The document discusses Activity-Based Costing (ABC), including what it is, how it allocates direct and indirect costs, and provides an example of calculating costs using ABC. Specifically:

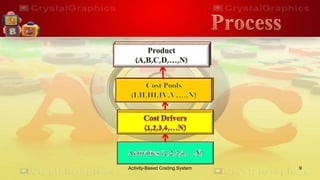

- ABC identifies activities in an organization and assigns costs to products/services based on consumption of activities. It allocates both direct and indirect costs.

- Indirect costs are allocated based on activities like purchasing, design, production, sales, and customer service.

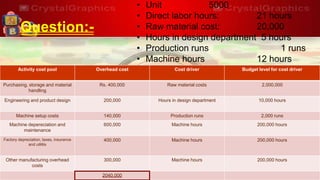

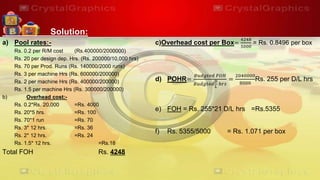

- The example shows calculating overhead costs allocated to a product based on cost pools and drivers like material costs, design hours, production runs, and machine hours.

- ABC provides more accurate product costing through better cost allocation and can lead to improved management decisions