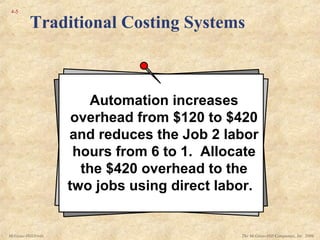

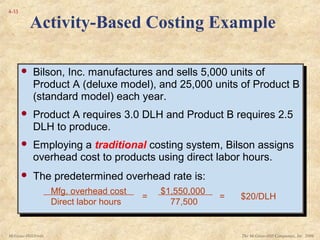

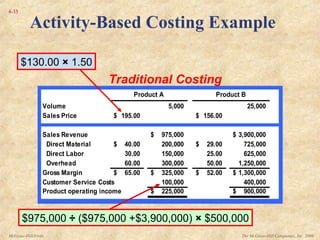

- Traditional costing systems allocate overhead to products using direct labor hours as the cost driver. However, this may not be reasonable if production processes change.

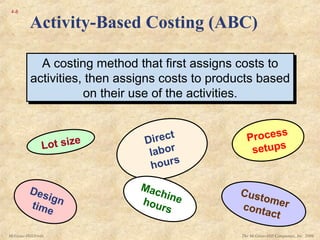

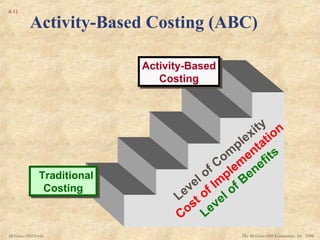

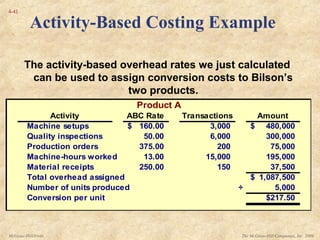

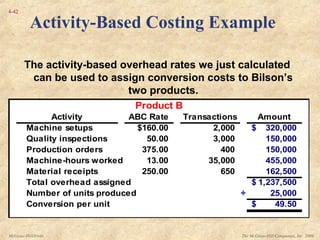

- Activity-based costing (ABC) assigns costs to activities first, then assigns activity costs to products based on their use of activities. This provides a more accurate allocation of overhead costs.

- The four steps of ABC are: 1) identify activities, 2) estimate activity costs, 3) calculate a cost driver rate for each activity, and 4) assign activity costs to products using the rates.