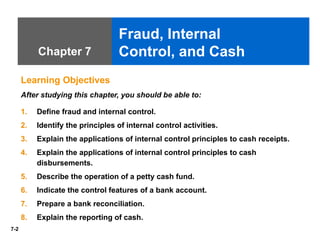

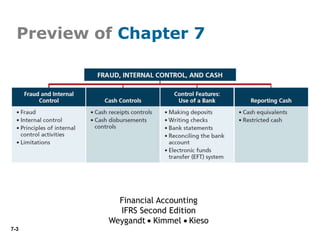

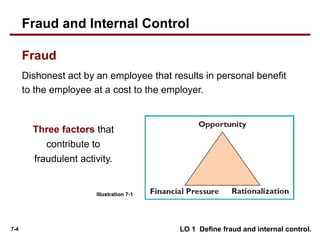

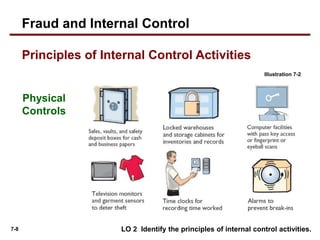

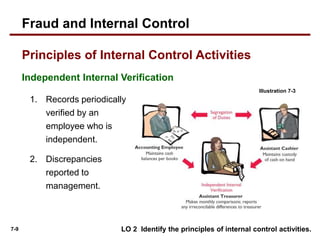

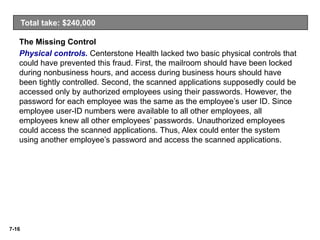

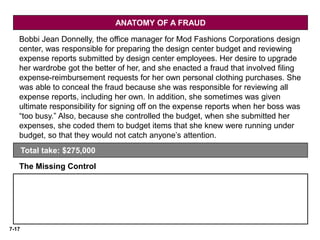

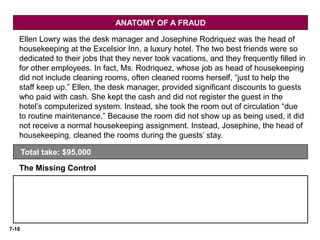

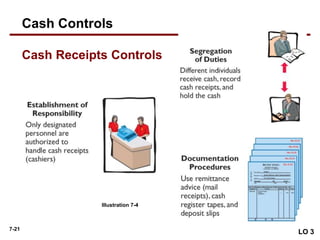

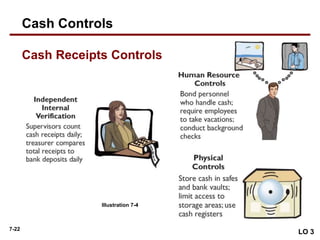

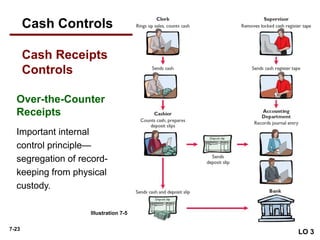

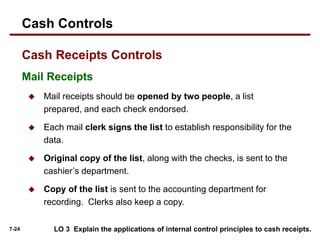

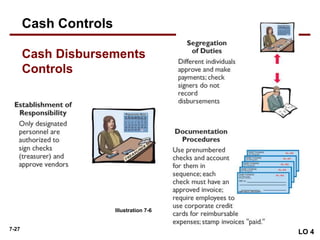

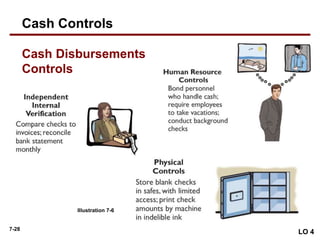

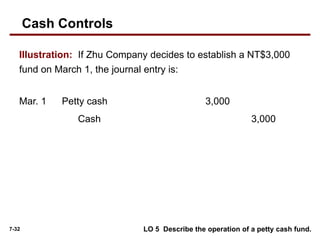

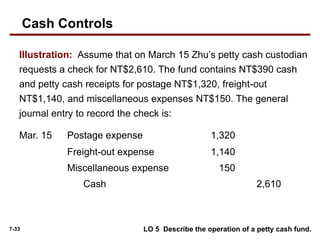

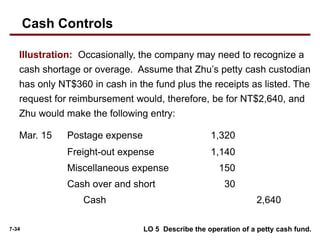

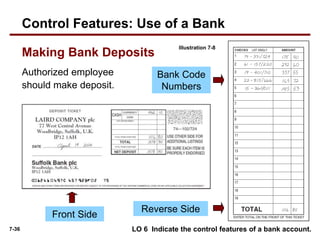

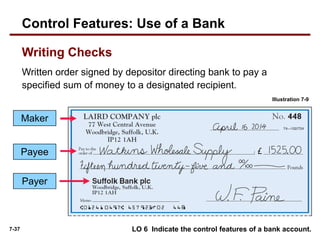

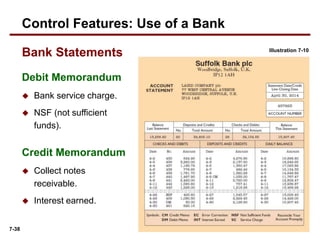

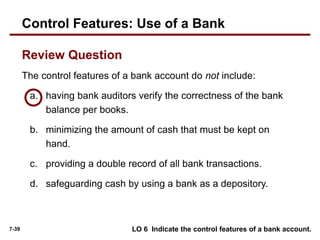

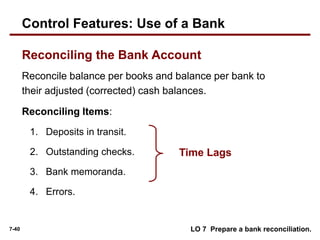

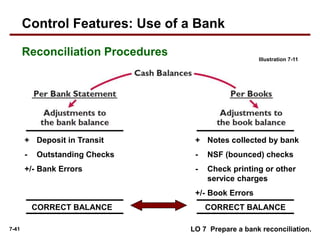

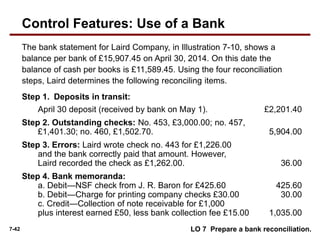

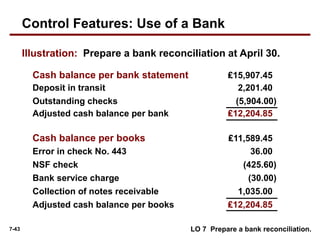

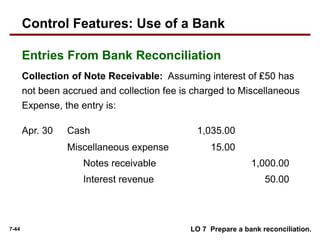

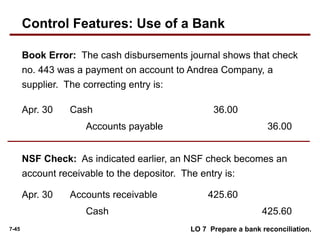

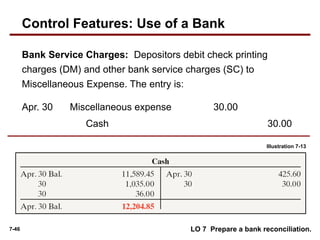

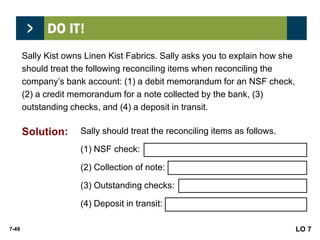

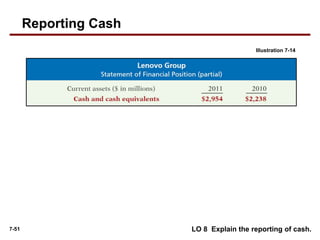

The document is a chapter from an accounting textbook that discusses fraud, internal control, and cash. It defines fraud and internal control, identifies principles of internal control activities like segregation of duties and documentation procedures, and explains how these principles can be applied to controls over cash receipts and cash disbursements. The chapter also describes operating a petty cash fund and the control features of using a bank account.