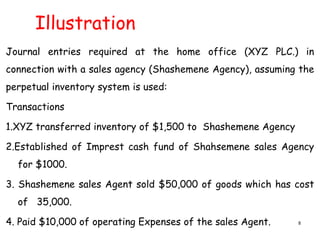

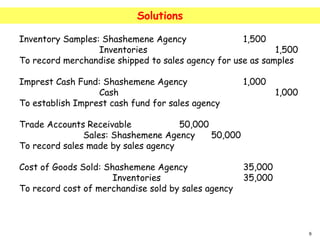

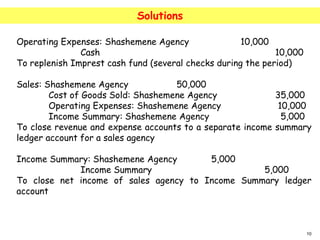

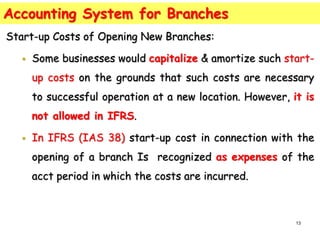

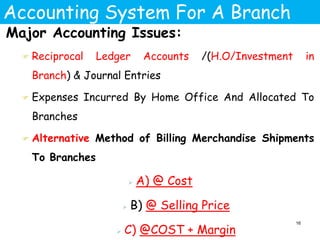

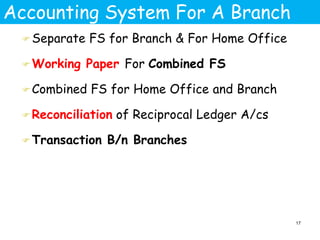

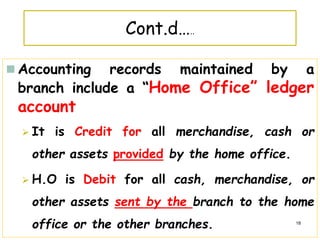

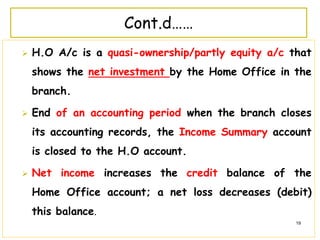

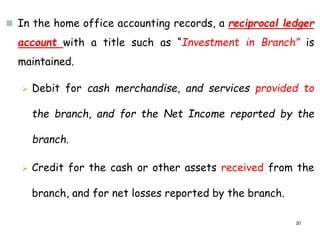

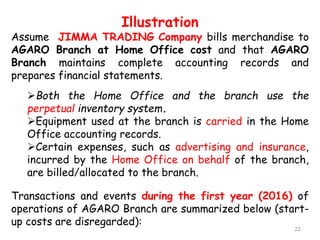

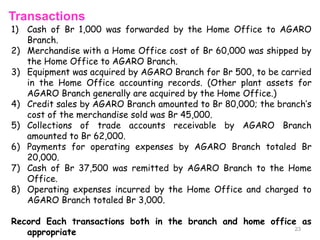

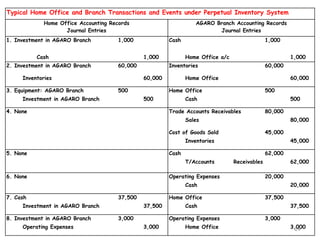

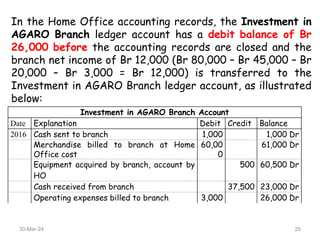

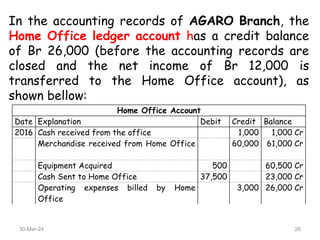

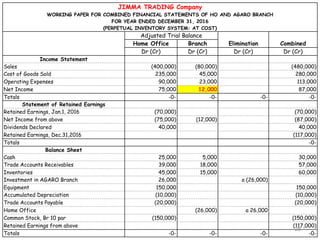

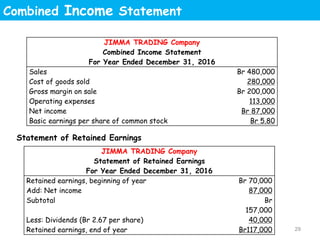

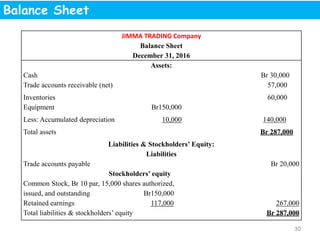

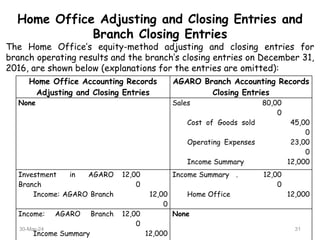

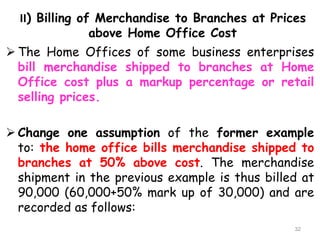

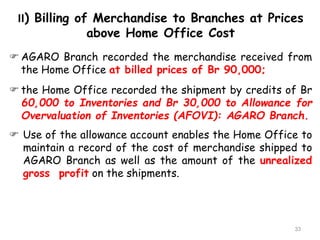

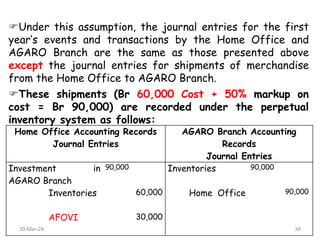

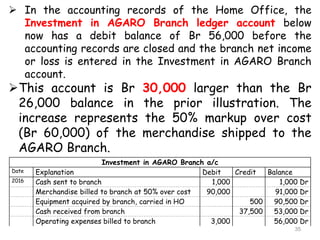

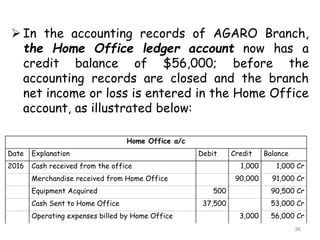

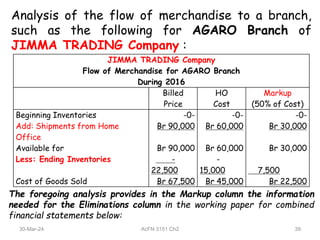

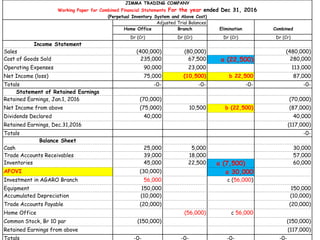

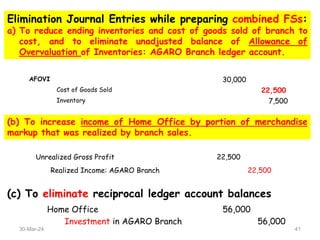

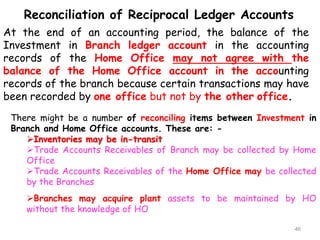

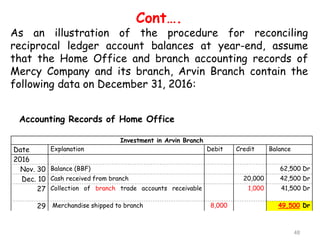

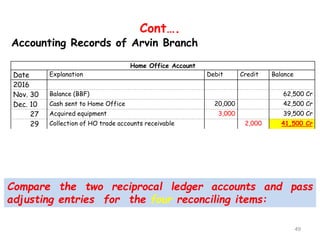

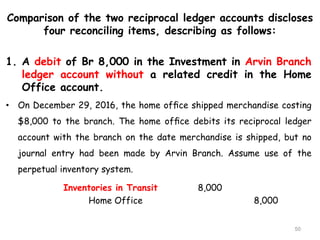

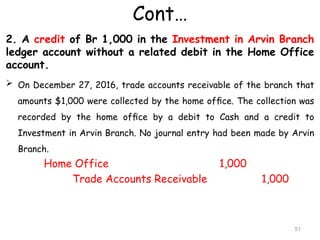

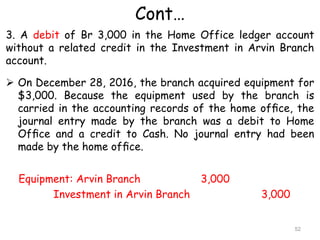

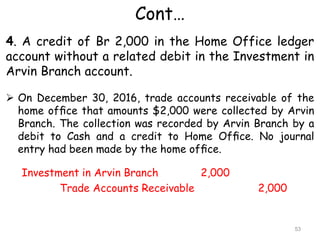

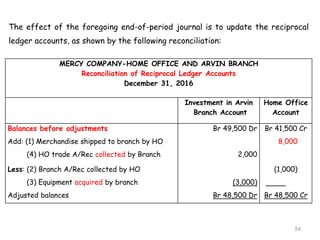

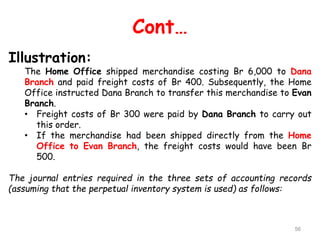

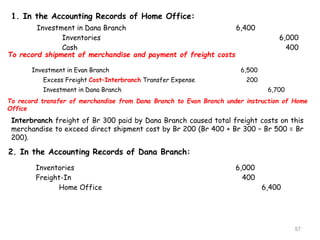

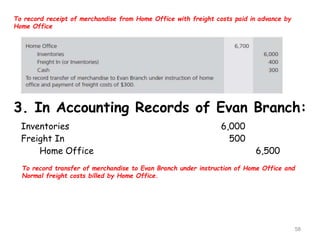

The document summarizes accounting procedures for sales agencies, branches, and the head office. It discusses key features of sales agencies, which perform a small portion of functions compared to branches and have lesser autonomy. Branches carry inventory, make sales, approve credit, and make collections. The document provides journal entries for transactions between the head office and a sales agency/branch. It also discusses working papers used to combine financial statements and eliminate reciprocal accounts between the head office and branches.