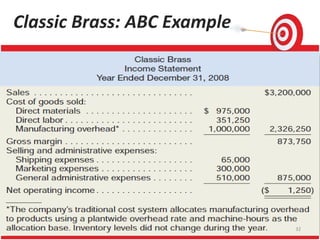

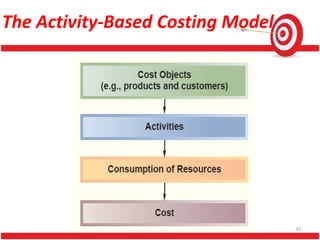

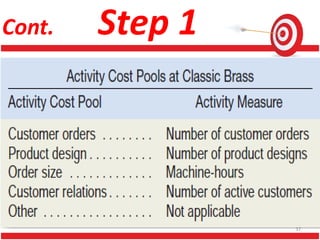

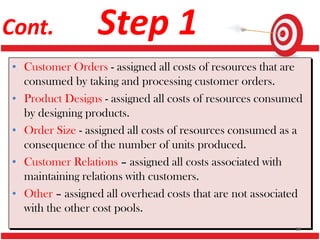

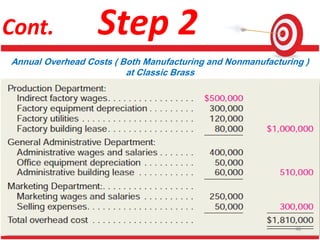

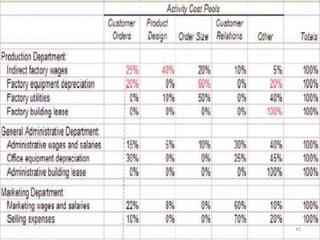

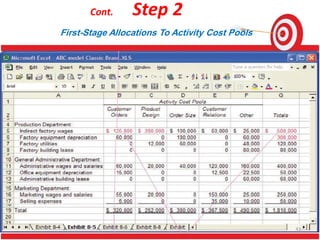

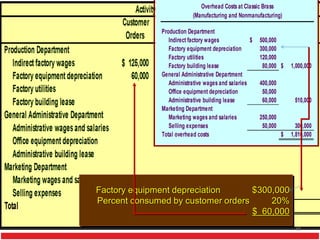

This document provides an overview of activity-based costing (ABC), which is a costing method that assigns overhead costs to products and services based on their use of activities and resources. The document discusses how ABC differs from traditional costing systems by assigning both manufacturing and nonmanufacturing costs based on causation. It explains that ABC uses multiple cost pools organized by activity and allocates costs to cost objects using activity drivers. The document outlines the basic steps for implementing ABC, including defining activities and cost pools, assigning costs to pools, calculating activity rates, and using those rates to assign costs. It provides an example of how ABC was implemented at a company called Classic Brass.