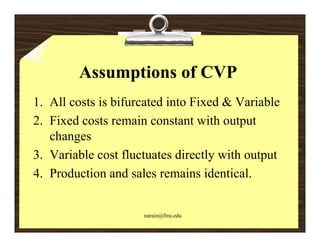

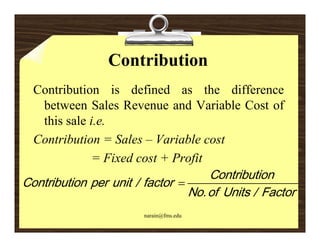

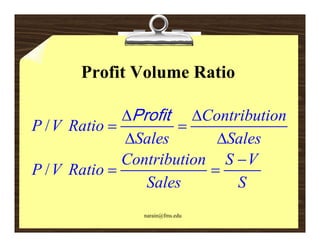

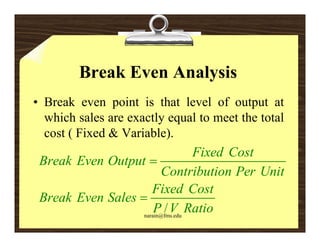

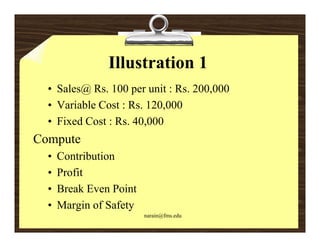

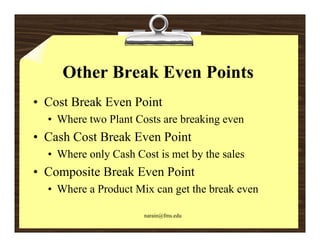

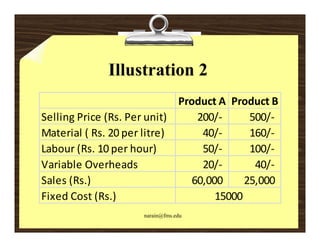

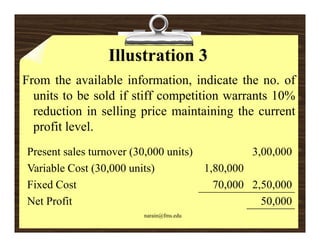

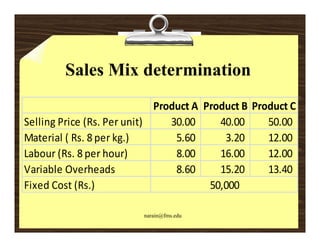

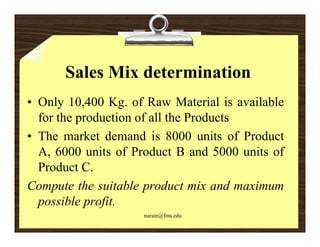

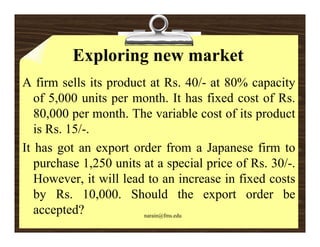

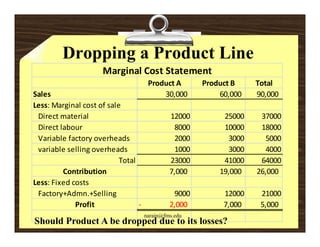

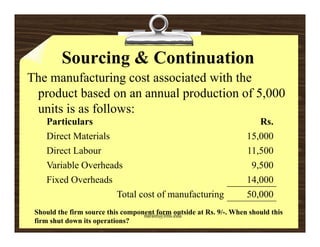

The document discusses cost volume profit (CVP) analysis, which involves separating costs into fixed and variable categories. It defines concepts like contribution, profit volume ratio, and break-even analysis to determine the output level where total revenue equals total costs. Examples are provided to illustrate how to use CVP analysis to make managerial decisions around pricing, production levels, product mix, and whether to accept or drop product lines.