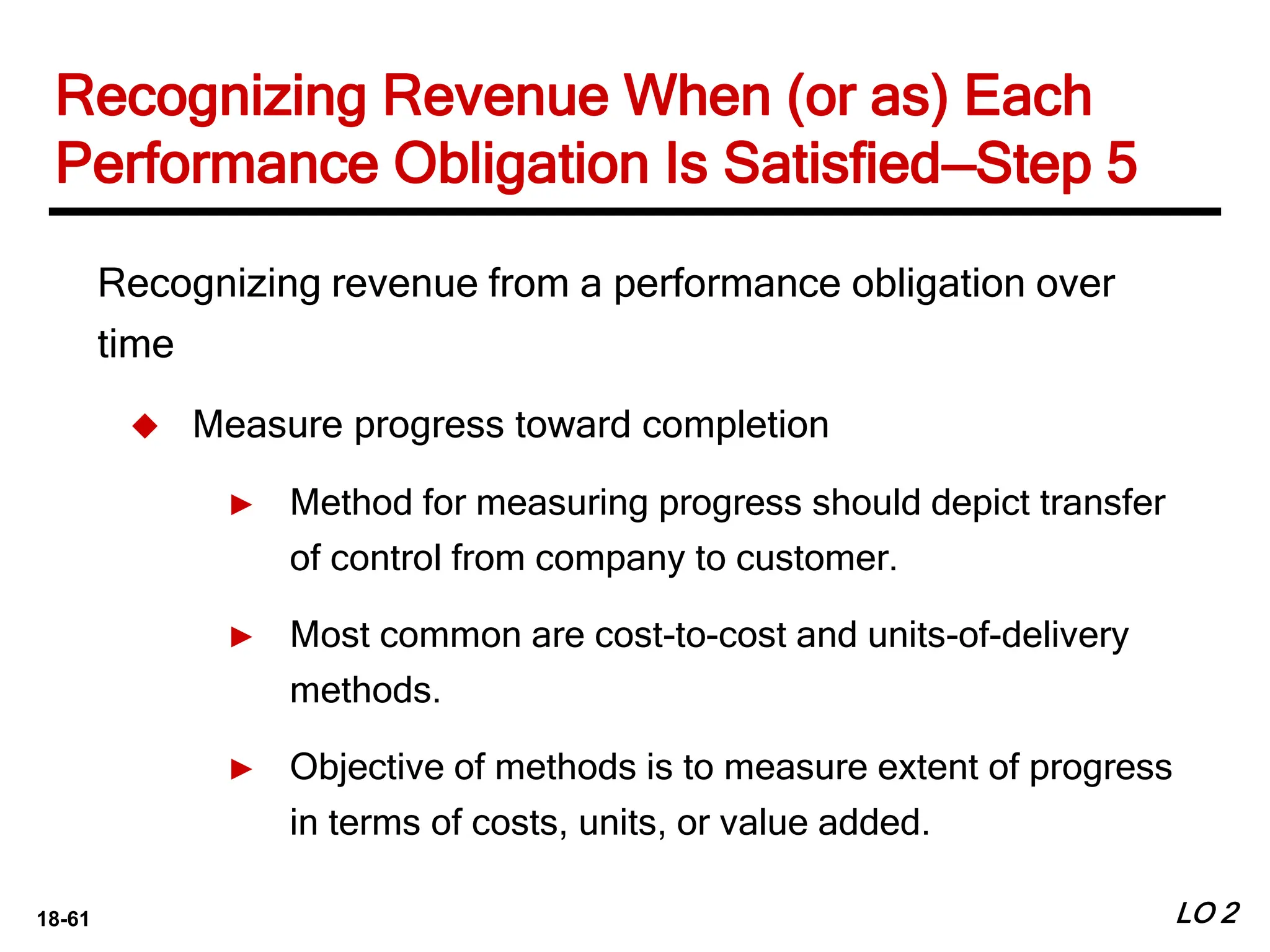

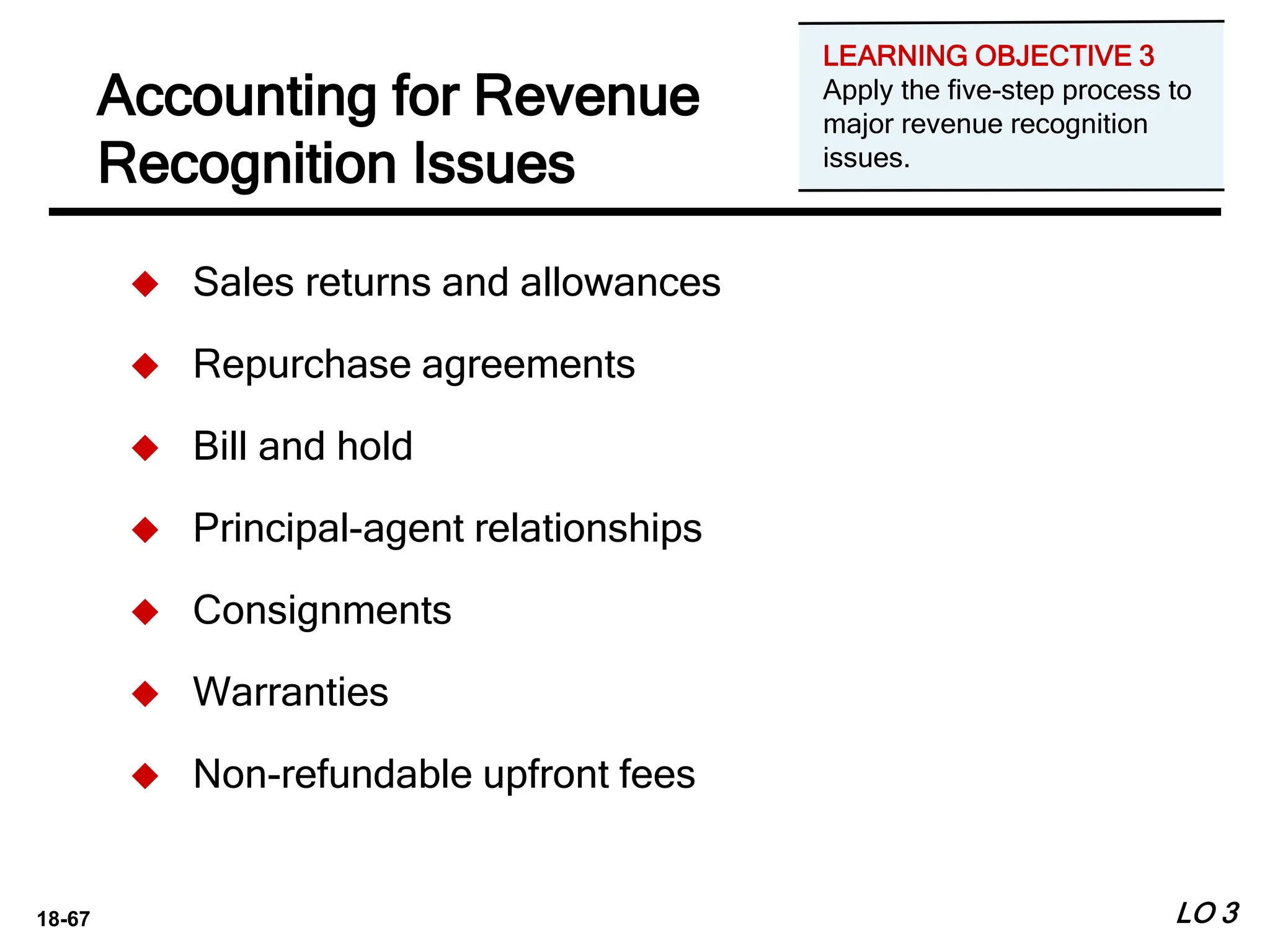

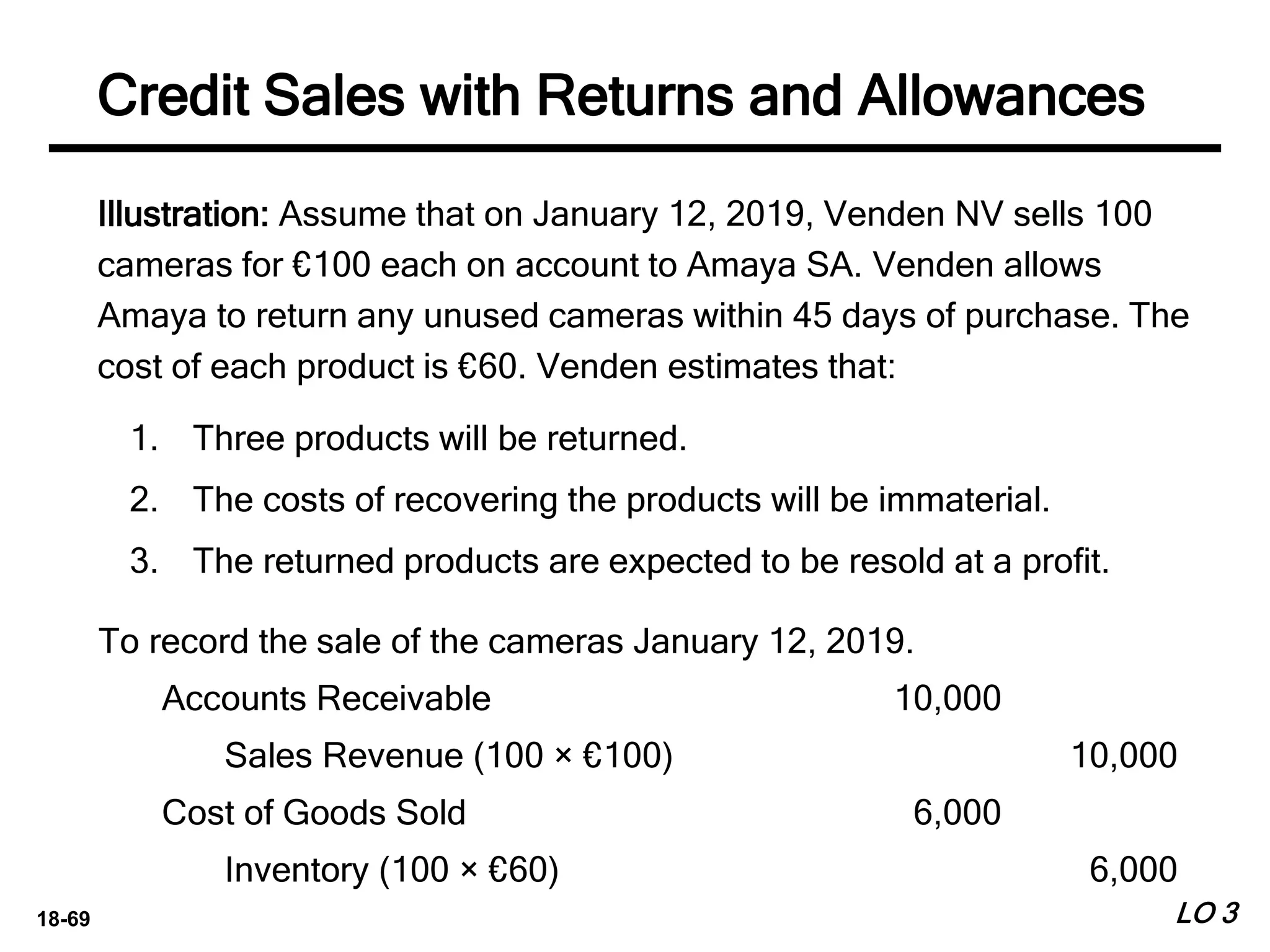

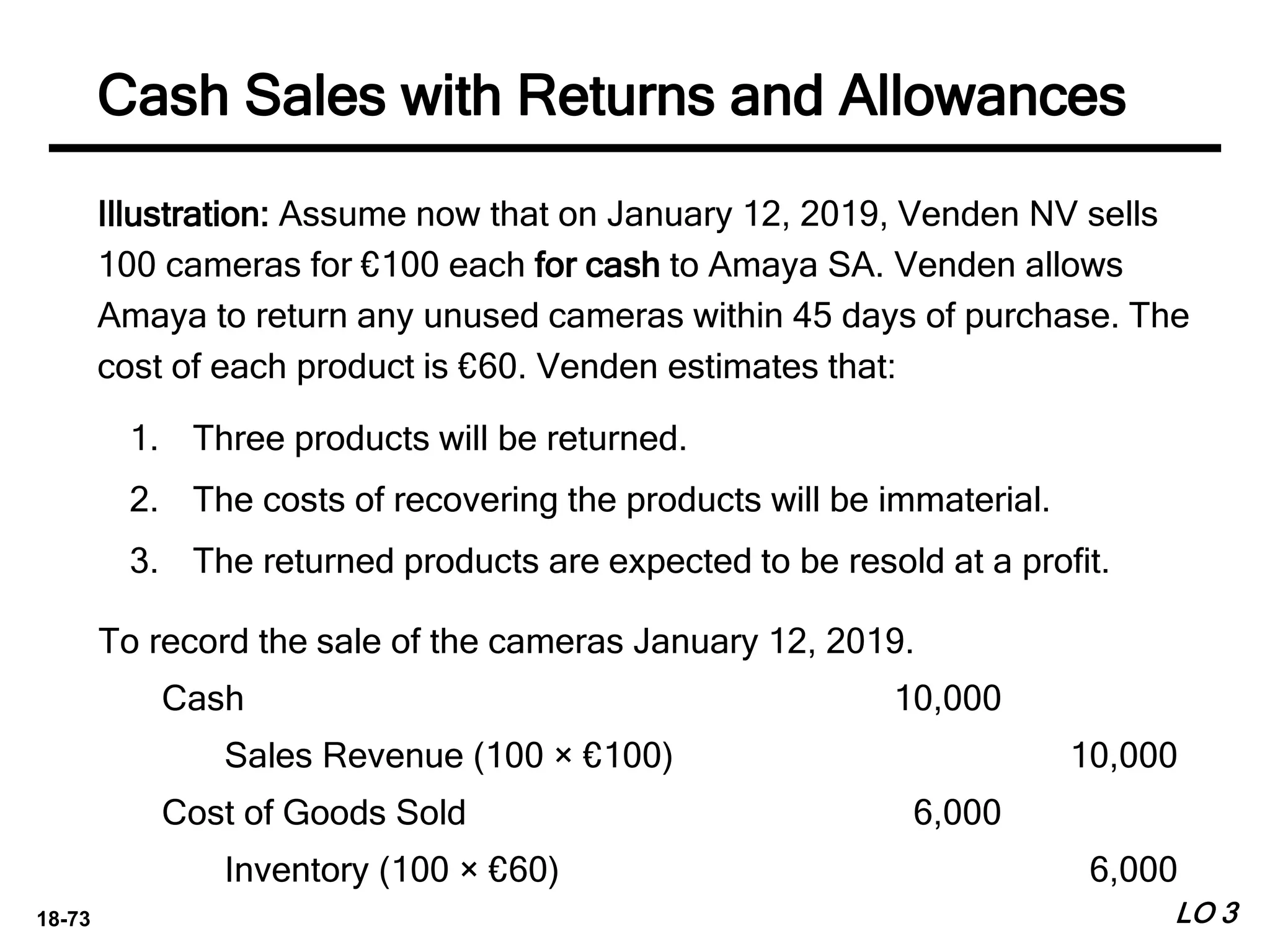

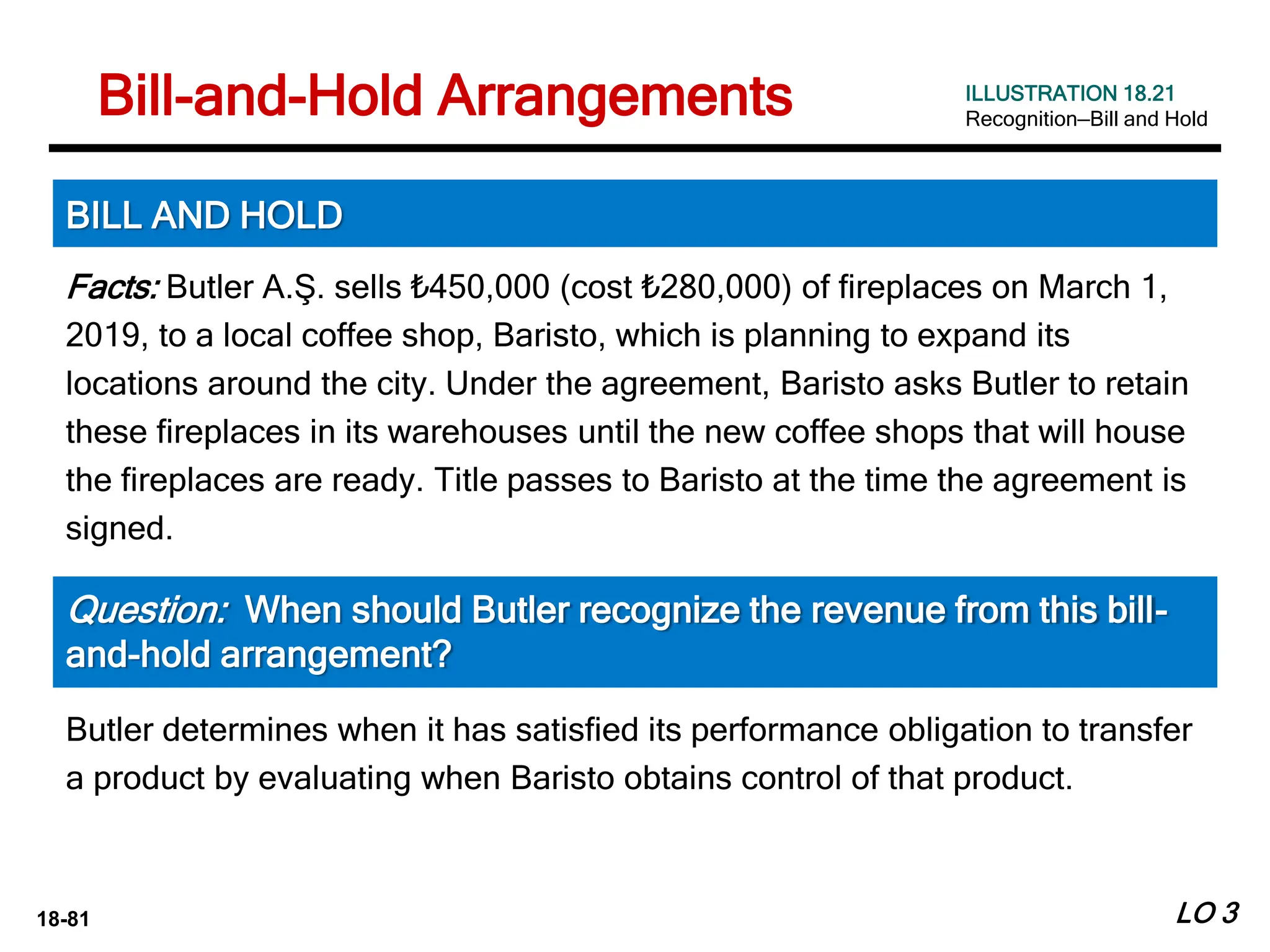

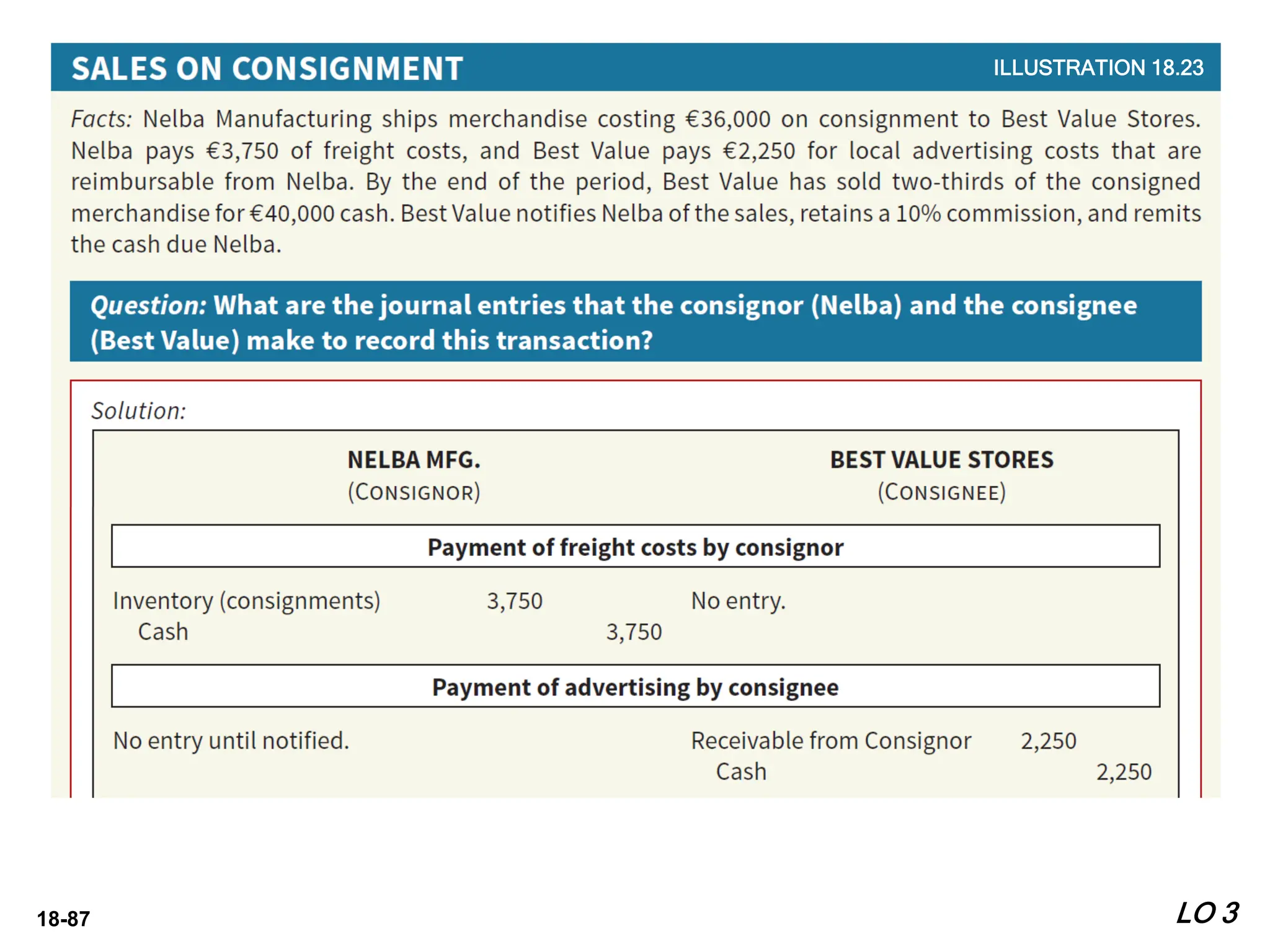

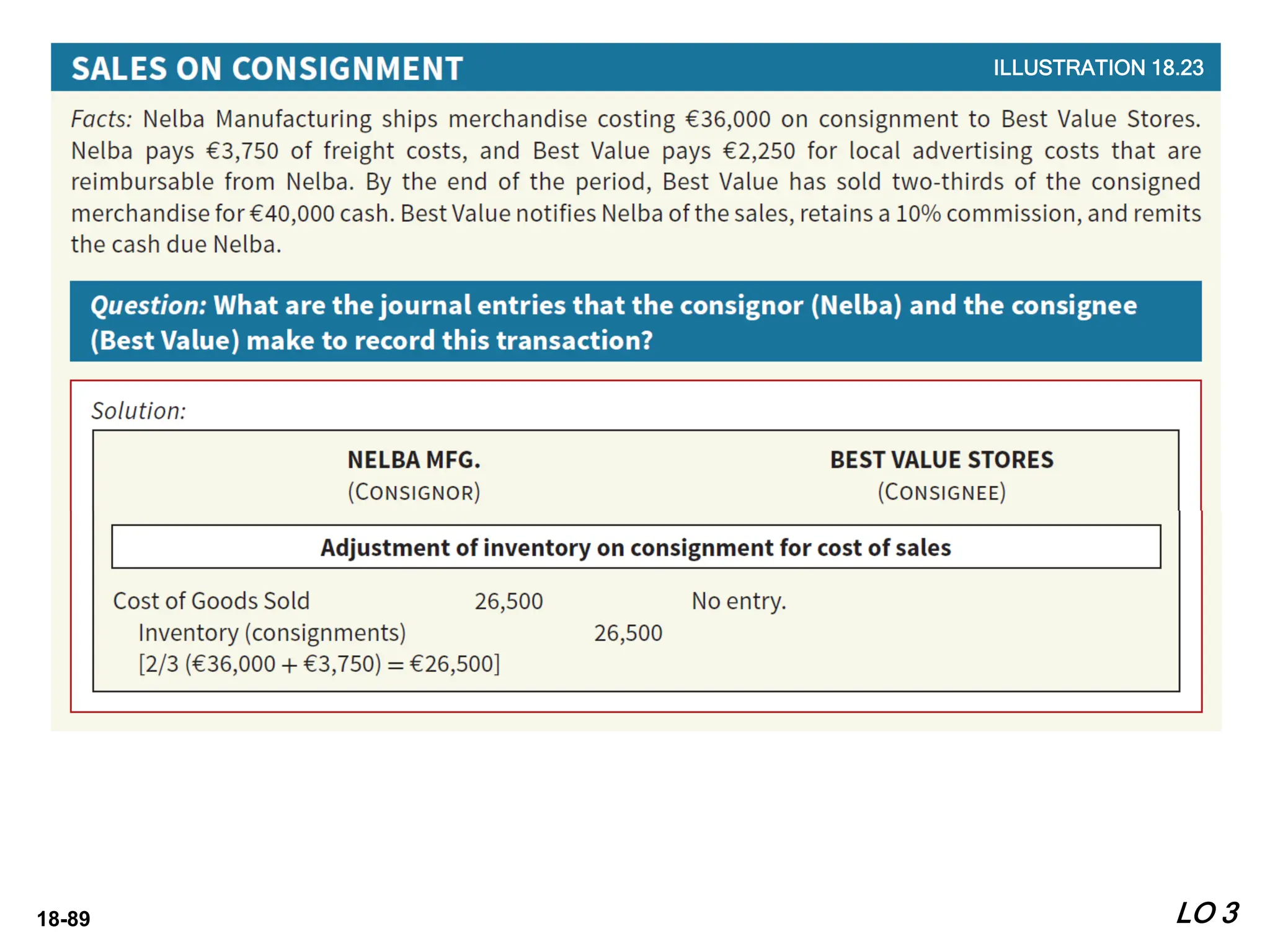

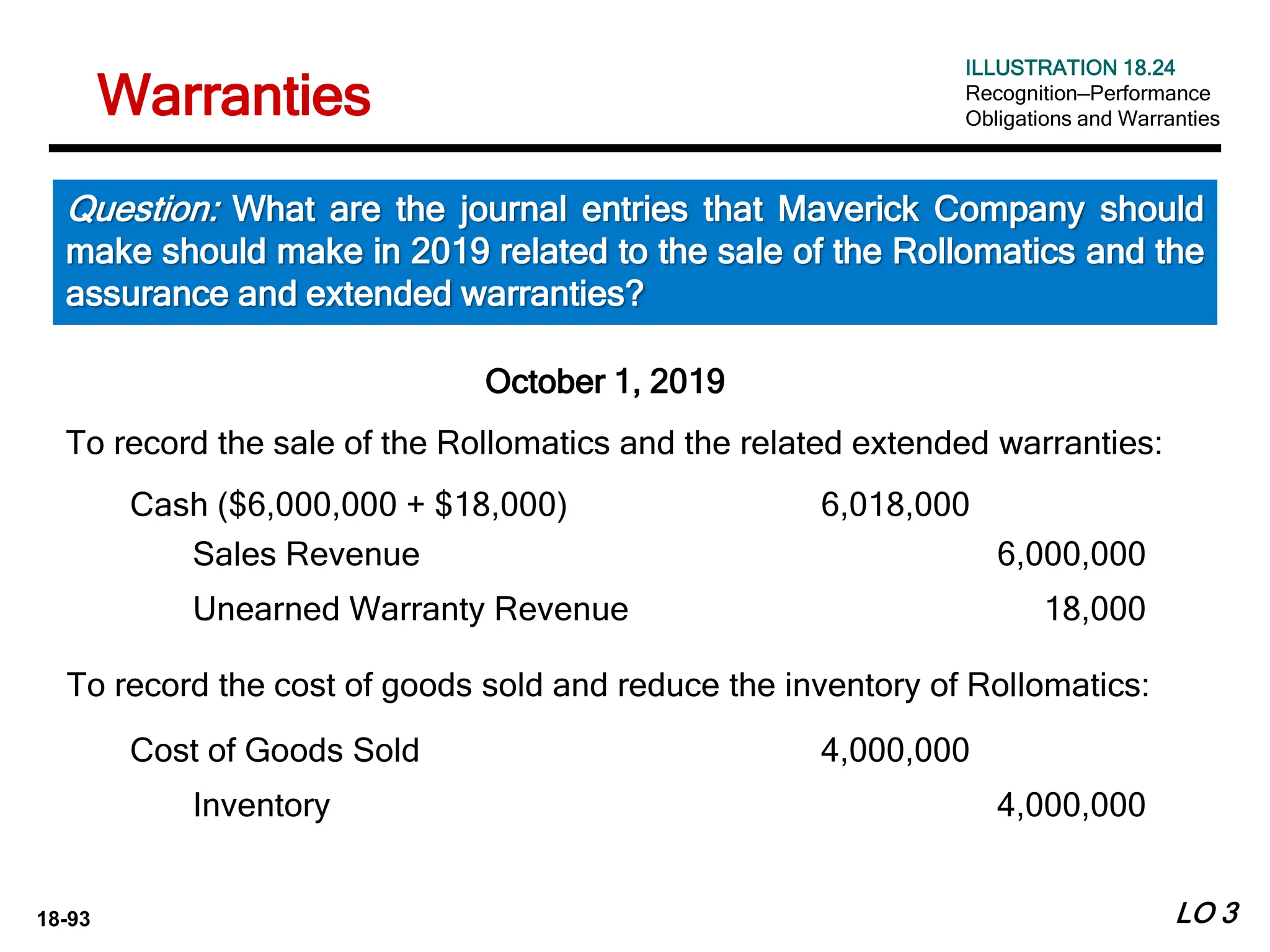

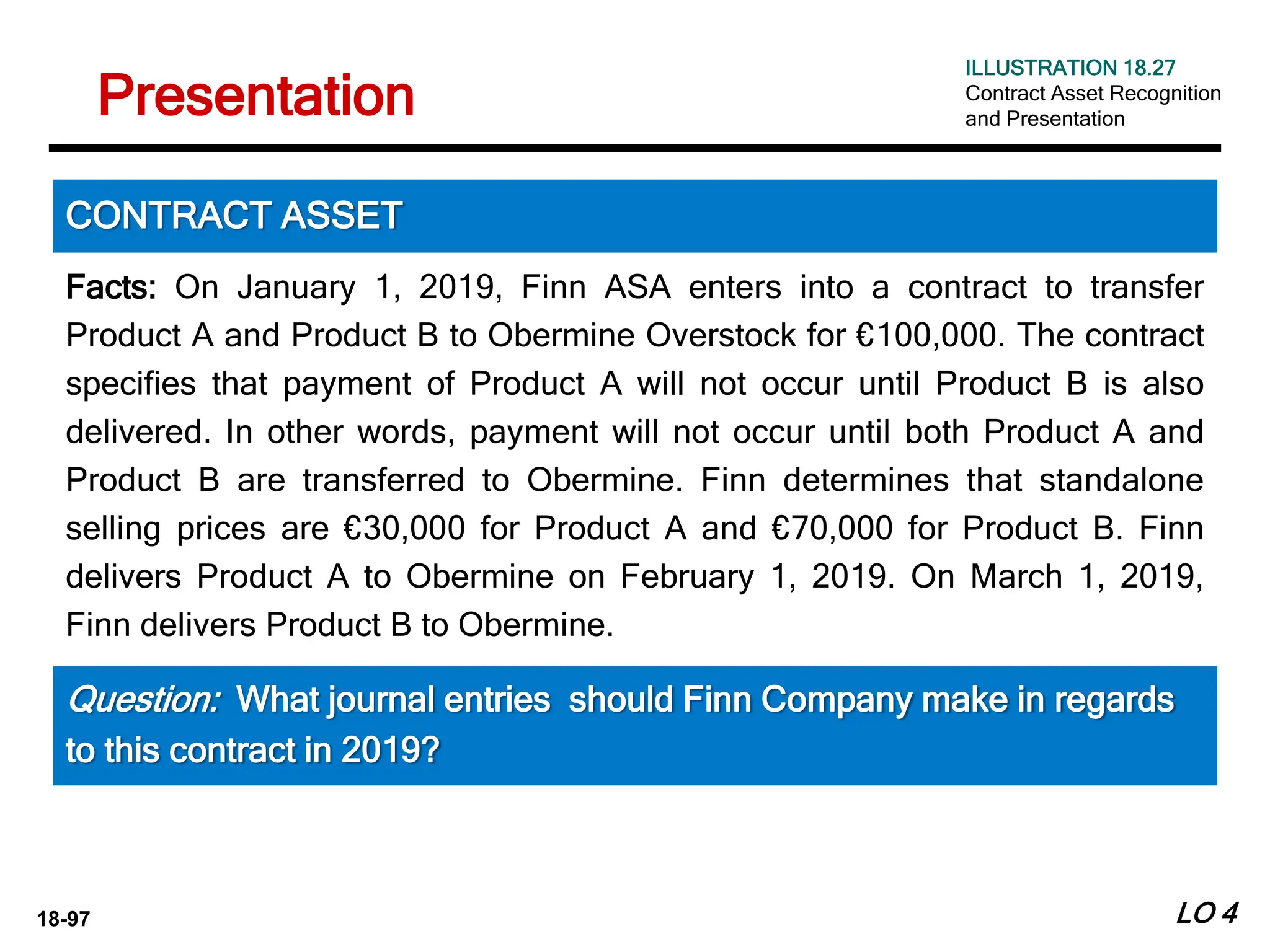

For example, Crandall Co. has a contract to sell 100 products to a

customer for $10,000 ($100 per product) at various points in time

over a six-month period. After 60 products have been delivered,

Crandall modifies the contract by promising to deliver 20 more

products for an additional $1,900, or $95 per product (which is the

standalone selling price of the products at the time of the contract

modification). Crandall regularly sells the products separately.

Given a new contract, Crandall recognizes an additional:

LO 4

Separate Performance Obligation

Original contract [(100 units - 60 units) x $100] = $4,000

New product (20 units x $95) = 1,900

Total revenue $5,900](https://image.slidesharecdn.com/ch18-240218193452-3f7db7c3/75/Revenue-Recognition-Intermediate-Accounting-103-2048.jpg)