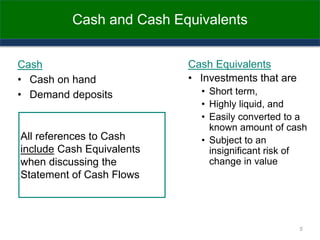

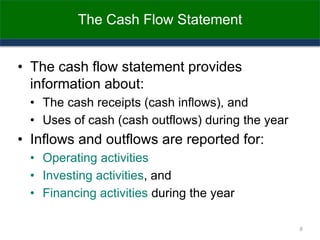

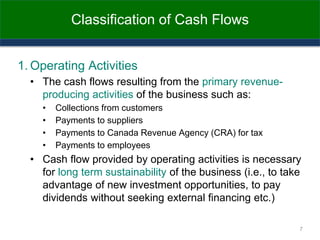

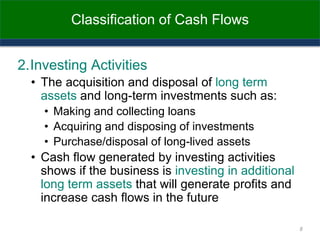

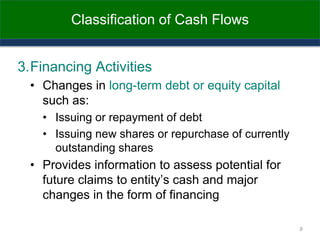

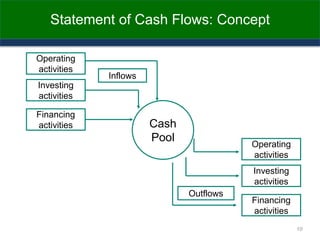

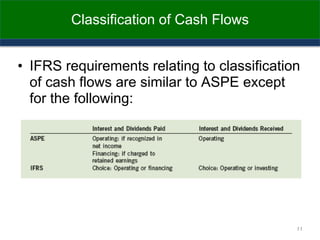

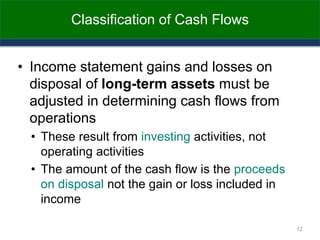

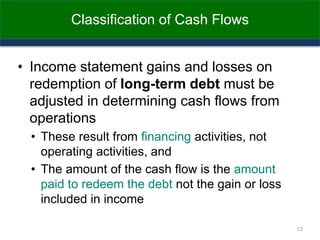

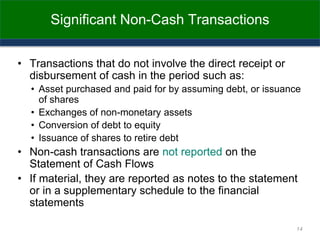

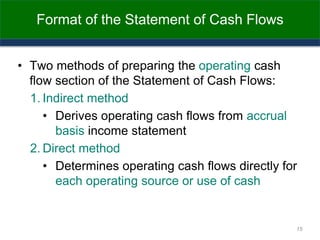

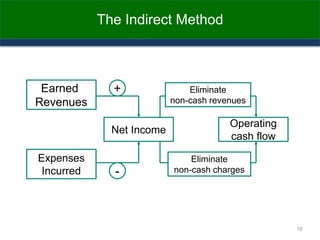

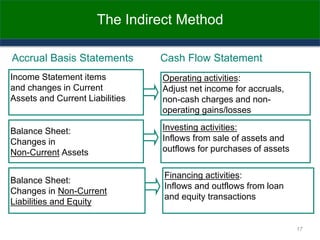

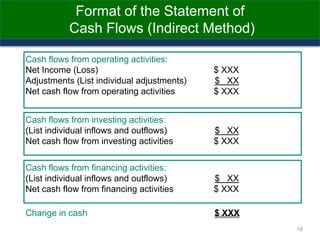

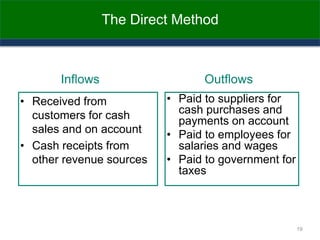

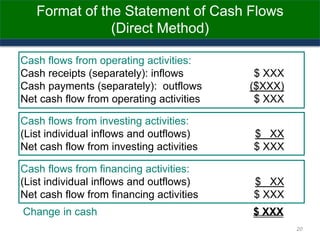

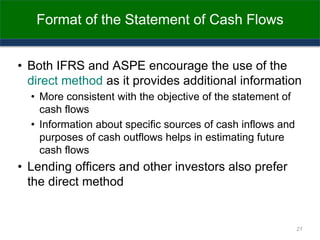

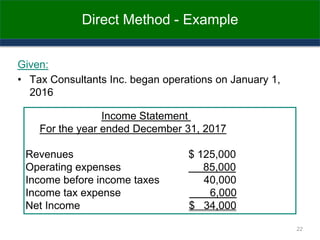

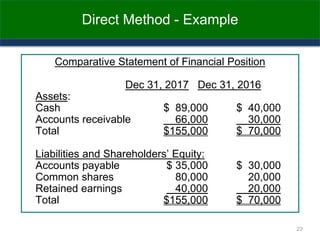

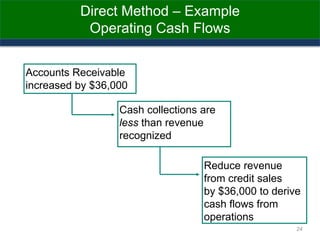

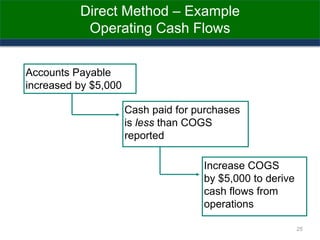

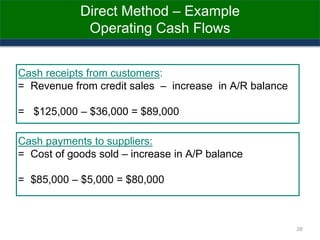

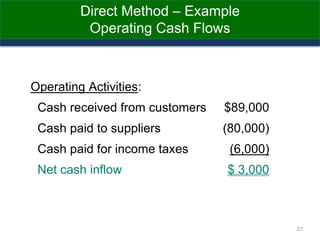

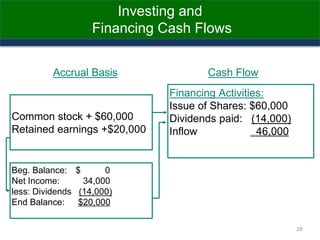

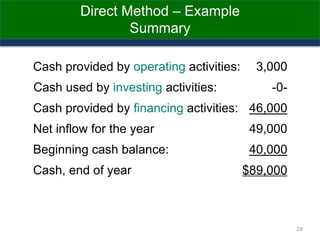

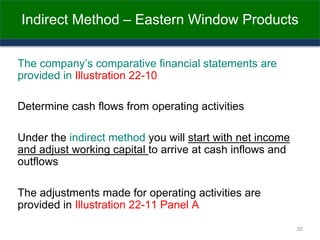

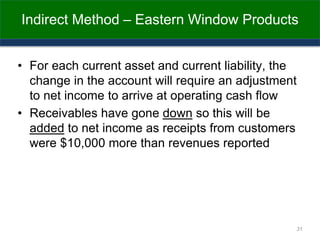

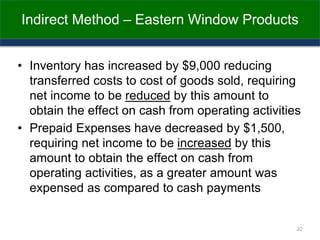

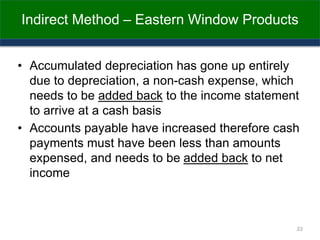

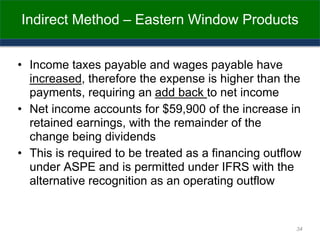

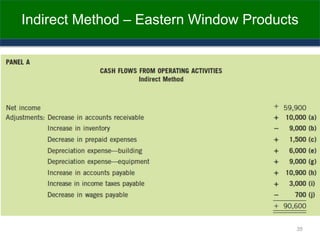

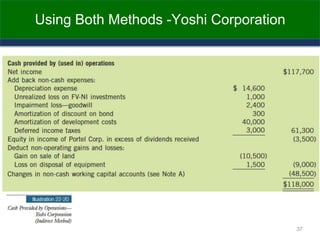

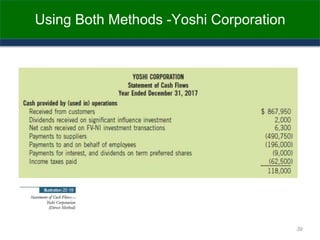

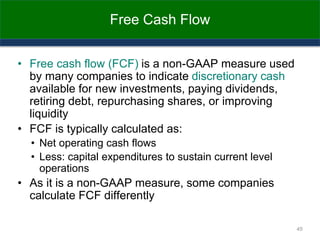

This document provides an overview of the statement of cash flows, including its purpose, key components, and methods of preparation. It discusses cash flows from operating, investing and financing activities and how they are classified. It also describes the indirect and direct methods for preparing the statement of cash flows and provides an example of each. Key terms like cash and cash equivalents, free cash flow, and non-cash transactions are also explained.