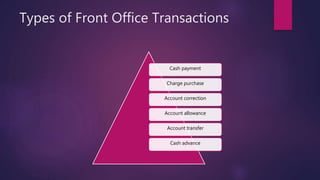

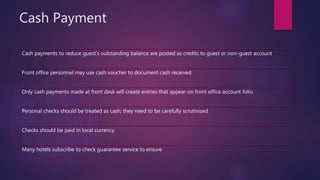

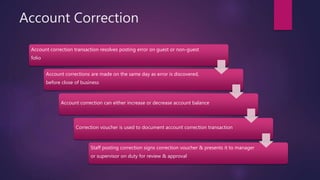

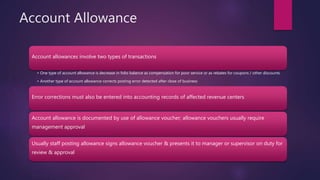

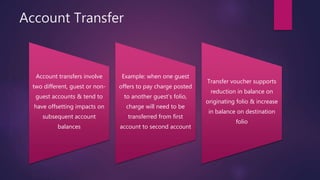

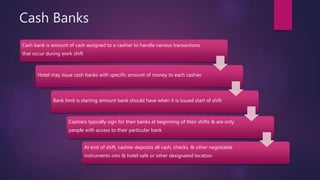

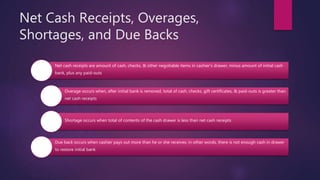

The document provides an overview of front office accounting procedures in the hotel industry. It discusses topics such as accounting fundamentals, creating and maintaining guest and non-guest accounts, tracking transactions through vouchers and points of sale, internal controls like cash banks and audits, and settling accounts. Key aspects covered include creating folios for guests and non-guests to record transactions, extending charge privileges, monitoring credit, correcting errors, allowing discounts, and transferring charges between accounts. The document also explains how automated systems have streamlined many front office accounting functions.