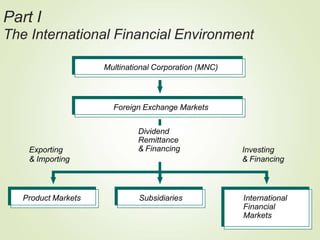

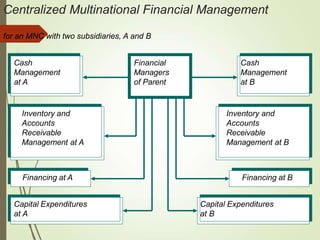

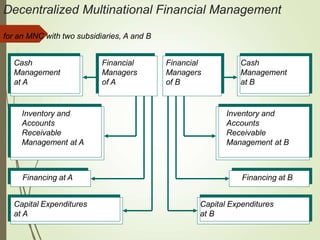

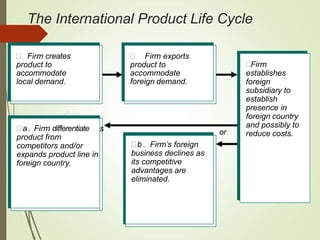

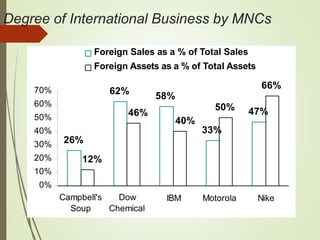

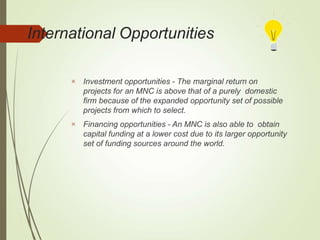

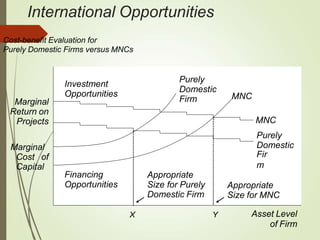

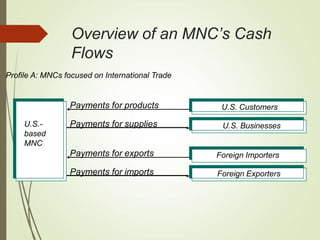

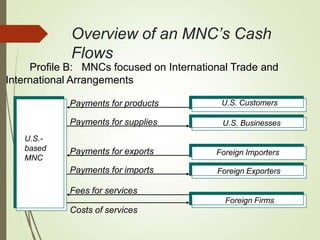

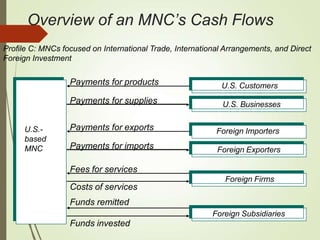

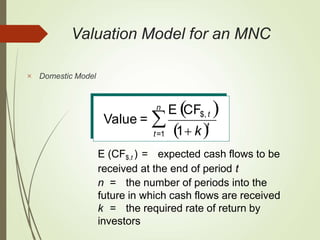

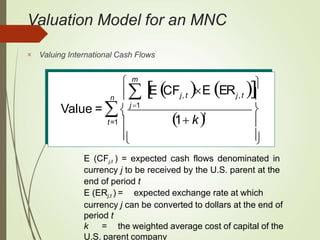

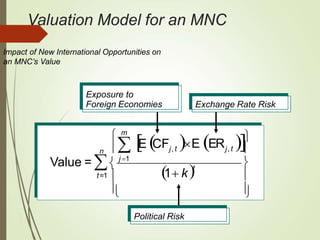

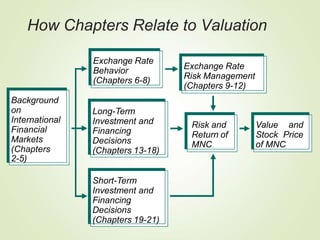

This document provides an overview of multinational financial management. It discusses the goal of multinational corporations to maximize shareholder wealth and conflicts against this goal. Various international business methods are described, including international trade, licensing, franchising, and establishing foreign subsidiaries. Managing cash flows and making financial decisions that consider exchange rate risk, foreign economic conditions, and political risk can help maximize the value of a multinational corporation.