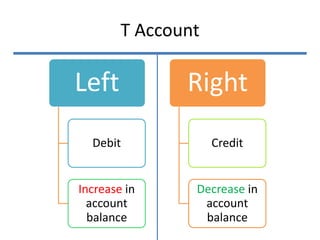

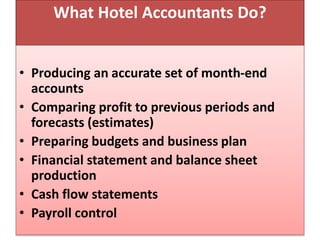

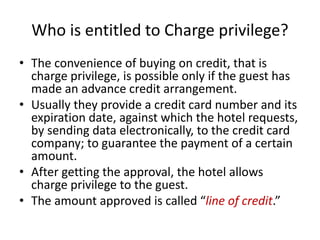

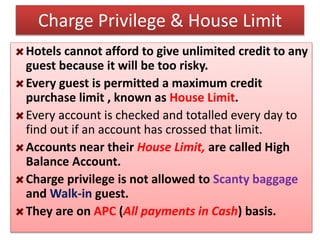

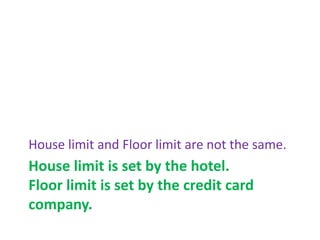

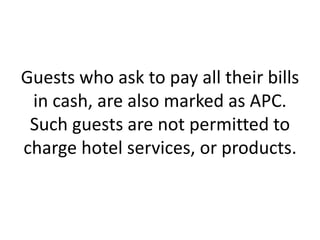

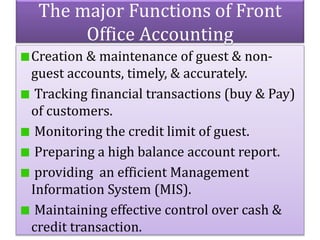

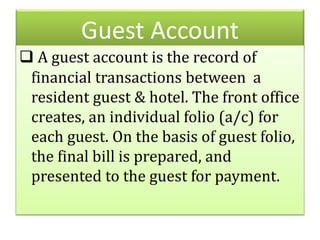

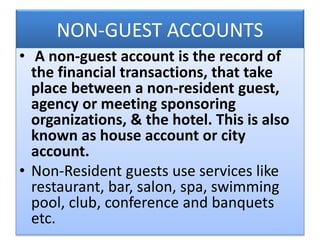

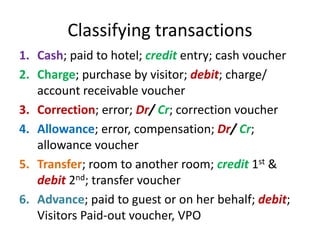

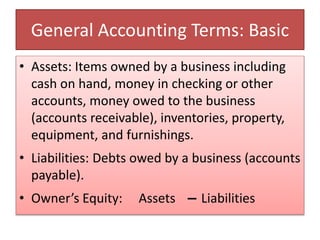

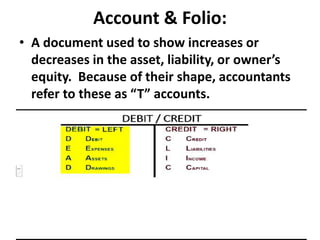

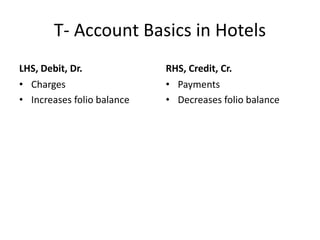

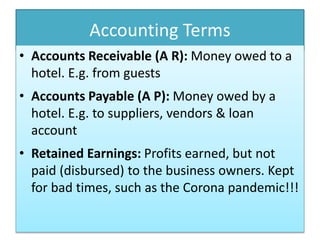

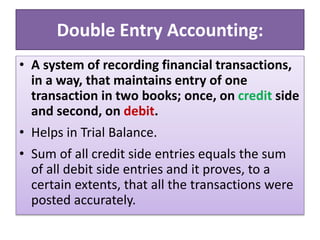

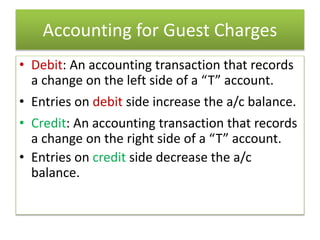

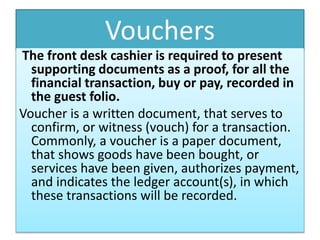

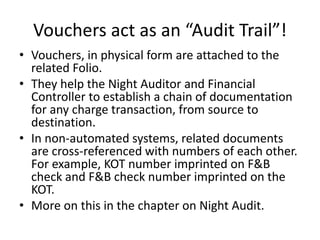

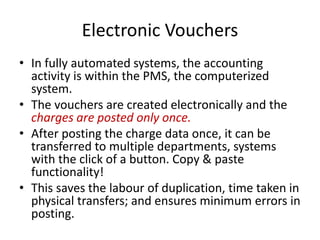

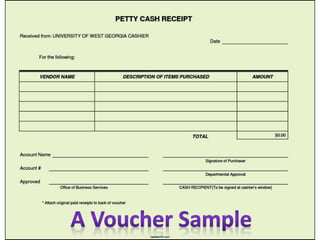

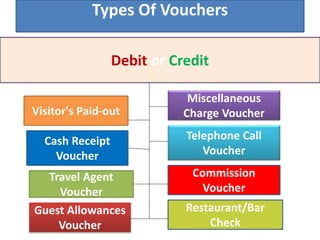

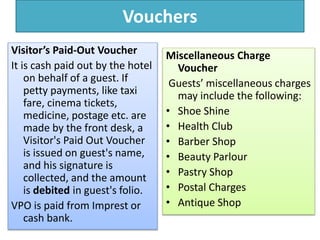

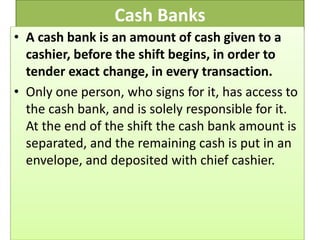

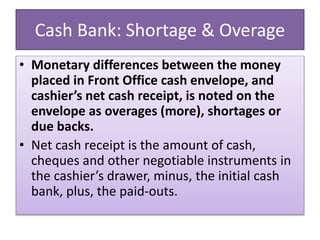

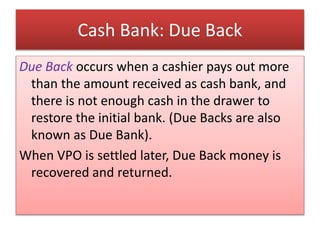

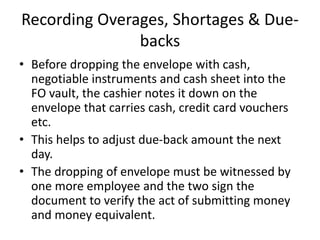

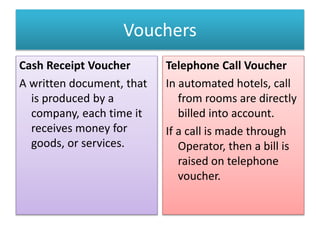

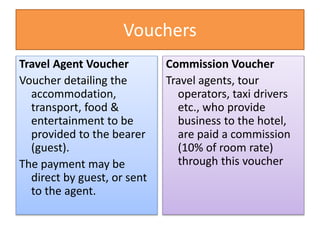

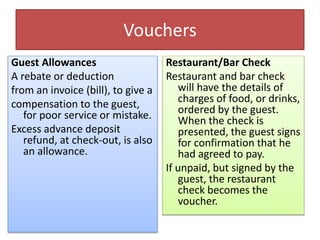

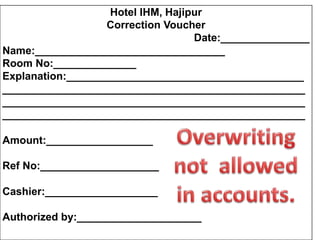

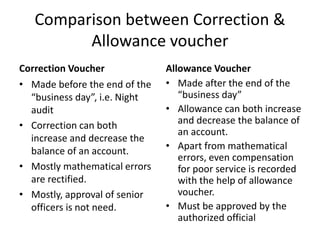

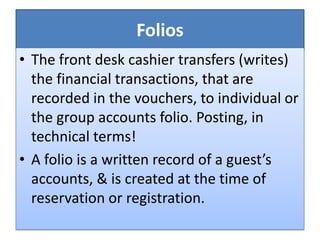

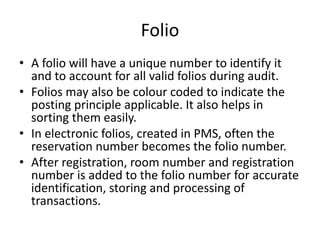

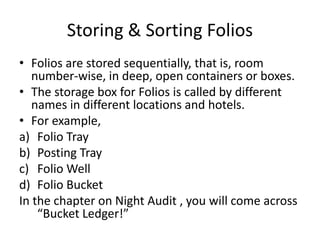

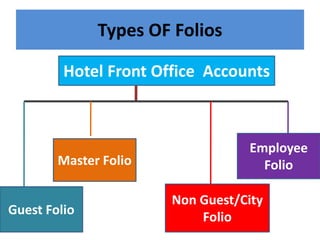

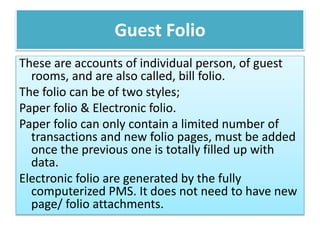

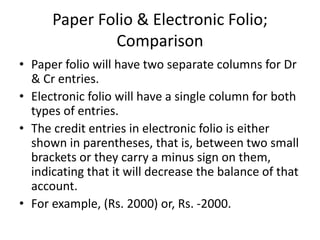

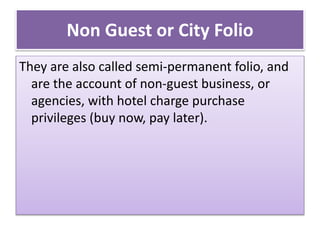

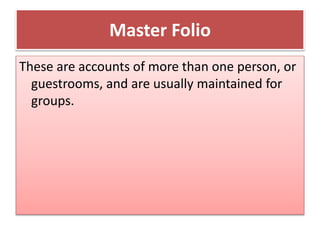

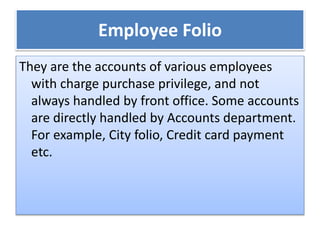

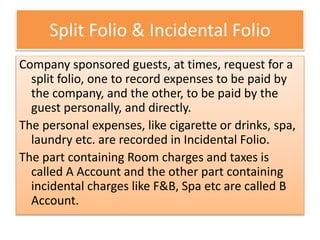

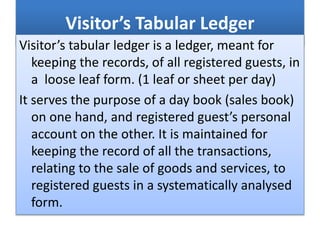

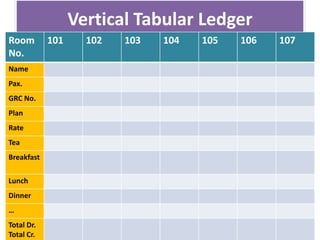

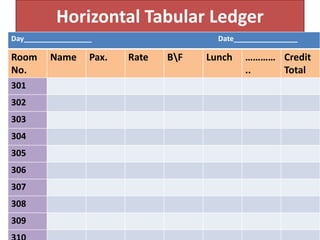

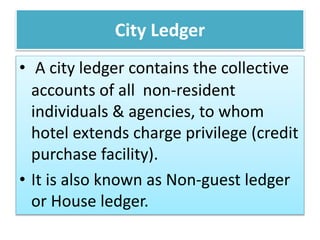

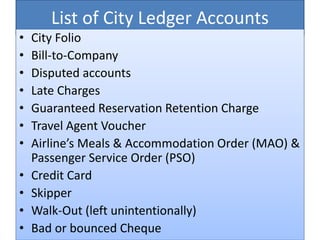

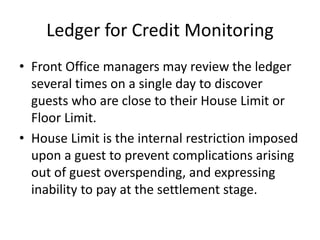

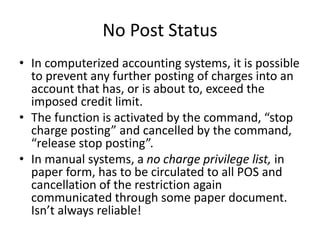

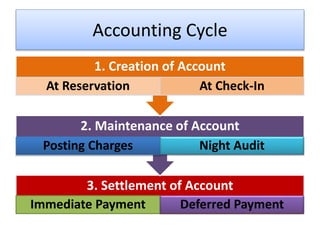

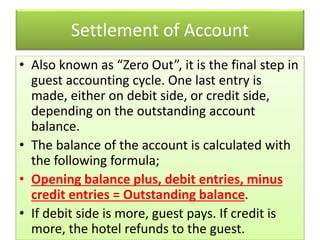

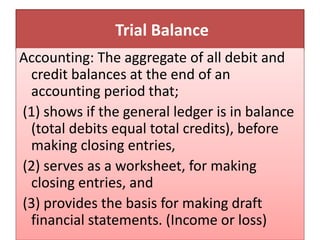

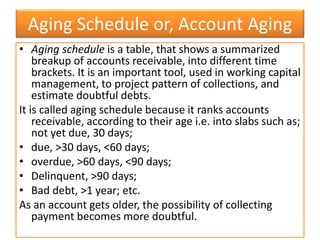

The document introduces the fundamentals of hotel front office accounting, emphasizing the importance of maintaining accurate financial records for sustainability and guest satisfaction. It covers key concepts such as guest accounts, charge privileges, and various accounting terms and processes, including transaction recording methods and the purpose of vouchers. Additionally, it explains the roles and responsibilities of hotel accountants in managing financial information effectively.