The document discusses audit evidence and related concepts:

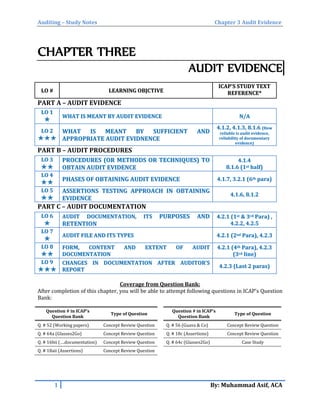

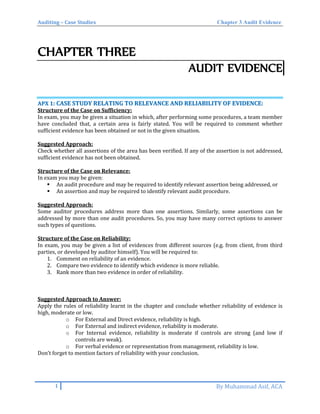

1. Audit evidence is information used by auditors to arrive at conclusions and includes accounting records and other corroborating evidence. Auditors must obtain sufficient and appropriate audit evidence through audit procedures.

2. Sufficient evidence is a measure of quantity based on risk, materiality, knowledge. Appropriate evidence is relevant and reliable based on source, documentation, and objectivity.

3. Audit procedures include inquiry, observation, inspection, confirmation, recalculation, and analytical procedures to obtain evidence for assertions about transactions, account balances, and disclosures.