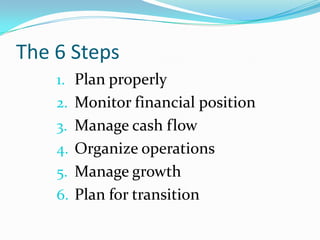

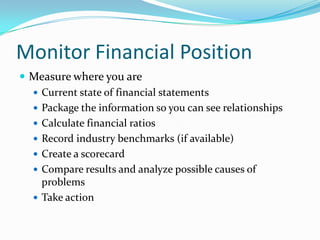

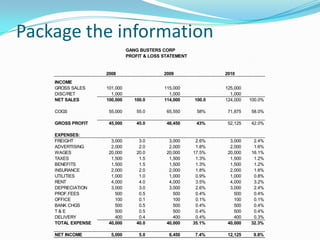

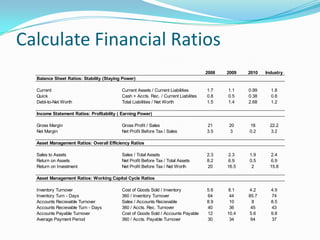

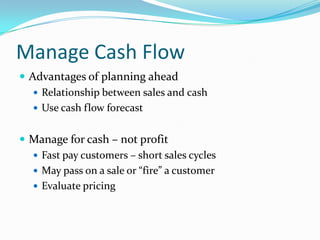

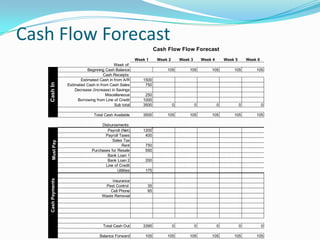

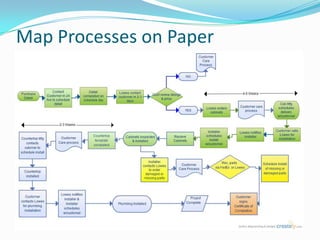

The document outlines 6 steps business owners can take to improve their business, including properly planning goals and actions, monitoring financial metrics, managing cash flow, organizing operations, managing growth, and planning for transition. It then discusses each of these steps in more detail, providing advice on tasks like establishing a vision and measurable goals, regularly reviewing financial statements and key ratios, using cash flow forecasts to manage cash needs, and periodically evaluating the business for improvement opportunities. The overall message is that business owners should follow a structured process to effectively operate and grow their company over time.