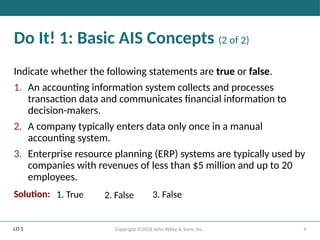

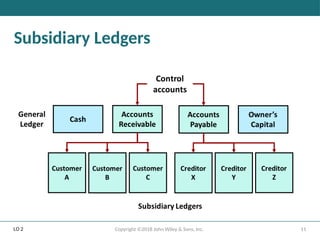

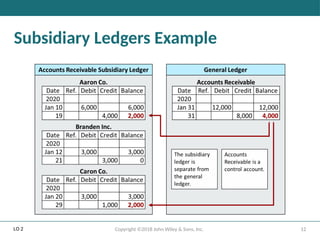

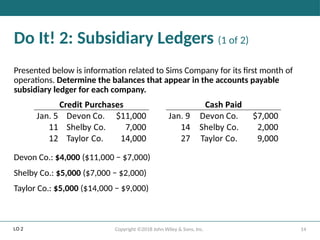

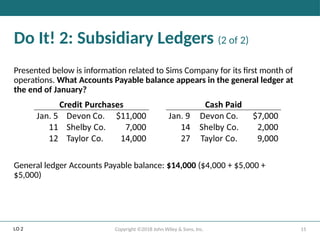

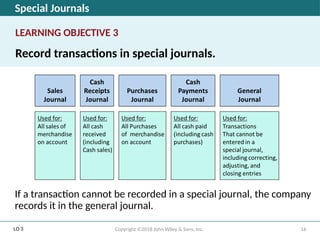

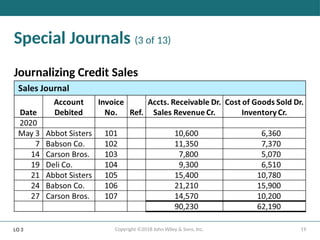

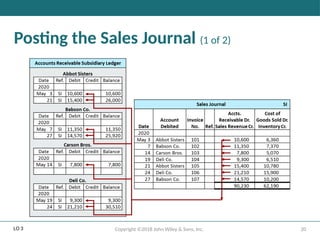

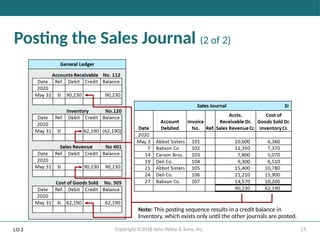

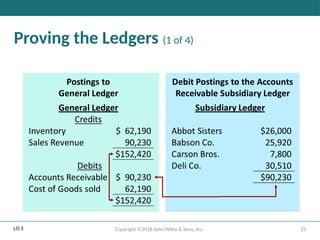

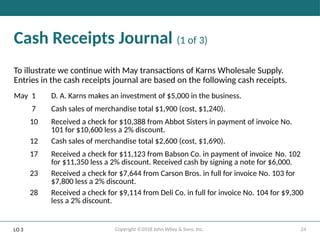

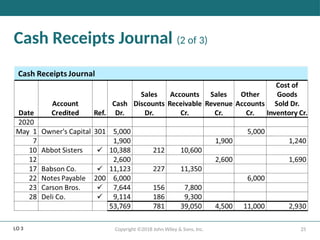

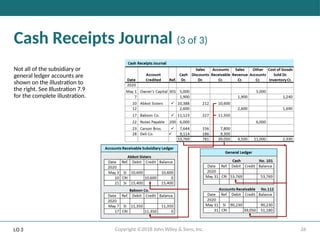

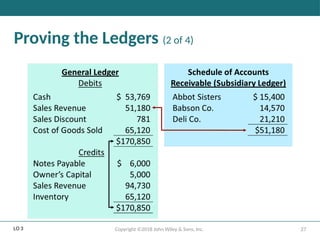

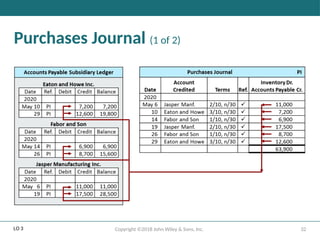

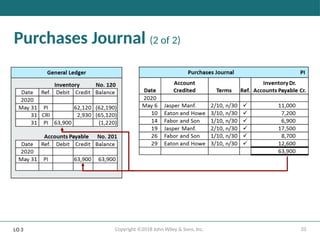

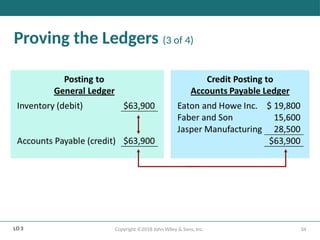

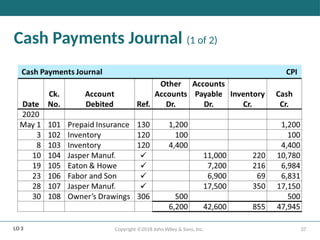

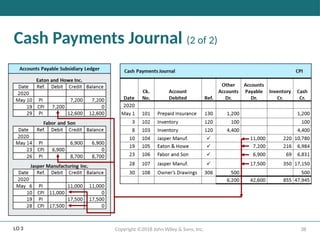

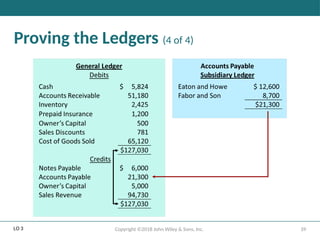

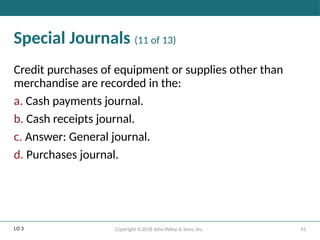

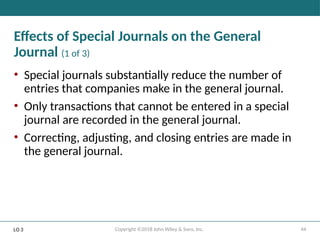

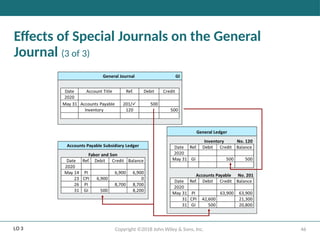

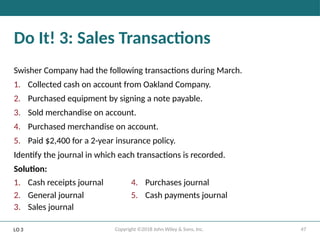

Chapter 7 of 'Accounting Principles' outlines key concepts of accounting information systems, including their nature, purpose, and the difference between manual and computerized systems. It discusses subsidiary ledgers, their advantages, and how transactions are recorded in special journals. The chapter also compares standards under GAAP and IFRS, highlighting similarities and differences.