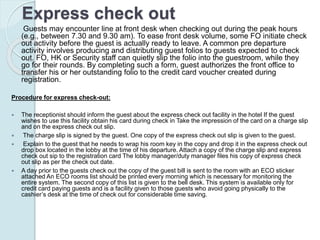

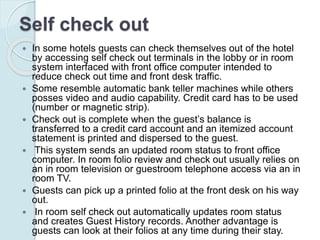

This document discusses checkout and settlement processes at hotels. It describes the key activities that occur at checkout, including those handled by the bell desk, housekeeping, and cashier's desk. Various checkout options like late checkout, express checkout, and self checkout are also outlined. Payment methods like cash, traveler's checks, credit cards, foreign currency exchange, and direct billing are summarized. The document provides an overview of the final phase of the guest cycle and the standard procedures involved in checking guests out of their rooms and settling any bills.