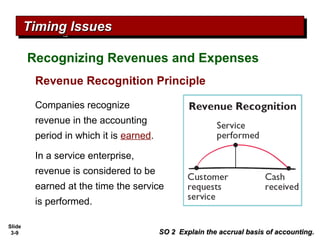

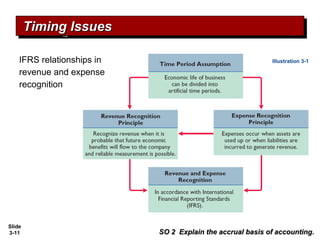

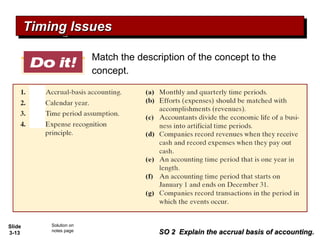

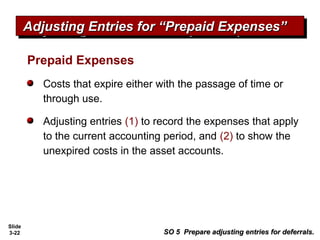

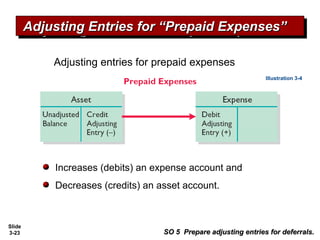

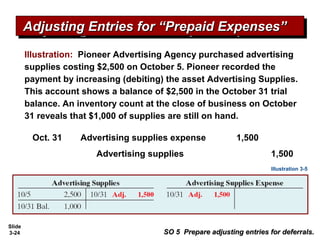

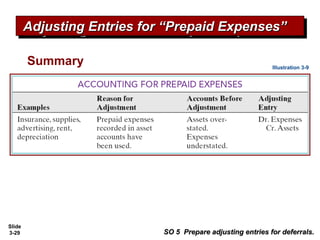

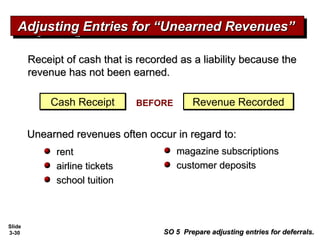

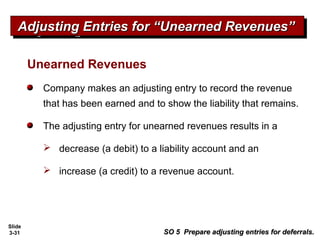

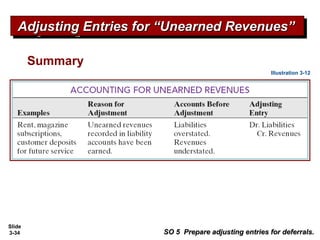

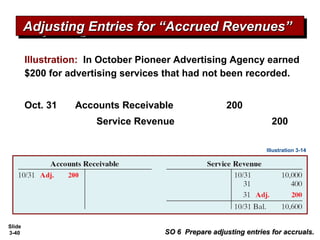

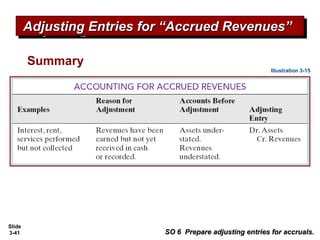

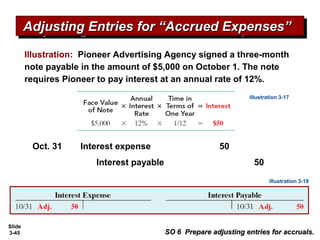

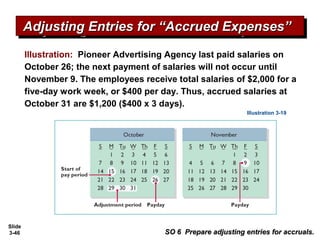

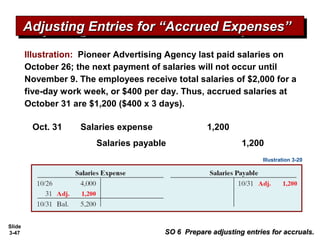

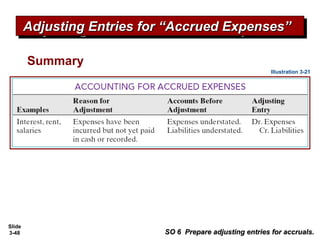

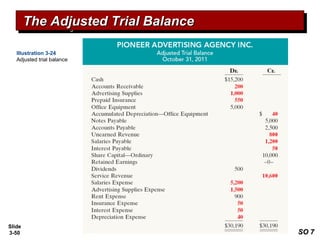

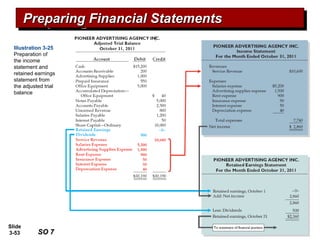

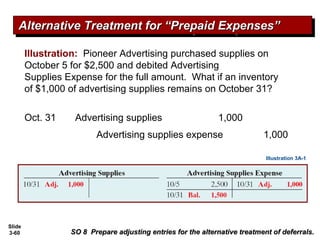

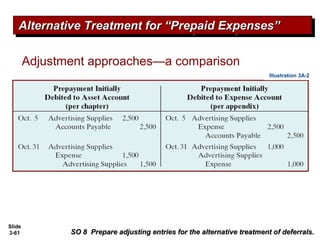

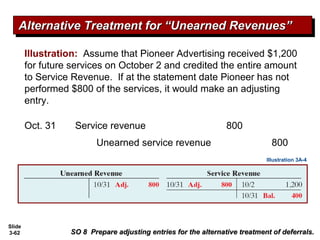

The document provides an overview of adjusting entries and related accounting concepts. It begins with explaining the time period assumption and how accountants divide a business's economic life into artificial time periods. Then it discusses the accrual basis of accounting and how revenues are recognized when earned and expenses are recognized when incurred. The reasons for adjusting entries are to ensure revenues and expenses are recorded in the proper periods according to accrual accounting. The major types of adjusting entries are identified as those for deferrals, such as prepaid expenses and unearned revenues, and those for accruals, such as accrued revenues and accrued expenses. Instructions and examples are provided for preparing adjusting entries for deferrals.