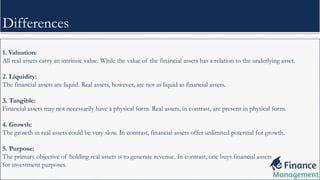

The document explains the differences and similarities between real and financial assets. Real assets are physical and generate revenue, while financial assets are non-physical and can be quickly converted to cash. It discusses aspects such as valuation, liquidity, growth potential, and their roles in investment and inflation hedging.