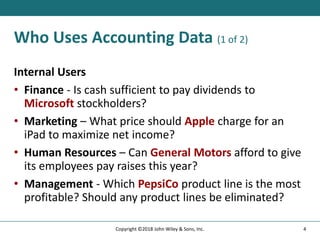

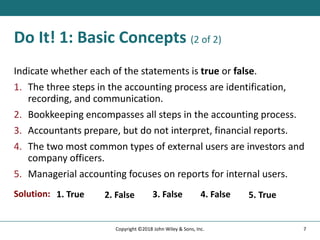

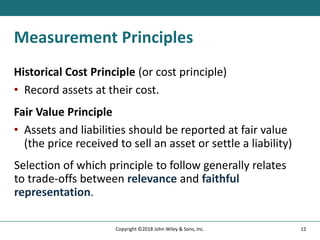

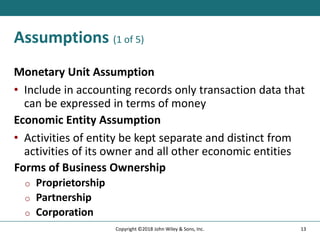

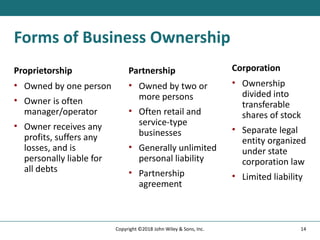

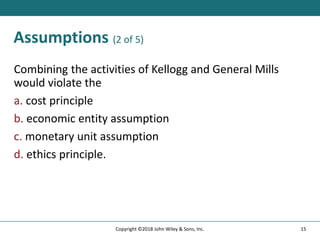

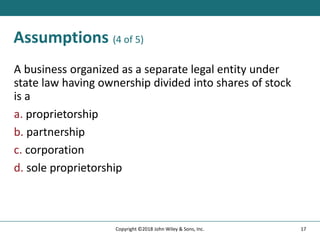

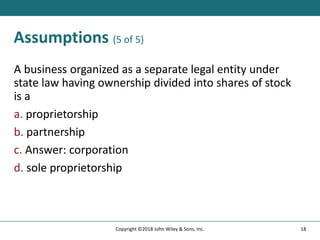

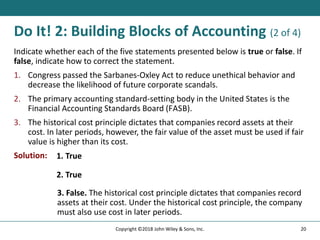

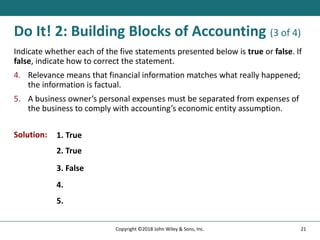

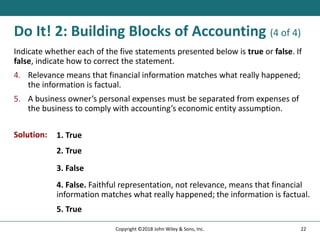

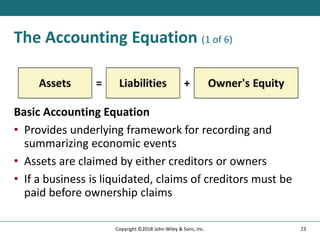

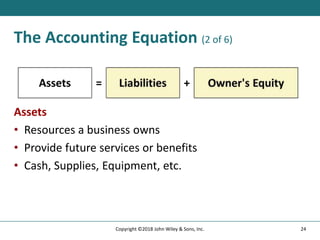

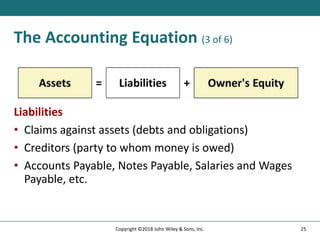

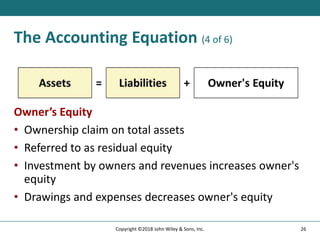

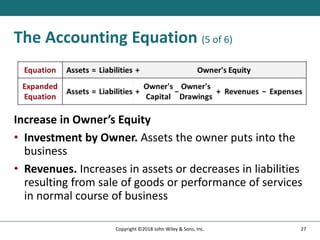

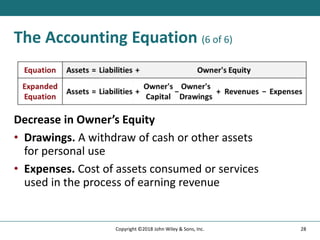

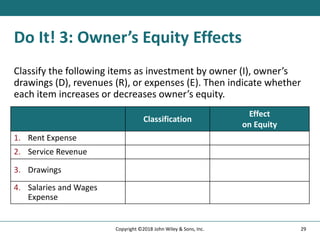

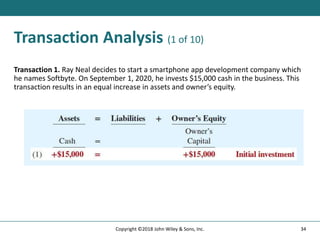

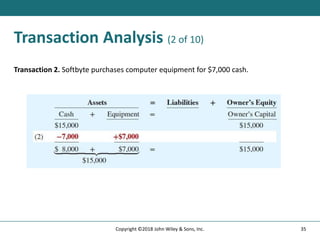

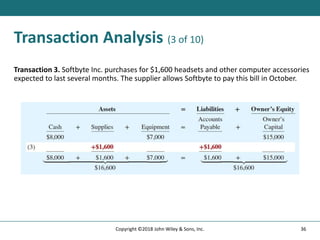

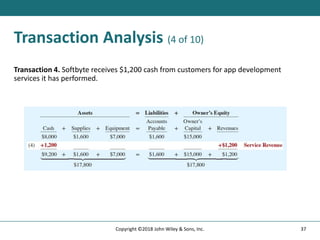

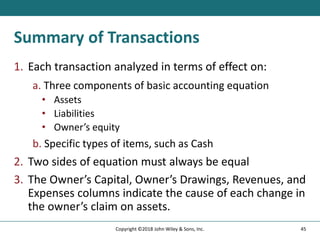

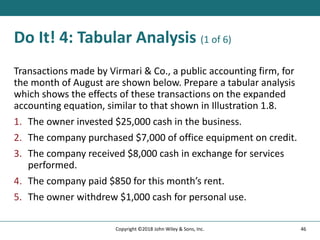

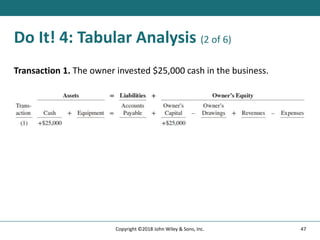

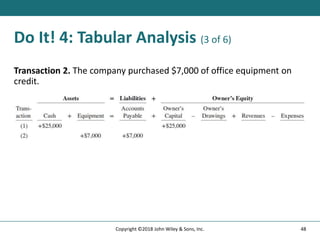

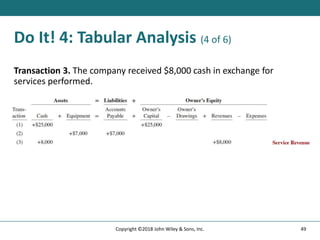

The document provides an overview of accounting principles from Chapter 1 of an accounting textbook. It discusses the three activities of accounting: identification, recording, and communication. It explains that accounting data is used by internal users like managers and external users like investors and creditors. It also outlines the building blocks of accounting including ethics, generally accepted accounting principles (GAAP), and assumptions. Finally, it introduces the basic accounting equation that balances assets with liabilities and owner's equity.