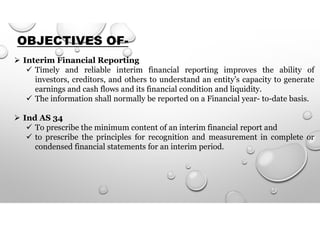

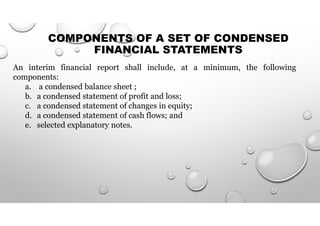

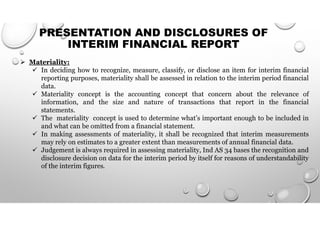

Financial reporting involves the disclosure of a company's financial results and performance over a specified period. It can be annual or interim. Annual reports cover a full financial year, while interim reports are for periods shorter than a year. Both types of reports include financial statements such as the balance sheet, income statement, cash flow statement, and notes. Interim reports provide timely information to stakeholders and follow the same recognition and measurement principles as annual reports, with estimates used more frequently given the shorter periods. The objective is to present a reliable picture of a company's financial position and performance.

![ANNUAL FINANCIAL REPORTING

Annual Financial Report means a financial report containing a complete set of

financial statements (as described in Ind AS 1, Presentation of Financial Statements)

for a financial year.

Financial Year [Sec. 2 (41) of the companies Act, 2013] in relation to any company or

body corporate, means

the period ending on the 31st day of March every year,

where it has been incorporated on or after the 1st day of January of a year,

the period ending on the 31st day of March of the following year,

where a company or body corporate, which is a holding company or a subsidiary or

associate company of a company incorporated outside India and is required to

follow a different financial year for consolidation of its accounts outside India, the

Central Government may, on an application made by that company or body corporate

in such form and manner as may be prescribed, allow any period as its financial year,

whether or not that period is a year.](https://image.slidesharecdn.com/indas34-201118084129/85/Ind-as-34-3-320.jpg)