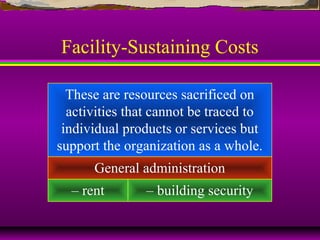

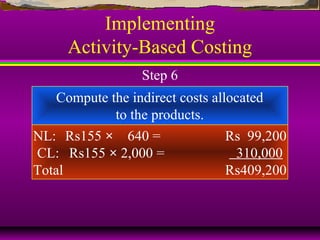

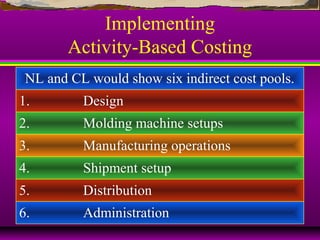

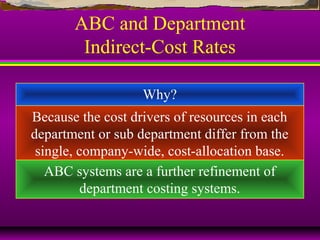

This document discusses activity-based costing (ABC) and activity-based management (ABM). It provides examples of implementing ABC at a company called Super Corporation. ABC involves identifying activities within a company and assigning indirect costs to products based on their use of each activity. This provides more accurate product costs than traditional costing systems. ABM uses the cost information from ABC to make decisions around pricing, cost reduction, process improvement and product design to improve profits. While more complex than departmental costing systems, ABC provides benefits like more accurate product costs and insights to help management make better decisions.