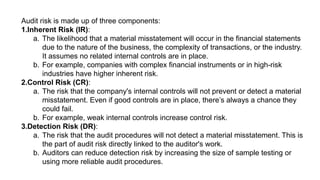

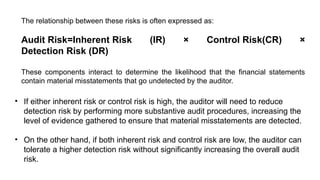

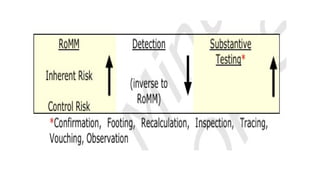

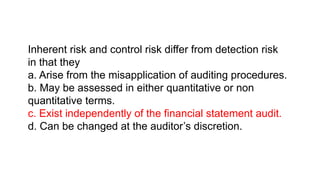

Audit risk refers to the possibility of an auditor mistakenly giving an incorrect opinion on financial statements due to undetected material misstatements. It comprises three key components: inherent risk, control risk, and detection risk, all of which interact to influence the overall audit risk. Higher inherent or control risks necessitate more substantive audit procedures to ensure misstatements are detected.