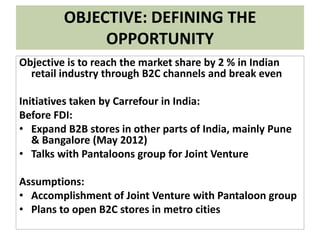

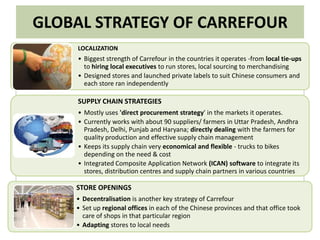

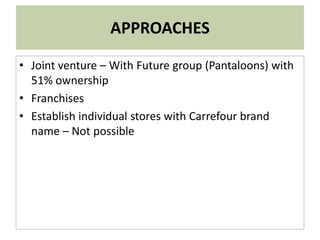

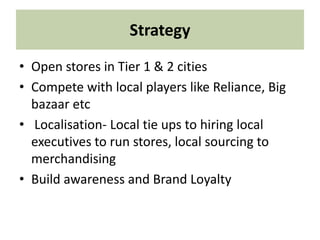

Carrefour is a French multinational retailer aiming to expand its market share in the Indian retail industry through B2C channels and strategic joint ventures, notably with the Pantaloons Group. The company emphasizes localization and supply chain efficiency, sourcing locally and adapting store formats to meet regional demands. The Indian retail sector is projected to grow significantly, attracting international competition and investment, prompting Carrefour to implement competitive strategies that focus on brand loyalty and increased customer engagement.