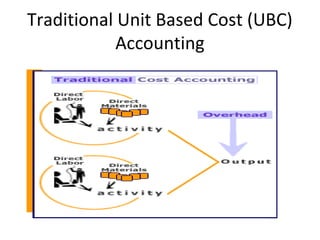

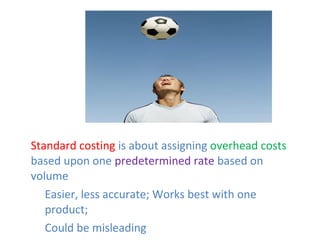

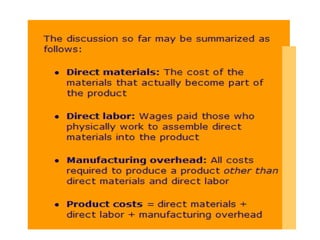

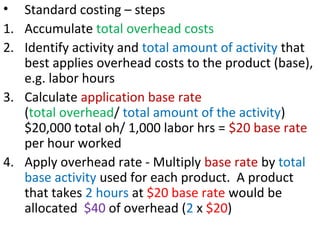

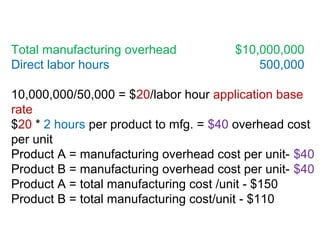

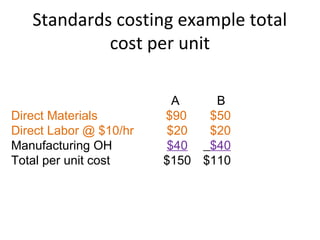

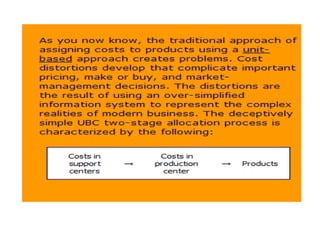

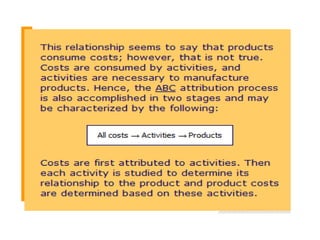

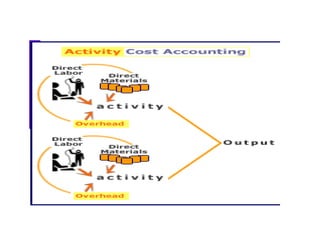

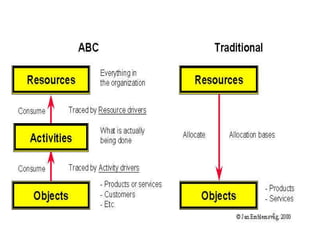

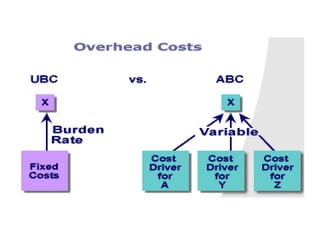

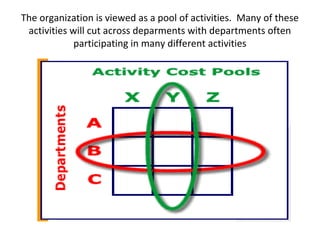

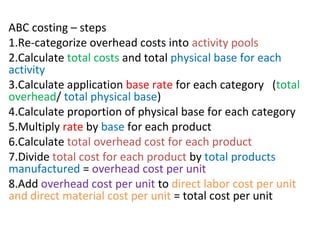

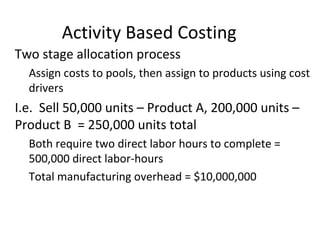

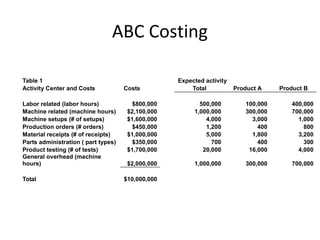

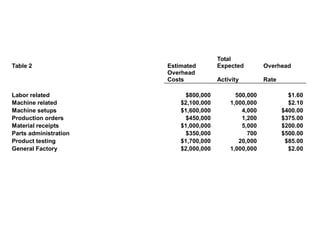

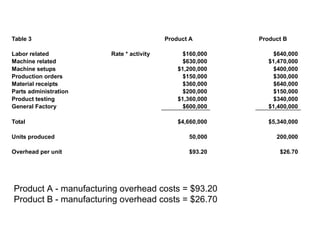

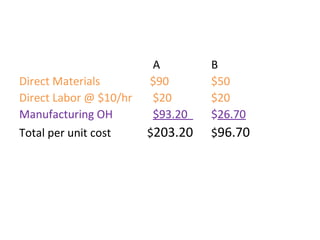

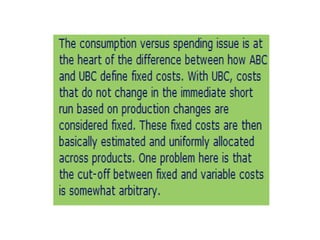

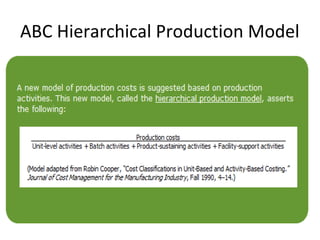

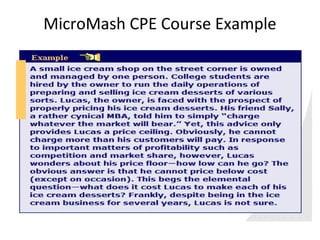

This document discusses traditional unit-based costing and activity-based costing approaches. Under traditional costing, overhead is allocated to products using a single predetermined rate based on direct labor hours. This can result in inaccurate and misleading product costs. Activity-based costing assigns overhead costs to cost pools or activity centers first, then assigns these costs to products based on cost drivers. The document provides a numerical example comparing overhead allocation and unit costs for two products under the traditional and activity-based costing methods.

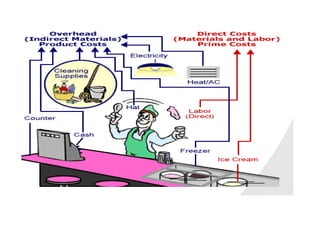

![• Make sure that costing done correctly, reduce

costs

• Direct labor and materials costs [prime costs]–

easy to trace to product

• Manufacturing overhead is indirect cost – hard

to trace, control – estimate, calculate cost per

unit](https://image.slidesharecdn.com/activitybasedcosting-150727085556-lva1-app6892/85/Activity-based-costing-approach-4-320.jpg)