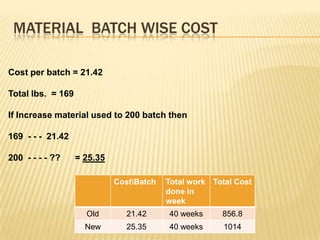

Group A5 presents a case study on Giberson's glass studio, which is facing financial difficulties due to a lack of pricing strategy and proper accounting. Key issues include deteriorating finances, high operating costs, and no batch-level costing. Options discussed are maintaining batch-level profits, accounting, and increasing batch size from 169 to 200 lbs at a higher cost per batch to improve margins. The group recommends preparing accounting records and evaluating costs batch-wise to address the problems.